FHA UFMIP Refund Chart 2025: Save Money On Your Refi

You’ll find our FHA UFMIP refund chart farther down this page. But, before you scroll to it, take some time to discover how the refund works, who’s eligible, and how you can maximize yours.

Suppose you have an FHA loan, which is partly insured by the Federal Housing Administration. When you closed on your home purchase, you’ll have paid an upfront mortgage insurance premium (UFMIP).

Don’t confuse your upfront MIP with your annual mortgage insurance premiums (MIPs), which are included in your monthly mortgage payments. There’s no refund on those (though, FHA MIP can be canceled. Learn how with our guide).

Still, you might be in line for a refund of some of the UFMIP you paid if you refinance to another FHA loan within three years of the existing mortgage starting.

No, you won’t get a check or cash. But the amount you’re due in our FHA UFMIP refund chart will be credited to the UFMIP you’ll pay on closing your refinance. So, it’s a real saving because you’ll need to find less cash on closing day.

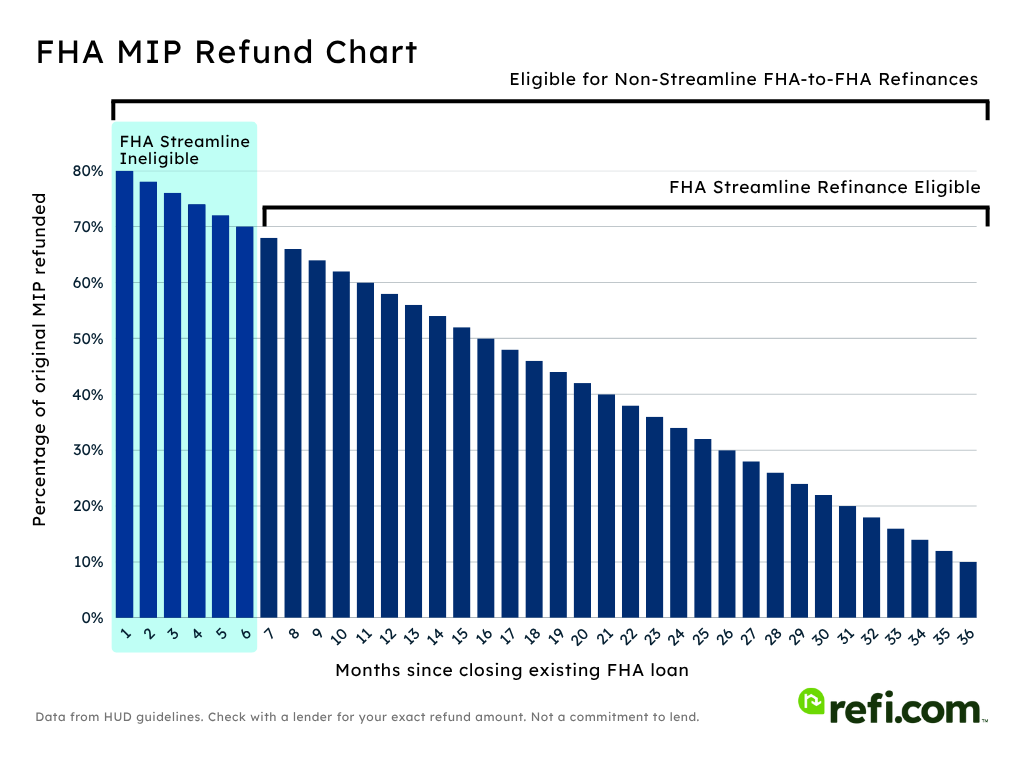

FHA UFMIP Refund Chart 2025

This chart shows the potential refund percentage based on the UFMIP you paid on your current loan.

| Months after closing | Refund | Months after closing | Refund |

| 1 | 80% | 19 | 44% |

| 2 | 78% | 20 | 42% |

| 3 | 76% | 21 | 40% |

| 4 | 74% | 22 | 38% |

| 5 | 72% | 23 | 36% |

| 6 | 70% | 24 | 34% |

| 7 | 68% | 25 | 32% |

| 8 | 66% | 26 | 30% |

| 9 | 64% | 27 | 28% |

| 10 | 62% | 28 | 26% |

| 11 | 60% | 29 | 24% |

| 12 | 58% | 30 | 22% |

| 13 | 56% | 31 | 20% |

| 14 | 54% | 32 | 18% |

| 15 | 52% | 33 | 16% |

| 16 | 50% | 34 | 14% |

| 17 | 48% | 35 | 12% |

| 18 | 46% | 36 | 10% |

How Does the FHA Refund Your UFMIP?

As already mentioned, you’ll never see your refund directly. Instead, somewhere between 80% and 10% of the upfront MIP you paid on your existing mortgage will be deducted from what you’d otherwise owe on closing for the UFMIP on your refinance. Remember that a refinance loan is essentially just a new mortgage, and all FHA loans require UFMIP. So, even though you’re refinancing, you’ll still owe a 1.75% UFMIP on the new loan balance.

So, the savings are real. But you might quibble over the accuracy of the word refund. It’s closer to a store credit.

And there’s a strict time limit. If the period between your closing on your purchase and refinance is longer than 36 months, you won’t get anything at all. What’s more, your refund percentage drops by 2% every month that passes from the time you closed. So, in month 1, you’d get 80% refunded. By month 36, you only get 10%.

At the time of writing, 36 months sounds like a very short period. Indeed, mortgage rates have mostly been rising for years. Here’s a quick look at how FHA refinance rates are trending:

How we source rates and rate trends

Rates based on market averages as of Dec 01, 2025.Product Rate APR 30-year Fixed Fha Purchase 5.56% 6.78% 30-year Fixed Fha Refinance 5.54% 6.75%

And very few are refinancing at all. It makes no sense to refi to a higher rate — and a higher monthly payment — unless you have to.

