FHA Loan Refinances: A How-To Guide

Bottom Line:

An FHA refinance can save you money monthly or over the life of the loan. If you have an FHA loan currently, you may qualify for a refinance with no appraisal and minimal paperwork. Some FHA refinances allow cash back.

Can You Refinance an FHA Loan?

Yes, you can refinance an FHA loan. In many cases, doing so will be far more straightforward than when you initially took out your mortgage.

However, to qualify for an FHA refinance, you must still meet a handful of program requirements. Some apply to all FHA-backed mortgages, while others are specific to the various FHA refinance options.

These can include requirements related to:

- Credit Score

- Debt-to-Income Ratio

- Loan Seasoning

- Net Tangible Benefit

Related: How Soon Can You Refinance an FHA Loan?

Types of FHA Loan Refinances

There are five types of FHA loan refinances, each designed to meet the unique needs of different borrowers. Two options are reserved exclusively for current FHA loan holders, while the other three are available to homeowners with any type of existing mortgage.

FHA Streamline Refinance

The FHA streamline refinance is a low-doc refi option available for current FHA borrowers. It allows you to adjust your interest rate or loan term without an appraisal and, in most cases, without going through income verification or a detailed credit check.

Who Is It Best For?

When mortgage rates drop, most FHA loan holders might find this program useful to save money each month.

Credit Qualifying vs Non-Credit Qualifying

Most applicants will be eligible for the non-credit qualifying streamline refinance. This option allows you to refinance with minimal paperwork and underwriting.

If you need to remove a co-borrower, however, you’ll be required to undergo a credit check and reverify your earnings to prove that you can support your payments without the income of the former co-borrower. You still won’t, however, need to obtain an appraisal.

Net Tangible Benefit Test

To ensure borrowers save money when refinancing, the FHA requires all streamline loans to pass the net tangible benefit test. For most homeowners – those refinancing their fixed-rate mortgage to another with the same term – this means realizing a combined interest and MIP rate savings of at least 0.5%.

Homeowners in other situations must meet other Net Tangible Benefit requirements.

|

Current Loan |

New Loan |

Net Tangible Benefit |

|

Fixed Rate |

Fixed Rate |

Rate + MIP drops 0.50% |

|

30-Year Fixed |

15-Year Fixed |

Rate reduction, payment rises no more than $50 |

|

Fixed Rate |

Adjustable Rate |

Combined rate at least 2% lower |

|

Adjustable Rate |

Fixed Rate |

Combined rate up to 2% higher |

|

Adjustable Rate |

Adjustable Rate |

Combined rate at least 1% lower |

What Else You Need to Know

Borrowers can qualify for a Streamline refinance once they’ve had their mortgage for at least 210 days, made at least six monthly payments, and six months have passed since their first payment due date. All mortgage payments must have been made on time for the past six months, and there cannot be more than one 30-day late payment in the six months preceding.

You can’t wrap closing costs into a Streamline refinance. However, some mortgage companies may offer lender credits to reduce your out-of-pocket expenses.

Related: How Much Does It Cost to Refinance a Mortgage?

FHA Simple Refinance

Current FHA borrowers can use the FHA Simple refinance to change their interest rate or adjust the terms of their mortgage. Unlike the Streamline program, the FHA Simple refinance requires an appraisal and full income and credit qualifying.

Who Is It Best For?

Homeowners currently with an FHA loan who do not meet the net tangible benefit requirement for a Streamline refi or want to roll closing costs into their mortgage.

What Else You Need to Know

The FHA Simple refinance does not have a net tangible benefit requirement like the Streamline program. You may be eligible for a Simple refi, even if you don’t qualify for a Streamline loan.

As with most FHA refinance loans, you can’t have any late mortgage payments in the past six months and no more than one in the six months prior.

FHA Rate-and-Term Refinance

An FHA Rate-and-Term refinance is a standard home refi that allows borrowers with any type of mortgage to refinance and adjust their interest rate and loan length. You do not need to currently have an FHA loan to qualify.

