How Often Can You Refinance Your Home?

There’s no federally imposed cap on the number of times you can refinance, but lender restrictions, closing costs, and equity requirements can limit how frequently it makes financial sense. How often you can refinance will depend on your loan’s seasoning requirements, which can range from 0 to 12 months, depending on what kind of refinance loan you’re seeking.

Refinancing can be a valuable tool for lowering your interest rate, adjusting your loan term, or tapping into home equity—but how often can you do it? While there’s no set limit on the number of times you can refinance, lender rules, waiting periods, and closing costs can impact your strategy.

Here’s what you need to know about how often you can refinance, when you’re eligible, and whether refinancing multiple times makes sense for you.

The least you need to know:

- You can refinance your mortgage as many times as you’d like, as long as you meet eligibility criteria, pay the necessary closing fees, and abide by your refinance type’s seasoning requirements (if any).

- The required waiting period between refinances depends on the type of loan, generally ranging from 0 to 12 months, with additional rules for government-backed loans. Lenders can impose their own, stricter, rules.

- Refinancing more than once can offer benefits like reduced interest rates, adjusted loan terms, or tapping into home equity, but it’s important to weigh the costs of closing fees and potential long-term interest.

How Many Times Can You Refinance Your Home?

Lenders typically don’t impose a strict cap on the number of times you can refinance, provided you meet eligibility requirements.

Of course, even though there is no cap on repeat refinances, you must still meet general refi qualification requirements, wait for the process to complete (which often takes 30 to 45 days from start to finish), and pay closing costs, which can equate to 2% to 5% or more of your loan amount.

Closing costs may be the biggest barrier to multiple refinances, as they are generally 2 – 5% of the loan amount, which can be a sizeable sum to pay.

There are also loan seasoning requirements that must be met for some refinances.

Loan Seasoning: How Long Do You Have to Wait to Refinance?

Although there’s no limit to the number of refinances you can do on your home, there are still waiting periods to be aware of. These waiting periods apply to the loan that you’re refinancing into – not the loan you already have. For example, if you’re looking to refinance your FHA loan into a conventional loan, the conventional loan section below will be the most relevant to you.

Here’s a breakdown of the waiting rules based on loan type:

Conventional loans: 0 – 12 Months

There is no official waiting period for conventional rate-and-term refinances, though some lenders may impose their own waiting periods between refinances – typically around six months.

“Fannie Mae and Freddie Mac usually recommend this six-month waiting period to ensure that the new terms genuinely benefit the homeowner,” says personal finance expert Angelo Crocco, owner of AC Accounting. “However, be aware that some lenders may implement internal restrictions to mitigate perceived risks, making strategic timing crucial.”

For a conventional cash-out refinance, the existing mortgage must be at least 12 months old.

FHA loans: 210 Days – One Year

Similar to conventional loans, FHA Simple Refinances have no FHA-imposed waiting period. FHA rate-and-term refinances require six months of on-time payments.

“An FHA streamlined refinance requires at least 210 days since the first mortgage payment and six consecutive months of on-time payments before you can refinance again,” says Dennis Shirshikov, a professor of economics and finance at City University of New York/Queens College.

Like conventional cash-outs, FHA cash-out refinances require the existing mortgage to be 12 months old.

VA loans: 210 Days

The VA Streamline Refinance, also known as the VA Interest Rate Reduction Refinance Loan (VA IRRRL, or “Earl”) requires a 210-day seasoning period and six on-time monthly payments. VA cash-out refinances also require 210 days.

USDA loans: 12 Months

You need to wait 12 months from the closing date of your existing loan before you can do a USDA refinance.

Jumbo loans: Varies by Lender

Because jumbo loans are not government-backed, terms are often dictated by the lender, with no federal restrictions on how often you are allowed to refinance. Be aware that most lenders expect at least 6 to 12 months to pass before allowing a jumbo loan refinance.

Even though you may be permitted to refinance as soon as 6 to 12 months after closing on your existing loan, that doesn’t mean this accelerated timeline is in your best interest. Again, you must pay closing costs.

