Disadvantages to Refinancing: Here Are 10 Reasons Not to Refinance Your Home

Fact-checked by Tim Lucas

Refinancing a mortgage can be a powerful financial tool, offering benefits like lower monthly payments, reduced interest costs, and access to home equity. Many homeowners use refinancing to free up cash for home improvements, consolidate debt, or shorten their loan term to build equity faster. Done strategically, it can strengthen your financial position and help you achieve long-term goals.

However, refinancing isn’t always the right move. While it can provide significant advantages, it also comes with costs, potential risks, and scenarios where it might not be in your best interest. Before committing to a new loan, it’s important to weigh the benefits against the potential downsides. In this guide, we’ll explore common situations where refinancing may not be the best choice—helping you make a fully informed decision.

Key Takeaways

- The disadvantages of refinancing a home loan can sometimes be real — and costly.

- However, in the right circumstances, a refi can be a smart and even necessary move.

- Take a moment to understand the pros and cons of a refi so you can make an informed decision.

Factors to Consider When Refinancing

Before refinancing, ask yourself the following questions to ensure it’s the right financial move:

- What’s my goal? Are you looking to lower monthly payments, tap into home equity, or pay off your mortgage faster?

- Do current interest rates work in my favor? A lower rate can save thousands, and waiting for a better market could be wise.

- How’s my financial health? Your credit score, debt load, and income stability will impact your new loan terms.

- What’s my break-even point? Calculate how long it will take for refinancing savings to cover closing costs. If you plan to move soon, a refi might not be worth it.

- Are there better alternatives? A HELOC or home equity loan might be a better option for accessing cash while keeping your current mortgage terms.

We’ll explore some of these further later in this article. They may or may not be reasons not to refinance your home.

10 Situations When Refinancing May Not Be Right for You

Refinancing can be a great financial move, but it’s not always the right choice. While lowering your mortgage rate or accessing home equity can provide big benefits, refinancing also comes with costs and risks that may outweigh the advantages in certain situations.

Additionally, lenders must verify that your refinance meets Net Tangible Benefit (NTB) rules, meaning the new loan must improve your financial position—whether by reducing your monthly payment, lowering interest costs, or offering another clear benefit.

Before moving forward, consider whether refinancing truly aligns with your long-term goals. Below are 10 common situations where refinancing may not be the best move.

1. When You Plan to Move Soon

We’re back to the break-even point. This is the time it takes to recover the cost of your refinance through the savings you make through your reduced monthly payment.

Refinance closing costs tend to be similar to those for a straight mortgage, usually in a range of 2%-5% of the loan amount. So, on a $300,000 loan, those might be anything between $6,000 and $15,000. Let’s say you got a good deal at 2%, or $6,000.

Suppose your refinance reduces your monthly payment by $200. It would take you 30 months ($6,000 ÷ $200 = 30) or two and a half years for you to break even on the deal.

And, if you were to sell your home and move within a shorter period than that timeframe, you’d incur a financial loss. Many mortgage advisors would suggest such a long break-even point is a bad idea.

Of course, if your monthly savings were $400 instead of $200, your break-even point would halve to 15 months. That’s a much more sensible time, and it cuts the chances of loss if you move unexpectedly early.

Try out our refinance break-even calculator to find your break-even point.

2. When Mortgage Rates Are Falling, But Might Fall Further

If you’re refinancing solely to reduce your mortgage rate and monthly payment (a “rate-and-term” refinance), you need to refinance to a lower rate than the one you’re currently paying.

And mortgage rates were high at the time this was written. So, that can be a problem.

They will almost inevitably fall at some time. But nobody can say when.

How we source rates and rate trends

Rates based on market averages as of Dec 02, 2025.Product Rate APR 15-year Fixed Refinance 5.37% 5.42% 30-year Fixed Refinance 6.35% 6.37%

If and when they do, this presents another problem. Closing costs mean you don’t want to refinance too often. But equally, you don’t want to keep paying more than you need for your mortgage.

Many experts recommend waiting until you can shave at least 1% (100 basis points) from your current rate. That typically delivers a reasonable break-even period.

However, if rates are falling quickly, you may want to wait for a bigger fall. Why refinance to drop 1% when you might pay the same closing costs for a 1.5% reduction three months later? On the other hand, suppose rates unexpectedly reverse course and start rising.

