Cash-Out Refinance vs. HELOC: What’s the better option?

That home equity you’ve accrued can be a powerful asset that comes in handy when you need extra cash. Fortunately, you can tap into it in multiple ways, including a cash-out refinance or a home equity line of credit (HELOC). Each option has its pros and cons.

Read on to learn more about a cash-out refinance vs. HELOC, including:

- How they work

- Their eligibility requirements

- Interest rates

- Monthly payments

- Closing costs

- When and how you’ll access the funds

The least you need to know:

- A cash-out refinance loan lets you take out a new mortgage that exceeds the amount you currently owe, giving you the difference in cash.

- A home equity line of credit (HELOC) is a second mortgage that lets you borrow against your home’s equity up to a certain limit, with the option to withdraw and repay funds as needed.

- Cash-out refinances are often better for bigger financial needs or for those who want to adjust their mortgage terms. HELOCs are often better for smaller, variable, or ongoing needs.

A Quick Refresher on Equity

Home equity is the difference between your home’s market value and the balance of your outstanding mortgage. It’s essentially the amount of your property’s worth that you own outright and could pocket today if you sold your home. You earn equity through:

- The down payment you made

- The principal portion of your monthly mortgage payments

- Home appreciation over time (if your home appreciates)

For example, if you own a $500,000 home but still owe $200,000 on your mortgage loan, your equity portion would be $300,000, meaning you’ve accrued 60% equity in the property.

There are plenty of good reasons for liquidating home equity. The most common uses for home equity include:

- Funding home improvement projects

- Consolidating debt

- Investing in a business

- Paying for major life expenses like a college education

- Making another large purchase like a second home

There are a few ways you can tap into your home equity: a home equity loan, a home equity line of credit (HELOC), or a cash-out mortgage refinance loan. The latter two are the most popular options among many homeowners.

What Is a Cash-Out Refinance?

A cash-out refinance is like getting a new mortgage but with a twist: You refinance and replace your existing mortgage loan for more than what you currently owe and take the difference out at closing as cash. You’ll use your home as collateral for the loan, which means you risk losing your property to foreclosure if you don’t repay your debt as agreed upon.

If you have a high LTV and your home declines in value, you also risk having negative equity, which is known as being underwater on your mortgage.

A cash-out refinance can be a great option if you’ve built up significant equity and need a large lump sum of money for something like a major renovation, debt consolidation, or big purchase.

Good candidates for pursuing a cash-out refinance include homeowners who have accrued at least 20% equity, those who want to consolidate high-interest debt, finance home improvements, or cover large expenses, and borrowers who can secure a lower interest rate on the new mortgage compared to their current rate.

