Does a Cash-Out Refinance Increase Your Mortgage Payment?

Homeowners typically come to me assuming that a cash-out refinance will increase their mortgage payments. Most of the time, they’ll be right. Adding extra debt to your home loan will increase monthly payments for the majority of borrowers. However, that isn’t always the case.

I’ll review the factors that’ll impact your new payment following a cash-out refinance and explain how spending more on your mortgage doesn’t necessarily have to be a bad thing.

How a Cash-Out Refinance Works

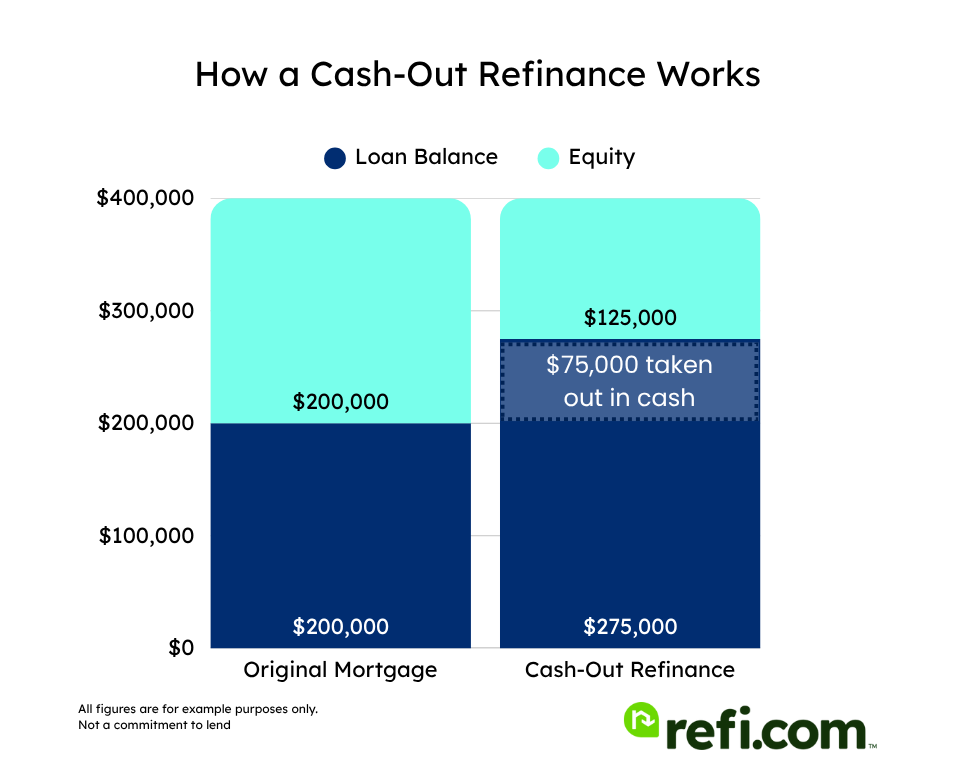

A cash-out refinance is a financial tool that lets you access the equity you’ve built up in your home. This involves taking out a new loan that’s larger than your present mortgage, paying off what you currently owe, and receiving the difference back in cash as part of the closing process.

For example, if you currently owe $200,000 on your home and do a cash-out refinance for $275,000, you’ll receive that $75,000 difference – minus closing costs – to use in whatever manner you choose.

The homeowners I help often use this cashed-out equity to consolidate debts and pay off high-interest loans. However, some folks choose to use the funds for other purposes, such as making home improvements, purchasing investment properties, or even saving as a financial safety net.

Factors That Impact Your New Mortgage Payment

Before we go any further, let’s review a few of the factors that will impact your new mortgage payment.

New Loan Balance

With a cash-out refinance, your new loan balance will always be more than you presently owe. It will likely even be more than your original mortgage amount. If you’re increasing the size of your loan – especially above what you initially borrowed – you can usually expect larger payments.

As far as loan amounts go, we typically discourage someone from doing a traditional cash-out to access less than around $30,000 of equity. Between closing costs and the favorable rates many homeowners currently have, it’s not usually beneficial to take out less.

On average, my clients doing a cash-out refinance are typically adding another $50,000 to $100,000 to their loan balance.

How Long It Takes to Build Enough Equity For a Cash-Out Refi

In the past, it could take seven or eight – or even more – years for a homeowner to pay down their loan and see sufficient appreciation in their home to access their equity.

That’s because properties have historically appreciated between 3% and 5% per year, and lenders only let you do a cash-out refinance for up to 80% of your home’s appraised value, including the equity that you’re cashing out. This means that someone who owes 60% of what their home is worth could cash out around 20% of its value.

That dynamic has changed a lot in the past few years. Between 2020 and 2022 or so, we saw homes appreciate at a rapid rate. This allowed people – including myself – who had only been in their homes for perhaps two or three years to be eligible to cash out equity, thanks to rising property values.

