What Is a Cash-In Refinance? And Should You Do It?

A cash-in refinance allows you to pay down your mortgage with a lump sum payment while improving its terms. It’s not the most common refinance type, but there are several reasons why someone might choose to bring cash to the refinance closing table. Sometimes, a lender could even require one to approve your loan.

The least you need to know:

- A cash-in refinance lowers your loan balance and improves terms, potentially reducing payments, interest rates, or mortgage insurance.

- A cash-in refinance can be a good option for homeowners who stand to improve their loan terms with a refinance and have extra funds on hand.

- Alternatives exist, like principal reduction, mortgage recasting, or paying down higher-interest debt. The alternatives may be the better option in some cases.

What Is a Cash-In Refinance?

A cash-in refinance is when you refinance your mortgage and make a lump sum payment to reduce your total balance. The lump sum directly reduces your principal balance, similar to a down payment on a new mortgage. This can lower the amount of interest you pay over time and may help you qualify for better loan terms.

A cash-in refinance is the opposite of a cash-out refinance where you take cash at closing, reducing your home equity.

For most homeowners, a cash-in refinance is best when paired with a lower interest rate or a change in loan terms via the refinance; not just for paying down the balance. When rates are high, alternatives like mortgage recasting or principal reduction may be more cost-effective.

But a cash-in could be a smart idea if you already have another reason to refinance, something like:

- Reducing your interest rate

- Changing from a 30-year fixed to a 15-year, or vice versa

- Changing to a more favorable type of mortgage

- Changing from an ARM to a fixed-rate mortgage, or vice versa

How we source rates and rate trends

Rates based on market averages as of Dec 02, 2025.Product Rate APR 15-year Fixed Refinance 5.37% 5.42% 30-year Fixed Refinance 6.35% 6.37%

Benefits of a Cash-In Refinance

If you have a considerable sum of cash on hand – this could be from savings or from a one-time windfall such as an inheritance, work bonus, or insurance settlement – it might make sense to pay down your loan as part of your refinance.

Reduce Your Monthly Payments

Doing a cash-in refinance to pay down your mortgage balance will help reduce your payments in nearly all cases. If you have cash on hand and want to alleviate some of the burden on your monthly budget, a cash-in refinance can help.

This is particularly true if you can do a cash-in and reduce your interest rate simultaneously.

Note: Refinancing may result in higher finance charges over the life of the loan.

Qualify for a Lower Interest Rate

You know that your credit score is a major factor in the interest rate you receive from lenders. But are you aware that the amount of equity you have in your home also plays a significant role?

Reducing your loan-to-value (LTV) ratio through a cash-in refinance can improve your loan terms, and in some cases, qualify you for a lower interest rate—depending on other factors like credit score, debt-to-income ratio, and overall market conditions.

Eliminate Mortgage Insurance Payments

You’re probably paying for mortgage insurance if you have a conventional loan with less than 20% equity. If you have an FHA loan, you’re likely on the hook for mortgage insurance premiums regardless of how much you’ve paid toward your home.

Either way, your monthly mortgage insurance cost could be hundreds of dollars.

If you’re currently responsible for mortgage insurance and can do a cash-in conventional refinance that brings your equity up to 20% (an 80% LTV), you may be able to eliminate PMI or FHA mortgage insurance and cut your payments significantly.

Shorten Your Loan Term

You may not need a cash-in refinance to shorten your loan term, but it can certainly help make the payments more affordable. Shorter-term loans require larger payments even though the interest rate is often lower.

By doing a cash-in refinance at the same time as shortening your loan term, you can offset the impact of having fewer payments while still working towards paying your property off sooner.

For example: You are refinancing your $300,000 loan balance to either a 30-year loan at 7% or a 15-year loan at 6.5%. The principal and interest payments on the 30-year mortgage would be $1,996, while the 15-year would be $2,613. However, if you do a cash-in refinance and reduce your loan balance to $250,000, the 15-year P&I payments would drop to $2,178.

