FHA Streamline Refinance: How It Works, Rates, and Requirements

Have interest rates dropped since you took out your current home loan? If you have an FHA loan, you may qualify for a low-doc FHA streamline refinance and avoid much of the hassle typically associated with the refinancing process.

This guide will cover everything you need to know about the FHA streamline refinance program, including the eligibility requirements and other potential refi options.

Key Takeaways

- FHA streamline refinances do not require an appraisal, and in most cases, you do not need to verify your income or undergo a detailed credit check.

- Borrowers with credit issues, low home equity, reduced income, or high debt may still qualify for a streamline refinance.

- All FHA streamline refinances must pass a net tangible benefit test to be eligible for funding.

What Is an FHA Streamline Refinance?

An FHA Streamline Refinance is a simplified refinance option available to homeowners with an existing FHA loan. This option is designed to reduce paperwork and speed up the process. Unlike most other refinance options, the FHA streamline typically does not require a home appraisal, detailed credit check, or income verification. Instead, it allows eligible borrowers to take advantage of lower interest rates or better loan terms with minimal hassle.

The FHA Streamline Refinance is especially beneficial for those who may have limited home equity, credit challenges, or reduced income, as it bypasses many of the strict requirements of traditional refinancing.

This could be someone who:

- Is out of work or doesn’t meet the income and employment history requirements of other loans

- Has seen their home’s value stagnate or decrease and doesn’t have the equity to refinance otherwise

- Has had credit issues that disqualify them from most mortgage options

How Does It Work?

The streamline refinance process is simple and straightforward for most borrowers. Document requirements are minimal, and some lenders even use direct verification to reduce the required paperwork further.

Depending on your individual situation and borrowing needs, your FHA-approved lender will tell you whether you’re eligible for a credit-qualifying or non-credit-qualifying streamline refinance.

Non-Credit Qualifying Streamline Refinance

Most homeowners are eligible for the non-credit qualifying streamline refinance. This means you will not need an appraisal, in-depth credit check, or income verification.

Credit Qualifying Streamline Refinance

A credit qualifying streamline refinance does not require an appraisal, but you will need to undergo a credit check and reverify your income. This means you’ll have to meet FHA qualifying guidelines for your debt-to-income ratio.

The most common reason for a credit qualifying streamline refinance is to remove a co-borrower. Loans currently or recently in forbearance may also require this type of streamline refinance.

FHA Streamline Refinance Eligibility

Even though most FHA streamline refis do not require an appraisal, detailed credit check, or income verification, you must still meet other specific FHA eligibility guidelines.

Eligible Loan Types

Your existing loan must be backed by the Federal Housing Administration (FHA). If you have any other type of mortgage, you have to apply for an FHA non-streamline rate-and-term refinance, which requires going through the standard underwriting procedure.

Loan Seasoning Requirements

Your current mortgage needs to be appropriately seasoned. For an FHA streamline, this means:

- 210 days have passed since your first mortgage payment’s due date.

- You have made at least six monthly payments during that time.

On-Time Payment History

You must have made payments on time for the last six months, and you may only have one 30-day late payment in the six months preceding that.

Net Tangible Benefit

All FHA streamline refinance loans must pass the agency’s net tangible benefit (NTB) test. This helps ensure that homeowners actually save money by refinancing. To qualify, the vast majority of borrowers need to reduce their combined interest rate and annual mortgage insurance premium by at least 0.5%.

However, net tangible benefit requirements can vary depending on the terms of your current loan and the mortgage you’re refinancing. We’ll discuss those requirements in more depth below.

Maximum Loan Term

FHA streamline guidelines set a limit on new loan terms at the lesser of 30 years or your current term plus 12 years.

For example, if you have 25 years remaining on your current mortgage, you could refinance for up to 30 years. If you only have ten years left, your maximum loan term would be 22 years.

Mortgage Forbearance

You can still qualify for an FHA streamline refinance if you’ve previously been granted mortgage forbearance so long as you’ve completed your forbearance plan and made at least three on-time payments.

However, borrowers still in forbearance or who haven’t made the required three payments may still be eligible under the credit qualifying streamline refi option.

Closing Costs

The FHA streamline refinance has associated closing costs like any other type of mortgage. Although most refinance options allow you to wrap your closing costs into your new loan balance, the streamline refi does not. This means you are required to provide account statements showing that you have the funds available to cover closing.