In this situation, it might be worth noting what mortgage rate experts are saying. There are never any guarantees their forecasts will prove correct, but at least they give you some context for the current market.

3. When Your Finances Have Declined Since Your Original Mortgage

The mortgage rate you’ll pay on your refinanced loan is closely tied to your creditworthiness and indebtedness. And, if you currently have an appreciably lower score or higher debts than you did when you applied for your existing mortgage, you may face problems.

Even if mortgage rates have generally fallen by then, you may have to pay a higher rate than you are right now. And you possibly might struggle to get approved at all.

Streamline refinances on FHA, VA and USDA loans may let you avoid income, credit, and debt checks. But these are rate-and-term refinances, meaning you can’t take cash out. And you can only use these when you’re refinancing on a like-for-like basis: FHA for FHA and so on.

Programs to check out if you have lower income or credit scores since your last mortgage:

Of course, your score and indebtedness are not set in stone. So, if this is a problem for you, take time to address your issues before you apply.

Paying down card balances to below 10% of their credit limits can move things fast. And the CFPB has an excellent, downloadable factsheet called How to Rebuild Your Credit.

4. When You Can’t Afford the Higher Payment That Comes with a Shorter Term

Suppose you got your existing 30-year mortgage 10 years ago. If you refinance to a new 30-year loan, you should get a much lower monthly payment because you’re spreading your payments across 40 years: 30 for the new loan and 10 for the old one.

Sounds good. Except you’ll be paying interest on a large sum over 40 years instead of 30. And you won’t be mortgage-free for another 30 years instead of 20.

Let’s look at an example using a refinance calculator. We’ll assume a current $300,000 loan at 7.6% (rates and figures mentioned are for example purposes only):

- If you don’t touch your loan, you’d have to pay back $247,417 over the next 20 years.

- If you refinance to a new 30-year loan, you’d have to pay back $395,194 over the next 30 years.

- If you refinance to a new 15-year loan, you’d have to pay back $170,398 over the next 15 years. You can typically get a lower rate on a shorter term.

You stand to save a bundle on your total cost of borrowing if you avoid meddling with your repayment clock by refinancing to a 15- or 20-year loan.

The downside is that monthly payments won’t reduce and may rise. You’ll get a big benefit in exchange for that pain, but can you afford it?

If not, think twice before refinancing. You may still go ahead, but recognize the long-term damage it could do to your net worth.

Alternatively, you could pay down your existing loan more quickly by making additional payments. Just let your lender know that the extra money you send should be applied to your principal balance, not interest.

5. When Interest Rates Are Higher

It’s rarely a good idea to refinance to a higher rate than the one you’re already paying. You’ll either:

- Have a higher monthly payment

- Extend the term of your loan, increasing your total cost of borrowing (see last section)

That’s not to say such a refinance can’t be necessary. For example, if you’re emerging from a divorce, you may need to remove your spouse’s name from the mortgage.

Or you may have such an urgent requirement for money that you’ve no choice but to take the financial hit of a cash-out refinancing to a high rate. Just make sure you don’t have better options. We’ll cover those further down this page.

6. When You Can’t Afford the Closing Costs

Ideally, you’ll have sufficient savings to cover your closing costs. That should save you some money.

It’s not typically a dealbreaker: your lenders will typically accommodate you in one of two ways:

- It will roll up the closing costs within your new loan. You don’t need to put cash in but you will be paying interest (at your mortgage rate) on the sum, perhaps for 30 years.

- It will offer you a no-closing-costs refinance. Tempted? Your lender will almost certainly charge you a slightly higher mortgage rate to cover its expenses. Again, that will be payable on your whole loan for up to 30 years.

Lots of borrowers use one or other of those ways to duck the immediate pain of closing costs. But you should be aware that both can end up being costly.