Potential Drawbacks of a Cash-In Refinance

Despite the benefits a cash-in refinance can provide, there are potential drawbacks to keep in mind:

Ties Up Your Cash

Using a lump sum to pay down your mortgage reduces liquidity, leaving you with less cash for emergencies, investments, or other financial goals.

Upfront Costs

Refinancing comes with closing costs, which can range from 2% to 5% of the loan amount. Even if you’re reducing your balance, these fees can eat into your savings.

Lower Returns Compared to Other Investments

If your mortgage has a low interest rate, putting extra cash into higher-yield investments may provide better long-term returns than paying down your loan.

No Guaranteed Savings

While a lower loan balance can reduce payments, the actual savings depend on factors like your new interest rate and loan term. In some cases, a cash-in refinance may not significantly lower your costs.

Limited Availability of Recasting

If lowering your monthly payment is the goal, a mortgage recast might be a cheaper alternative—but not all lenders offer this option, and government-backed loans don’t qualify.

Common Requirements for a Cash-In Refinance

If you’re considering a cash-in refinance, you’ll need to meet certain lender requirements to qualify. While specific criteria vary by lender and loan type, here are the key factors that influence your approval:

1. Credit Score Requirements

Your credit score affects your eligibility and the interest rate you qualify for.

- Conventional Loans: Most lenders require a minimum 620 credit score, but a 700+ score is typically needed for the best rates.

- FHA Loans: You may qualify with a score as low as 580, though many lenders, including Refi.com, require 620+ for refinancing.

- VA Loans: No official minimum, but most lenders look for a 620+ credit score.

- USDA Loans: Require a 640+ credit score in most cases.

2. Loan-to-Value (LTV) Ratio

Lenders use LTV to determine how much equity you have in your home. A lower LTV reduces lender risk and can help you qualify for better terms.

- Conventional Loans: Most lenders require a minimum of 5% to 10% equity (90–95% LTV) for a refinance, but stronger terms are often available with lower LTVs.

- FHA Loans: Allow up to 97.75% LTV for rate-and-term refinances. Cash-in may be required if your existing balance exceeds this limit.

- VA Loans: Offer up to 100% LTV for rate-and-term refinances. Cash-in is rarely required unless dictated by lender overlays.

- USDA Loans: Allow up to 100% LTV for refinancing, but additional requirements may apply.

3. Debt-to-Income (DTI) Ratio

DTI compares your monthly debt payments to your income. Most lenders prefer a lower DTI to reduce lending risk.

- Conventional Loans: Generally require a DTI of 43% or lower, though up to 50% is possible with strong compensating factors.

- FHA Loans: Typically allow DTI up to 50%, but lower DTIs may be required for manual underwriting.

- VA Loans: No set maximum, but lenders prefer DTI under 41% for easy approval.

- USDA Loans: Maximum DTI is usually 41%, though higher may be allowed with compensating factors.

4. Minimum Cash Contribution

The amount of cash required for a cash-in refinance depends on your lender’s LTV guidelines and whether you need to eliminate PMI.

- Conventional Loans: If you’re reducing LTV to 80% to remove PMI, you may need thousands in additional funds at closing.

- FHA Loans: You can refinance with as little as 3.5% equity, but cash-in may be needed if your current LTV exceeds FHA limits.

- VA Loans: Typically don’t require cash-in, but some lenders may require a small cash contribution if you’re close to approval limits.

- USDA Loans: Cash-in is generally not required since 100% financing is available, but some lenders may require reserves or a small payment in specific cases.

5. Reserve Funds

Some lenders require cash reserves after closing to ensure financial stability. This applies more commonly to jumbo loans and high-risk borrowers.

- Conventional Loans: Some lenders require three to six months’ worth of mortgage payments in reserves, especially for high-LTV refinances.

- FHA Loans: Generally no reserve requirements, but some lenders may impose overlays.

- VA Loans: Typically no reserve requirements, though reserves may be needed for multi-unit properties.

- USDA Loans: Reserves are not required, but having extra savings may strengthen your application.

Can a Lender Require Cash-In to Refinance?

