Cash-Out Refinance to Buy a Second Home or Rental Property: How It Works

Lots of people who want to buy a second home think they’ll never save enough money. The down payment alone can reach $100,000 or higher for some buyers since rules for second homes are stricter than for primary residences.

But many of these same buyers are already sitting on an untapped resource that could push them over the down payment hurdle or possibly pay for the second home outright: home equity.

Home equity is the difference between your home’s value and what you still owe on it. In other words, it’s the portion of the house you own outright.

And, with enough of it, you can turn a portion of that equity into cash with a cash-out refinance.

Key Takeaways:

- A cash-out refinance loan can unlock the equity that’s built up in your current home

- This equity can be invested in a second home or investment property

- Getting approved for a cash-out refi is a lot like getting approved for a home purchase loan

How a Cash-Out Refinance Can Help You Purchase a Second Home

Here’s how a cash-out refinance can help you buy a second home:

- The cash-out refinance replaces a home’s existing mortgage with a new mortgage with a higher balance

- Funds from the new mortgage pay off the old mortgage loan

- The difference between the original and new mortgage’s balance is turned into cash. It’s this cash from equity that could help pay for a second home

- The homeowner starts making payments on the new cash-out refi

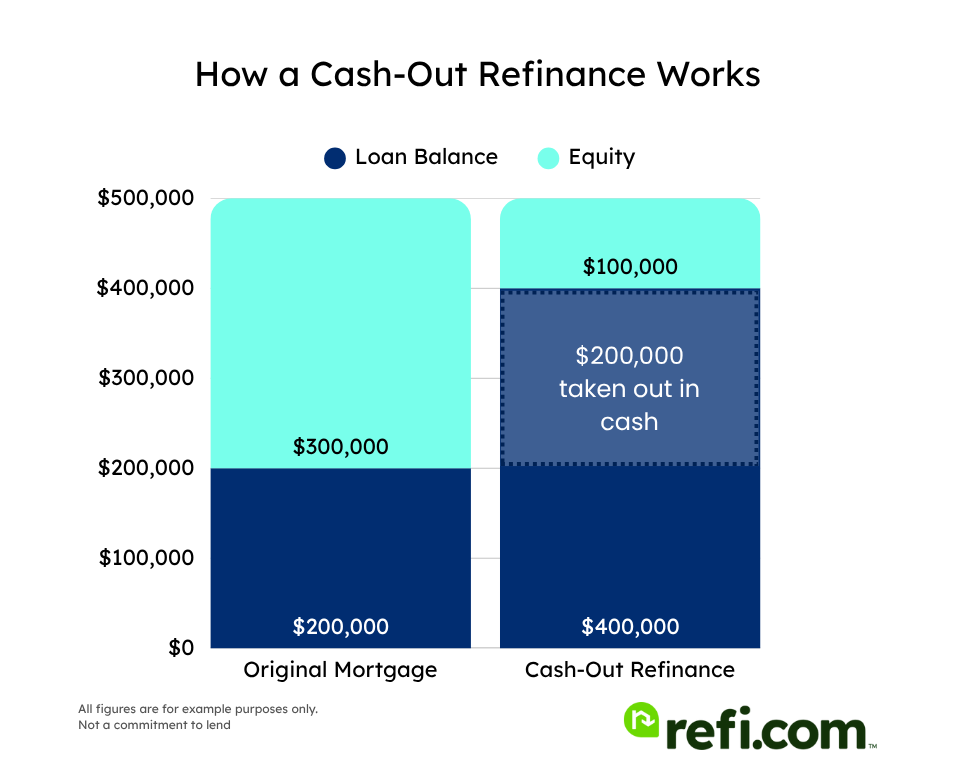

How much money can you get? Let’s say the Smith family’s home in Salem, Ore., is worth $500,000. The family still owes $200,000 on the mortgage. Most cash-out refinance options have a maximum loan-to-value (LTV) ratio of 80% of the home’s value. So, the Smiths could tap into a total of $400,000 of their home’s value. Here’s how that cash would be distributed.

