Debt Consolidation with a Mortgage Refinance: Is It a Good Idea?

- A cash-out refinance lets you turn your home equity into cash.

- You can then use that cash for any purpose, including paying off debts.

- Consolidating your debt with a cash-out refinance could be a good idea if you can get a lower interest rate and stay in the home long enough to break even on your refinancing costs.

- It might not be wise if you won’t be in the home long or you’d have to trade in a low rate on your current mortgage for a higher one.

Are you feeling overwhelmed by high-interest debt? You’re not alone. The average household carries a credit card balance of $7,226, according to the Federal Reserve Bank of St. Louis. And, with interest rates on credit cards averaging around 29%, according to Forbes Advisor, paying off that debt can feel like an uphill battle.

For homeowners, a potential solution is a cash-out refinance, which allows you to tap into home equity and convert it into cash. This type of refinance allows you to replace your existing mortgage with a larger loan and take out the difference in cash. If used wisely, this strategy can help consolidate high-interest debts into a single, lower-interest payment—potentially saving you thousands in interest.

But is it always the right move? Let’s explore the pros, cons, and key considerations before deciding whether refinancing for debt consolidation makes sense for you.

How a Cash-Out Refinance Works

A cash-out refinance is a new mortgage loan with a higher balance.

The new loan pays off the old one, and you get the difference back in cash. You can then use those funds to pay off your other debts.

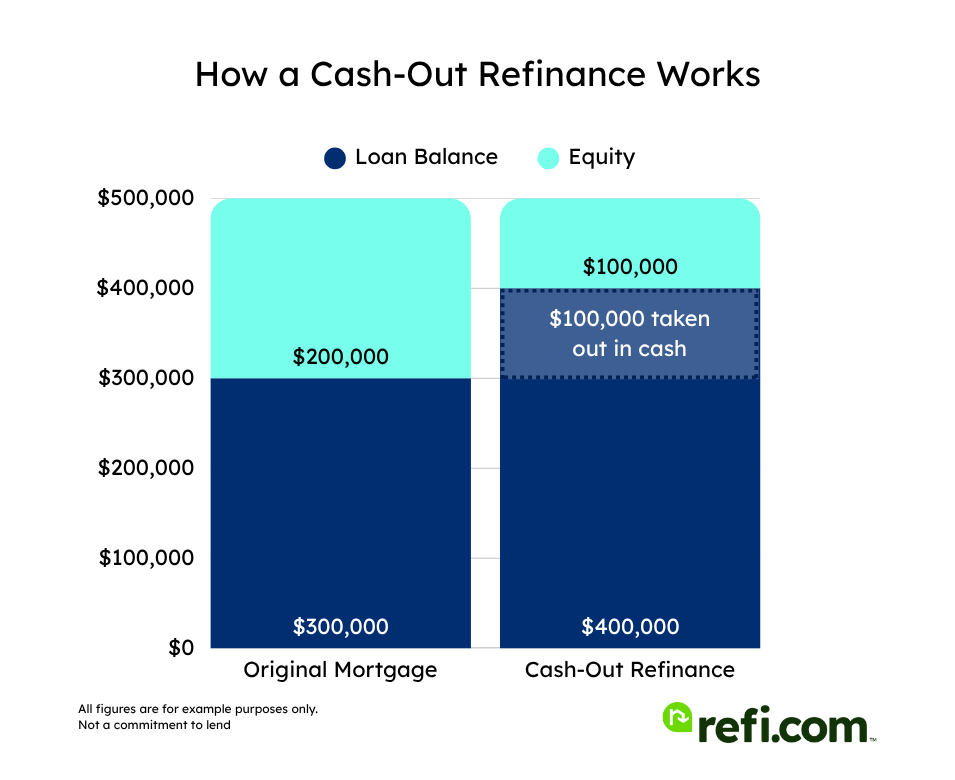

Here’s a visualization of how a cash-out refinance works:

In this scenario, the homeowner has $200,000 in equity on a $400,000 home. They do a cash-out refinance, replacing their $200,000 balance with a $300,000 one, pocketing $100,000 to do whatever they want – including paying off high-interest debt.

| Original Loan | After Cash-Out Refinance | |

| Home Value | $400,000 | $400,000 |

| Equity | $200,000 | $100,000 |

| Remaining Balance | $200,000 | $300,000 |

| Cash-Out | N/A | $100,000 |

Keep in mind refinancing fully replaces your existing mortgage loan, which means you’ll have a new rate, new terms, and a new payment. For this reason, using a cash-out refinance toward your debts isn’t always the right move. In fact, for some borrowers, it may actually cost you more in lifetime interest costs in the long run.