Who Is It Best For?

Homeowners with a different current type of loan, someone legally required to buy out a co-borrower’s equity, and FHA loan holders with a second mortgage they want to wrap into their refinance.

What Else You Need to Know

As long as you’ve occupied the home as your primary residence for the past 12 months (or since acquiring the property if you’ve owned it less), you can refinance up to 97.75% of the appraised value with a Rate-and-Term.

This is a good program for someone who needs to refinance but doesn’t have enough equity or otherwise does not qualify for a conventional refi. Or for a homeowner who wants to wrap their second mortgage into their new loan.

Remember, however, that the FHA Rate and Term refinance requires that you have no late mortgage payments in the past six months and no more than one over the past year.

Note: FHA guidelines allow borrowers to use the Rate and Term refinance program to buy out equity from a co-owner in the case of a divorce or other legally ordered settlement.

FHA Cash-Out Refinance

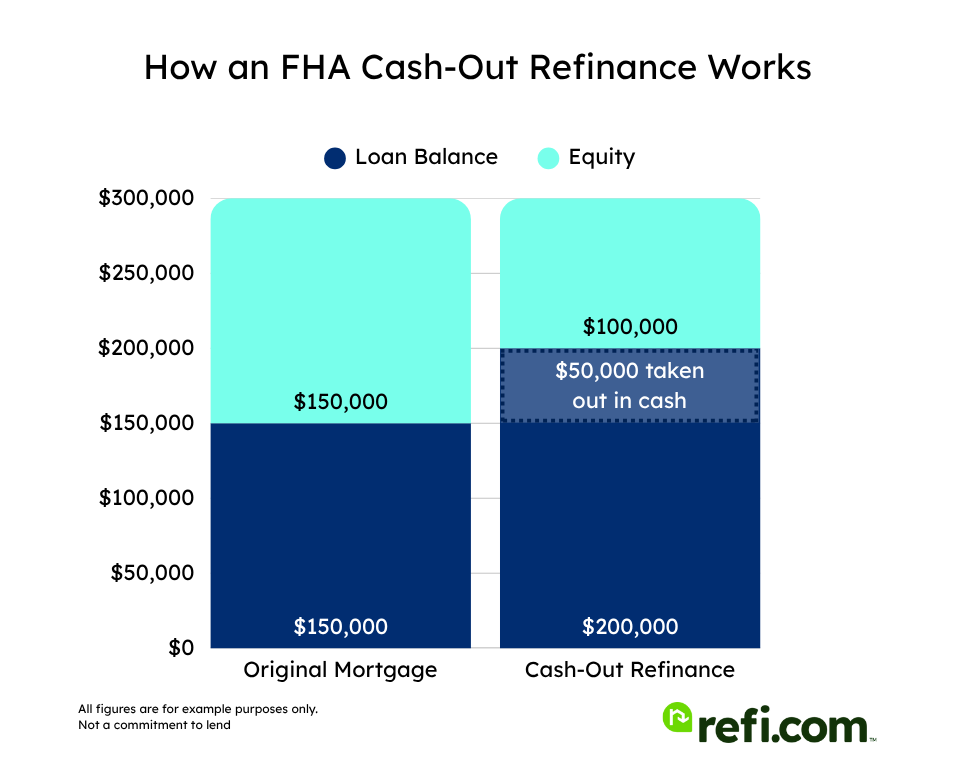

You can use an FHA cash-out refinance to withdraw a portion of your home’s equity as a lump sum of cash, regardless of your current mortgage type.

Who Is It Best For?

Borrowers who need to tap into their equity but aren’t eligible for a conventional cash-out or who meet conventional minimums yet still qualify for lower FHA cash-out rates.

What Else You Need to Know

An FHA Cash-Out refinance lets you borrow up to 80% of your home’s total appraised value. Your refinance loan is used to pay off your existing mortgage, and the difference between the two is returned to you, minus closing costs, as cash.