Example

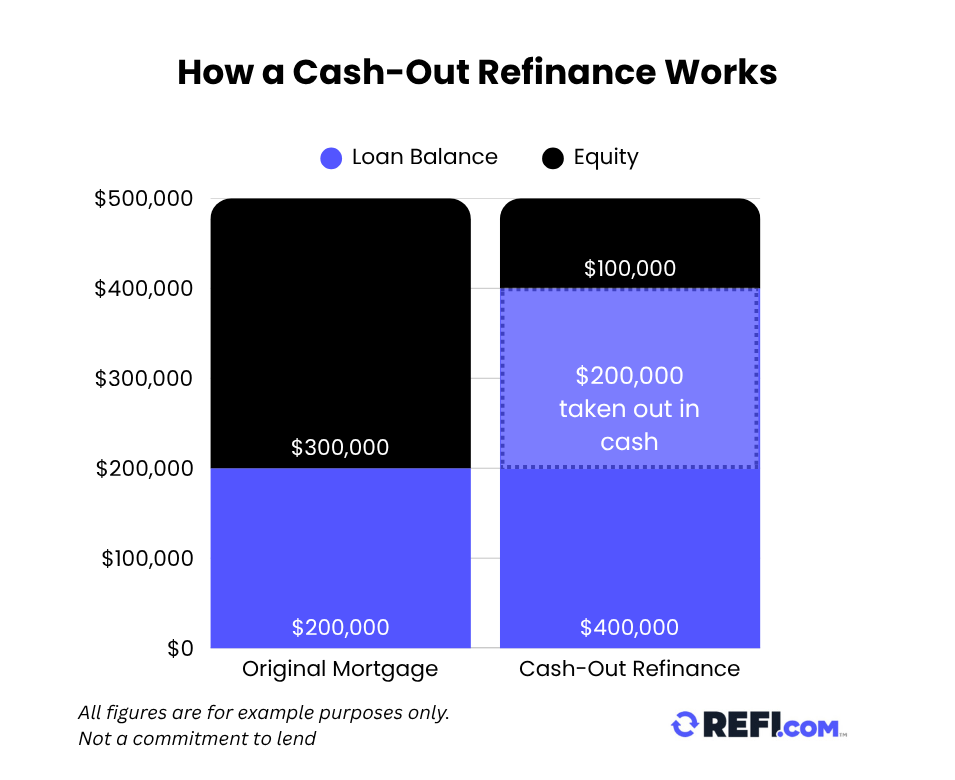

Let’s stick with the $500,000 home example from earlier:

- $500,000 home value

- $200,000 mortgage balance

- $300,000 equity

This homeowner may be able to use a cash-out refinance to do the following:

- Replace their $200,000 mortgage with a $400,000 mortgage

- Take out the $200,000 difference in cash

- This leaves them with $100,000 in equity (20%)

Now, they have a higher mortgage balance to pay off over time. But, they’ve also pocketed $200,000 (less closing costs) of their equity to use however they want.

What Is a HELOC?

A HELOC, on the other hand, works more like a credit card than a loan. It’s a revolving line of credit secured by the home equity you have in your home.

With a HELOC, you can borrow as needed at a time of your choosing, up to a pre-approved limit, during what’s called a ‘draw period’–which is typically the first 3 to 10 years. During the draw period, you make interest-only payments on whatever you borrow.

Then, when the draw period ends, the repayment period begins, often lasting 10 to 20 years. During the repayment period, you can no longer borrow funds and must repay both the principal and interest, resulting in typically higher monthly payments.

Worthy prospects for a HELOC include homeowners who desire flexible, ongoing access to funds for goals like home improvements, education, or emergency expenses, as well as those who prefer a line of credit they can draw from as needed rather than a lump sum.

How They’re Similar

Cash-out refinances and HELOCs are similar in that they:

- Allow you to leverage your home equity as cash for any purpose. It’s generally advisable to use it for things that improve your financial standing, such as home improvements, education, or consolidating high-interest debt.

- Both typically allow you to borrow up to 80–90% of your home’s value, depending on loan type and lender guidelines.

How They Differ

Here’s how they differ:

| Cash-out refinance | HELOC |

| Interest rates are often lower than HELOCs | Often higher interest rates than cash-outs, but lower than credit cards |

| Interest rates can be fixed or variable | Interest rates are usually variable |

| Higher closing costs than HELOCs | Lower and sometimes no closing costs |

| A new mortgage | A second mortgage on top of your existing one |

| Receive the funds all at once | Withdraw from the HELOC as needed over time |

Cash-out refinances and HELOCs also have some similarities and differences in their requirements. Let’s take a look at those next.

Cash-Out Refinance & HELOC Requirements

Cash-out refinances and HELOCs can have similar requirements, though these will vary by lender. Even in cases where government-backed programs have minimum/maximum requirements, lenders often impose their own, stricter requirements.

Lenders will oftentimes take compensating factors into consideration as well.

