How Auto Loans Impact Your Mortgage Refinance Eligibility

Auto loans and mortgages are two of the biggest debts most Americans carry. If you’re looking to refinance your mortgage, it’s important to understand how your current auto loan could affect your eligibility—and your bottom line.

In this guide, we’ll walk through how your car payment factors into mortgage refinance decisions, how to evaluate whether paying off your loan makes sense, and what alternatives might be available.

A Car Loan’s Impact On Your Mortgage Eligibility

According to the Experian State of the Automotive Finance Market Report, the average car payment on a new car reached $742 a month in the last quarter of 2024. A payment this high could impact your buying/refinancing power by around $116,000, according to our methodology below.

Home purchases and refinances come with debt-to-income (DTI) ratio requirements, which ensure the borrower can realistically afford to take on the new loan.

For conventional and FHA loans, your total debt payments, including the new house, are limited to between 43-50% of your gross income.

A car payment eats up a lot of that percentage. Here’s how a car payment diminishes your homebuying power.

| Annual gross income | Credit card, student loan payments | Car payment | Max home payment* | Max home price* |

| $75,000 | $500 | $0 | $2,300 | $315,000 |

| $75,000 | $500 | $300 | $2,000 | $270,000 |

| $75,000 | $500 | $500 | $1,800 | $240,000 |

| $75,000 | $500 | $750 | $1,550 | $200,000 |

| $75,000 | $500 | $1,000 | $1,300 | $160,000 |

| $75,000 | $500 | $1,250 | $1,050 | $120,000 |

*Assumes an FHA loan at 3.5% down and 6% interest rate, 45% back-end ratio, $200/mo property taxes and $50/mo insurance, no HOA. Your rate and costs will vary.

Using the assumptions above, each $100 in car payment reduces your home buying power by $15,400.

Should You Pay Off Your Car Before Applying for a Mortgage Refinance?

The answer depends on several factors, including your current DTI, cash flow, and financial goals. Below, we break down the pros and cons of paying off your car loan before refinancing your home.

Pros of Paying Off Your Car Loan First

- Improves Your DTI Ratio

- Mortgage lenders typically look for a back-end DTI ratio of 43-50%, including all monthly debt payments. Paying off a car loan reduces your debt load and increases your borrowing capacity.

- Example: If your car payment is $500 per month, eliminating it could increase your potential mortgage approval by $77,000 to $85,000, depending on lender guidelines.

- For DTI purposes, lenders typically ignore accounts that are due to be paid off within 10 months. If that describes your auto loan, there may be no point in paying it off early.

- May Help You Qualify for a Better Interest Rate

- A lower DTI signals financial stability, which may lead to lower mortgage rates and better loan terms.

- Some lenders may offer better rates to borrowers with less overall debt, saving you thousands over the life of your mortgage.

- Boosts Your Credit Score

- Paying off an auto loan can sometimes improve your debt mix, which is a factor in determining your credit score. A higher credit score may qualify you for better mortgage refinancing options.

- However, your score also takes into account the average age of your accounts, and closing one unnecessarily may reduce that age and lower your score a little.

- Frees Up Monthly Cash Flow

- Without a car payment, you’ll have more disposable income each month, making it easier to handle mortgage payments, home maintenance, and other expenses.

Cons of Paying Off Your Car Loan Before Refinancing

- May Drain Your Savings

- If paying off your car loan requires using a large chunk of savings, you may reduce your financial cushion for emergencies or a home down payment.

- Lenders prefer borrowers to have at least three to six months of reserves for mortgage payments.

- Not Always Necessary for Loan Approval

- If your DTI is already within an acceptable range (typically under 43-45%), paying off your auto loan may not significantly impact your ability to refinance.

- Instead, you might be better off making extra payments toward high-interest debt, like credit cards, before refinancing.

- Could Limit Other Investment Opportunities

- If you have a low-interest car loan (e.g., 2-4% APR), paying it off early might not be the best financial move. You may get a better return investing your extra cash elsewhere, such as in retirement accounts or home improvements.

