What Documents Do You Need to Refinance Your Home?

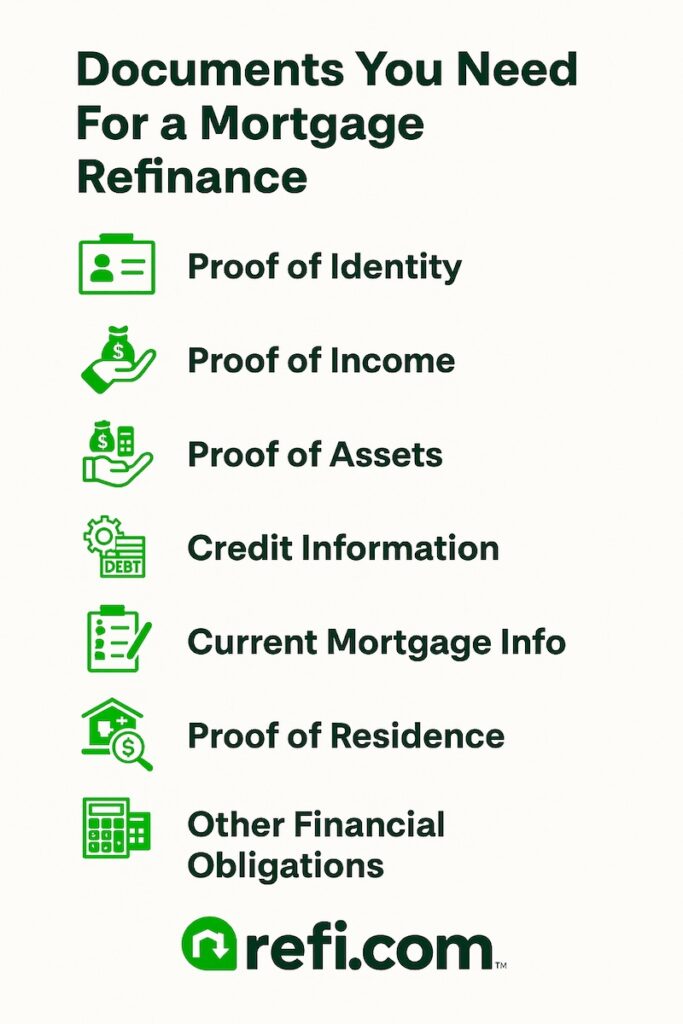

Eager to refinance your mortgage loan? You’ll need to gather some important paperwork and files that the lender will request. What documents do I need to refinance my home, you wonder? Actually, these are often the same papers or digital files you needed to obtain your initial mortgage loan. Prepare to gather key records and wallet contents like proof of identity, income, assets, residence, credit information, and details on your current mortgage.

1. Proof of Identity

Proof of your identity is a cornerstone of any refinance application. Hence, lenders usually require at least two forms of government-issued ID, such as a Social Security card, driver’s license, or passport.

These documents verify who you are and are necessary to meet federal lending and anti-fraud requirements. It’s a good idea to have these readily available before starting the process to avoid delays.

2. Proof of Income

You want to demonstrate your ability to repay the refinance loan, which is why providing proof of earnings is essential. Many lenders will require seeing your last two pay stubs and two years’ worth of W-2 forms.

Few factors are more important to your creditworthiness than your wages. By proving that you have a steady stream of income, you’ll be able to qualify for a better refinance loan at a lower interest rate.

Pay Stubs

Your pay stubs help the lender assess your financial stability and ensure your income meets the qualifying criteria. Many lenders will require seeing at least your last two pay stubs or as many as the last two months of paycheck stubs.

You can access pay stubs through your employer’s HR or payroll system.

W-2 Forms

Your W-2 (wage and statement) forms report annual wages and any taxes withheld from your paycheck. That’s why these are valued documents your lender will ask for, which further verify your earnings and employment stability.

Expect to provide the last two years’ worth of W-2s. If you don’t have access to these, request copies from your current or previous employer.

Tax Returns

Your recent tax returns also provide a helpful snapshot to the lender that further validates your financial stability, employment history, and proof of wages. Be prepared to turn over your two most recent tax returns.

The lender will typically review Form 1040, which summarizes your income, deductions, and taxes, along with schedules like Schedule C (self-employment income), Schedule E (rental or partnership income), and Schedule B (interest and dividends).

Make sure your tax returns are complete and signed, include all required schedules, match other income documents, and provide both original and amended versions if applicable.

You can obtain copies of your past tax returns via the IRS website.

Profit and Loss Statement if You’re Self-Employed

Things get a little trickier if you work for yourself. That’s because you may not have consistent earnings and it could be more difficult to verify your income.

If you are self-employed, prepare to furnish the last two years of tax returns and possibly a profit and loss statement (which can be generated by your accountant or by using accounting software).

Check out our guide to refinancing your home when you’re self-employed to learn more.

3. Proof of Assets

Your income isn’t the only evidence of financial stability your lender will scrutinize. They’ll also look at your assets, which include liquid assets like cash, savings, and easily convertible investments; fixed assets such as real estate and valuables; retirement accounts; and other investments like business ownership.

Your assets are less essential than proving your income, but they could potentially be used to help pay off your mortgage if you lose access to your income.