- $200,000 of the new loan to pay off their current loan

- The other $200,000 in the loan would be paid out in cash to the Smiths at closing.

- $100,000 (20%) equity remains in the home.

The Smiths could put this money down on their vacation home or investment property.

This is a Common Real Estate Investment Tactic

For a homeowner with enough home equity, a cash-out refi can make buying a second home faster and easier, especially when compared to spending years saving up a down payment.

This can also be a smart investment strategy, according to Chad Collins, a Realtor and Certified Public Accountant and financial adviser in Greensboro, N.C.

“Ask yourself, ‘Does the return on investment (ROI) exceed the cost of capital (interest rate)?’” Collins said. “For example, if my ROI is 10% and my interest rate is 7%, then I may consider this as an option.”

With real estate, return on investment can include the appreciation of the new home and any earnings from long-term or short-term rentals. Many real estate investors do this math and decide that using equity to buy a new property is a good idea.

Collins said to consider inflation, too. Inflation, along with interest, helps determine the cost of the investment. Periods of low inflation reduce the costs of investing. Inflation was unusually high in 2022 and 2023 but subsequently fell to more normal levels. Historically, it ranges from 2 to 4% a year, and the Federal Reserve aims to keep it close to 2%.

Real-Life Example: Turning Equity Into a Vacation Property

Let’s say Maria owns a home in Phoenix valued at $600,000 and has a $280,000 mortgage balance. With 80% LTV limits, she could refinance up to $480,000.

After paying off the original mortgage, Maria has $200,000 (less closing costs) in cash-out funds. She uses $150,000 of that as a down payment on a $500,000 beach house in California.

Now, she has a new mortgage on her primary home and another mortgage on the vacation property. She rents out the second home part-time to offset expenses and builds wealth in both properties.

Advantages of Using a Cash-Out Refinance

A cash-out refinance isn’t the only way to generate a down payment for a second home or investment property. A buyer could also use a personal loan, sell another property to earn cash or use money they’ve already saved.

But the cash-out refi strategy has unique advantages:

- New mortgage, new terms: A cash-out refinance means a whole new mortgage, which means new terms. So, if the timing is right, you could lower your interest rate and/or improve other terms while also tapping equity.

- There’s no need to sell a home: With a cash-out refinance, the buyer can keep living in (or earning money from) a home while still leveraging its equity toward a new home.

- Costs are lower: Lenders use the home’s equity as collateral, allowing them to charge lower borrowing rates when compared to many unsecured personal loans. This helps achieve Collins’s rule for keeping costs lower than earnings.

- Still one mortgage on primary home: Second loans like home equity lines of credit (HELOCs) also tap into equity, but they require making two mortgage payments each month. A cash-out refi leaves only one house payment to keep up with.

- May speed up the buying process: In the time needed to save tens of thousands of dollars, home prices will likely keep going up. Using a cash-out refi can allow the buyer to benefit from higher home prices rather than chasing after them.

- No need to tap your savings: Borrowers who have savings in cash can keep that cash and use their equity instead. Keeping a healthy savings account balance can create peace of mind and leave doors open to other investment opportunities. Healthy savings can also help with future mortgage eligibility.

In short, many investors like the symmetry of using their existing home equity to gain more equity in a new home. A cash-out loan can make this happen.

Disadvantages of Using a Cash-Out Refinance

Using cash-out loans to generate a down payment for a second home won’t be the best plan for everyone. Keep these disadvantages in mind:

- Cash-out refi increases debt on current home: Homeowners who’ve been working for 10 years or longer to pay down their mortgage debt may not want to increase debt on the same home for any reason

- It could increase interest rate: A cash-out refinance will lock in today’s interest rates, which could be higher than the rate on an existing loan, especially if the loan originated during the pandemic when rates were historically low

- It could increase long-term interest expenses: Even if the new cash-out rate stays about the same as the current loan’s rate, stretching the debt over a longer term usually increases long-term interest costs

- Closing costs: Closing costs could equal 2-5% of the loan. On a $400,000 loan, closing costs could range from $8,000 to $20,000.

