How to Get a Cash-Out Refinance on an Investment Property

- A cash-out refinance on an investment property can provide funds for upgrades, new property purchases, or debt consolidation, but it comes with higher equity and interest rate requirements than refinances on a primary residence.

- Borrowers typically need at least 25-30% equity remaining after refinancing, strong credit, and sufficient reserves, making preparation essential.

- Alternatives like HELOCs, home equity loans, or saving cash may be more cost-effective for smaller funding needs or if you want to keep your existing mortgage.

A cash-out refinance can be a great way to access the built-up equity in your investment property. This can be used for home or property improvements, investing in another property, consolidating debt, and, in general, anything you need it for.

However, getting a cash-out refinance on an investment property comes with stricter requirements than a cash-out on your primary residence.

To give you an idea of what to expect, we’ll cover all the specifics of getting a cash-out refinance on an investment property.

What Is a Cash-Out Refinance for an Investment Property?

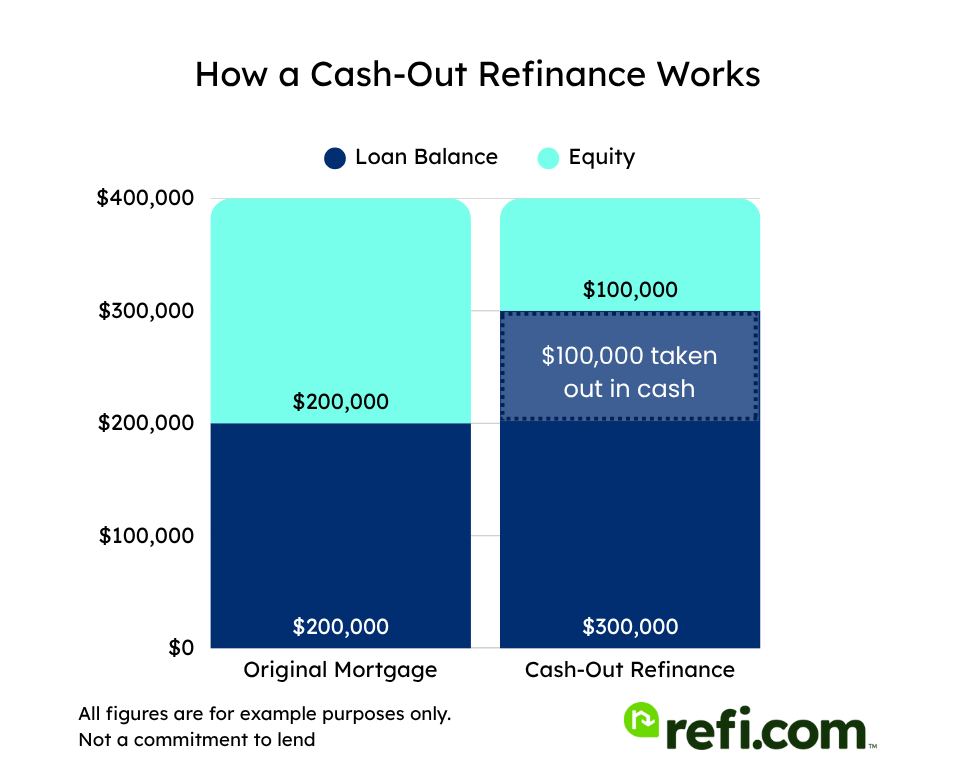

A cash-out refinance on an investment property lets you tap into your property’s equity by replacing your existing loan with a larger one. The difference between the new loan and what you still owe comes back to you as cash, which you can use however you choose.

Here’s a visual example of a cash-out refinance: The borrower has $200,000 equity on a $400,000 home. They cash out $100,000, keeping $100,000 (25%) in equity and increasing their loan balance from $200,000 to $300,000.

Reasons to Get a Cash-Out Refinance on an Investment Property

Why do a cash-out refi on an investment property? In many cases, investors tap into their built-up equity to increase their property’s market value or rentability. This could be:

- Modernizing the kitchen or other features

- Adding extra bedrooms or bathrooms

- Improving curb appeal

- Converting a single-unit property into a multi-unit one

You could also choose to use the funds to invest in other rental properties, whether that means cashing out enough for a down payment or the entire purchase price.

Sometimes, it may even make sense to do a cash-out refinance and use the funds to pay off other higher-rate debts, such as a carried credit card balance.

Requirements for Refinancing Investment Properties

Lenders often require stricter eligibility qualifications on investment properties because they’re seen as riskier than primary residences. This goes for the initial loan and refinances.

- Loan type: Cash-out refinances on investment properties must be done with conventional or, in some cases, jumbo loans. FHA and VA loans can’t be used for investment properties, as those programs are restricted to primary residences.