You can do a cash-out FHA refinance with any type of existing mortgage. You can also use it to get cash out of a property you own free and clear.

To be eligible for an FHA cash-out refinance, you must have occupied the home as your primary residence for at least 12 months (except in some instances of inheritance) and have made no late mortgage payments during that period.

FHA 203(k) Rehab Refinance

The FHA 203(k) Rehab refinance is a unique renovation loan that allows you to refinance any existing mortgage and fund home improvements based on the property’s anticipated future value.

Who Is It Best For?

Homeowners who want to borrow funds to make improvements and renovations and those currently unable to meet the minimum property requirements for other FHA refi loans.

Standard 203(k) vs Limited 203(k)

The FHA offers two types of 203(k) rehab refinance loans: the Standard 203(k) and the Limited 203(k)

- Standard 203(k) – allows you to fund major home improvements, including structural repairs, additions, and complete renovations. For the most part, repairs are only restricted by FHA loan limits and your ability to borrow.

- Limited 203 (k) – allows you to borrow up to $75,000 for minor non-structural improvements such as adding a new roof, updating plumbing or electric, or making cosmetic repairs.

What Else You Need to Know

Like a cash-out refinance, the 203(k) Rehab program lets you use your property’s equity to pay for home improvements. You can use 203(k) funds for almost any renovation project, except for luxury upgrades like adding a swimming pool or gazebo.

However, unlike a cash-out refinance, a 203(k) Rehab loan doesn’t give you a lump sum of cash to spend on the repairs. Instead, you’ll need to have an established plan for the project, and all payments will be disbursed to your pre-approved contractor directly by the lender.

The amount of funding you can qualify for with an FHA 203(k) loan is also different. Instead of relying on your property’s current value, an appraiser estimates what your home would be worth once the proposed repairs are complete.

With a 203(k) Rehab refinance, you can borrow up to 97.75% of the property’s After Improved Value. If your credit score is below 580, you may still be able to get a Rehab loan for up to 90% LTV.

FHA Refinance Requirements

In addition to any loan-specific requirements mentioned above, you’ll also need to meet the FHA standards required on all mortgages. Keep in mind that lenders, like Refi.com, often impose their own rules on top of what’s required by the FHA.

- Credit score of 580 (500 for most refis with at least 10% equity). Refi.com requires a 620 FICO credit score for FHA rate-and-term and cash-out refinances. Credit checks are not required by the FHA for Streamline refinances, but some lenders still perform them.

- Debt-to-income (DTI) ratio below 56.9% for strong applicants, with 50% or less preferred

- Home must be your primary residence (or approved second home)

- Proof of steady and stable employment (except for most Streamline refinances)

- 1.75% upfront mortgage insurance premium

- Annual mortgage insurance premiums ranging from 0.15% to 0.75%

Refinancing Out of an FHA Loan

Although the FHA loan program can be an excellent option for numerous types of borrowers, there are some situations where it may be in your best interest to refinance out of an FHA loan.

Here are some other popular refi options, how they compare to the FHA, and when you may be better off refinancing from an FHA-backed mortgage.

FHA to Conventional Refinance

Conventional mortgages make up the majority of all refinance loans. Borrowers with higher credit scores can often qualify for lower rates. At the same time, homeowners with at least 20% equity can save by avoiding the need for mortgage insurance. In contrast, FHA refinances require a mortgage insurance premium regardless of your equity.

Keep in mind that the qualification requirements are a little higher for conventional refinances. To refinance an FHA loan to a conventional loan, you’ll need a:

- Credit score of at least 620

- DTI no higher than 50%

- Between 3% and 5% equity for a rate and term

- At least 20% remaining equity for a cash-out

FHA to VA Refinance

VA loans are available to veterans and active-duty service members. They are often one of the best options for those who qualify. VA refinance rates are typically among the lowest out there, and there’s no ongoing mortgage insurance requirement, regardless of your equity. Here’s a quick look at how FHA refinance rates are trending compared to VA refinance rates:

How we source rates and rate trends

Rates based on market averages as of Dec 02, 2025.Product Rate APR 30-year Fixed Fha Refinance 5.56% 6.77% 30-year Fixed Va Refinance 5.68% 5.82%

Plus, some lenders may let you refinance up to 100% of your home’s value – even when receiving cash back at closing.

