How an FHA Cash-Out Refinance Can Help You Keep the Home After Divorce

Divorce often requires making difficult financial decisions, especially around housing. For many couples, the home is their largest shared asset, and dividing it can be complex.

For the spouse who wants to keep the house, qualifying for a new mortgage with just one income may not be possible, especially when child support, attorney fees, or credit card debt are already stacked against you.

However, the FHA cash-out refinance option might be able to help.

With higher debt-to-income ratios and more flexible credit requirements than conventional loans, this refinancing option lets you tap into your home’s equity to buy out your ex-spouse’s share while securing a new loan in your name only.

We recently covered how cash-out refinances can help one partner keep the home during divorce, but the FHA version deserves special attention due to its more accommodating guidelines.

Key Takeaways

- FHA loans allow much higher debt-to-income ratios than conventional loans, which is ideal when qualifying with one income.

- You can use the cash to buy out your ex, pay off debt, or handle other divorce-related expenses.

- Flexible credit requirements mean you may still qualify even if your score dropped during the separation process.

What Is an FHA Cash-Out Refinance?

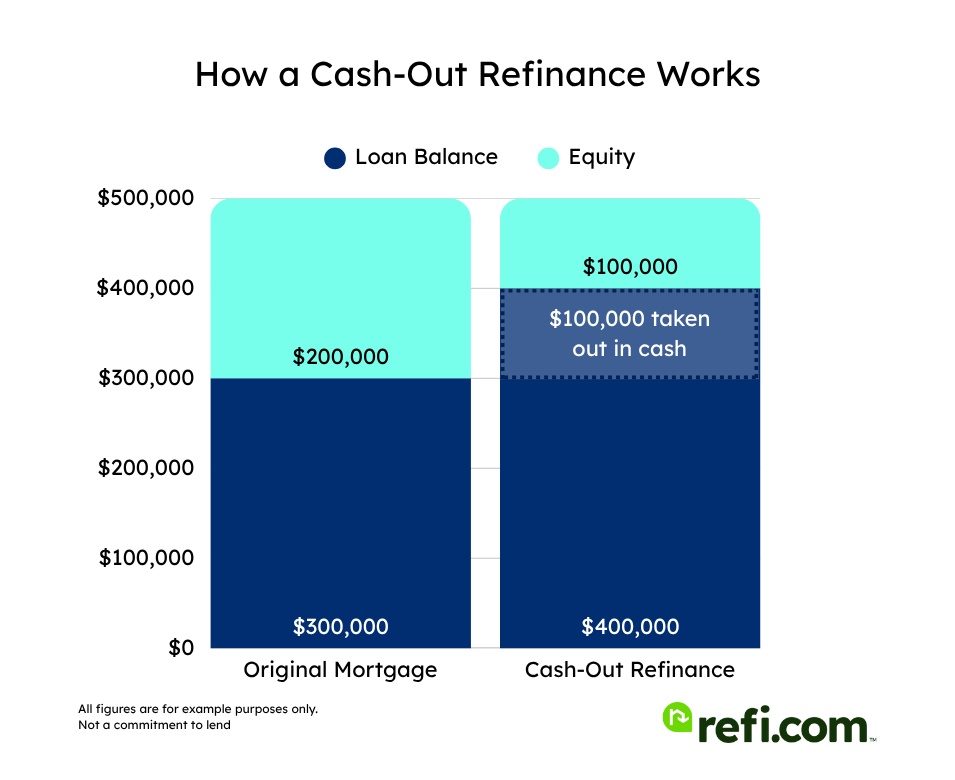

An FHA cash-out refinance allows homeowners to replace their current mortgage with a new, larger loan backed by the Federal Housing Administration. The difference between your home’s value and what you owe becomes available as cash, which can be used for any purpose (including paying off divorce expenses).

To qualify for an FHA cash-out refinance, you must meet these requirements:

- Maximum 80% loan-to-value ratio (meaning you need at least 20% equity in your home after refinancing).

- The property must be your primary residence.

- You must have lived in the home for at least 12 months.

- Minimum credit score requirements (typically 580-600, though FHA guidelines permit scores as low as 500). Refi.com requires a 620 FICO credit score for an FHA cash-out refinance.

- Debt-to-income ratios can reach up to 50% and even up to 56.99% with compensating factors (compared to a 45–50% cap on conventional loans, which rarely allow anything above 45%).

This last point makes FHA cash-out refinances highly advantageous during divorce proceedings.

Why FHA Cash-Out Refinancing Can Be a Game-Changer in Divorce

Divorce often means qualifying for a mortgage on a single income at a time when expenses may be increasing. The FHA cash-out refinance program can give you three advantages that will help during this challenging transition.