Bank Statements

Checking and savings bank account statements will help satisfy the proof of assets requirement. Plan on showing two to three months’ worth of bank statements for each account you have. Some lenders make this process easy by allowing you to permit safe online access to your bank accounts so they can quickly verify these statements themselves.

Investment Account Statements

Own any investments? They can also aid you in getting approved for a refinance loan. Investment account statements point to extra assets that can serve as financial reserves, proving you have additional resources beyond your income to manage mortgage payments in the event of unexpected challenges or hardship.

Expect to give the lender recent account statements for any retirement, brokerage, trust, money market, or other type of investment account you have.

4. Credit Information

The lender will certainly want to check your credit carefully during this process, which can offer insights into how well you manage debt and finances and whether or not you meet the refinance program’s minimum credit score and debt-to-income (DTI) ratio requirements.

They’ll access your credit report to assess your creditworthiness and review your debts. If there are discrepancies or high debts, you might need to provide additional explanations or documentation – like payoff letters or payment plans.

You’ll need to authorize your lender to pull your credit report, which will likely be a hard pull that can temporarily lower your credit score. Some lenders may charge a small fee for this, often between $20 and $50.

It’s a good idea to check your three free credit reports well before applying for a refinance loan; if you notice any errors or inaccuracies, you can dispute them with the three credit bureaus (TransUnion, Equifax, and Experian).

5. Current Mortgage Details

Your lender will request details about your existing mortgage loan, as well, such as the remaining balance, terms, and payment history. Furthermore, they’ll need to see your homeowner’s insurance declaration page and proof that your property taxes are paid up.

These documents ensure the lender has a full understanding of your existing obligations.

Mortgage Statement

Your mortgage statement document, which should be mailed or emailed to you monthly, indicates your current mortgage loan balance and terms as well as payment history. Count on likely handing over your two most recent mortgage statements.

You can request recent mortgage statements from your current lender or log into your account online to print them out yourself.

Homeowners Insurance Declaration

A homeowner’s declaration page summarizes your homeowner’s insurance policy, detailing premiums, coverage types, deductibles, and other policy details. The lender usually requests this document during a mortgage refinance to verify that your home is properly insured and that the coverage meets their requirements.

You can access your homeowner’s insurance declaration page by requesting it from your insurance agent or carrier or logging into your insurance account online.

Property Tax Statements

The lender will want to ensure you are financially reliable and check to see if any tax liens apply to your property that could affect its value or the security of the loan. Consequently, expect to furnish evidence that your property taxes are paid up.

To prove you are current, prepare to provide property tax receipts, escrow account statements, online payment confirmations, or a letter from your local tax authority verifying your payments. You can request tax documents from your local tax office if necessary.

6. Proof of Residence

The lender will need to check that you actually live in your property as a primary residence. Utility bills, a voter registration card, a driver’s license with your current address, a deed with your name and address listed, or any official mail listing your current address can serve as proof.

Usually, one or two of these documents will suffice. These are relatively easy to obtain through your utility provider or local DMV.

7. Additional Documents You May Need

Certain scenarios may require extra documentation. Case in point: If you pay child support or are divorced, you may need a court-issued decree. If you live in an HOA community, you may need to provide HOA statements. Or if you went through bankruptcy, expect to turn over bankruptcy discharge papers if asked.

These documents clarify financial obligations or income sources that could impact your ability to repay the loan.

Divorce decrees or child support orders can be obtained from court records. Bankruptcy discharge papers are provided by the court handling your case. And HOA statements can be accessed via your homeowner’s association.

When to Have These Documents Ready

It’s best to have all of these documents ready to go before beginning the refinancing process. However, it’s not the end of the world if you forget a form or two. Most lenders will patiently wait for the information they need to complete your loan. But it could prolong the process.

Keep in mind that not all documents are mandatory at the initial stage, but you’ll need to have them eventually, so it’s better to be ready well ahead of time.

Tax returns and bankruptcy papers can take longer to retrieve if misplaced, so start collecting these early.

Documents You’ll See Along the Way

As you progress through the refinance process, the lender will provide you with several critical documents. These can include:

- Home appraisal, which assesses your property’s current value

- Loan estimate, which details the loan terms, interest rate, and fees upfront

- Closing disclosures, which list the final loan terms and costs

- Title report, which confirms ownership and identifies liens on the property

- Rate lock agreement, which confirms your interest rate won’t change before closing

- Promissory note, which legally binds you to repay the loan

- Right to cancel, which allows you to cancel the refinance within a specified period (usually three days)

It’s essential to review all of these carefully and ask questions about anything that’s unclear.

Streamline Refinances Need Fewer Documents

If you opt for a streamlined refinance (offered with FHA, USDA, or VA loans), fewer documents will be required because income verification and appraisals are often waived.

Generally, you’ll only need proof of identity, current mortgage details, and proof of residence for a streamlined refi. These programs are designed to simplify the process for borrowers who already meet specific criteria.

Learn more about each streamline program below:

Ready to Get Started?

Being organized and having your documents ready can make the refinance process significantly smoother. You don’t want to be rushing around at the eleventh hour, worrying about what documents you need. Proactively gathering documents long before they’re requested shows you’re serious about your refinance and can even speed up the underwriting process.

When you’re ready to move forward, start your refinance application with Refi.com. Our streamlined process and experienced team will guide you through each step, making your refinance as simple as possible.