Plus, the process can be time-consuming. And if rates have increased since your last closing, it may be better to wait things out until rates drop.

| Product | Rate | APR |

|---|---|---|

| 30-year Fixed Refinance | 6.35% | 6.37% |

| 30-year Fixed Jumbo Refinance | 6.82% | 6.84% |

| 30-year Fixed Fha Refinance | 5.56% | 6.77% |

| 30-year Fixed Usda Refinance | 5.56% | 5.70% |

| 30-year Fixed Va Refinance | 5.68% | 5.82% |

How we source rates and rate trends

Don’t Forget General Refinance Requirements

Do you meet your desired refinance type’s seasoning requirements? Make sure you also meet the typical eligibility requirements before moving forward. Let’s take a closer look based on loan type:

Conventional loans

You usually need a credit score of at least 620, debt-to-income (DTI) ratio below 43%, and at least 3% equity in the home (LTV of 97%).

For conventional cash-out refinances, you’ll usually need 20% equity left in the home after cash is taken out, but this can vary by lender.

FHA loans

The minimum credit score allowed is 580, unless you have at least 10% equity – then your score can be as low as 500, according to FHA guidelines. Lenders, like Refi.com, often impose their own, stricter guidelines. Refi.com requires a 620 credit score for an FHA refinance.

Aim for a DTI of 43% or less and an LTV no higher than 97.75% for a rate-and-term refi. Similar to conventional cash-outs, FHA cash-out refinances require 20% equity left after cash is taken out.

VA loans

VA loans have no specific credit score requirements set by the VA, although lenders often require a score of 620 or higher.

Your DTI should ideally be below 41%, and your LTV can actually top out at 100%.

VA cash-out refinances technically allow 100% LTV cash-outs, meaning you don’t need to have equity left after cash is taken out. This will vary by lender, though, with many lenders requiring at least 10% equity left over. Again – lenders are allowed to impose stricter rules on top of what the governing agency requires.

USDA loans

Shoot for a credit score of 640 or higher, with a DTI limit of 41% and an LTV of up to 100%.

Jumbo loans

Jumbo loans typically require a credit score of 700 or higher, DTI ratios preferably under 43%, and a max LTV of 80% to 90%.

Should You Refinance More than Once?

In most cases, refinancing is all about improving your financial position through better terms (interest rate, loan length) or by accessing home equity. So, whether or not you should refinance more than once depends on what you stand to gain from it and how that weighs against the cost of refinancing.

Take a deeper dive into the advantages and disadvantages of multiple refinances. Consult a financial advisor or a mortgage lender.

Pros of Refinancing More than Once

Homeowners often refinance multiple times for several different reasons. Here are some of the most common:

Lower your interest rate and pay less

If rates have dropped since your last refi or original closing, you can refi and lower the total interest you pay monthly and over the life of your loan.