But that rising trend followed a falling one. And, when mortgage rates were tumbling, some homeowners refinanced annually or even more frequently.

Because interest rates are constantly fluctuating, we’ll likely see them fall again. And the three-year limit you see on the FHA UFMIP refund chart above might again look reasonable.

Calculating Your Refund

The percentage you stand to get refunded is wholly dependent on the length of the period between your first closing and the one for your refinance.

You get 80% if your refinance closes one month after your first. (Inevitably, almost nobody ever gets that.) And you’ll get 10% if that gap is 36 months. So, the sooner you act when you’re ready to refinance, the greater your benefit should be.

Each month after month one, the refund rate drops 2%. So, it’s 80% in the first month, 78% in the second, 76% in the third and so on. So, the sooner the better. To complicate things a bit further – FHA streamline refinances, which are arguably the simplest FHA refinance option, are only available seven or more months after closing, making a 68% refund your best option.

So, to calculate your refund, just look up the relevant number of months and read across to the percentage you’re due.

Then you simply multiply the UFMIP you paid on your current loan by the appropriate percentage.

Not sure how much you paid? Check your original loan documents. Still stuck? Call your loan officer.

An Example

Let’s look at an example. We’ll assume you borrowed $300,000 on your FHA loan and closed on your existing mortgage 18 months before your refi will close.

The standard UFMIP on an FHA loan is 1.75%, which is $5,250 on $300,000. The FHA UFMIP refund chart shows you’re due a 46% refund after 18 months. So, that’s $2,415 you stand to save.

No, it’s not life-changing. But it sure ain’t nothing. Here’s the step-by-step calculation:

- $300,000 FHA loan x 1.75% UFMIP rate = $5,250 original UFMIP

- $5,250 original UFMIP x 46% refund rate after 18 months (from chart) = $2,415 deducted from your new UFMIP

How much will your new UFMIP be? That depends on your loan balance. Let’s say that your loan balance is $290,000 when you refinance:

- $290,000 FHA refinance loan x 1.75% UFMIP rate = $5,075

- $5,075 new UFMIP – $2,415 UFMIP refund = $2,660

So, you’d only owe $2,660 in UFMIP for your new FHA loan. UFMIP can be rolled into the loan amount. So, if you’re refinancing your mortgage balance at $290,000 and roll that $2,660 into the loan, your new FHA refinance loan balance will be $292,660.

Eligibility Requirements

There’s a high probability that you’ll be eligible for your UFMIP refund. But you may not be if you can’t clear the following hurdles. Your existing FHA loan must not be:

- More than three years old since closing

- In arrears or showing serious historical delinquencies

- In foreclosure

- An assumed loan. Those aren’t eligible

An assumed loan is one that’s been taken over from an existing borrower on the same terms. They’re fairly rare because most people get a brand new mortgage each time. And assuming someone else’s isn’t easy. But they do exist.

As long as none of those are issues, your road ahead should be clear.

Other Rules

Let’s clarify some of the rules we’ve mentioned:

- You must be refinancing one FHA loan into another using an FHA streamline or FHA rate-and-term refinance. UFMIP is required for FHA cash-out refinances, but refunds are not available with them. Refinancing from an FHA loan to a conventional loan is also ineligible for UFMIP refunds.

- Your refund will be applied to (meaning deducted from) your new upfront mortgage insurance premium. No cash. Since UFMIP is based on a percentage of your loan amount and you’re refinancing some time into the loan, your loan balance (and, thus, UFMIP) should be smaller.

- Your refinance closing must happen 36 months or less after you closed on your existing FHA loan.

And we need to introduce a new rule. FHA streamline refinances can happen only seven months or longer after closing on your existing mortgage.

So, you’ll have to wait that long for one of those and that has implications for your UFMIP refund rates.

As our FHA MIP refund chart shows, the refund rate at seven months is down to 68%. So, that’s the highest refund you can get on an FHA streamline refinance. But the rest of the chart still applies.

How to Request an FHA UFMIP Refund

You’re unable to request a refund directly. Instead, the lender you’re working with for your refinance handles this on your behalf.

Sources of Help and Advice

The lender that’s setting up your refinance should handle getting you your FHA MIP refund. Mention it to your loan officer to make sure they’re on it.

If you don’t yet have a lender or loan officer, you can still get answers to general queries. Contact the U.S. Department of Housing and Urban Development (HUD), which manages the refund program.

HUD has a lookup tool on its website that lets you check your individual eligibility. However, you’ll need your FHA case number. It consists of three digits followed by a dash and seven more digits, for example, 051-4567890. It should be on your current mortgage paperwork.

If you can’t find your case number or need to speak to someone, you can call HUD at 1-800-697-6967.

HUD warns that some companies are contacting consumers directly, offering to help with unclaimed UFMIP refunds. While these may (or presumably sometimes may not) help you, they can do nothing for their finder’s fee that you can’t do yourself for free with HUD.

Conclusion

You might easily save $1,000+ through getting your FHA UFMIP refund. And it requires very little effort on your part.

Your mortgage lender should do the hard bit. But you might want to remind your loan officer that you’re in line for the refund.

The refund can’t be taken in cash. It will be deducted from the amount you’d otherwise owe on your refinance’s UFMIP upon closing.

Be aware that the rules are strict. You need to refinance your existing FHA loan into a new one, and the maximum period between the two closings is 36 months.

But, if you qualify (and as long as you’ve kept up with your mortgage payments), the sum you’re hoping to save looks pretty safe.