Buyers should factor in these potential disadvantages when they compare costs to benefits. For some buyers, the advantage of investing in more real estate can outweigh these costs.

Cash-Out Refinance Eligibility

Cash-out refinances are available as conventional, FHA, and VA loans. Each comes with its own set of eligibility criteria. And lenders, like Refi.com, often have their own rules on top of the program minimums.

Here’s a quick snapshot of what’s typically required. We’ll discuss some of the nuances in further detail below.

| Requirement | Conventional Loan | FHA Loan | VA Loan |

| Credit Score | 620+ (680+ preferred) Refi.com requires 660 | 500, according to FHA guidelines Most lenders require 600+ Refi.com requires 620 | No VA-set minimum. Most lenders require 620+ |

| Max Loan-to-Value (LTV) | 80% | 80% | 100%, according to VA guidelines Most lenders allow 90% |

| Debt-to-Income (DTI) | ≤ 43% (some up to 50%) | ≤ 50% | Flexible, varies by lender |

| Homeownership History | 12 months | 12 months | 12 months |

| Occupancy | Primary or secondary residence* | Must be primary residence | Must be primary residence |

*Cash-out refinances on secondary residences come with stricter requirements. This article focuses on primary residence cash-out refinances.

Home Equity and Loan-to-Value Ratio

Most lenders require borrowers to leave at least 20% of their equity untouched, which means the max LTV is 80%. That’s why the Smiths from our example earlier could borrow only $400,000. That loan would have left $100,000 (or 20%) equity in the home.

Credit Score

Credit scores for cash-out refinancing resemble scores for home purchase loans. Keep in mind that lenders, like Refi.com, often have stricter rules than what government agencies like the FHA and VA require in their guidelines.

- Conventional borrowers need scores of at least 620 but can often get the best rates when their scores exceed 720. Refi.com requires a 660 FICO credit score for a conventional cash-out refinance.

- The VA does not mandate a specific credit score requirement, but most lenders require a FICO of 620 or higher.

- According to HUD guidelines, FHA borrowers can get approved with scores as low as 500. However, most lenders require scores above 600. Refi.com requires a 620 FICO credit score for an FHA cash-out refinance.

Higher credit scores can help borrowers access more of their home equity.

Debt-to-Income (DTI) Ratio

As with purchase loans, lenders need to know whether borrowers can afford the loan’s monthly payments. They determine this through debt-to-income ratio, or DTI. This ratio compares gross monthly income to payments on debt, including the new home loan, student loans, credit card minimum payments, car loans, or any other debt.

- Conventional borrowers ideally stay below 36%, but many lenders allow up to 45% or even 50% with compensating factors.

- FHA borrowers could reach 45% DTI, and sometimes even higher.

- VA borrowers, ideally, shouldn’t exceed 41% DTI.

DTI also helps set maximum loan sizes for cash-out loans.

Seasoning and Occupancy

Most lenders require you to have owned your current home for at least 6- 12 months before doing a cash-out refinance.

For government-backed loans (FHA, VA), the home you’re refinancing must be your primary residence. Conventional guidelines allow cash-out refinances on both primary and secondary residences, though requirements on second homes are often stricter due to the increased risk for lenders.

Cash-Out Refinance Costs

Like any mortgage transaction, a cash-out refinance comes with costs—some upfront, some baked into the long-term loan structure. Understanding these costs can help you decide whether this strategy makes financial sense.

Closing Costs

As mentioned previously, expect to pay between 2% and 5% of the loan amount in closing costs. On a $400,000 loan, that’s $8,000 to $20,000. These costs typically include:

- Lender origination fees

- Appraisal

- Title insurance and recording fees

- Taxes or prepaid escrow (property taxes, insurance)

In most cases, these costs are paid using the funds from the cash-out itself. So, instead of writing a check at the closing table, the closing costs are simply deducted from the cash you’d receive.

Example: If you’re approved for $100,000 in cash-out funds and your closing costs total $10,000, you’d receive $90,000 at closing.

