FHA Cash-Out Refinance: What You Need to Know in 2025

The Federal Housing Administration (FHA) offers an assortment of mortgage options aimed at borrowers who may have trouble qualifying with other lenders. One of their most popular loan products is the FHA cash-out refinance, which allows homeowners to withdraw a portion of their equity as a lump sum of cash to use however they see fit.

This guide covers everything you need to know about the FHA cash-out plan, including how it works, what it takes to qualify, and the alternatives you may want to consider first.

- An FHA cash-out refinance lets you withdraw your home’s equity as a lump sum of cash, which you can use however you like.

- Common reasons for a cash-out refinance include making home improvements, paying off other debts, and covering major life expenses.

- Thanks to more lenient requirements, borrowers who cannot qualify for other cash-out loans may be eligible for the FHA cash-out plan.

What Is an FHA Cash-Out Refinance?

An FHA cash-out refinance allows homeowners to take out a new loan for more than they owe on their current mortgage by using their home equity. Home equity is the difference between your home’s current value and what you still owe on your mortgage. The more equity you have, the more cash you can get.

Here’s how it works: you take out a new, bigger loan to replace your current mortgage. The new FHA loan amount depends on your home equity. The extra funds, or the difference between the new loan and what you owe on your old mortgage, are given to you in cash.

What Is FACOP, and Is the FHA Cash-Out Plan Legit?

You may hear the FHA cash-out plan referred to as a “FACOP” refi, meaning a “Federal Assistance Cash-Out Program” refinance loan. Though some lenders may use these terms interchangeably for marketing purposes, this is not an official term for an FHA cash-out refinance.

If you encounter FACOP refi terminology, evaluate the offer’s validity carefully. Remember, the Federal Housing Administration backs all legitimate FHA cash-out refinance loans.

Who Is an FHA Cash-Out Plan Good For?

Any homeowner who meets program guidelines can use the FHA cash-out plan to tap into their built-up equity. But who, exactly, is the ideal candidate for an FHA cash-out?

- Homeowners who do not qualify for a conventional cash-out refinance

- Homeowners with lower credit scores who are eligible for a conventional cash-out but at rates higher than an FHA-backed mortgage