7. When Your Home Is Almost Paid Off

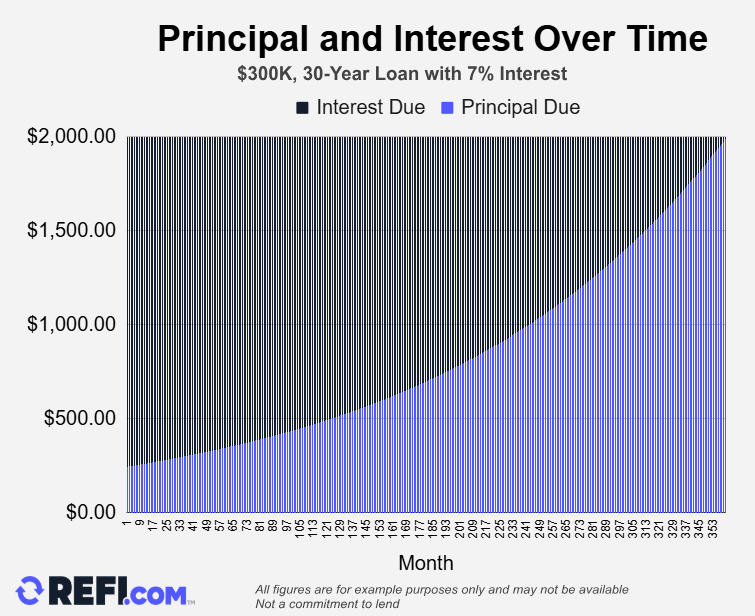

Fixed-rate mortgage loans are “amortized.” That means that, while each monthly payment stays the same, the amount of each payment that’s allocated to interest and the amount that reduces what you owe (the “principal”) changes month by month.

When you start out, you owe a huge sum. So nearly all your payment goes on interest. Very gradually, the amount that pays the interest due reduces as your mortgage balance falls.

Here’s an example of that in action with a $300K, 30-year loan with 7% interest and a $1,996 monthly principal and interest payment (all figures are for example purposes only and may not be available. Not a commitment to lend):

For the first ten months, that looks like:

| Month | Principal Due | Interest Due |

| 1 | $246.00 | $1,750.00 |

| 2 | $247.43 | $1,748.57 |

| 3 | $248.88 | $1,747.12 |

| 4 | $250.33 | $1,745.67 |

| 5 | $251.79 | $1,744.21 |

| 6 | $253.26 | $1,742.74 |

| 7 | $254.74 | $1,741.26 |

| 8 | $256.22 | $1,739.78 |

| 9 | $257.72 | $1,738.28 |

| 10 | $259.22 | $1,736.78 |

And over a longer span of time, that looks like:

- Month 1: $246 towards principal, $1,750 towards interest

- Month 48: $323 towards principal, $1,672.66 towards interest

- Month 180: $696.78 towards principal, $1,299.22 towards interest

- Month 360: $1,985.08 towards principal, $10.92 towards interest

As you can see, you start off paying mostly interest and only begin reducing your debt quickly roughly halfway through your loan. Then it’s downhill all the way, so by the end when you zero your balance, you’re paying hardly any interest at all.

Apply that understanding to a refinance, and the implications are clear. Resetting the clock when the finish line is in sight means starting all over again with a higher proportion of your payments covering interest.

Unless you absolutely must, it’s better to avoid refinancing in the last several years of your mortgage’s term.

8. Cash-Out Refinance: When There Are Better Alternatives

If you’re thinking of a cash-out refinance, there may be better ways to access credit:

- Personal loans — These tend to have the highest rates but they have the advantages of typically having a shorter term and of being unsecured (so your home’s not on the line).

- Home equity loans — These second mortgages are a bit like personal loans in that you borrow a lump sum and repay it in equal installments. Because it’s secured by your home’s equity, it tends to have a lower rate than a personal loan.

- Home equity line of credit (HELOC) — Another second mortgage but you get a line of credit rather than a lump sum, similar to a credit card. You can borrow up to your credit limit, repay, and borrow again. Again, as a secured loan, its rates tend to be lower than unsecured loans.

Why are these sometimes better than cash-out refinances? Well, it depends on whether current mortgage rates are higher or lower than your existing one.

If your new mortgage rate will be higher than your current one, you’ll be paying it on your entire new balance. But you’ll be paying a higher rate on these alternatives only on your new borrowing.

So, you can access cash while leaving in place your current mortgage with its lower rate.

9. Cash-Out Refinance: When Debt Consolidation Doesn’t Solve the Root Issue

Financial regulator the Consumer Financial Protection Bureau (CFPB) published a paper about cash-out refinancing in January 2025, based on data from 2014-21.

It found that debt consolidation was the most common reason cited by borrowers when asked why they chose a cash-out refinance. Unsurprisingly, the paper said, “Cash-out borrowers had sharp improvements in their debt load and credit scores at the time of refinancing.”