Sometimes, you might need to pay down your loan balance to be able to refinance. This occurs when you don’t have enough equity to meet the lender’s minimum requirements.

Suppose you purchased your home with a 3.5%-down FHA loan, and local property values have not risen since. In that case, you may not have the 5% equity needed for a conventional refinance.

If not, a cash-in refinance could be your best and only option to reduce your loan balance enough to meet the lender’s LTV requirements. That, or wait to refinance until home prices have risen and you’ve gained enough equity organically.

Of course, a big problem with waiting until your home value increases is that interest rates cannot be predicted.

For example: You purchased your home for $300k with 3.5% down, and property values in your area have remained constant. You currently have a loan total of $289,500. A 95% LTV conventional refinance would max out at $285,000. This would require you to do a $4,500 cash-in to cover the difference and be able to close.

What if home prices have decreased in your area? If your home’s value has dropped by 5% and your property now appraises for $285,000, the maximum conventional refinance loan would be about $271,000. In this scenario, you could be required to do a $20k cash-in refinance.

Streamline Refinance: Antidote for Cash-In Refinancing

Do you currently have a government-backed mortgage through the FHA, VA, or USDA? If so, you may be able to do a streamline refinance and avoid having to put cash in at closing.

A streamline refinance is a low-doc refi loan with:

- No detailed credit check

- No verification of income

- No appraisal typically required

With a streamline refinance, the amount of equity you have in your home doesn’t matter. You can do a streamline refi to lower your rate without bringing extra cash to the table, even if you’re fully underwater on your loan.

Unfortunately, borrowers who have an existing conventional mortgage are not able to take advantage of this option. There are no current conventional streamline refinance programs. But if you have a government-secured loan, you should check out the:

Cash-In Refinance vs. Cash-Out Refinance

A cash-in refinance is widely considered the opposite of a cash-out refinance. However, they are similar in that they both require you to take out a new loan to pay off your existing mortgage. In most cases, this will result in adjusting your interest rate and the length of your payments.

The fundamental difference between these two types of loans has to do with your home’s equity. When you do a cash-out refinance, you convert some of your property’s built-up value into cash. As a result, the amount of equity in your home ends up lower than before.

With a cash-in refinance, you’re converting cash into home equity. After closing, you’ll owe less on your property, increasing equity, and be that much closer to owning it outright.

Cash-In Refinancing Alternatives To Reduce Your Loan Balance

We’ve covered a number of the benefits of a voluntary cash-in refinance. Still, there are other options for paying down your mortgage. Here are some cash-in refinancing alternatives and some different ways you might choose to use your funds instead.

Make a One-Time Principal Reduction Payment

Nearly all mortgages will allow you to make extra payments to reduce your principal balance. You don’t need to refinance to do so if this is your only goal.

With a one-time principal reduction payment, you will lessen how much you owe and shorten the time until your home is paid off. This will save you interest over the life of the loan.

It won’t, however, adjust your monthly payment. You’ll still be on the hook each month for the same amount you currently pay.

Get Your Mortgage Recast

If you have a conventional loan, you may be able to lower your monthly payments without refinancing. With a mortgage recast, you can make a one-time principal reduction payment and have your lender re-amortize your future payments based on the new loan balance.

Your interest rate and number of remaining payments won’t change, so it will still take you the same amount of time to pay off your loan. However, the reduced balance will mean paying less each month and in total lifetime interest.

Mortgage recasts typically have a fee of $250 to $500, which is much cheaper than refinance closing costs. Cash-in refinances also often require a principal payment of at least $10,000, though this varies by lender.

Government-backed loans like FHA, VA, and USDA cannot be recast. Conventional loans may be eligible, but not all servicers offer this option. You’ll need to check with yours to confirm availability and terms.

Pay Down Higher-Interest Loans

When you have a surplus of cash, paying down a significant debt like your mortgage can be tempting. But if you currently have other higher-interest loans, obligations like auto payments or credit card debt, it might make more sense to pay them off instead.

