Is the FHA Streamline Refinance a Good Idea in 2025?

The FHA streamline program is often advertised as a fast and easy way to refinance your FHA loan and reduce your monthly mortgage payments. But interest rates are still high and the current atmosphere of economic uncertainty, is the FHA streamline refinance a good idea in 2025?

Key Takeaways

- Despite current market conditions, the FHA streamline refinance is still a good idea for many homeowners.

- Borrowers who took out their existing loan within the past couple of years are likely eligible for a lower interest rate.

- Because of the streamline process, it’s possible to qualify even if you’re currently unemployed or underwater on your mortgage.

FHA Streamline Refinance: The Basics

The FHA streamline refinance is a low-doc refi loan available to current FHA borrowers. The streamline name comes from the simplicity of the lending process: you don’t need to obtain a new appraisal, and, in most cases, you won’t need to re-verify your income or undergo an in-depth credit check to qualify.

These relaxed requirements make the FHA streamline one of the quickest, most affordable, and lowest-stress options for refinancing a home loan.

Why FHA Streamline Refis Matter in 2025

So, is the FHA streamline refinance a good idea in 2025? For many homeowners, the answer is a resounding “yes.” Despite the current conditions of the real estate and mortgage markets, an FHA streamline remains a practical refi option because:

- Government-backed mortgages continue to have lower interest rates than many other types of loans

- The streamline process means easy approval, even during volatile economic periods

- Borrowers who’ve seen their home’s value stagnate or depreciate are still eligible

- Borrowers who’ve lost their jobs or experienced a reduction in income can still qualify

“The FHA streamline refinance program can be a smart move for the right homeowner, especially in today’s mortgage environment,” says Matt Ward, Realtor and team lead at the Matt Ward Group.

When the FHA Streamline Is a Good Idea

Choosing the right refinance program will depend on your individual circumstances and financing needs. However, if you identify with at least one of these seven scenarios, an FHA streamline refinance is probably worth considering.

1. You Can Lower Your Interest Rate

Homeowners who have taken out their present loan within the past couple of years can very likely reduce their interest rate. FHA rates could now be lower than they were from late-2022 to early 2025. As a rule of thumb, a 1% rate reduction is a great target to aim for during a refinance. However, even a 0.5% savings could lead to noticeably lower payments.

How we source rates and rate trends

Rates based on market averages as of Dec 02, 2025.Product Rate APR 30-year Fixed Fha Refinance 5.56% 6.77% 30-year Fixed Refinance 6.35% 6.37%

2. You Might Reduce Your Mortgage Insurance Premiums

In early 2023, the FHA reduced annual mortgage insurance costs by around 0.3%. Most current refinances come with an ongoing premium of 0.55%. However, if you took out your loan before the reduction, you still pay the higher rate.

With an FHA streamline refinance, you may be able to lock in the new, lower mortgage insurance rate going forward.

3. You Need to Remove a Co-Borrower

Need to remove a co-borrower, such as an ex-spouse, from your mortgage? The FHA streamline program allows you to do so without ordering a new appraisal. You will, however, be required to undergo a credit check and verify your income to prove that you can still afford the mortgage without the other party.

4. You Need to Switch From an Adjustable-Rate to a Fixed-Rate

As interest rates spiked following COVID-era lows, many homebuyers turned to adjustable-rate mortgages (ARMs) to expand their purchasing power and reduce the cost of their new loan. Those with a three-year introductory period will see their rates starting to adjust soon.

An FHA streamline refinance can help these borrowers lock into a fixed-rate mortgage before their introductory period ends and their payments begin to fluctuate.

5. Your Home Has Depreciated in Value

Since the FHA streamline program does not require you to order a new appraisal, you can refinance regardless of the equity in your home. This means that recent buyers who have seen their property’s value depreciate can still qualify for a streamline refinance, even if they’re currently underwater on their loan.

6. You’ve Lost Income or Taken On Extra Debt

Have your finances changed since you took out your original mortgage? In most cases, you can qualify for an FHA streamline refi even if your income has been reduced or you’ve recently taken on extra debt. You may even be eligible if you’re currently unemployed.

7. Your Credit Score Has Taken a Hit

The FHA streamline refinance generally doesn’t require an in-depth credit check, meaning it may be possible to refinance even if your credit score has taken a hit and you don’t meet the typical FHA minimum.

Related: Credit Requirements to Refinance Your Home

Situations Where It Might Not Be Worth It

There are many reasons why an FHA streamline refinance can be a smart move in 2025. However, this low-doc loan program isn’t right for everyone. Here are five situations where a streamline refi may not be worth it.