- Equity: 25 – 30% equity must remain after the funds are withdrawn, depending on how many units the property has (more on this below). Primary residence cash-out refinances often require 20%.

- Credit score: Conventional guidelines require a minimum credit score of 620 for all purchase and refinance loans. However, most lenders will be looking for a higher score to approve a cash-out refinance on an investment property. For example, Refi.com requires a 700 FICO credit score for a conventional cash-out refinance on an investment property.

- Debt-to-Income Ratio (DTI): You will also want a debt-to-income (DTI) ratio of 45% or below. In many cases, you may be able to use some of the income from your investment property to help you qualify.

- Seasoning: If you currently have a mortgage, the primary loan must be at least 12 months old. However, you can use the funds from your cash-out to pay off second mortgages and liens of any age.

- Title: At least one borrower needs to have been on the title for a minimum of six months. There are exceptions to this, such as refinancing to reimburse an all-cash purchase or receiving the property through inheritance or court order.

- Reserve Funds: All investment property transactions will require proof of reserve funds equal to six months of housing expenses.

Cash Reserves for Multiple Financed Properties

If you have other financed investment properties, you’ll likely need additional reserves. This reserve amount is calculated as a percentage of your total outstanding mortgage balance, not including your primary residence and the property you’re refinancing.

| # of Financed Properties | % of Total Loan Balance |

| 1-4 | 2% |

| 5-6 | 4% |

| 7-10 | 6% |

Note: In addition to your primary residence and the investment being refinanced, you can exclude any properties that are pending sale or will otherwise be paid off by closing.

Maximum Loan Limits

To qualify for a conventional cash-out with Fannie Mae or Freddie Mac branding, loans must be within the limits set annually by the Federal Housing Finance Agency. Here’s what the loan limits look like for 2026.

| # of Units: | Maximum Loan | Maximum Loan (High-Cost Areas) |

| One | $832,750 | $1,249,125 |

| Two | $1,066,250 | $1,599,375 |

| Three | $1,288,800 | $1,933,200 |

| Four | $1,601,750 | $2,402,625 |

Equity Requirements

Equity requirements are higher for refinancing rentals than most other real estate types. Conventional guidelines require at least 25% equity for a standard rate-and-term refinance, aka a maximum 75% loan-to-value or LTV.

To do a cash-out refinance on an investment property, you will need 25% remaining equity for a single-unit home and 30% remaining equity (70% LTV) for those with two to four units.

Remember, this is the required remaining equity. For a cash-out refinance, that’s how much equity you must have left over after you take out the funds you need.

Plus, make sure to consider closing costs, as they’ll either increase the amount you need to borrow or reduce the amount you can withdraw. Closing costs for a conventional refinance typically run between 2% and 4% of the loan balance.

Investment Property Cash-Out Refinance Examples

Example #1: Single-Family Home

You want to refinance a single-family investment property valued at $225,000. You currently have a mortgage for $100,000 and would like to cash out an additional $50,000. Based on a 25% equity requirement, the largest loan your property could qualify for would be about $168,000. Assuming closing costs of $4,500 (3%), the $154,500 ($150k + $4,500 closing costs) total would be within the lender’s maximum LTV.

| Original Loan | Cash-Out Refinance | |

| Home Value | $225,000 | $225,000 |

| Remaining loan balance | $100,000 | $150,000 |

| Equity | $125,000 (55%) | $75,000 (33.3%) |

| Cash-Out (less closing costs) | N/A | $50,000 |

Example #2: Triplex

You want to refinance a triplex valued at $450,000. Your existing mortgage balance is $250,000, and you’d like to withdraw $75,000 in cash from your equity.

With a 30% equity requirement, the maximum loan amount you could qualify for is:

$450,000 × (1 – 0.30) = $315,000

After paying off your $250,000 mortgage balance, this would leave you with $65,000 in potential cash proceeds.

However, after deducting estimated closing costs of $10,000 (~3%), the actual cash-out amount you could receive is $55,000. So, you could release $20,000 less than the $75,000 you were hoping for.

Example #3: Delayed Financing on a Duplex

You want to refinance a duplex valued at $350,000 and do not currently have a mortgage on the property. You plan to use the funds to purchase another rental and would like to borrow as much as possible. Based on a 30% equity requirement, you could borrow up to $245,000. Assuming closing costs of $7,500 (~3%), you could potentially get cash-in-hand at closing up to $237,500.

More on delayed financing below.

How to Cash-Out Refinance Investment Property

Getting a cash-out refinance involves more than just applying for a loan. Since investment properties come with stricter requirements, understanding the process can help you prepare and increase your chances of approval. Here’s a step-by-step guide:

1. Evaluate Your Equity & Finances

Before applying, determine whether you meet the lender’s minimum requirements for:

- Loan-to-Value (LTV) Ratio: You’ll need at least 25% remaining equity for a single-unit home and 30% for 2-4 unit properties.