Despite the possible variance, here’s what you may expect regarding eligibility:

Credit Score Requirements

For a cash-out refinance, aim to have a minimum credit score of 660, although a score of 700 or higher could secure better terms and some lenders may go as low as 620, which is the minimum required by Fannie Mae and Freddie Mac. Here’s a breakdown of the minimum credit score typically needed by loan type:

- Conventional cash-out refi: 620 (note: Refi.com requires a minimum 660 FICO credit score for a conventional cash-out refinance)

- FHA cash-out refi: 500-620 (note: Refi.com requires a minimum 620 FICO credit score for an FHA cash-out)

- VA cash-out refi: The VA does not set a minimum credit score, but 620 is a common requirement.

HELOCs have very similar credit score requirements, with lenders often requiring between 620 and 700.

Debt-to-income ratio

Your debt-to-income (DTI) ratio measures your ability to manage debt, expressed as a percentage of your gross monthly income. Most lenders look at your back-end DTI ratio, which accounts for all debts (as opposed to your front-end DTI, which only considers housing expenses).

For instance, with a $5,000 monthly income, if $1,200 goes to housing, and with $600 in other debts, the back-end DTI is 36% ($1,800 / $5,000 = 36%). Lenders use this ratio to determine how much additional debt a borrower can handle, with lower ratios often resulting in better loan terms.

Many cash-out refinance lenders prefer a DTI ratio of 50% or lower.

Here are common DTI requirements based on loan type:

- Conventional cash-out refi: 36% to 43%

- FHA cash-out refi: Up to 50%

- VA cash-out refi: While the VA doesn’t cap DTI, most lenders prefer it at or below 50%, unless the borrower meets residual income guidelines and other compensating factors.

Note: lender-specific guidelines may impose stricter DTI limits. Compensating factors can also impact approval, sometimes allowing for higher DTI ratios.

HELOCs require a similar range in DTI, with many lenders requiring a maximum of 43%, though some may go as high as 50%. This can vary widely and lenders may consider additional compensating factors.

Loan-to-value ratio

In a cash-out refinance, your loan-to-value (LTV) ratio determines how much of your home’s appraised value you can borrow; typically up to 80%. For example, if your home is valued at $300,000 and you owe $150,000 on your mortgage, you could borrow up to $240,000, using the remaining amount as cash after paying off the existing mortgage. That’s a maximum of $90,000 cash out.

Here are the maximum LTVs allowed for a cash-out refinance based on loan type:

- Conventional cash-out refi: Up to 80% of the home’s appraised value

- FHA cash-out refi: Up to 80% of the home’s appraised value

- VA cash-out refi: Up to 100% of the home’s appraised value, though many lenders cap it at 90%

Note: lender-specific guidelines may impose stricter LTV limits.

For HELOCs, most lenders want you to keep your LTV at 85% or lower, meaning you should have at least 15% equity built up in your home.

However, some lenders require an LTV of no more than 80%.

Interest rate and monthly payments

With a cash-out refinance loan, you can opt for either a fixed interest rate or an adjustable rate. Rates can vary widely from lender to lender and based on loan type; you could be charged a higher rate for a conventional versus an FHA, VA, or USDA loan, for instance.

Let’s say you currently own a home worth $400,000 and have a remaining loan balance of $250,000. If you refinance to a new 30-year cash-out refi loan at a fixed rate of 6.55%, and take $50,000 out at closing, your new monthly principal and interest payments would be around $1,906.

HELOCs typically have variable interest rates which adjust periodically as detailed in your HELOC agreement. However, some lenders offer fixed-rate ones. Typical adjustment periods are monthly, quarterly, or annually.

So, cash-out refinances can offer more predictable costs over time with a fixed rate, while HELOCs may initially offer lower rates, but those can adjust higher.

Closing Costs

Regardless of whether you opt for a conventional, FHA, or VA cash-out refinance loan, you will be charged closing costs. These typically equate to 2 to 5% of your total loan amount. Common closing costs include:

- Loan origination fee: generally ranges from 0.5% to 1% of the loan amount

- Title search and title insurance: usually costs between $500 and $1,000

- Appraisal fee: typically between $300 and $600

- Escrow fees: often ranging from $200 to $500, depending on location

- Credit report fee: usually $30 to $50

- Recording fees: generally between $50 and $150.