1. You Already Have a Favorable Interest Rate

Average rates have come down since their late 2023 peak of nearly 8%, but they’re still not as low as they’ve been in recent history. If you took out your mortgage before mid-2022, there’s a good chance you already have a more favorable interest rate than you could get with a streamline refi.

“With rates still elevated compared to 2020-2021 lows, the savings will depend on when the original loan was taken out. If you got yourself a 3% FHA Loan during the COVID pandemic, it’s likely you probably won’t want to utilize this program,” states Rich Kaul, owner of 702 Cash Buyers.

2. You Plan to Sell Your Home Soon

Refinancing your mortgage means incurring closing costs on the new loan, including an upfront mortgage insurance premium (UFMIP) of 1.75%. Even with considerable monthly savings, it will take most borrowers at least a couple of years to break even.

Note, however, that you can get a partial refund of the upfront mortgage insurance paid on your existing loan.

Still, homeowners planning to sell soon may be better off keeping their current loan unless your lender covers your closing expenses at an interest rate lower than you’re currently paying.

Use our refinance break-even calculator to learn more about breaking even on a refinance.

3. You Have at Least 20% Equity

Due to their strong government backing, FHA mortgages have some of the best interest rates on the market. Still, mandatory mortgage insurance adds to the true cost of the loan. For many homeowners, though, these premiums are cheaper than the private mortgage insurance they’d pay for with conventional lenders.

However, conventional loans do not require private mortgage insurance if you have at least 20% equity. As such, homeowners needing to finance 80% or less of their home’s current value will likely see lower monthly payments by refinancing conventional.

4. You Want to Cash Out Your Equity

Want to tap into your property’s built-up equity as part of your refinance? With an FHA streamline refi, you’re only allowed to receive up to $500 back at closing, which is primarily to account for minor discrepancies between your estimated and actual closing costs.

In this scenario, you’ll need to consider an FHA cash-out refinance instead.

5. You Need to Include Closing Costs in Your Loan

While other types of mortgages will allow you to wrap closing costs into your new loan balance, the FHA streamline program requires these expenses to be paid upfront. Borrowers who don’t have the cash to close will need to consider other options or look for a mortgage provider willing to pay the closing costs for them.

FHA Streamline Program: Pros and Cons

Still trying to decide whether an FHA streamline refinance is right for you? Here’s a breakdown of some of the program’s biggest pros and cons to help you make up your mind.

Pros

- No appraisal, income verification, or in-depth credit check: The FHA streamline loan does not require an appraisal, and most borrowers won’t need to go through income verification or a detailed credit check.

- Lower interest rates than other loan types: Since the federal government insures the FHA program, lenders face less risk issuing these loans. This reduced risk is passed on to borrowers through lower interest rates.