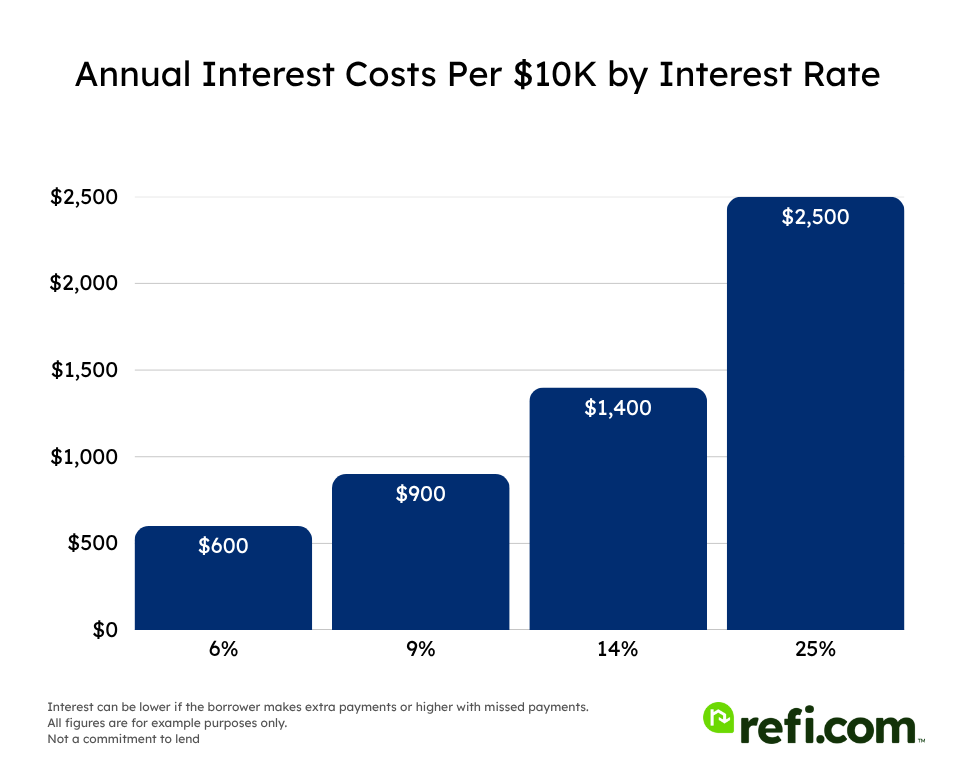

| Type of Debt | Example Interest Rate | Annual Interest Cost Per $10k |

| Home Mortgage | 6% | $600 |

| Automotive Loan | 9% | $900 |

| Personal Loan | 14% | $1,400 |

| Credit Card Debt | 25% | $2,500 |

While long-term interest costs can vary depending on the terms of different loans or the length of time you maintain a credit card balance, allocating your funds to higher-interest debts will result in immediate savings. Doing so can also potentially free up your budget by eliminating smaller payments altogether.

Maintain a Reserve Fund

Paying down your mortgage can be a great idea. However, it’s important to still maintain funds in reserve for unplanned expenses and emergencies.

If you’re contemplating putting all your on-hand cash into your mortgage, you may want to reconsider. While the feeling of owing less on your home can be powerful, you don’t want to wind up “house rich, cash poor.”

Invest for a Higher Rate of Return

If your existing mortgage has a low interest rate – especially if your loan is in the 3% to 4% range or below – you may not want to pay down that balance.

In this situation, investing the funds in opportunities offering a higher rate of return could make more financial sense. However, when weighing your options, consider both the uncertainty of investments and the predictable results of reducing your outstanding debt.

Is a Cash-In Refinance Right for You?

If you’re planning to refinance and have the cash available to pay down your mortgage balance, a cash-in can help you reduce your monthly payment, qualify for a lower interest rate, and even eliminate costly mortgage insurance premiums.

But you have other options – even for paying down your mortgage – which could be more practical in certain situations. To determine if a cash-in refinance is right for you, get a quote today with Refi.com.