How an FHA Cash-Out Works

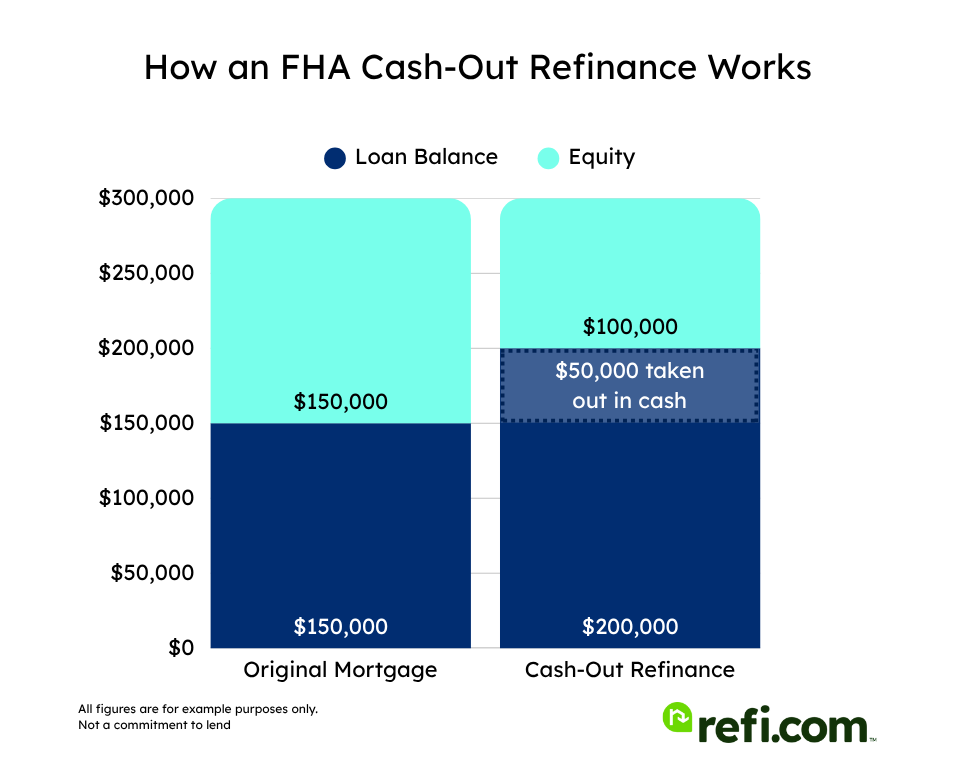

The FHA cash-out plan involves taking out a new, larger loan that pays off your current mortgage and provides you with the difference as a lump sum of cash during the closing process.

For Example: You currently have a $150,000 mortgage on your home valued at $300,000. You’ve applied with an FHA lender who has qualified you for a loan as large as $240,000. You decided to do a $200,000 FHA cash-out refinance, with the new loan paying off your current mortgage and you receiving the difference of $50,000 (minus closing costs) to spend however you choose.

Let’s break that down:

- Home value: $300,000

- Mortgage: $150,000

- Your equity: $150,000 ($300,000 – $150,000)

You take out a loan of $200,000 and are left with $50,000 in cash:

- Loan amount: $200,000

- Loan portion to pay off your mortgage: $150,000

- Cash left over for you to take out: $50,000 ($200,000 loan – $150,000 to pay off current mortgage)

- Remaining equity: $100,000 ($300,000 home value – $200,000 loan amount)

There’s no limit to how you can use the funds from an FHA cash-out. Some of the most popular reasons for cashing out built-up equity include:

- Home improvements and renovations

- Consolidating high-rate debts

- Paying off HELOCs and other second mortgages

- Purchasing a second home or investment property

- Covering major life expenses such as a wedding or college tuition

Who Qualifies for an FHA Cash-Out Refinance?

What does it take to qualify for an FHA cash-out refinance? You may be surprised to discover that the FHA loan requirements are more relaxed than for most other types of mortgages.

Credit Score

FHA guidelines allow credit scores as low as 500 for an FHA cash-out refinance. However, most lenders, including Refi.com, have their own requirements. Refi.com requires a 620 credit score for an FHA cash-out refinance.

Maximum Loan-to-Value (LTV)

The maximum loan-to-value (LTV) is the total amount of a property’s value that FHA lenders are allowed to loan. FHA guidelines set the maximum LTV at 80% for cash-out refinances. Remember, this is the maximum loan-to-value after you’ve cashed out your equity.

For example, a $250,000 home would have a maximum LTV of $200,000. If you currently owe $150,000 on your mortgage, you could cash out as much as $50,000 in equity minus closing costs on the new loan.

Debt-to-Income Ratio (DTI)

Your debt-to-income ratio (DTI) is the percentage of your monthly income going toward your housing expenses and other debt obligations. For example, if you earn $6,000 per month, are applying for a $1,500 mortgage, and your only other debt is a $500 car payment, your DTI would be just over 33% ($2,000 debt / $6,000 income).

FHA lenders generally have maximum DTI limits ranging from 43% to 50%. However, borrowers with positive compensating factors may qualify with a DTI as high as 56.9%.

Occupancy Requirements

FHA loans are only for borrowers who have occupied the subject property as their primary residence for at least 12 months. You cannot get an FHA cash-out refi on a second home or investment property. You must also certify that you plan to continue living in the house for at least another year after closing on your cash-out.

Payment History

To qualify for the FHA cash-out plan, you must have made all your mortgage payments on time within the past 12 months. This rule also applies to any second mortgage secured by the property.

Mortgage Insurance Premiums

All FHA-backed loans come with mortgage insurance premiums. This includes a 1.75% upfront mortgage insurance premium (UFMIP) and an annual MIP of 0.5% for most cash-out borrowers. If you took out your current FHA mortgage fewer than three years ago, you may qualify for a partial UFMIP refund to help reduce your closing costs.

FHA Loan Limits

All agency-backed loans must be within current FHA loan limits: in 2025, that limit is $524,225 for a single-family home in most areas of the country. However, certain high-cost areas have expanded loan limits, which can be as much as $1,209,750 for a single-family home. Alaska, Hawaii, Guam, and the USVI have an even higher single-family limit of $1,814,625.