Higher DTI Allowances Make Qualifying Easier

One of the biggest shocks in a divorce is often going from two incomes to one. If you’re left with the mortgage, utilities, childcare, and everything else, your bills can pile up fast. For many, this pushes their debt-to-income (DTI) ratio beyond what most conventional lenders will allow.

FHA loans are more forgiving here by allowing DTI ratios of up to 43% without compensating factors and potentially as high as 50% with them. Rarely do they get as high as 56.99%, but it’s still possible.

Compensating factors are strengths in your application that make up for the higher debt load, such as:

- A strong credit history

- A large amount of savings left after closing

- A track record of paying rent that’s equal to or higher than your new mortgage

- A new loan that reduces your overall monthly debt

For example, say your income is $6,000 a month and your total monthly debts (including the new mortgage) reach $3,300. That’s a 55% DTI. Most conventional lenders would stop you long before. But if you’ve got a 620+ credit score, a few months of reserves in the bank, and you’ve been paying $3,200 in rent every month, an FHA lender might greenlight you.

Those extra percentage points in allowable debt-to-income ratio can make the difference between qualifying and not qualifying for a new loan on your own.

More Flexible Credit Requirements

Divorce doesn’t automatically damage credit scores, but the financial stress it causes often does. Legal fees, moving expenses, and the complications of splitting joint accounts can all impact your credit profile.

While conventional cash-out refinances typically require credit scores of 620 and often higher, FHA loans accept scores as low as 580 at some lenders. Some FHA-approved lenders will even consider scores down to 500 with larger down payments or other compensating factors.

Refi.com requires the following:

- 660 FICO credit score for a conventional cash-out refinance

- 620 FICO credit score for an FHA cash-out refinance

Eligible for All Loan Types

It doesn’t matter what kind of mortgage you have right now. You can have a conventional, VA, USDA, or whatever. As long as the home is your primary residence and you’ve lived there for at least a year, you can apply for an FHA cash-out refinance.

The new FHA loan will replace your old one, wiping the slate clean, removing your ex from the mortgage, and giving you the option to cash out equity. What matters most is whether you, as the borrower, meet FHA’s guidelines now.

That’s part of why this loan works so well in divorce.

Ways to Use an FHA Cash-Out Refinance During Divorce

An FHA cash-out refinance is a tool to give you cash, reset your loan, and let you take full control of the home. How you use that opportunity depends on your situation. Some use it to buy out their ex, while others reset their loan terms entirely. Here’s how it works and what you should keep in mind.

Access Cash for an Equity Buyout and/or to Pay for Divorce Expenses

One of the biggest benefits, and the reason most people turn to FHA cash-out refinancing during a divorce, is that they need cash.

Keeping the home often requires buying out your ex-spouse’s share of the equity. Depending on how long you’ve owned the property and how much it has appreciated, this can be a significant amount.

That money might not be easily accessible to you. However, with an FHA cash-out refinance, you can borrow up to 80% of your home’s appraised value and use the cash however you need. During a divorce, though, it usually makes the most sense to focus on the essentials, like buying out your ex’s equity share in the home, covering attorney fees and court costs, or paying off joint debts outlined in the divorce agreement.

Here’s an example of what that 80% would look like: if your home is worth $400,000 with a remaining mortgage of $200,000, you could potentially access up to $120,000 in cash ($400,000 × 80% = $320,000 – $200,000 = $120,000) to handle these expenses.

Remove Your Ex-Spouse from the Mortgage

If you and your ex are both listed on the mortgage, you’re both responsible for paying back the loan. But if you no longer want to share responsibility for monthly mortgage payments, you’ll have to remove your ex from the mortgage, which can be done through refinancing.

The FHA cash-out refinance option will replace your original mortgage with a new one. This new mortgage will not include your ex, making you the sole borrower. You keep the home, and your ex walks away free of the loan.

The harder part is qualifying on your own. Mortgage lenders will look at your credit file, not yours plus your ex’s, as well as your income, DTI, and job history.

This is why the more flexible FHA guidelines are so useful. The higher DTI allowances, lower credit score requirements, and consideration of compensating factors create a more accessible path to qualification over conventional loans.

Related: Refinancing Your Mortgage After Divorce: What to Know

Adjust Terms and Interest Rates

Refinancing after a divorce can allow you to take advantage of lower interest rates and even modify your loan terms.