Some FHA streamline lenders may be willing to pay for your closing costs through lender credits, called a “no closing cost refinance,” in which you accept a marginally higher interest rate on your new loan.

Upfront Mortgage Insurance Premium (UFMIP)

All FHA loans require an upfront mortgage insurance premium of 1.75% due at closing. However, the FHA does allow borrowers to wrap this specific closing cost into their loan if they choose.

If you opt to pay for your UFMIP at closing, you must also provide proof of those funds. However, if you’ve had your current FHA loan for fewer than three years, you may qualify for a partial MIP refund to be credited back to you at closing.

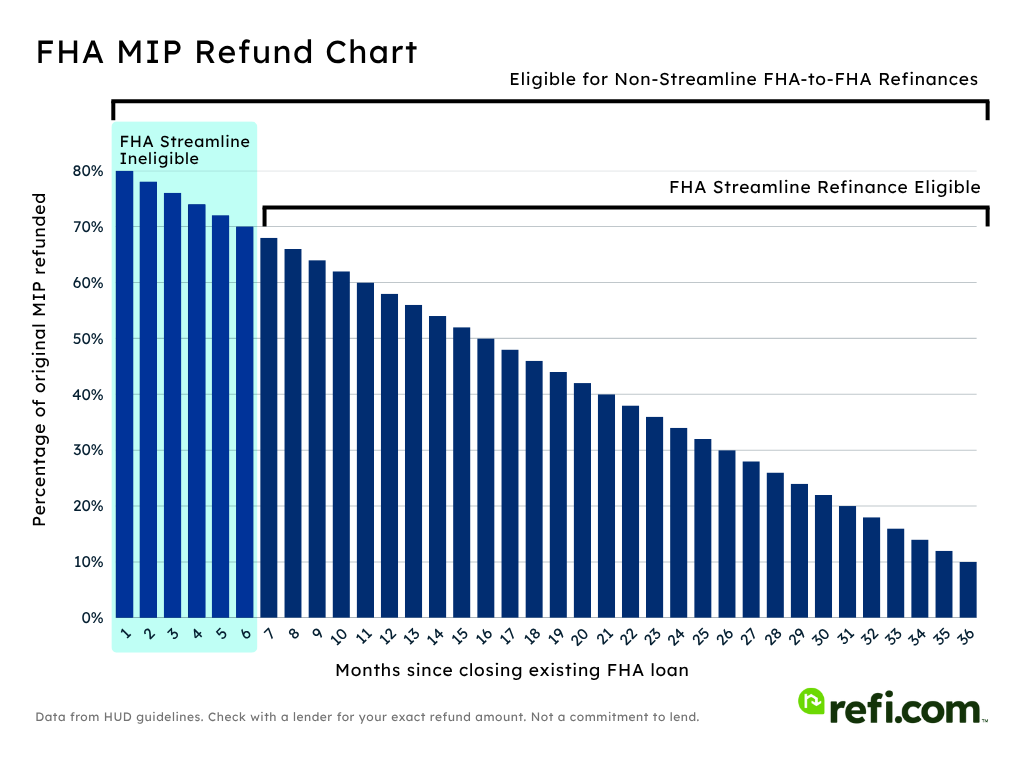

The MIP Refund

Current FHA borrowers refinancing into another agency-backed loan, such as the streamline refi, may be eligible for a partial MIP refund if their existing mortgage has been in place for 36 months or less.

If you qualify for an MIP refund, you benefit by either:

- Needing less cash to close

- Wrapping a smaller UFMIP into your new mortgage

UFMIP refund amounts decrease the longer you’ve had your loan. Borrowers refinancing in their seventh month, the earliest you can do a streamline refinance, can qualify for a 68% refund of their original payment amount. Conversely, borrowers at the 36-month limit are eligible for 10%.

FHA MIP Refund Chart

Here’s a helpful chart to give you an idea of how much of an FHA MIP refund you may qualify for and how the MIP refund rate decreases with the age of a loan.

| Months after closing | FHA MIP refund | Months after closing | FHA MIP refund |

| 1 | 80% | 19 | 44% |

| 2 | 78% | 20 | 42% |

| 3 | 76% | 21 | 40% |

| 4 | 74% | 22 | 38% |

| 5 | 72% | 23 | 36% |

| 6 | 70% | 24 | 34% |

| 7 | 68% | 25 | 32% |

| 8 | 66% | 26 | 30% |

| 9 | 64% | 27 | 28% |

| 10 | 62% | 28 | 26% |

| 11 | 60% | 29 | 24% |

| 12 | 58% | 30 | 22% |

| 13 | 56% | 31 | 20% |

| 14 | 54% | 32 | 18% |

| 15 | 52% | 33 | 16% |

| 16 | 50% | 34 | 14% |

| 17 | 48% | 35 | 12% |

| 18 | 46% | 36 | 10% |

FHA Net Tangible Benefit Test

Most borrowers applying for a streamline refinance need to reduce their combined interest and MIP rates by at least 0.5% to pass the FHA net tangible benefit test. This applies to all fixed-rate to fixed-rate refinances with a similar or longer repayment period than the loan being replaced.