You can check out HUD’s FHA Mortgage Limits tool to discover the current loan limits in your area.

FHA Cash-Out Rates

Lenders face less risk in issuing FHA loans since the federal government insures them. For borrowers, this translates into more lenient qualifications and overall lower rates. Most homeowners, except those with the highest credit scores, will likely be quoted lower cash-out rates with an FHA-backed loan. Let’s take a look at how FHA refinance rates are trending compared to conventional refinances:

How we source rates and rate trends

Rates based on market averages as of Dec 02, 2025.Product Rate APR 30-year Fixed Fha Refinance 5.56% 6.77% 30-year Fixed Refinance 6.35% 6.37%

However, although FHA cash-out rates are likely lower than conventional alternatives, the mortgage insurance premiums will likely drive the annual percentage rate (APR) – a more accurate measure of your borrowing costs – higher than conventional cash-outs, which don’t require mortgage insurance.

Keep in mind that FHA cash-out rates are going to be higher than the basic rate-and-term refi. You can expect to pay 0.25% to 0.50% more for a cash-out refinance. However, those ranges may vary based on dynamic market conditions.

Back in 2024, I helped a borrower who could’ve gone conventional, but FHA cash-out rates were almost a point lower. That lower rate plus consolidating debt slashed her monthly bills by hundreds—even with mortgage insurance—and gave her extra funds for a remodel.

How Much Will It Cost to Get an FHA Cash-Out Refinance?

Getting an FHA cash-out refinance means taking out a brand-new loan and paying the associated closing costs. Costs can vary by lender and location but typically run between 3% and 6% of the financed amount.

This includes the FHA’s 1.75% UFMIP, as well as other standard expenses like:

- Origination fees

- Underwriting fees

- Lender discount points

- Title insurance

- Appraisal fees

- Prepaid escrows

Homeowners who refinance into a new FHA loan within three years of their original FHA mortgage may be eligible for a partial UFMIP refund, which is credited toward the new upfront premium and can lower the overall cost of refinancing.

Also, in contrast to conventional cash-outs, which do not require mortgage insurance on loans with an LTV of 80% or lower, all FHA loans have an ongoing annual mortgage insurance premium (MIP). This annual MIP rate ranges from 0.15% to 0.75%, with most cash-out refinances having an ongoing MIP of 0.5% that remains in effect for 11 years.

How to Apply for the FHA Cash-Out Plan

What does the process of applying for the FHA cash-out plan entail? Here’s a quick breakdown of what you can expect.

Determine your current loan balance.

You should be able to find this information on your monthly mortgage statement or online on your mortgage servicer’s payment portal. A rough estimate is fine at this point, although you will need an exact payoff balance later on.2. Calculate how large of a cash-out you could qualify for.

Using your current loan balance and the estimated value of your home, you can get a good idea of what size FHA cash-out refinance you may qualify for. Since FHA lenders can loan up to 80% of a property’s value, simply multiply your home’s value by 0.8 and then subtract your current mortgage balance.

For example, if you have a $175,000 loan on a $350,000 home, you multiply $350,000 by 0.8, resulting in a maximum loan amount of $280,000. Subtracting the $175,000 existing balance would leave $105,000 in available equity that could be cashed out, minus closing costs.Shop around with multiple lenders to compare quotes.

You’re unlikely to get a great deal if you only apply for a single lender quote. Even worse? Using your current lender for your refinance without checking the competition.

To maximize your chances of getting the best deal on an FHA cash-out mortgage, shop around with a minimum of three lenders, comparing their quoted interest rates and estimated closing costs. You can also send your best quote to the other lenders you’ve contacted to see if they can offer a better deal to win your business.Accept a loan estimate and proceed with underwriting and the appraisal.

After you’ve chosen a lender and accepted their loan estimate, the next step is to order a refinance appraisal to confirm the property’s value. During this time, loan underwriters review your documentation to ensure everything is complete and ready to move forward with the refinance.Go through with the closing and receive your equity in cash.