When it comes to interest rates, market conditions change year by year, and the rate you locked in when you first bought your home may be higher than what’s currently available. If that’s the case, refinancing could reduce your monthly payment and ease some of your financial pressure.

You also have the opportunity to change the structure of the loan itself:

- You might extend the term back to 30 years to lower monthly payments.

- You could switch from an adjustable-rate to a fixed-rate mortgage for payment stability.

- You might consolidate a first and second mortgage into one loan.

That said, current rates may not always work in your favor. If rates have risen since your original loan, refinancing could mean accepting a higher rate than you have now, not a lower one. And while extending the term can help you pay less each month, it often leads to higher interest costs over the life of the loan.

How we source rates and rate trends

Rates based on market averages as of Dec 02, 2025.Product Rate APR 30-year Fixed Fha Refinance 5.56% 6.77% 30-year Fixed Refinance 6.35% 6.37%

Pros and Cons of an FHA Cash-Out Refinance

An FHA cash-out refinance can be a powerful tool during divorce, but like any financial decision, it has some less-than-stellar drawbacks. What makes it appealing for some may create complications for others. Below, we break down the most important advantages and disadvantages to help you decide if it fits your situation.

Pros of an FHA Cash-Out Refinance

- FHA cash-out refinancing is often easier to qualify for because of its flexible eligibility requirements, including higher debt-to-income limits and lower credit score thresholds than conventional loans.

- It also allows you to access cash from your home equity, which can help cover buyouts, legal expenses, or other costs that arise during and after a divorce.

- You can adjust your loan terms in the process, whether that means locking in a fixed rate, extending your repayment period, or combining multiple loans into one.

- There’s also no requirement to stay with the same loan type, so you can refinance into FHA from a conventional, VA, or USDA loan if you meet the program’s basic criteria.

- Unlike some first-time buyer programs, FHA refinancing is open to any qualified homeowner, regardless of how many homes you’ve owned or financed.

Cons of an FHA Cash-Out Refinance

- FHA loans require an upfront mortgage insurance premium (UFMIP), which is a one-time fee (usually around 1.75% of the loan amount) and an annual premium payment (MIP).

- You get smaller loan limits with the FHA than you would with a conventional loan, which restricts how much equity you can borrow against.

- You’ll need to account for refinancing expenses. Loan origination charges, credit report pulls, recording taxes, and prepaid escrow deposits can cost thousands of dollars. Check out our guide to refinance closing costs to learn more.

- If interest rates have increased since you took out your original mortgage, you’ll have a higher interest rate.

- Refinancing the loan to a fresh 30‑year term keeps interest accruing far longer, so your overall cost rises.

Alternative Options for Refinancing or Accessing Equity

An FHA cash-out refinance can be a great option for some, but it’s not your only option.

Conventional Cash-Out Refinance

If you have a strong credit score and a debt-to-income ratio below 45%, a conventional cash-out refinance could offer lower interest rates and fewer fees compared to FHA. These loans are also a good fit for homeowners who have at least 20% equity and want to avoid the upfront and ongoing mortgage insurance premiums required by FHA loans.

Home Equity Loan or HELOC

These second-mortgage products let you tap equity without replacing your first mortgage, which works well if your existing mortgage has a low interest rate worth keeping.

It won’t remove your ex from the original mortgage, though, and typically requires better credit scores and lower DTI ratios than FHA loans.

Sell the Home & Split the Proceeds

When neither partner can comfortably shoulder the payments alone, the smartest thing to do is also the simplest. By putting the house on the market, you end the joint mortgage in a single stroke, skip the stress of qualifying on one income, and convert bricks into cash both of you can use to rebuild. Sometimes it’s best to close the deal, split the proceeds, and start fresh.

Loan Assumption

An assumable mortgage lets a buyer step into the seller’s existing loan, often snagging a lower fixed rate if market rates have increased since buying the home. Most conventional mortgages can’t be assumed unless you qualify as a successor in interest or the loan is an adjustable‑rate mortgage past its fixed period. By contrast, government‑backed loans like FHA, VA, and USDA are generally assumable once the buyer meets program guidelines and the lender signs off.

Related: Choosing Between Mortgage Assumption and a Refinance During a Divorce

Final Thoughts: Is an FHA Cash-Out Refinance Right for You?

An FHA cash-out refinance won’t solve every financial challenge related to divorce, but it can provide a path to sole ownership of the home with more flexible qualification standards than conventional options.

It’s not perfect for everyone, not by a long shot, but if you’re rebuilding your finances after a divorce and need accessible, realistic options, this refinance option can offer financial flexibility and a clearer path to sole ownership during a major life transition.

Start your application with Refi.com today.