Lenders may also allow you to roll closing costs into the loan balance, which increases your loan amount and interest costs but avoids reducing your cash proceeds.

Higher Interest Rates

Cash-out refinances usually carry slightly higher rates than rate-and-term refinances—often 0.25% to 0.5% higher. Lenders charge more because you’re increasing your loan balance and accessing equity, which adds risk.

Even a small rate difference can add up over time, so it’s important to compare offers from multiple lenders and understand how your new rate affects monthly payments and total interest.

Optional: Paying Mortgage Points

Mortgage points (also known as discount points) are an optional fee you can pay at closing to “buy down” your interest rate. One point typically costs 1% of your loan amount and may reduce your rate by about 0.25%, though this varies by lender.

Example:

On a $400,000 refinance, one point would cost $4,000. Paying that point could reduce your interest rate from 7.0% to 6.75%, potentially saving thousands over the life of the loan.

Can You Use Cash-Out Funds to Buy Points?

Yes, you can use part of your cash-out proceeds to pay for mortgage points. In that case, the cost of the points would be subtracted from the cash you’re receiving at closing.

However, not all lenders allow this, and it depends on how your loan is structured. If the primary goal is to maximize cash-in-hand for your second home, using funds for points may not make sense. But if you’re focused on minimizing your long-term costs, it could be a worthwhile trade-off.

Cost-Saving Tip:

To minimize total borrowing costs:

- Shop at least 3–5 lenders for the best rate and fee combo

- Ask whether closing costs can be rolled into the loan

- Avoid extending your loan term unless necessary

- Consider paying points to lower your rate if you plan to keep the home long-term

How to Use a Cash-Out Refinance to Buy a Second Home: Step-by-Step

If you’re considering tapping into your home equity to purchase a second property, here’s how to navigate the process:

- Assess Your Home Equity. Estimate how much equity you have by subtracting your current mortgage balance from your home’s market value. You’ll generally need to leave 20% equity untouched. The required appraisal will ultimately determine how much equity you truly have.

- Check Your Credit and Finances. Lenders will review your credit score, DTI, and financial stability. The higher your credit score and the lower your DTI, the better your options.

- Shop Around for Lenders. Compare cash-out refinance options across banks, credit unions, and mortgage lenders. Rates and fees vary, so don’t settle for the first offer. It’s generally best to shop around with at least three lenders.

- Apply for a Cash-Out Refinance Loan. Submit documentation like pay stubs, W-2s, tax returns, and details about the property you’re buying.

- Get a Home Appraisal. Your lender will order an appraisal to determine your home’s current value. This affects how much equity you can access.

- Close on Your Loan and Access the Funds. Once approved, you’ll close on the refinance. Your new mortgage pays off the old one, and you receive the remaining equity in cash, usually within three days or so.

- Use the Funds for Your Second Home. Apply the cash toward a down payment or even buy the property outright, depending on the amount you receive and your goals.

Market Conditions and Timing Your Refinance

Refinances are all about timing. Interest rates, home values, and your financial profile all play a role in how favorable your refinance terms will be.

In the case of using a cash-out refinance to buy a second home, timing can have a double impact: you’re securing the rate on both your new refinance loan and potentially on the second home’s mortgage (if you’re financing it).

That’s why shopping during a low-rate environment can be a big win—your primary mortgage rate stays affordable, and your new property’s financing costs are reduced, too.

Even a small difference in rates can mean thousands of dollars saved over time, so if you’re eyeing a second home, keep a close watch on market trends and consider acting when rates dip.