If the appraisal comes back good and no problems arise during underwriting, the final step is to close on your loan – officially signing all the required documents – and receive your cashed-out equity as a lump sum payment.

Because federal regulations regarding cash-out refis enable homeowners to change their minds and cancel their loans within three days, you will receive your funds on the fourth business day after closing. Depending on your lender’s processes and preferences, the payment is typically delivered via check or direct wire transfer.

From start to finish, an FHA cash-out refinance typically takes between 30 and 60 days to complete, depending on the lender’s workload and waits related to appraisals and other third-party providers.

FHA Cash-Out vs FHA Streamline

You may have heard about another popular FHA refinance program: the FHA streamline refinance. What exactly is the FHA streamline, and how does it differ from the FHA cash-out plan?

Most importantly, the FHA streamline does not allow you to cash out your equity or receive funds back at closing.

Instead, the FHA streamline refinance is a low-doc refi option that lets homeowners lower their interest rate and monthly payments without the hassle of the entire refinancing process.

Also, while the FHA cash-out plan is open to all homeowners regardless of their existing mortgage type, only current FHA borrowers can qualify for a streamline refinance.

Streamline refis do not require a home appraisal. In most cases, you won’t need to undergo a detailed credit check or reverify your income either. Current FHA loan holders who can cut costs by refinancing and don’t need to touch their equity are likely better off with the streamline.

FHA Cash-Out vs Other Cash-Out Loans

How does the FHA cash-out refinance stack up against other popular loan options? Here’s a quick chart outlining the most noteworthy differences.

| FHA Cash-Out | Conventional Cash-Out | VA Cash-Out | |

| Credit Score | 500* | 620* | 620** |

| LTV | 80% | 80% | 100% |

| DTI | 56.9% | 50% | 41%-50%* |

| Loan Limit*** | $524,225 | $806,500 | n/a |

**VA guidelines set no required credit score or DTI, with individual lenders establishing their own limits. These are common lender requirements.

***Baseline loan limit for a single-family home in most areas of the United States in 2025.

Alternatives to an FHA Cash-Out Refinance

The FHA cash-out plan is a great way to utilize your home’s built-up equity, but there may be other options for getting the funds you need. Here’s more info about the different types of cash-out refinances and some other alternatives worth considering.

Conventional Cash-Out Refinance

A conventional cash-out refinance works much the same way as the FHA cash-out plan but with one significant advantage: you won’t be required to pay for mortgage insurance premiums. All FHA loans require mortgage insurance, but conventional loans only require it from borrowers with less than 20% equity. Refinancing an FHA loan to a conventional loan is a common strategy homeowners use to cancel their FHA mortgage insurance.

This can save you 1.75% at closing by avoiding the FHA UFMIP and let you avoid the ongoing premiums that last for 11 years with most FHA cashouts.

Keep in mind, however, that conventional lenders do have stricter qualifying standards, with most borrowers needing a credit score of 620+ and debt levels lower than required for FHA-backed mortgages. Refi.com requires a 660 credit score for a conventional cash-out refinance.

VA Cash-Out Refinance

The VA cash-out refinance program is open to homeowners who qualify for a Certificate of Eligibility from the US Department of Veterans Affairs. VA cash-out rates are often lower than the FHA cash-out plan, and VA loans do not require ongoing mortgage insurance payments.

Also, while FHA lenders are limited to an 80% loan-to-value ratio, the VA allows borrowers to tap into their full home equity and withdraw up to 100% of the property’s current appraised value. Some lenders, however, limit VA cash-outs to 90%.

Plus, VA loans have no maximum loan limit – the amount you can borrow is only restricted by your repayment ability.

VA cash-out refis have a funding fee, similar to the FHA’s UFMIP. Borrowers who have never used their VA loan benefits pay a cash-out funding fee of 2.15%, while repeat users pay a fee of 3.3%. Specific borrowers who qualify for compensation from a service-related disability may have the funding fee waived.

Home Equity Line of Credit (HELOC)

A home equity line of credit (HELOC) is a second mortgage you take out alongside your current loan. Unlike a cash-out refinance, a HELOC does not replace or interfere with your existing mortgage.