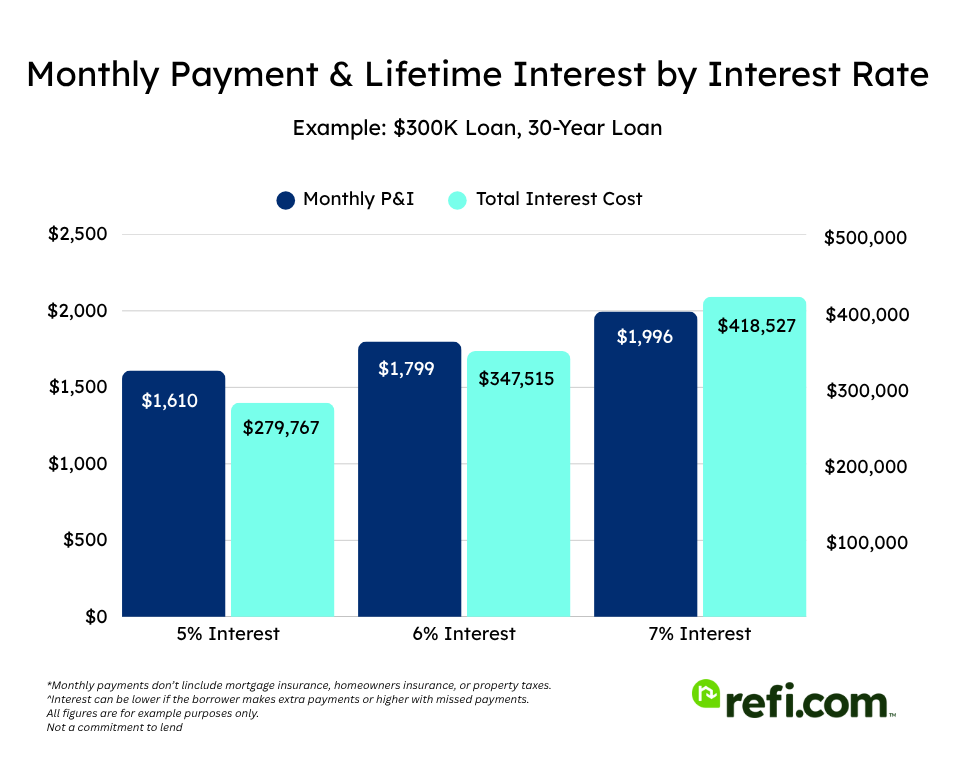

Let’s take a look at how much interest impacts your payment, using a $300,000, 30-year loan as an example:

| $300,000, 30-year loan by interest rate | ||

| Monthly P&I Payment | Lifetime Interest Costs | |

| 5% interest | $1,610 | $279,767 |

| 6% interest | $1,799 | $347,515 |

| 7% interest | $1,996 | $418,527 |

Even a single percentage can save you big on monthly payments and lifetime interest costs.

Extending your loan term

Resetting/extending your loan term can also help you decrease your monthly payment, though it may cost you more in the long run. Doing this and getting a lower interest rate can lower your monthly payment even further.

Let’s say you took out a $300,000, 30-year loan at 7% interest. Your monthly principal and interest (P&I) payment is $1,996 (rounded to the nearest dollar).

Six years later, you have $278,000 left to pay, and you refinance that balance to a new 30-year term at 6% interest. This lowers your monthly P&I payment to $1,667, saving you over $300 per month.

However, in this example, you’re making payments on the home for a total of 36 years instead of just 30, which adds over $25,000 of lifetime interest costs. Let’s take a look at this example broken down:

| Original Loan | Refinance Loan | |

| Loan Amount | $300,000 | $278,000 |

| Interest Rate | 7% | 6% |

| Term | 30 years | 30 years |

| Combined Time to Payoff Home | N/A | 36 years* |

| Monthly P&I Payment | $1,996 | $1,667 |

| Lifetime Interest | $418,527 | $322,030 |

| Combined Lifetime Interest | N/A | $443,810** |

*This includes the first 6 years on the original mortgage + the refinance loan’s 30-year term

**This includes $121,780 in interest paid during the first 6 years + the new 30-year mortgage’s $322,030 of lifetime interest

This is just one of the costs to keep in mind when refinancing.

Move from an adjustable to a fixed rate

If you currently have an adjustable-rate mortgage, refinancing to a fixed-rate mortgage can offer more stability. This is especially appealing if your loan’s fixed-rate period is ending or has recently ended, as fluctuating rates can lead to uncertainty and place a strain on your budget.

Cancel mortgage insurance

If you have an FHA loan and have reached at least 20% equity, you can refinance into a conventional loan to eliminate your FHA mortgage insurance premium (MIP), as conventional loans don’t require PMI with 20% equity or more.

Even if you haven’t reached 20% equity yet, you can still refinance to a conventional loan with the plan to cancel PMI later, once you’ve reached it.

Tap into home equity

If you’re looking to access your home equity for specific financial goals, a cash-out refinance may be the right choice. This allows you to borrow more than your existing mortgage balance and use the extra funds for purposes like home improvements, college tuition, or paying off high-interest debts. This strategy can be particularly beneficial if your home has increased in value and you’ve made significant progress on your principal since taking out your original loan.

Related: Consolidating Debt with a Cash-Out Refinance: How It Works

Cons of Refinancing More than Once

On the downside, refinancing several times can hurt in the long run. Here’s how.