- Credit Score: A score of 640+ is typically required, though some lenders may accept 620.

- Debt-to-Income (DTI) Ratio: Must be 45% or lower in most cases.

- Reserve Funds: Expect to show at least six months of housing expenses in cash reserves.

2. Compare Lenders & Rates

Not all lenders offer cash-out refinancing on investment properties, and rates can vary widely. It’s a good idea to:

- Get quotes from at least three lenders.

- Compare interest rates, fees, and terms.

- Ask about debt service coverage ratio (DSCR) loans if you have a short-term rental property.

3. Gather Necessary Documentation

Lenders require extensive documentation, including:

- Proof of property ownership (title, mortgage statements)

- Lease agreements or projected rental income

- Tax returns & W-2s (if using personal income)

- Bank statements showing cash reserves

- Property insurance & HOA documents (if applicable)

4. Apply & Get an Appraisal

Once you apply, the lender will order an appraisal to determine the property’s current value. The appraisal will affect:

- How much equity you can tap

- Your final loan approval

- Your loan-to-value (LTV) ratio

5. Underwriting and Approval

During underwriting, the lender reviews:

- Your credit report and DTI ratio

- Property valuation and rental income

- Your ability to make payments

This stage may take 2-4 weeks, depending on the lender’s workload.

6. Closing and Receiving Funds

Once approved, you’ll:

- Sign final loan documents.

- Pay any closing costs (2%-4% of the loan).

- Receive your cash-out funds, typically within a few days of closing.

What Does a Cash-Out Refinance Cost?

While a cash-out refinance can provide quick access to capital, it’s important to factor in the costs involved. Expect closing costs to range from 2% to 4% of your loan amount. Here’s a breakdown:

| Fee | Estimated Cost |

| Loan Origination Fee | 0.5% – 1% of the loan amount |

| Appraisal Fee | $500 – $1,000 |

| Title Insurance & Fees | $1,000+ |

| Escrow/Recording Fees | $500 – $1,500 |

| Prepaid Interest | Varies |

| Total Closing Costs | 2% – 4% of the loan |

If your goal is to maximize your cash-out amount, lender credits can offset some closing costs. This might result in a slightly higher interest rate, but it could reduce your upfront expenses.

Delayed Financing Cash-Out Refinance

If you recently purchased your investment property with cash – meaning you didn’t use any type of direct financing – you may be able to do a cash-out refi sooner than six months, thanks to the delayed financing rule.

To qualify for a no-wait cash-out refinance, you must have:

- Purchased the property in an arm’s length transaction

- Not used any financing to complete the purchase

- No current loan or lien attached to the title

- Proof of the source of funds that were used for the purchase

It’s possible to use a HELOC or other line of credit on another property or asset and still qualify for delayed financing. In this situation, however, the proceeds would need to pay off these accounts first before you receive cash back.

Long-Term vs Short-Term Rentals

When you refinance a long-term rental, mortgage companies generally request a copy of your signed lease or a declaration of your intended rental amount for vacant properties. You can often use up to 75% of this income to help you qualify for your loan.

However, if you’re trying to do a cash-out refinance on a short-term rental, the process may be a little more complicated. Lenders are often more hesitant to lend on these properties, and most won’t recognize your short-term income unless you have tax returns showing an established and steady income history.

Even still, lenders may only be willing to consider a portion of the income due to the volatility of the short-term rental market.

For a cash-out refinance on a short-term rental, you may want to look into non-conforming DSCR loans. These mortgages are designed for investors, with individual lenders each setting their own guidelines. If your short-term rental is generating healthy income, you’ll likely find that qualifying for a DSCR is much simpler.

Investment Property Cash-Out Refi Rates

Cash-out refinances carry a higher interest rate than the standard rate-and-term refi. Similarly, lenders charge more for investment properties than for primary residences or second homes.

This means that investment property cash-out refinance rates are among the highest-costing conventional loans. You could be looking at a rate that’s 1% to 2% or even higher than a basic primary residence refi.

While it’s always a savvy decision, it’s even more crucial to shop around with different lenders – plan to apply with at least three – to price your investment property refinance.

Still, the costs of a cash-out refi are likely to be lower than tapping your equity with a HELOC or borrowing the funds through an unsecured personal loan.

Pros and Cons: Cash-Out Refinance on an Investment Property

Doing a cash-out refinance on your investment property can be a smart move if you have a practical way to use the funds. But even still, there are some disadvantages to a cash-out refi that you’ll want to consider before taking out a loan.