Can You Save Money If Your Interest Rate Rises?

Interest rates for cash-out refinances are higher than with a basic rate-and-term refinance – usually about 1% more. Many homeowners, especially those who purchased or refinanced their homes more than a couple of years ago, are likely to see their rate rise during a cash-out refi.

However, I think that how many people look at it – especially those I work with – is not so much about the rate but more about how much money they can save. Cash-out refinance borrowers are typically less rate-sensitive because most can trade off a higher rate for lower debt payments.

I had a borrower close on a loan last week who had a 3.5% rate on their previous mortgage. They ended up with a new rate of 7.5%, but when they used their equity to pay off their other debts, they were still saving somewhere between $600 and $700 per month.

Plus, I always let my clients know that if six months or a year goes by and rates fall, they can take advantage of that and refinance again down the road.

How we source rates and rate trends

Rates based on market averages as of Dec 02, 2025.Product Rate APR 15-year Fixed Refinance 5.37% 5.42% 20-year Fixed Refinance 6.05% 6.08% 30-year Fixed Refinance 6.35% 6.37%

You Don’t Have to Choose Another 30-Year Loan

A lot of folks I talk to haven’t even thought about their new loan term prior to our first meeting. After all, around 90% of homebuyers take out a 30-year mortgage. So, when it comes time to refinance, they typically have a predisposition to think in a 30-year term.

But you do have other options.

Lenders commonly offer mortgage terms of 15, 20, and 25 years. You can even find some who offer 10-year loans. When I’m talking with a client who is 10 years into their repayment schedule, I’ll say, “Hey, we can do a 20-year term so that you’re not resetting your mortgage.”

However, for homeowners doing a cash-out refinance, shortening their term may not offer the monthly savings they’re looking for. So, in most cases – especially for those consolidating other bills and trying to lower their overall debt payments – a 30-year term is where most people will end up.

But once again, I remind them they could always shorten that with a rate-and-term refinance later on if they want.

Are You Using It to Consolidate Debt?

The majority of homeowners I work with – maybe 70% – are using their cash-out refinance to consolidate debts.

This is usually going to be credit card debt. The most recent data from the Federal Reserve indicates that the average credit card interest rate is above 21%. Consolidating this into a 7% or 7.5% mortgage can save borrowers a ton of interest, especially if they’re only making their minimum credit card payments.

I also see many individuals who have a 3.5% or 4% interest rate on their primary home loan, but then they have a second mortgage at 11% or 12%. Depending on the sizes of these loans, this could mean their true, blended interest rate is actually 8% or 9%. So a 7.5% rate for a single loan suddenly doesn’t sound too bad.

Or they may have a HELOC that they’re only paying interest on, but it’s about to enter the repayment period, and they know their monthly payments are about to increase significantly. Here, they may opt to give up their lower interest rate to alleviate some of that pressure.

Another common reason for a cash-out refinance is education debt. When I refinanced my home, I used some of my equity to pay off my student loans and consolidate those costs into my property’s mortgage.

Using The Cash for a Home Project or More Real Estate

I mentioned that around 70% of my clients use their cash-out refi to pay off debt. Well, the other 30% are generally using their equity to get cash for different projects.

Maybe around 10% or so use their refinance to fund major home improvements, while the remaining 20% are typically investors trying to leverage their assets.

For example, I’m currently working with a gentleman who has a $400,000 mortgage but wants almost to double it. He’ll be closing on a new $780,000 loan, but he plans to use that equity to buy two rental properties and pay them off in full.

His payment is going up considerably, but he’ll be collecting rent every month and also have free-and-clear ownership of those assets.

I have another client with an investment property that doesn’t currently have a mortgage. Still, he’s doing a cash-out refinance to add more real estate to his portfolio. Yes, he’ll incur some new debt, but the growth will offset this expense.

Scenarios Where Your Payment May Go Up

As I mentioned earlier, the reality is that, in most cases, your payment will increase with a cash-out refinance. If you currently owe $100,000 and you take $50,000 out, the likelihood that you’re going to reduce your payment is low because you’re adding considerably more to your loan amount.

From a strictly mathematical perspective, you would need to reduce your rate substantially to get back to the payment you had. And with most homeowners refinancing from lower pandemic-era rates, that simply isn’t likely.

However, even if your mortgage payments are going up, it could still be a net-positive change if you’re able to wrap in some other debts and reduce your overall monthly costs.

Debt Consolidation Scenario

For example, I have a borrower with a home that has a $180,000 mortgage. They’re taking out a $256,000 loan, which will raise their balance by nearly $80,000. Their total mortgage payments are going from around $1,800 to $2,600 per month.

However, with the proceeds from their cash-out refinance, they will eliminate around $2,400 in other monthly debt payments. So, while their mortgage costs may increase by $800, they will end up keeping approximately $1,600 more in their pocket every month. That’s a huge savings that will really lighten their financial burden.