Closing costs add up

Every time you refinance, you’ll have to pay closing costs for items like the appraisal, title check, attorney services, and lender fees. Closing costs generally amount to 2 – 5% of the loan amount.

Using the previous $450,000 loan refinance example, that means forking over $9,000 to $22,500 to refinance.

This is all based on the loan amount, however, so this could theoretically get cheaper each subsequent refinance, since your balance will decrease over time (unless you’re getting a cash-out refinance).

You could pay more long-term

“Refinancing resets your loan term, meaning you could end up paying more in total interest over the life of the loan,” says Shirshikov. Case in point: If you currently have 25 years left on a $450,000 loan, but refi to a new 30-year fixed-rate loan, you’ll be adding five extra years of payments (and interest).

Granted, mortgages come in various loan terms. The example mortgage with 25 years left could potentially be refinanced into a 20- or 15-year term if your chosen lender allows it. Some even customize beyond that (i.e. you could potentially refinance to a 25-year term).

The shorter the term, the less lifetime interest you’ll pay. And, shorter terms usually come with lower interest rates than their longer-term counterparts, saving you even more.

Related: Refinance without resetting the 30-year clock

Prepayment penalties may apply

Check your loan documents carefully: Your lender could charge a prepayment penalty if you pay off your loan too early. Prepayment penalties are rare for conventional loans and not allowed on FHA, VA, or USDA loans. However, they may still apply to some jumbo and non-QM loans, so it’s important to review your loan terms.

Your equity could fall

If you pull the trigger on a cash-out refinance, that can lower your equity position, meaning you own less of your home outright.

Your credit could take a hit

Refinancing involves a hard credit inquiry, which might cause your credit score to drop a few points for several months. Additionally, when your existing mortgage is paid off, it will be listed as a closed account on your credit report. While closed accounts continue to contribute to your credit history for up to 10 years, they no longer count toward the average age of your open accounts, which could have a minor impact on your credit score.

Related: Check out our full guide to how refinancing impacts your credit to learn more.

Refinance Cost Breakdown Example

Let’s go back to that $450,000 loan example. Again, assume your fixed rate is 7.25%, your loan term is 30 years, and your monthly payment (principal and interest) is $3,070.

Now, let’s consider scenarios where you may want to refinance this loan multiple times at different intervals and what your new loan principal, term, closing costs, and breakeven point (how many years it would take for your new lower payments to offset the closing costs) would be.

| Loan principal | $450,000 | $434,614 | $405,657 |

| Interval since last closing | 0 years | 3 years later | 5 years |

| New refi term | 30 years | 30 years | 25 years |

| Interest rate | 7.25% | 6.25% | 4.75% |

| Monthly principal + interest payments | $3,070 | $2,676 | $2,313 |

| Closing costs | 3% ($13,500) | 3% ($13,038) | 3% ($12,170) |

| Break-even period | 2.75 years | 2.8 years |

*All figures are for example purposes only and may not be available

If you decided to refinance 3 years after closing on your original loan, and locked in at a new 6.25% rate, your monthly payments would be lowered by $394. That means it would take just short of 3 years to recoup your closing costs paid (estimated at 3%, or $13,500). However, you’d be resetting to a new 30-year term.

Five years later, let’s assume you choose to refi again to take advantage of a major rate drop, locking in at 4.75%. Instead of adding more years to your term, you set the new loan at 25 years.

That means your new monthly payment would be $2,313, and it would take you a little less than 3 years to break even on your estimated $12,170 closing costs.

The Bottom Line

Don’t be afraid to refinance multiple times, even if it’s only been a few months or years since you last closed on your current loan. Crunch the numbers using a refinance calculator and determine if refinancing is worth it based on the ability to lower your rate, shorten or lengthen your term as desired, liquidate home equity, eliminate mortgage insurance, or shift from an adjustable to a fixed rate.

The pros can outweigh the cons – even expensive closing costs – under the right scenarios.

To help you make a more informed decision, consult closely with a trusted personal finance expert or loan professional.

Ready to get started? Apply with Refi.com today.