Because refinancing fully replaces your current mortgage, lenders will evaluate your financial profile, home equity, and creditworthiness before approving the loan. Understanding these qualification requirements can help determine whether this strategy is an option for you.

How to Qualify for a Cash-Out Refinance

Cash-out refinances are generally more difficult to qualify for than traditional refinances because there’s more money on the line.

Equity Requirements

Equity — or the difference between your home’s value and your mortgage balance — is one of the biggest considerations. That’s because equity is what you’re borrowing against and acts as the collateral for the loan.

Most lenders and loan programs want you to have at least 15 to 20% equity in your home left over after the cash-out refinance to qualify. The more you have, the easier it will be to qualify and the more you’ll likely be able to borrow. Higher equity may also help get a lower interest rate, as it means there’s less risk for the lender.

Financial Profile Requirements

While the exact qualifications vary by loan program and lender, you can typically expect to need a decent credit score (think 620 or higher) and a low debt-to-income ratio (DTI) once your new loan is factored in. A DTI of 43% is typically preferred, though some lenders may allow for higher ones.

Eligibility requirements vary by the type of cash-out refinance you’re looking for.

Types of Cash-Out Refinances

There are three primary types of cash-out refinances—conventional, VA, and FHA—each with unique eligibility requirements and loan terms.

1. Conventional Cash-Out Refinance

A conventional cash-out refinance is available to most borrowers who meet lender qualifications. It typically requires:

- Minimum credit score: While conventional loan programs set minimums at 620, most lenders, including Refi.com, require 660 or higher for cash-out refinances.

- Maximum loan-to-value (LTV): 80% (meaning you must leave at least 20% equity in your home after the refinance)

Conventional loans are widely available and ideal for borrowers with strong credit and equity in their home.

2. VA Cash-Out Refinance (For Eligible Veterans & Service Members)

A VA cash-out refinance is backed by the Department of Veterans Affairs (VA) and is available only to eligible veterans, active-duty service members, and qualifying spouses. Unique benefits include:

- 100% LTV allowed (you can refinance up to 100% of your home’s value)

- No private mortgage insurance (PMI)

- More flexible credit and income requirements

Because of the no-equity requirement, a VA cash-out refinance can be a powerful tool for veterans looking to access their home equity. Loan approval criteria will vary by lender, though, with many lenders requiring at least 10% equity left in the home.

3. FHA Cash-Out Refinance

An FHA cash-out refinance is backed by the Federal Housing Administration (FHA) and is often used by borrowers with lower credit scores or less home equity. Key requirements:

- Minimum credit score: FHA guidelines allow for cash-out refinances with credit scores as low as 500, although most lenders, including Refi.com, require 620 or higher.

- Maximum loan-to-value (LTV): 80% (like conventional loans)

- Mortgage insurance required (both upfront and monthly)

FHA cash-out refinances are a good option for borrowers with lower credit scores, but the required mortgage insurance premiums (MIP) can make them more expensive over time.

Changing Your Interest Rate and Other Terms

One very important thing to consider before using a cash-out refinance to consolidate debt is the interest rate you’d have. For one, you need to compare this new rate to the rate on your current mortgage. If you’d swap a low rate for a much higher one, it might not make financial sense to refinance.

You also need to consider how the new rate compares to the rates on the debts you’d pay off. Generally, mortgage rates — even cash-out refinance rates — are lower than rates on most credit cards and other loan products. (Credit cards, for instance, currently have average rates of nearly 29%!) But if the rate you’d get on a refinance is the same or higher than those debts, it may not be a wise choice either.

| Product | Rate | APR |

|---|---|---|

| 15-year Fixed Refinance | 5.37% | 5.42% |

| 20-year Fixed Refinance | 6.05% | 6.08% |

| 30-year Fixed Refinance | 6.35% | 6.37% |

How we source rates and rate trends

Refinancing Costs

Don’t forget that refinancing comes at a cost. Just like with your first mortgage, you’ll pay closing costs to refinance your loan, which usually amount to 3 – 6% of your new mortgage principal, according to Freddie Mac. If you don’t save at least this much by consolidating your debts, it might not be worth it in the long run.