Scenarios Where Your Payment May Stay the Same or Go Down

Can your payment stay the same – or even decrease – with a cash-out refinance? It’s not likely, but it is possible.

This typically means that you’re only cashing out a small amount relative to your current loan balance and that you’re also managing to lower your interest rate at the same time. In some situations, you may also have similar or lower payments if you’ve paid down a large amount of your mortgage since initially taking out your loan.

I’ve worked with borrowers who own manufactured homes that were originally locked into 12% or 13% rates. Perhaps their credit score has improved over the past couple of years, and they’re only doing a small cash-out. In this situation, these homeowners may break even on their mortgage payments. Still, those are very much the exception rather than the rule in today’s rate environment.

Other Costs to Keep in Mind

There’s more to consider when refinancing than just your new payment amount. Other costs may impact your decision. Let’s cover a few of the most important.

Closing Costs

Depending on the cash-out refinance program you use, closing costs on your new mortgage will generally run between 2% and 6% of your total loan balance. On a $250,000 refinance, this could equate to anywhere from $5,000 to $15,000.

Closing costs are a big part of why we don’t recommend doing a cash-out for less than $30,000. The more equity you’re tapping into, the lower the percentage of your proceeds that will get eaten up at closing.

Typical closing costs can include expenses such as:

- Origination/underwriting fees

- Title insurance costs

- Appraisal fees

- Recording fees

- Lender discount points

Government-backed cash-out refinances can come with their own unique closing expenses, such as the FHA’s 1.75% upfront mortgage insurance premium (UFMIP) or the VA’s loan funding fee, which is 3.3% for the majority of cash-out borrowers.

Prepaid Expenses

Prepaid expenses are often considered part of your closing costs, but they’re actually a bit different. Frequently referred to as “prepaids,” these are funds collected in advance and held in escrow to cover certain costs associated with homeownership.

This will most commonly include a portion of your annual property taxes and home insurance premiums. You likely already have funds in escrow for these expenses with your current lender. Those balances will be refunded to you shortly after your new loan closes.

Long-Term Interest

Resetting your loan term will likely result in you paying more in total interest over the life of your mortgage. Since most cash-out borrowers refinance into another 30-year term, this could be a sizable cost depending on how far you are into your current repayment schedule.

For example, if you took a $200,000 30-year mortgage at a rate of 7%, after five years, you’ll have already paid around $68,100 in interest.

If, at that point, you do a $250,000 cash out at 7.5% and reset into another 30-year term, the total interest costs on your new loan will be just under $379,300. This means you’ll wind up paying a total of nearly $447,400 in interest by the time your home is fully paid off.

Should I Wait for Lower Rates?

In my experience, cash-out borrowers typically aren’t overly concerned about their interest rate. Most people understand that with current mortgage trends, doing a cash-out refinance will generally result in a higher interest rate than they presently have.

But clearly, lower refinance rates are better. So, if you’re in a position to do so, does it make sense to put off a cash-out refi until rates go down further?

Maybe, but you need to have realistic expectations. Here are a few things to consider:

Rate decreases aren’t usually very drastic: When the Federal Reserve announces a change to the federal funds rate, people often envision a best-case scenario in their minds and think rates will drop by something like 2% – this isn’t the case.

Most of the time, the change will be around 25 basis points, which is equivalent to a 0.25% reduction. This is great overall but not nearly as dramatic as the typical homeowner expects.

Lenders proactively cut rates in anticipation of market changes: I’ve had borrowers come to me and say, “The Fed just cut rates – how is it that your rates aren’t any lower than they were a week ago?” At that point, I have to explain to them that lenders typically anticipate these changes and adjust their rates in advance. If rates are likely to be cut in the near future, lenders have probably already incorporated those changes.

Pandemic-era rates aren’t coming back: Rates dropped so far during the COVID pandemic that it gave people a false sense of expectation, leading them to believe that those all-time historic lows are possible again. It will take another global catastrophe for us to see rates like that. Whenever someone considering a refinance tells me their current rate is anywhere below 5%, I make sure they know that the reality is that rate will probably not exist for them again – at least not anytime soon.

Your Mortgage Payment May Increase, But You Can Still Win

For most folks, a cash-out refinance is really just about taking care of whatever financial needs they have at that moment.

Sometimes, this can be a good situation – such as the investor tapping into their equity to expand their portfolio and build long-term wealth. Other times, it may be a less pleasant scenario where the homeowner is swamped with high-interest credit cards and needs access to cash to pay off that debt.

Ultimately, though, even if a cash-out refinance does increase your mortgage payment, you can still come out ahead, whether that’s creating a new source of income for the future or cutting monthly costs and improving your cash flow right now.

Ready for a personalized estimate of how a cash-out refinance may help you? Take the first step and apply with Refi.com today.