- Delays the Refinance

- Refinancing your mortgage is all about timing. If rates are low, but you wait to pay your car off first, you may risk having to take a higher interest rate down the road. See our guide to when to refinance for more information.

How we source rates and rate trends

Rates based on market averages as of Dec 02, 2025.Product Rate APR 15-year Fixed Refinance 5.37% 5.42% 30-year Fixed Refinance 6.35% 6.37%

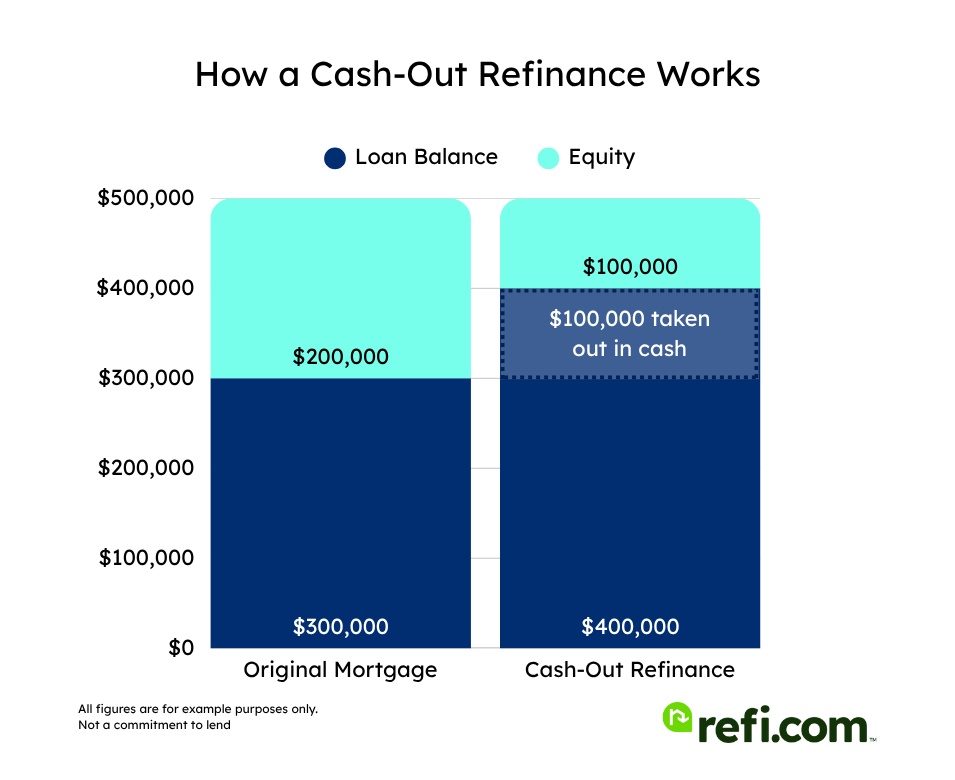

Alternative Option: Rolling Your Car Loan into a Cash-Out Refinance

If you are looking to consolidate debt, a cash-out refinance allows you to tap into your home’s equity to pay off your car loan. However, this moves your short-term auto debt into a long-term mortgage loan, which could result in paying more interest over time. Indeed, you could still be paying down your current car loan in 30 years’ time, decades after the vehicle has been scrapped. Carefully compare interest rates and repayment terms before choosing this option.

Check out our guide to debt consolidation with a cash-out refinance to learn more.

What to Do Next

If you’re thinking about refinancing your mortgage and juggling a car loan, here are a few smart next steps:

- Use our Mortgage Refinance Calculator to see how your current debts impact what you can borrow.

- Check your DTI ratio and see whether paying off your car loan would move the needle.

- Explore our guide to Cash-Out Refinancing to learn if consolidating your auto loan into your mortgage makes financial sense.

- Talk to a lender to get personalized insight based on your credit, income, and goals.

Ready to move forward on a mortgage refinance? Apply with Refi.com today.