Alternatives to a Cash-Out Refinance

Cash-out loans aren’t the only path to a new second home or investment property. These loans can also help:

| Option | Description | Pros | Cons |

| Home Equity Loan | A lump-sum second mortgage based on home equity | Fixed rate, predictable payments | Two mortgage payments; higher rate |

| HELOC (Home Equity Line of Credit) | A revolving line of credit against your home | Flexible access to funds | Variable interest rates; risk of overspending |

| Personal Loan | Unsecured installment loan | Fast funding; no home risk | Can have higher interest rates; smaller loan limits |

| 401(k) Loan | Borrow against your retirement | No credit check | Potential penalties; impacts retirement growth |

| Sell Investments or Assets | Liquidate stocks or properties | Immediate cash | Potential tax implications; lose future growth |

Let’s explore some of these in further detail below:

Home Equity Loan

Like a cash-out refi, a home equity loan borrows against a home’s equity. Unlike a cash-out refinance, a home equity loan is a second mortgage. They leave a home’s existing mortgage intact while adding a second loan to access equity. So, if you use a second mortgage to pay for a second home, you could have up to three mortgage payments to make.

A second mortgage can be a good option if you’ve already got great terms on your mortgage and don’t want them changed. For example, if you bought your home in late 2020 when rates were at historic lows, getting a cash-out refinance now, with rates near the 7% mark (at the time of writing), may not sound that enticing.

- Pros: Keep the first mortgage intact

- Cons: Second loans typically charge higher rates than primary mortgage rates. They also add a second monthly payment and a second lien on the property.

“Keep in mind that the lender will need to calculate the new home equity loan payment into your debt-to-income ratio,” said Christina McCollum, a producing market leader for Churchill Mortgage.

This extra payment for the home equity loan could affect eligibility on any other financing needed for the second home, she said.

If a cash-out refinance means taking a higher interest rate, a home equity loan may be a better option.

HELOC

A home equity line of credit (HELOC) is another second mortgage option. But instead of getting a fixed loan for this purpose, a HELOC opens a revolving line of credit that has a variable rate. It functions much like a credit card – just with much lower interest rates.

HELOCs can be paid down and reused as needed during their draw periods, which usually last 10 years. During this time, borrowers can make interest-only payments, allowing for lower out-of-pocket costs.

- Pros: Like a home equity loan, a HELOC lets borrowers keep their current primary mortgage rates in place

- Cons: The HELOC’s variable rate can scare off some borrowers. However, fixed-rate HELOCs are available.

“The HELOC and home equity loan options are both good short-term options for securing the funds for a down payment,” Collins said.

But Collins pointed out that current tax laws don’t allow borrowers to write off interest on HELOCs or home equity loans unless they reinvest the money back into their primary residences. As a result, borrowers making a down payment on a second home couldn’t write off HELOC or home equity loan interest.

Bridge Loan

A bridge loan could also generate a down payment for a vacation home or investment property, but bridge loans must be repaid quickly. This kind of temporary financing can help buyers who need cash quickly to close a deal.

But the buyer will need a built-in exit strategy in place before they open the bridge loan.

For example, if the Smith family found the perfect vacation home but knew it would sell within days if they didn’t make an offer, they could use cash from a bridge loan for the down payment. Then, in a few months, they could use funds from their cash-out refinance to pay off the bridge loan.

- Pros: Borrowers with excellent credit scores can get quick approval, which helps shoppers in competitive real estate markets

- Cons: Interest rates are high, and the loans must be paid off quickly. Some bridge loans require huge balloon payments at the end of their short terms

A bridge loan is not a permanent form of financing like a cash-out refi or home equity loan.

Will a Cash-Out Refinance Affect My Taxes?

In most cases, the funds you receive from a cash-out refinance are not taxable because they’re considered a loan—not income.

However, mortgage interest deductions can get tricky. If you use the cash to improve your primary residence, interest may be tax-deductible. But if the funds are used for a second home or investment property, the deductibility depends on how you use the new property and your tax situation.

It’s wise to speak with a tax professional before making a final decision.

Should You Use a Cash-Out Refinance to Buy a Second Home?

Directing existing home equity into buying a new home can work well when gains outweigh the costs of borrowing the money.

Since it requires only one mortgage payment each month, a cash-out refinance lowers month-to-month costs for many borrowers when compared to other types of home equity loans.

This strategy depends on getting the lowest rates and fees on the cash-out loan. Shopping around and comparing rates makes finding the best deal a lot more likely.