You could also be charged additional fees depending on the loan type, including:

- FHA cash-out refi: Upfront mortgage insurance premium (UFMIP) of 1.75% of your loan amount

- VA cash-out refi: Funding fee of 1.4% to 3.6% of the loan amount, depending on your service status and whether it’s a first or subsequent use of VA benefits.

HELOC closing costs may average 2% to 5% of your credit line/borrowed amount. However, some lenders charge minimal to no closing costs. HELOCs can also come with ongoing costs, such as annual fees, transaction fees, and early closure fees.

How you access your money

With a cash-out refinance loan, you receive your tapped equity right away in a lump sum. After closing, the cash-out portion is typically disbursed via wire transfer or check and can usually be accessed three to five days after the closing.

With a HELOC, your funds can be accessed during the HELOC’s draw period, which is typically 10 years, but can range from 3 – 15 years. To do so, you can use online transfers, checks, or a credit card provided by the lender.

Tax implications

Interest on both cash-out refinances and HELOCs is typically only tax-deductible if used to buy, build, or substantially improve your primary or second home, in accordance with IRS rules.

Additionally, the money you receive is not taxable since it’s a loan – not income.

What’s the best option for you?

Not sure which one fits your needs? Ask yourself:

- Can you accept a variable interest rate?

- Do you need all the money now, or over time?

- Are you comfortable replacing your mortgage?

Based on those questions, here’s a quick look:

| Cash-out refinance | HELOC |

| Best for bigger needs | Best for smaller, long-term, or variable needs |

| Best for those who are able to lower their mortgage interest rate or need to adjust their terms | Best for those who don’t want to adjust their current mortgage terms |

| Best for consolidating debt |

“For smaller or temporary needs, a HELOC is often best,” advises Lauryn Grayes, founder of Wealth Gems Financial Solutions. “For bigger needs at a good rate, a cash-out refinance loan can save you more money in the long term. But be careful to only tap your equity judiciously, as it reduces ownership stake and is risky if home values fall.

Consider your needs, timeline, credit rating, and amount of home equity accrued to choose the right option.”

A cash-out refi may be best for those looking to lower their mortgage interest rate while also accessing a large lump sum. It’s ideal when you can get a good interest rate on your new mortgage and need funds for a specific, large expense.

How we source rates and rate trends

Rates based on market averages as of Dec 02, 2025.Product Rate APR 15-year Fixed Refinance 5.37% 5.42% 30-year Fixed Refinance 6.35% 6.37%

For example, those who bought a home in 2020 or 2021 during the historically low interest rates may be hesitant to do a cash-out refinance now, at the time of writing, with interest rates in the high 6s or low 7s. This could put considerable strain on their budget.

A HELOC, meanwhile, is best for homeowners who need flexible access to funds over time – like ongoing home renovations. It’s also beneficial if you don’t want to change your lower existing mortgage rate or reset your term, which can add extra years to your mortgage repayment schedule.

If you are seeking to consolidate debt, a cash-out refi is likely the better choice.

For example, imagine you have $50,000 in high-interest credit card debt and a mortgage with a 7% interest rate. If you could refinance your mortgage to 6% and pay off your high-interest debt, you could put yourself in a considerably better position, financially.

Even taking a higher mortgage rate with a cash-out refinance can be a beneficial move if it means clearing up high monthly debt payments.

To help you make a more informed choice and avoid borrower regret, consult with a trusted financial advisor and/or experienced lending professional who can help you weigh the pros and cons based on your particular financial situation and objectives.

Ready to get started on a cash-out refinance? You can do so with Refi.com here.

More Reading

Good and Bad Reasons for Tapping Home Equity

Refi, HELOC or Home Equity Loan? How to Tap Your Equity