The VA does not have rigid rules regarding credit scores and debt ratios. However, VA lenders typically have credit score minimums ranging from 580 to 640 and look for a maximum DTI between 40% and 50%.

FHA to USDA Refinance

Although the USDA program typically has lower fees than FHA loan refinances, only existing USDA borrowers are eligible for any of the USDA’s refi options. If you currently have an FHA loan, you cannot refinance it into the USDA.

Refinancing Into an FHA Loan

In some cases, homeowners who currently have a different type of mortgage may be better off refinancing into an FHA loan. Oftentimes, this is because their credit score has decreased, they’ve lost income, taken on additional debt, or don’t have the equity to refinance through other programs.

For Example: A homeowner who currently has a conventional loan has seen their credit score drop to 610 and their debt-to-income ratio rise to 52% since they initially took out their mortgage. In this scenario, they would not qualify for a conventional refi. However, they would still meet the minimum standards required to refinance into an FHA loan.

Benefits of Refinancing an FHA Loan

What benefits should you expect when refinancing an FHA loan? Some of the most common reasons homeowners choose to refinance include:

- Interest rates have dropped

- Monthly payments are lower

- Changing to more favorable terms

- Cashing out equity

FHA Refinance Costs

Generally speaking, you can expect FHA refinance costs to run between 4% and 6% of your total mortgage. This estimate includes your upfront mortgage insurance premium and other expenses such as underwriting fees, title insurance, and lender discount points.

However, many factors can impact this amount, and some loans may be cheaper than others. For example, most FHA streamline refinances do not require an appraisal, which can save an average of $400 to $700, according to HomeGuide.

In addition, existing FHA borrowers who have had their current loan for fewer than three years may qualify for a UFMIP refund. This refund can reduce the closing costs associated with the refi. Depending on how long you’ve had your loan, you could be eligible for between 10% and 68% of the upfront mortgage insurance premium you previously paid.

How to Refinance Your FHA Loan

What does refinancing your FHA loan entail? Here’s a quick breakdown of the FHA loan refinance process in five simple steps.

- Establish Refinance Goals: What benefits do you hope to achieve from your refinance? This could be something like lowering your interest rate, changing the length of your mortgage, or cashing out some of your built-up equity.

- Apply With Multiple FHA Lenders: You’re unlikely to get the lowest rates simply by refinancing with your current lender. To find the best deal possible, shop around with at least three different FHA lenders.

- Compare Loan Estimates and Lock In Your Interest Rate: By applying with at least three mortgage companies, you can compare your different loan estimates and use the best to try and negotiate more favorable terms with the others. This could be in the form of a lower rate or reduced closing costs.

- Work With Your Lender to Provide Necessary Documents: The amount of paperwork will depend on the type of FHA loan refinance you’re applying for. Streamline refinances won’t require much, while others will need you to provide things like pay stubs, tax returns, and bank statements. You’ll also need to pay for a home appraisal to establish an accurate market value for your property.

- Close on Your Refinance: Once your application has cleared underwriting, you’ll be given a date for closing. This is when you’ll sign all your paperwork, pay any required closing costs, and officially have refinanced your FHA loan.

An FHA Refinance Is a Good Fit for Many Homeowners

Refinancing an FHA loan often allows homeowners to slash their monthly payments by reducing their interest rate or extending their mortgage’s term. Some borrowers even shorten their term to pay their home off sooner, while others use the refinance to turn their equity into cash.

Ready to get started? Start your application with Refi.com today.