Cash-Out Refinance vs. Home Equity Loan: Which Is Best for You?

- Cash-out refinances replace your existing mortgage with a brand-new loan, which can change your interest rate, loan term, and monthly payments.

- Home equity loans are second mortgages that exist alongside your existing loan, meaning you’ll be responsible for two separate monthly payments.

- Homeowners needing to borrow a considerable chunk of equity may be better off with a cash-out refi, while those currently locked into an ultra-low interest rate may prefer a home equity loan.

The built-up equity in your home can be a practical source of funding for everything from renovations and improvements to debt consolidation. Choosing the most effective way to tap into this equity, however, depends on a variety of factors.

Most often, homeowners seeking to access their equity as a lump sum of cash end up choosing between a cash-out refinance and a home equity loan. We’ll take a thorough look at both options and discuss the scenarios where each type of mortgage tends to be a better fit.

Understanding the Basics

Before we compare cash-out refinances vs home equity loans, and the scenarios for which they’re best suited, let’s review how each of these mortgage options works.

Cash-Out Refinances

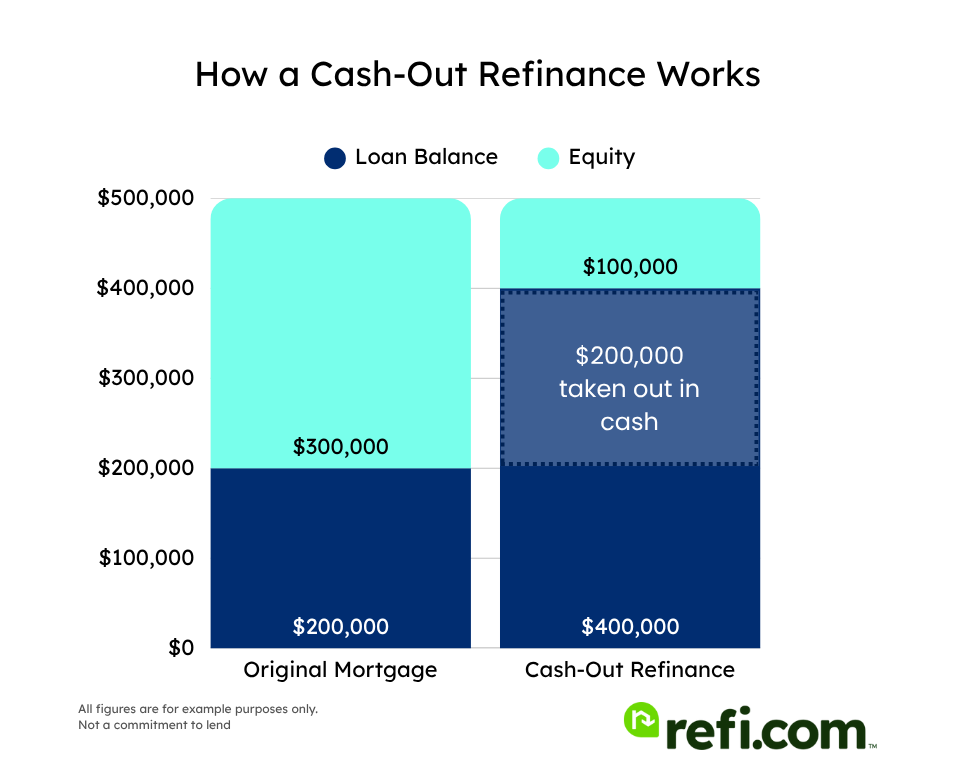

A cash-out refinance is a new loan that replaces your existing primary mortgage. With a cash-out refi, you’re taking out a loan that’s larger than what you currently have, with a portion of the funds going to pay off your existing mortgage and the remainder returned to you as a lump sum of cash a few days after closing.

Since it’s an entirely different mortgage, you will have a:

- New rate

- New repayment term

- New monthly payment

You’ll also be responsible for paying closing costs on your refinance, typically ranging from 2% to 6% of the loan amount, depending on the lender and cash-out refinance program you choose.

Interest rates on cash-out refinances tend to be higher than standard rate-and-term refinances, as the increased loan balance and reduced equity in your property represent a higher level of risk to the lender.

| Pros | Cons |

| Lower interest rates | May be more costly if you currently have a low interest rate |

| One single monthly payment | Typically provides access to less of your equity |

| Generally easier to qualify for | Higher overall closing costs |

Home Equity Loans

A home equity loan functions separately from your primary mortgage. Instead of replacing it, as a cash-out refinance does, the home equity loan sits in the second lien position. This means that your existing home loan remains intact – your current terms won’t change – but you will be responsible for making two different monthly payments.

The process for obtaining a home equity loan is similar to a standard mortgage, and the funds from the equity you’re tapping into will be disbursed as a lump sum shortly after closing.

In most cases, home equity loans have a fixed interest rate and consistent, fully amortized, monthly payments. Because they function as a second mortgage, however, they generally have higher interest rates than first-position loans, such as a cash-out refinance.