Before opting to refinance, try calculating the breakeven point, which is the month your refinance starts saving you more than it costs. If you don’t plan on staying in the home past that point, refinancing is probably not a great idea.

For example, if your refinance closing costs are $6,000, and you save $200 per month on payments, your break-even point would be 30 months (6,000 ÷ 200 = 30). If you plan to stay in your home longer than that, refinancing may be worthwhile.

Check out our refinance breakeven calculator to get started.

How the Process Works

If you decide that using a cash-out refinance to pay off debt makes sense for your situation, here are some tips to get started.

1. Figuring out how much equity you can borrow

Most lenders allow you to borrow up to 80% of your home’s value, meaning you must leave at least 20% equity in the home after refinancing. Here’s how to calculate your maximum cash-out amount:

(Home Value × 0.8)−Existing Mortgage Balance = Maximum Cash-Out Amount

To keep with our $400,000 home example from earlier, this would look like:

(400,000 x 0.8 = 320,000). 320,000 – 200,000 = $120,000 maximum cash-out amount

2. Decide how much cash you need

Whether you pay off high-interest debt, pay for a home improvement project, or use the cash for something else, you must decide exactly how much you’ll need. Borrowing more than that means paying additional interest.

3. Shop around for a lender

Shopping around for a lender is critical to the cash-out refinance process. Choose at least three lenders, including your current lender, and get a rate quote from each.

When you compare these quotes, make sure you look at the interest rate offered and the fees charged. This will allow you to pick the best lender for your situation.

4. Apply for a cash-out refinance loan

Just like when you applied for your original mortgage, you’ll need to go through the mortgage application process for your cash-out refinance. This often includes a refinance appraisal and complete underwriting to examine your finances and credit history.

5. Close on your loan

Once you’ve been approved, you’ll move on to closing your loan. You’ll be responsible for paying closing costs on the loan, but in most instances, this can be rolled into the loan amount.

However, if you choose to go this route, it will reduce the amount of cash you’ll be able to receive.

6. Pay off your debt

Once you’ve closed your loan, the lender will pay off your old mortgage and distribute the cash so you can pay off your high-interest debts.

Will refinancing my mortgage to pay off debt benefit me?

With housing prices up nationwide, using a cash-out refinance to pay off debt, especially credit card debt, can be a great idea for many people. Not only are mortgage rates significantly less than credit card interest rates, but you can also consolidate multiple credit cards into one manageable monthly payment.

Before deciding if a cash-out refinance makes sense for you, consider some of the pros and cons.

Pros

- Mortgage rates are significantly less than the interest rate on credit cards. This can considerably reduce the amount of interest you’re paying.

- If mortgage rates have dropped or your credit score has increased, you might end up with better mortgage terms, which can decrease the interest you’re paying over the life of your new loan.

- Using a cash-out refinance to pay down your credit card balance will reduce your credit utilization. By doing so, you’ll help improve your credit score.

Cons

- Like when you received your first mortgage, you’ll need to pay closing costs when refinancing. If you’re planning to stay in the home for a while, this can make sense. However, it’s important to understand your break-even point, including the interest savings you’ll have from paying off your credit card.

- By doing a cash-out refinance, you’re reducing the equity you have in your home. If you choose to sell, this would reduce the amount of money you have available to use for a new down payment.

- Unless you’re replacing your original mortgage with a shorter-term loan, you’ll end up paying more in interest over the life of your loan. For example, if you have 20 years left on your mortgage and take out a 30-year loan, you’ll reset the clock.

- If your new mortgage rate is higher than your existing one, a cash-out refinance may not make financial sense. Consider a home equity loan or HELOC as an alternative.

Should You Use a Cash-Out Refinance to Pay Off Debt?

Using a cash-out refinance to consolidate debt is usually smart if it reduces the total amount of interest you’d pay and saves you enough to make up for the total closing costs of the refinance. But, you’ll need to do some careful calculations to determine if using a cash-out refinance for debt consolidation is the best move. Check out our debt consolidation calculator here to run your numbers.