However, borrowers who currently have or are refinancing to an adjustable-rate mortgage, as well as those who are shortening their repayment term by at least three years, need to meet other requirements.

Fixed-Rate to Fixed-Rate With a Term Reduction

Net tangible benefit requirements are relaxed for borrowers doing a fixed-rate to fixed-rate streamline refi with a term reduction of at least three years, often refinancing to a 15-year mortgage.

In this scenario, your new combined rate is only required to be lower than your previous loan. You do not need to meet the standard 0.5% reduction. However, your total monthly mortgage payment cannot increase by more than $50.

All Other FHA Streamline Refinances

The rules can be slightly more confusing with adjustable-rate mortgages (ARMs). This is because the net tangible benefit requirements can vary based on the type of ARM you’re refinancing into and the amount of time until the next payment change for existing ARM holders.

To simplify things, here’s a chart that breaks down the FHA net tangible benefit requirements in all situations except for a fixed-rate to fixed-rate with a term reduction.

| Existing Mortgage: | New Fixed-Rate Loan | New One-Year ARM | New Hybrid ARM |

| Fixed-Rate Loan | 0.5% Rate Reduction | 2% Rate Reduction | 2% Rate Reduction |

| ARM With Fewer Than 15 Months to Payment Change | Up to 2% Rate Increase | 1% Rate Reduction | 1% Rate Reduction |

| ARM With 15 Months or More to Payment Change | Up to 2% Rate Increase | 2% Rate Reduction | 1% Rate Reduction |

FHA Streamline Rates

FHA streamline refinance rates are typically lower than refinance options offered through conventional mortgage providers. This reduced rate is due to the loans being insured by the federal government, thus posing less risk to lenders. Here’s a quick look at how FHA refinance rates are trending compared to conventional refinances:

How we source rates and rate trends

Rates based on market averages as of Dec 02, 2025.Product Rate APR 30-year Fixed Fha Refinance 5.56% 6.77% 30-year Fixed Refinance 6.35% 6.37%

However, keep in mind that all FHA loans have an ongoing annual mortgage insurance premium of around 0.5%, which adds to the cost of borrowing and is accounted for in the annual percentage rate (APR).

Pros and Cons of the FHA Streamline

An FHA streamline refinance is often a wise idea for qualified homeowners. Still, some downsides may cause certain buyers to hesitate. Here is a look at both the pros and cons of the FHA streamline loan.

Pros of the FHA Streamline Refinance

Some of the most popular benefits of the FHA streamline refinance include:

Saving Money on Your Mortgage

The FHA streamline refinance program by design ensures homeowners benefit from their refi. Since all loans must pass the net tangible benefit test to qualify, you can be confident that you’re saving money or improving the terms of your mortgage through a streamline refi.

No Appraisal Required

FHA streamline refinances do not require you to have your home reappraised. Instead, calculations are based on your home’s original value. Most borrowers can save hundreds of dollars on closing costs by eliminating the appraisal fee.

The lack of an appraisal also allows homeowners who are underwater on their mortgage or otherwise don’t have enough equity for a traditional refi to qualify under the FHA’s streamline program.

No Income Verification for Most Borrowers

Your lender only needs to verify your income and evaluate it against your debts if you require a credit-qualifying streamline refi.

This means that homeowners whose income has decreased or whose debt level has risen can still qualify for an FHA streamline when they may not be eligible for other refi options.

Refinancing Faster

Since you don’t need to wait for an appraisal, and in most cases, your lender won’t need to underwrite your repayment ability, FHA streamline refinances can typically close sooner than standard refi loans.

Cons of the FHA Streamline Refinance

Some disadvantages of the FHA streamline refinance program are:

No Cashing Out Equity

The FHA streamline refinance lets you adjust your interest rate and loan terms. It does not, however, allow you to cash out any of your equity. Homeowners hoping to receive funds back at closing need to look into the FHA cash-out refinance instead.