Closing costs can vary depending on the lender you choose, but typically also run between 2% and 6% of the amount borrowed.

| Pros | Cons |

| Typically provides access to more of your equity | Higher interest rates |

| Lower overall closing costs | More stringent qualification requirements |

| Does not affect your current mortgage | Two separate monthly payments |

Side-by-Side Loan Comparison

| Features | Cash-Out Refinance | Home Equity Loan |

| Mortgage Effect | Replaces current loan | Adds a second mortgage |

| Interest Rates | Lower | Higher |

| Closing Costs | Higher | Lower |

| Credit Requirements | Often 620+ | Often 640-680+ |

| # of Monthly Payments | One | Two |

| Most Useful For | When you want to adjust the terms of your current loan or need to access a large amount of equity | When you’re currently locked into a highly favorable rate on your current loan, or only need to tap a small amount of equity |

How Much Can You Get With Each Option?

The amount that you’re able to borrow can vary based on several factors, including:

- Your home’s value

- Your built-up equity

- Your individual financial situation

- The lender and the loan you choose

Most of the time, however, a home equity loan will provide you with access to a greater amount of money. That’s because a cash-out refinance is typically limited to a maximum of 80% of your home’s value. Home equity loans, however, commonly go up to 85% – inclusive of your primary mortgage – and in some cases even higher.

For Example: Say that your home is valued at $400,000 and you currently owe $200,000 on your existing mortgage. With an 80% loan-to-value cash-out refinance, you would be eligible for a maximum loan of $320,000, providing you with access to up to $120,000 of equity that you’re able to tap into.

With an 85% combined loan-to-value home equity loan, you could finance up to $340,000. Deducting the existing $200,000 mortgage balance, you would have access to as much as $140,000 of your home’s equity.

If you were working with a lender offering a 90% combined loan-to-value home equity loan, you could potentially get up to $160,000 as a lump sum of cash.

What About the Payments?

Let’s use this sample scenario to see how each option – and the amount you borrow – could affect your monthly mortgage payments.

For these calculations, we’ll assume that you qualify for a 30-year cash-out refinance at a rate of 7% and a 20-year home equity loan at a rate of 8.25%.

| 30-Year Cash-Out Refinance | 20-Year Home Equity Loan | |

| Max LTV (CLTV) | 80% | 85% |

| Loan Amount | $320,000 | $140,000 |

| Interest Rate | 7.00% | 8.25% |

| Monthly Payment | $2,129 | $1,193 |

| Lifetime Interest | $446,428 | $146,294 |

Note: Rates, terms, and monthly payment amount are for illustrative purposes. All loans are subject to credit and underwriting approval.

Keep in mind that with the home equity loan, you would still be responsible for making your current monthly mortgage payments, while the cash-out refinance would roll everything into a single all-inclusive payment.

In this scenario, if you were currently paying less than $936 on your primary mortgage – which may be possible for some homeowners with an ultra-low interest rate – the home equity loan would be the cheaper option from a monthly expense perspective. Otherwise, you’d see lower monthly housing costs by going with a cash-out refinance.

This, however, does not take into account other factors, such as the repayment period or overall interest costs, which should be an essential part of any mortgage decision.

Their Biggest Similarities

Both cash-out refinances and home equity loans share several similarities that can make each an ideal option for homeowners looking to cash out some of their built-up equity in various situations.

- They both use your home as collateral. Even though a home equity loan sits in the second position, defaulting on either mortgage can put your property at risk of foreclosure.

- They both provide access to a lump sum of cash. These funds are typically released to you around three days after closing, as federal law allows homeowners a three-day “right of rescission” to cancel the transaction.

- They both come with closing costs. In most cases, these will run between 2% and 6% of the total amount borrowed.

- They both require you to leave some equity in your home. Depending on the lender and type of loan you choose, you’ll typically be able to borrow up to 80% to 85% of your home’s current value.

Their Biggest Differences

Despite their similarities, it’s the differences between cash-out refinances and home equity loans that make them each suited for different types of borrowing needs. Let’s examine some of the key differences in a bit more detail.

New Mortgage vs. Second Mortgage

A cash-out refinance is an entirely new mortgage that replaces the home loan you presently have. This entails taking on a new interest rate, a different monthly payment, and likely resetting the term of your mortgage.

A home equity loan is a second mortgage that does not replace your existing loan. You’ll continue to make payments on your primary mortgage while taking on a second, completely separate loan that you’ll also be responsible for.

Closing Costs

While both cash-out refinances and home equity loans have closing costs that tend to range between 2% and 6% of the loan amount, the true costs are usually far different.

That’s because with a cash-out refinance, you’re also paying closing costs on the amount used to satisfy your current mortgage. With a home equity loan, you’re only paying closing costs on the equity you’re borrowing, so actual costs tend to be much less.

For Example: Using a scenario of a $200,000 existing loan and tapping into $100,000 of equity, you’d pay closing costs on the full $300,000 with a cash-out refinance – $6,000 to $18,000 under the 2% to 6% assumption. With a home equity loan, you’d only pay those costs on the $100,000, equating to just $2,000 to $6,000.