Some key numbers to consider when making this decision are:

- Mortgage interest rates: how will your interest rate be impacted? If a refinance will lower it, consolidating debt will likely be a win-win (paying off debt and lowering your mortgage rate). If it’s increasing, you’ll need to weigh the added costs against what you stand to gain.

- Monthly payment: If you take a higher interest rate, your monthly payment may increase. Will the savings from paying off your other debts offset this increase?

- Lifetime costs: Resetting your mortgage term often means spending more on lifetime interest costs. Luckily, mortgages come with different term lengths, including 10-, 15-, 20-, and 25-year terms.

Let’s take a look at some example scenarios:

Beneficial Debt Consolidation Scenario

For example, say you have a current mortgage rate of 8% and two credit cards with 20%. You apply for a cash-out refinance and are quoted a rate of 7%.

You’d still have to take into account the refinance costs and how long you plan to be in the home, but the cash-out refinance would likely make sense in this situation, saving you significantly on interest costs in the long run.

Non-Beneficial Debt Consolidation Scenario

If, however, your current mortgage rate was 3%, but refinancing would give you a 7% rate, it may not be wise to proceed.

While you’d definitely lower the rate you’re paying on your debts, you’d also be paying a lot more in interest on your mortgage loan. Since a refinance is typically a much larger loan balance than those on credit cards and other loans, it would likely cost you more in interest over the long haul.

Even if a refinance means taking a higher mortgage rate, it could still be worthwhile if the amount of high-interest debt you’re eliminating is significant enough. Let’s take a look at a real-world scenario to see how the numbers play out.

Taking a Higher Mortgage Rate

With interest rates as high as they are, there’s a good chance that you’d be taking a higher interest rate with a cash-out refinance at the time of writing.

Let’s break down an example of a homeowner considering a cash-out refinance to consolidate high-interest credit card debt. Below, we compare their existing mortgage and debt situation with two potential refinance options.

In this scenario, the homeowner has a $220,000 loan balance and a home worth $400,000. They are considering a cash-out refinance to pay off high-interest credit card debt, even though their mortgage rate will go up.

| Current Mortgage and Debt | Cash-Out Refinance Consolidation | |

| Remaining Loan Balance | $220,000 | $260,000 |

| Interest Rate | 4% | 6.5% |

| Monthly Mortgage Payment (P&I only) | $1,200 | $1,770 |

| Credit Card Debt (28%) | $40,000 | $0 |

| Credit Card Min. Payment | $1,000 | N/A |

| Blended Rate* | 7.69% | 6.5% |

| Combined Annual Interest Costs** | $20,157 | $16,814 |

| Total Payments | $2,200 | $1,770 |

*Blended rate is the rate for all loans considering the interest rate and balance for each.

**Includes mortgage and credit card interest. Assumes original mortgage is 5 years old.

In this scenario, the homeowner reduced their monthly payments from $2,200 to $1,770—giving them an extra $430 per month in financial flexibility and reducing their annual interest costs by over $3,000.

It’s worth noting that resetting a mortgage to a new 30-year term at a higher rate will lead to more lifetime interest costs. However, lifetime interest costs can be decreased by paying extra principal or choosing a shorter term.

Other Ways to Consolidate Debt

A cash-out refinance isn’t the only option if you want to pay off and consolidate your debts. Alternatives include:

- Home Equity Loan or HELOC: Borrow against your home equity without replacing your mortgage. Learn the differences between cash-out refinances, home equity loans, and HELOCs here.

- Reverse Mortgage (for seniors): Tap into home equity without monthly payments.

- Balance Transfer Credit Card: 0% intro APR for a limited time (watch for balance transfer fees — and potential damage to your credit score if you use more than 10% of the credit limit).

- Debt Consolidation Loan: Can simplify payments but often has a higher rate than a mortgage.

- Negotiating Lower Interest Rates: Some credit card issuers may lower your rate if you have a strong payment history.

Getting to the Root of the Issue

Consolidating your debt can make it easier and more affordable to pay off, but if you don’t tackle what got you into debt in the first place, it won’t matter. In some cases, you may find yourself right back in the same situation just years down the road.

If you’re not sure you have a handle on your spending issues, talk to a credit counselor or financial planner. They can help you put together a plan to stay on track.

Ready to explore how a cash-out refinance could help you achieve debt freedom and significant interest savings? Take the first step toward mortgage freedom and start your application with Refi.com today.