Required Closing Costs

Refinancing would be a no-brainer if you only reduced your interest rate and payment. Unfortunately, streamline refinances still have closing costs. These costs can make refinancing impractical for buyers without sufficient savings or those only able to reduce their payments by a small amount.

Paying Mortgage Insurance Premiums

Doing an FHA streamline refinance means paying the 1.75% UFMIP. You are also required to pay an ongoing annual MIP of around 0.5%. Homeowners with at least 20% equity may be able to do a conventional refinance and avoid paying for mortgage insurance altogether.

FHA Streamline vs Other Refi Options

A streamline refinance can help you lower your interest rate and reduce your monthly payment. Still, it isn’t the only type of refinance available in most cases. In addition to other FHA-backed options, you may want to consider conventional alternatives.

FHA Streamline | FHA Cash-Out | FHA Non-Streamline | Conventional Refi | |

| Credit Score | n/a | 500* | 500 – 580* (depending on equity) | 620+ |

| Equity Required | n/a | >20% | >2.25% | >5% |

| Mortgage Insurance | Yes | Yes | Yes | Only if less than 20% equity |

| Get Cash Out? | No | Yes | No | Maybe |

| Other Requirements | Must have a current FHA loan | Lenders often have stricter guidelines | Don’t need to meet NTB requirements | Higher eligibility requirements |

*According to program guidelines. However, most lenders, like Refi.com, often have higher requirements. Refi.com requires a 620 minimum credit score for an FHA cash-out refinance and 620 for an FHA rate-and-term refinance.

FHA Cash-Out Refinance

The FHA cash-out refinance loan lets you tap into your home’s built-up equity and withdraw a portion as part of the closing process. Homeowners do not need an existing FHA loan to be eligible for a cash-out refi. Still, you must have at least 20% equity remaining after taking out funds.

FHA guidelines for a cash-out refi require that you’ve lived in your home as your primary residence for at least the past year. You must also meet the standard FHA credit score requirement of 500, although most lenders require 600+. Refi.com requires a 620 minimum credit score for an FHA cash-out refinance.

FHA Non-Streamline Refinance

Like with the cash-out option, you do not need to be a current FHA loan holder to qualify for a non-streamline refinance, also known as an FHA rate-and-term refinance.

You need to undergo a credit check and have your home appraised, but the FHA’s non-streamline refinance program doesn’t require you to meet the seasoning or net tangible benefit requirements of a streamline loan.

Plus, the FHA non-streamline refinance lets you wrap your closing costs into your mortgage rather than being obligated to pay them upfront or accept a higher interest rate.

Conventional Refinance

Requirements are more stringent for a conventional refinance – you can expect a credit score minimum of at least 620 and more conservative debt-to-income limits than with FHA lenders.

However, conventional refinance loans do not have an upfront mortgage insurance premium, and borrowers with at least 20% equity are not required to pay for private mortgage insurance.

You need a minimum of 5% equity to qualify for a conventional rate-and-term refinance. The requirements for a conventional cash-out are similar to the FHA program in that you need at least 20% equity left over after cashing out your funds.

How to Apply for an FHA Streamline Refinance

If you currently have an FHA loan and are able to reduce your interest rate, you can likely qualify for an FHA streamline refinance. You won’t need to get a home appraisal; in most cases, lenders won’t need to evaluate your credit and income either.

To find out if you’re eligible for an FHA streamline refi, check out today’s current mortgage rates and apply with an FHA-approved lender serving homeowners in your community.

Frequently Asked Questions

Are There Closing Costs With an FHA Streamline Refinance?

Yes, like all mortgages, closing costs are associated with an FHA streamline refinance. However, borrowers with a current FHA loan under three years old may qualify for an MIP refund credit. Some lenders may even be willing to pay your closing costs in exchange for a higher interest rate.

How Long Do You Have to Wait to Do an FHA Streamline Refinance?

Program guidelines require waiting at least 210 days after closing on your loan before you are eligible for an FHA streamline refinance. You must also have made at least six monthly payments, with a minimum of six months since the first payment due date.

Can You Remove a Borrower on an FHA Streamline?

Yes, removing a borrower on an FHA streamline refinance is possible. However, this requires a credit qualifying streamline refi, meaning that even though you won’t need an appraisal, you still have to reverify your income and undergo a detailed credit check.