Instead of providing cash as part of closing, a HELOC lets you tap into a revolving line of credit tied to your home’s equity. You can borrow against your equity, repay the balance, and borrow funds again as many times as you’d like during the initial HELOC draw phase of up to 10 years.

HELOC interest costs are usually variable and often higher than FHA cash-out rates, although you only pay interest on your current balance. Home equity lines of credit generally make the most sense for borrowers who just need to access a small amount of equity or those with a favorable below-market rate on their existing mortgage.

Personal Loan

A personal loan can help you get the money you need much faster than an FHA cash-out and without the related closing costs. Personal loans are unsecured debt typically offered by private lenders and banks.

Because personal loans are unsecured, they are likely to have higher rates than a cash-out refinance. The repayment term is typically shorter, with most loans lasting a maximum of seven years.

However, the most significant benefit of an unsecured personal loan is that it is not tied to your home. If you run into financial difficulties and have trouble making payments, the lender cannot move to foreclose on your property like with a mortgage.

Pros and Cons of the FHA Cash-Out Plan

The FHA cash-out refinance loan can be a powerful tool for homeowners to tap into their built-up equity. However, there are some downsides to consider before deciding whether an FHA cash-out refi is the right move for you.

| Pros | Cons |

| Lenient Qualification Requirements Ability to Consolidate Debt Potential to Lower Rates MIP Reduction | Loan Closing Costs Mortgage Insurance Premiums Reduced Equity Occupancy Requirements |

Pros of an FHA Cash-Out Refinance

Lenient Qualification Requirements:

FHA lenders have more lenient borrower requirements than other types of loans. Homeowners with bad credit and high debt levels may still be eligible to cash out equity.

Ability to Consolidate Debt:

One practical way to use the funds from a cash-out refinance is to pay off other high-interest debts. For example, a $10,000 credit card balance at a 25% interest rate would cost you $2,500 a year in financing charges. The same debt wrapped into a 6.5% FHA cash-out refi would run just $650 in annual interest.

Potential to Lower Rates:

Interest rates are down from their recent peak, and borrowers who purchased within the past couple of years may be able to refinance at a lower rate, even with the FHA cash-out plan. This is particularly true for homeowners who have seen their finances and credit profile improve since initially obtaining their mortgage.

MIP Reduction:

The standard annual mortgage insurance premium was 0.85% on most new FHA loans until the agency cut its fees in early 2023. Now, most homeowners applying for an FHA cash-out refinance will pay an ongoing MIP rate of 0.5%. If you’re locked into the older, higher rate, refinancing allows you to switch to the lower mortgage insurance premium for immediate savings.

Cons of an FHA Cash-Out Refinance

Loan Closing Costs:

Since an FHA cash-out refi involves taking out an entirely new loan, you are responsible for paying closing costs, typically ranging from 3% to 6% of your loan balance. This can make cash-out refinancing impractical for homeowners who only need to access a small amount of equity.

Mortgage Insurance Premiums:

In addition to the 1.75% UFMIP due at closing, all FHA loans have ongoing mortgage insurance premiums. The annual MIP rate is 0.5% of the loan amount for most cash-out refis. Conventional cash-outs, however, do not require mortgage insurance when the homeowner retains at least 20% equity.

Reduced Equity:

Tapping into your built-up equity reduces the amount you have left and prevents you from using it in the future if the need arises. Plus, reducing your equity likely raises your monthly payments, increasing your overall risk of default.

Occupancy Requirements:

You can only do an FHA cash-out refinance on your primary residence that you’ve lived in for at least 12 months. On top of that, you have to plan to live in the home for at least another year following your refi.

FHA Cash-Out Refinance: Is It Right for You?

An FHA cash-out refinance can allow you to borrow against your home’s equity and receive a lump sum of cash that you can use for home improvements, debt consolidation, or just about any other purpose you can think of.

However, while FHA cash-out rates are typically lower than conventional alternatives, mortgage insurance requirements can drive up the actual monthly costs for most borrowers. Ultimately, the best way to find the right type of cash-out refinance is to check out current refi rates and apply with a lender who can review the different options available in your unique situation.

Ready for a personalized estimate of how an FHA cash-out refinance may help you? Take the first step and apply with Refi.com today.