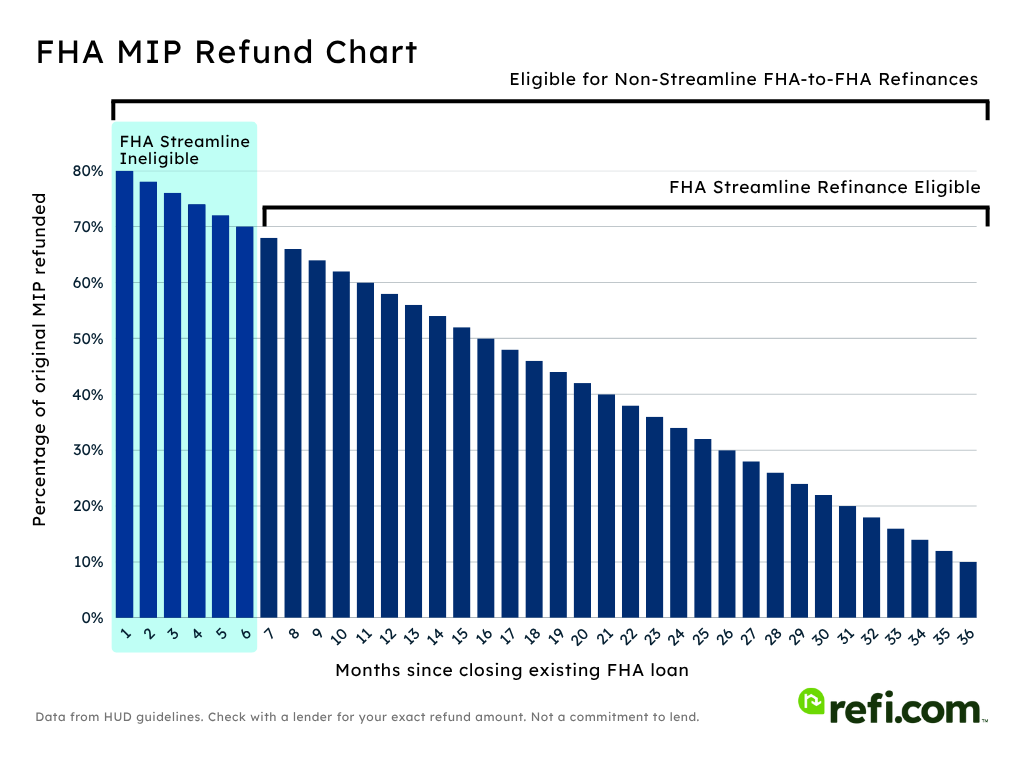

- MIP refund if you’ve had your loan for fewer than 36 months: Borrowers who have had their current FHA loan for fewer than 36 months can receive a credit for a portion of their original UFMIP to help reduce closing costs.

- Net tangible benefit rule prevents predatory lending: Since the FHA requires all streamline loans to meet their net tangible benefit rule, you can rest assured that you’re actually saving money with your refinance.

Cons

- You’ll still pay mortgage insurance premiums: All FHA refinances – even the streamline loan – require an upfront mortgage insurance premium of 1.75% and ongoing mortgage insurance of around 0.5% for most borrowers.

- Interest rates may continue to fall: While rates have come down from their recent peak, they’re still higher than they have been for much of the past 15 years. Even with the current economic climate, rates could potentially continue to fall in the near-to-mid future.

- You can’t finance closing costs: The FHA streamline refi program does not allow you to wrap closing costs into your loan like with other types of mortgages. In most cases, you’ll need the cash on hand to close, although some lenders may be willing to cover the expense in exchange for a marginally higher interest rate.

- You can’t cash out your equity: The streamline refinance is designed to reduce your interest rate and offer more favorable loan terms. As such, you cannot receive more than $500 back at closing, meaning borrowers who need to tap into their equity will want to apply for a cash-out refinance instead.

FHA vs Conventional Refis in 2025

Although an FHA streamline refi is a straightforward choice for existing FHA borrowers, it’s not the only option. In some cases, conventional refinancing may make more sense, particularly for homeowners with excellent credit or sizable equity.

That’s because even though government-backed loans generally have lower interest rates, well-qualified borrowers may still come out ahead with a conventional mortgage. Plus, while all FHA loans have both upfront and annual mortgage insurance premiums, conventional lenders only require ongoing mortgage insurance for borrowers with less than 20% equity.

Keep in mind, however, that there is no conventional streamline refinance. This means that you can expect to undergo the full underwriting process and need to obtain a new home appraisal when refinancing from the FHA to a conventional lender.

| FHA Streamline | Conventional | |

| Appraisal Needed | No | Yes |

| Credit Check & Income Verification | Sometimes | Yes |

| Minimum Credit Score | 580, if applicable Refi.com requires 620. | 620 |

| Maximum DTI | 56.9%, if applicable | 50% |

| Upfront Mortgage Insurance | Yes, 1.75% | No |

| Annual Mortgage Insurance | Yes, ~0.5% | With <20% equity, varies |

Choosing an FHA Streamline Refinance Lender in 2025

The FHA streamline refinance is a popular mortgage program, meaning it’s not difficult to find lenders who offer these types of loans. In fact, you can apply for an FHA streamline directly from Refi.com.

But even though we make the process as simple as possible from start to finish, it’s important to understand that you have a wide variety of lenders to choose from.

So, how should you go about choosing an FHA streamline refinance lender in 2025?

- Compare interest rates and closing costs: Costs and rates can differ between lenders. Always request loan estimates from a minimum of three different mortgage providers to ensure the best deal possible.

- Consider experience and lending knowledge: While many lenders offer FHA streamline refis, they’re not all equal. Make sure that you’re working with a company that is experienced and knowledgeable regarding FHA loans.

- Ask how long it will take to close: The FHA streamline refinance offers a quicker closing time than most loans, thanks to the reduced paperwork and lack of an appraisal. Still, the time it takes to close will sometimes vary significantly between lenders.

- Don’t settle for sub-par customer service: Even though the process is streamlined, working with a lender offering excellent customer service can simplify the refinance and help ensure a stress-free experience.

The Bottom Line

The FHA streamline refinance is one of the easiest refi options on the market, making it a good idea for many homeowners in 2025. If you took out your current FHA loan within the past few years, you may likely be able to use the program to qualify for a better interest rate and lower monthly payments.

Ready to get started? Begin your streamline application today to find out how much you can save.