Pros of a Cash-Out Refinance

- You can use the funds to reinvest in your property, increasing its value and upping the amount you can collect in rent.

- Having access to cash allows you to purchase other investments that may not allow for financing due to property conditions or the need to close quickly.

- Other sources of funding, such as personal loans or lines of credit, generally have higher interest costs.

- If your existing mortgage has an above-market rate, it may be possible to cash out equity and reduce your interest costs simultaneously. In some scenarios, this could mean taking out cash and ending up with a lower monthly payment.

Cons of a Cash-Out Refinance

- Increasing your loan balance will increase your monthly payments. This could up the risk of default if you run into issues with cash flow.

- Cash-out refis – especially on investment properties – have some of the highest conventional interest rates.

- Refinances come with closing costs. With a conventional cash-out refi, you can expect to spend between 2% and 4% of your loan amount.

- Reducing your equity now prevents you from using it in the future if the need arises.

Alternatives to a Cash-Out Refinance

A cash-out refinance is an effective way to tap your investment property’s built-up equity. However, other options may be a better fit in some scenarios.

HELOCs and Home Equity Loans

Home equity loans and home equity lines of credit (HELOCs) are subordinate loans that let you borrow against your property’s equity without having to refinance your existing mortgage. This can be ideal for anyone who only needs to access a little bit of cash or is currently locked into a low interest rate.

With a home equity loan, you receive a one-time lump sum with a fixed repayment schedule, much like a cash-out refinance.

HELOCs provide you with an adjustable-rate open line of credit that you can borrow against, repay, and use again as often as you’d like over the loan’s initial phase, typically lasting from five to ten years. Some lenders now offer fixed-rate HELOCs.

While HELOCs and home equity loans are common for borrowers taking equity out of their primary residences, it’s a bit trickier to use home equity for investment properties. Fewer lenders offer these types of mortgages, and those who do will likely have stringent criteria.

Personal Loans

Personal loans are a type of unsecured financing generally issued by banks, credit unions, and private lenders. Eligibility is based on the borrower’s creditworthiness, and loans are not backed by any property or other asset.

Since they are unsecured, personal loans generally have higher interest costs than mortgages – even investment property cash-out refis – although well-qualified borrowers may find the rates quite reasonable. Regardless, the costs will be lower than those of other types of unsecured loans, such as credit cards.

Keep in mind that you may not qualify to borrow as much with a personal loan as you would with a cash-out refinance and that the payment schedule will be shorter. Most personal loans have a term of seven years or fewer.

Build Up the Cash Without Borrowing

Borrowing against your investment’s equity has costs: first and foremost, the interest you’ll pay on the additional balance. Paying more each month also reduces your cash flow, which means less wiggle room in a crunch.

Plus, loans have closing costs. If you only plan to borrow a small amount, these fees can represent a significant portion of your equity withdrawal.

Instead, it may be more practical to build up the cash you need over time without borrowing. While it will take longer, you won’t be adding to your debt level and will likely save yourself thousands of dollars or more in interest and closing costs.

Is Now a Good Time for a Cash-Out Refinance?

A cash-out refinance can be a great tool, but timing matters. Consider these factors before moving forward:

1. Interest Rates

- If rates are low, refinancing may reduce your payments while providing extra cash.

- If rates are high, consider alternatives like HELOCs or personal loans.

How we source rates and rate trends

Rates based on market averages as of Dec 02, 2025.Product Rate APR 30-year Fixed Refinance 6.35% 6.37%

2. Property Value Trends

- If your property has appreciated, you can access more equity.

- If values are declining, you might not qualify for as much cash.

3. Rental Market Strength

- A strong rental market means higher rent potential, making it easier to cover increased loan payments.

- If demand is dropping, refinancing could strain cash flow.

Rule of Thumb: If your new loan payment exceeds 70% of your rental income, you may want to reconsider refinancing.

How a Cash-Out Refi Affects Your Taxes

The cash you receive in a cash-out refinance does not count as taxable income since you’re borrowing against equity, not earning money. However, how you use the funds can impact tax deductions:

- If used for property improvements: Interest on the new loan may be fully deductible.

- If used for personal expenses (e.g., paying off credit cards): Interest may not be deductible.

- If used to purchase another rental property: You may be able to deduct the interest as a business expense.

Mortgage interest on investment properties is generally deductible.

Tip: Always consult a tax professional to determine how your cash-out refinance affects your deductions and capital gains tax.

Finding the Best Cash-Out Refinance For Your Investment Property

If you have enough built-up equity and meet the other conventional lending requirements, you can likely convert that investment property equity into a lump sum with a cash-out refinance.

Ready to unlock your property’s equity and put it to work for your investment goals? Apply for a cash-out refinance with Refi.com today and discover how much you could access to grow your portfolio or improve your property.