Repayment Term

There’s a lot of flexibility when it comes to choosing a repayment term – the length of time you’ll spend paying back the loan – with both a cash-out refinance and a home equity loan. However, that being said, home equity loans tend to be offered with shorter terms than a full refinance.

Most commonly, you’ll find lenders advertising home equity loans with terms of 15 or 20 years, although it is possible to find these mortgages with a repayment period as short as five years or as long as 30 years.

Cash-out refinances, on the other hand, are typically issued with a term of 30 years, although 15-year terms are also regularly available. In some cases, you may find them with a repayment term as short as 10 years.

Keep in mind, though, that some lenders may offer both types of loans with a customized repayment schedule designed around your needs and financial goals.

Interest Rates

Since a cash-out refinance is a first-position loan, it typically has lower interest rates than a home equity loan, which sits in the second position. That’s because, in the event of foreclosure, the first mortgage holder will be able to recoup their losses before the second mortgage holder. This equates to more risk for lenders in the second spot, leading to higher rates to compensate.

In the current interest rate environment, you can expect to be quoted a rate around 1.25% to 1.50% higher for a home equity loan than you would receive with a cash-out refinance. Keep in mind, though, that this higher rate will be for a smaller balance and may be more practical if you’re currently locked into a below-market rate on your existing mortgage.

When to Choose Each Option

Now that we’ve reviewed each type of equity-accessing loan and their similarities and differences, let’s delve into the specifics of which types of scenarios both cash-out refinances and home equity loans are best suited for.

Note: Keep in mind that we’re discussing these situations in a broad, general sense – everyone’s financial situation is unique, and there may be cases where you could still be better off with the other type of mortgage. Be sure to speak with a lending professional for an individualized comparison customized to your unique borrowing needs.

Choose a Cash-Out Refinance When…

In most cases, it makes more sense to choose a cash-out refinance when:

- Current Mortgage Rates Are Lower Than Your Existing Loan: Homeowners who took out their mortgage or last refinanced after late 2022 may be able to obtain an interest rate lower than they currently have, as rates have decreased since peaking in the fall of 2023.

- You Want a Single Monthly Payment or a Longer Loan Term: Since a cash-out refinance replaces your existing loan, you’ll only be responsible for making one monthly payment. Plus, while some lenders may offer 25 or 30-year home equity loans, this longer term is far more common with cash-out refinances.

- Your Tapping Into a Significant Amount of Equity: As cash-out refinances have interest rates that are noticeably lower than home equity loans, borrowers needing to tap into a significant amount of money may save over the long run – especially if they have a relatively small current mortgage.

Choose a Home Equity Loan When…

In most cases, it makes more sense to choose a home equity loan when:

- Your Existing Mortgage Has a Highly Favorable Rate: Homeowners who took out their mortgage or last refinanced prior to interest rates spiking in 2022 are likely locked in to a rate far lower than what’s currently available.

- You Only Need to Borrow a Small to Moderate Amount: Despite the higher interest rates, a home equity loan can make sense when you only need to access a small to moderate amount of built-up equity, as you’ll only be paying the higher rate – and closing costs – on this balance.

- You Don’t Want to Reset the Clock on Your Primary Mortgage: Although some lenders may offer customized repayment terms, a cash-out refinance would typically require you to reset the clock on your primary mortgage back to a term of 15 to 30 years.

Alternatives to Consider

While cash-out refinances and home equity loans are two of the most popular ways to access the equity in your home and meet your funding needs, they may not be your only options. Let’s quickly touch on a few other alternatives that may also be worth considering.

HELOC

A HELOC is a type of second mortgage that provides you with a revolving line of credit – much like a credit card – that’s tied to your built-up equity. These unique loans have two phases: a draw period and a repayment period, both of which can last up to 15 years.

HELOCs may make sense for homeowners who need funds over time rather than a lump sum of cash upfront, or who are unsure of the exact amount they need to borrow.

Personal Loan

Personal loans are a type of unsecured debt that is not tied to your home, but is instead based on your overall creditworthiness. Since they aren’t secured by real property, personal loans tend to have higher interest rates and shorter repayment periods than cash-out refinances and home equity loans.

You might want to consider a personal loan if you only need to borrow a small amount or are concerned about the possibility of default putting your home at risk.

Shared Appreciation Mortgage

A shared appreciation mortgage is a niche home loan that provides you with a lump sum at a low interest rate in exchange for promising the lender a portion of your home’s increased value upon repayment of the loan.

For example, if your agreement stipulates the lender receives 20% of the appreciation and your home increases in value by $100,000 between taking out and repaying the loan, they would receive $20,000 at the end of the lending period.

Shared appreciation mortgages might make sense for homeowners who need the lowest possible monthly payments or who do not expect their home’s value to increase significantly in the near or mid-term future.

Ready to Get Started?

For homeowners seeking to refinance their existing loan or access a substantial amount of equity, a cash-out refinance is often the preferred option. However, those who are currently locked into a below-market interest rate and only need to tap into a moderate amount of equity may be better off with a home equity loan instead.

If you’re ready to discover how each option could fit in with your individual funding needs, apply and get started with Refi.com today.