The paper continued: “Credit card balances and use rates trended back toward pre-refinance levels in the year following the refinance, but they did not in that time increase to the pre-refinance level. Credit scores likewise decreased in the year following refinancing, but remained above pre-refinance levels.”

You can see what happened. Homeowners initially loved all their cards’ zero balances but couldn’t resist pushing them back up again. By now, presumably, some have similar or higher balances than they had when they last tapped their equity.

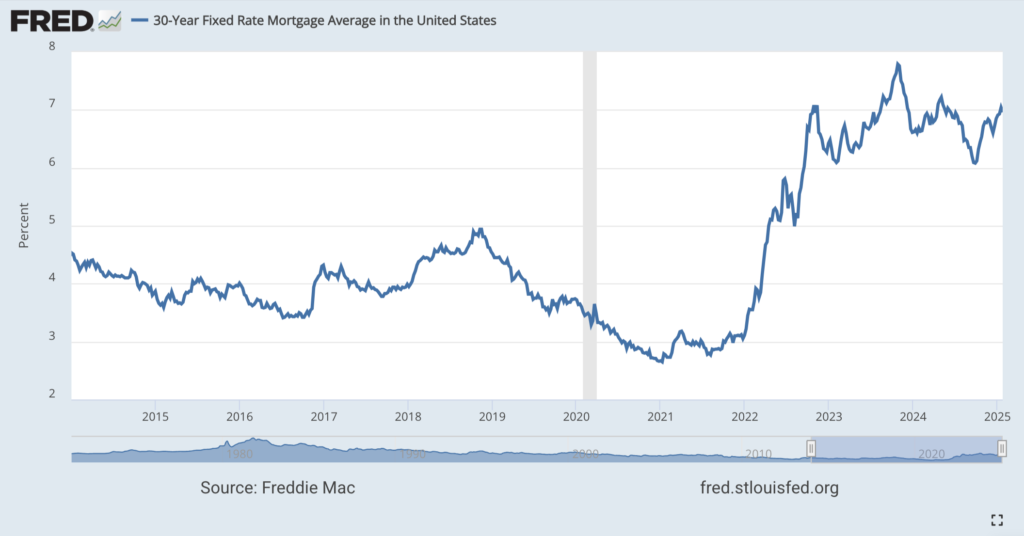

And many might now be hoping to pull the same trick again with a second cash-out refinancing. But look at what’s happened to mortgage rates since 2014:

Freddie Mac, 30-Year Fixed Rate Mortgage Average in the United States [MORTGAGE30US], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/MORTGAGE30US, January 26, 2025.

A cash-out refinance might be tempting and perhaps occasionally necessary. But those higher mortgage rates are going to mean sharply increased monthly mortgage payments — and a whole lot of pain.

Anyone thinking of a cash-out refinance for debt consolidation would be well advised to first draw up a household budget that balances their income and outflow. Otherwise, their overspending may come back to bite them.

10. Cash-Out Refinance: When You’re Decreasing Equity for the Wrong Reason

There can be good reasons for tapping home equity through a cash-out refinance. The CFPB says that, after debt consolidation, the next most popular reason is for “home repairs or new construction.”

Those can both be good reasons. And there may be others.

The golden rule is to be investing in a future tangible benefit. So, getting yourself additional qualifications or starting your own sure-fire business could count as sound reasons for a cash-out refinancing.

However, it’s typically a bad idea to refinance to treat yourself or others. You might find a personal loan a better choice if you want to pay for a family wedding, throw a lavish party for your big anniversary or birthday, or take the vacation of a lifetime.

True, you’ll likely pay a higher interest rate on a personal loan. But you won’t be putting your home on the line or paying off a vacation for thirty years.

Weigh the Benefits Against the Costs

Mostly, refinances are all about the savings you can make or the cash you can access. And you’ll likely find that running the numbers tells you all you need to know.

The key judgment you make is weighing the costs and hassle against the benefits a refinance will bring. Your breakeven point is a good indicator of when a refi is worthwhile. And you should always keep an eye on the long-term implications for your personal wealth.

However, sometimes, you may need to sacrifice your long-term financial well-being for short-term gain. For example, your pressing need for money may force you into a cash-out refinance even though you know it’s an undesirable move. Only you can decide whether your immediate requirement outweighs the reasons not to refinance your home.