FHA Cash-Out Refinance Rules for Non-Occupant Co-Borrowers

The FHA cash-out refinance loan is an effective way for property owners to tap into their existing home equity. However, applying for a cash-out refi with a non-occupant co-borrower may be difficult, even if the co-borrower is on your original purchase loan.

Key Takeaways

- FHA cash-out refinances do not allow non-occupant co-borrowers, even if you have one on your current mortgage.

- Conventional cash-outs can be more flexible, with many lenders allowing co-borrowers who do not reside in the home.

- Additional options include second mortgages such as HELOCs, portfolio loans from local financial institutions, and leveraging other existing assets.

Can You Have a Non-Occupant Co-Borrower on an FHA Cash-Out Refinance?

While the FHA allows homebuyers to qualify for a purchase loan with help from a non-occupant co-borrower, the rules regarding FHA cash-out refinances are stricter. All borrowers on the mortgage must occupy the home as their primary residence on a cash-out refinance.

FHA Cash-Out Occupancy Requirements

Federal Housing Administration guidelines state, “Any co-borrower or co-signer being added to the note must be an occupant of the property securing the new FHA-insured mortgage. Non-occupant co-borrowers or co-signers may not be added in order to meet FHA’s credit underwriting guidelines for the cash-out refinance.”

The FHA is not the only loan-backing government agency with this rule: the VA also restricts non-occupant co-borrowers on many types of loans, including VA cash-out refinances. The USDA rural development program, on the other hand, doesn’t offer cash-out refis at all.

Why Can’t You Use a Non-Occupant Co-Borrower?

It’s common for homeowners to wonder why they can’t use a non-occupant co-borrower on an FHA cash-out refinance, particularly when they were allowed to use one when obtaining their original loan.

The agency has this rule in place for a variety of reasons, including:

- Risk Level: Cash-out refinances are considered riskier loans, and homeowners needing a non-occupant co-borrower to qualify can imply an even greater risk to both lenders and the program’s overall stability.

- Program Intent: The primary intent of the FHA program is to provide an affordable path to homeownership for borrowers who may not qualify for other types of mortgages. This leads to more flexibility on purchase loans.

- Abuse Prevention: Applying with a non-occupant co-borrower gives otherwise unqualified homeowners the opportunity to cash out large sums of equity and then walk away from the property and stop making payments.

- Co-Borrower Protection: Related to the previous point, a non-occupant co-borrower could wind up on the hook for a substantial debt liability despite having no claim to the property or remaining equity.

What You Can Do Instead

Even though you cannot qualify for an FHA cash-out refinance using a non-occupant co-borrower, there are some alternatives to consider.

FHA Cash-Out Refinance With Only the Occupying Borrower

The simplest option is to apply for an FHA cash-out refi in just the name of the occupying borrower. Since the process involves obtaining a brand-new loan, you are under no obligation to use a co-borrower just because they’re on your current mortgage.

Keep in mind that this requires you to be able to meet FHA eligibility requirements on your own, including having the income level to support the new, larger debt. However, FHA guidelines tend to be more relaxed than conventional alternatives, particularly regarding credit scores and allowable debt-to-income ratios.

What requirements might you encounter when applying for an FHA cash-out refinance? While many lenders have their own more restrictive overlays, general program eligibility standards include:

- Credit Score: FHA guidelines allow for a minimum credit score of 500, although nearly all lenders – including Refi.com – impose higher requirements. Refi.com requires a 620 credit score for an FHA cash-out refinance.

- Debt-to-Income (DTI) Ratio: The FHA allows a debt-to-income ratio – the amount of your income allocated to pay debt obligations – as high as 50%. In some scenarios, this maximum can be extended to 56.9%.

- Loan-to-Value (LTV) Ratio: While FHA rate-and-term refinances are available for up to 97.75% of your property’s value, cash-out refis are limited to 80%. This LTV limit includes the funds you plan to cash out, meaning that you’ll need to currently have more than 20% equity to qualify.

- Occupancy and Payment History: You must have resided in the home as your primary residence for at least one year with no late mortgage payments within the past twelve months.

Conventional Cash-Out Refinance

If you aren’t eligible for an FHA cash-out refinance without the help of a non-occupant co-borrower, you may want to consider a conventional cash-out instead.

Although conventional loans can be more challenging to qualify for, they often allow for the use of co-borrowers who do not reside in the home. According to Fannie Mae, “Guarantors, co-signers, and non-occupant borrowers are permitted on purchase, limited cash-out and cash-out refinance transactions.”

“Unlike FHA loans, most conventional loans do not have a restriction on non-occupant co-borrowers. This means that if the borrower has a family member or close friend willing to be a co-signer on the loan, they may be able to qualify for a cash-out refinance with their help,” says Erica Nunley, founder and CEO of Nunley Home Buyers

Plus, refinancing with a conventional loan may even reduce your monthly payments if the refinance also includes canceling FHA mortgage insurance.

In contrast, all FHA cash-out refinances have an upfront mortgage insurance premium (UFMIP) of 1.75% of your total loan balance and an ongoing annual premium of 0.5% for most borrowers.

While requirements can vary by lenders, basic conventional cash-out guidelines – which apply to both the borrower and the non-occupant co-borrower – include:

- A credit score of 620 or higher (lender minimums often range from 640 to 700). Refi.com requires a 660 credit score.

- A DTI limit of up to 45% (50% may be allowed in some circumstances)

- A total LTV no greater than 80% (75% for properties with two-to-four units)

- The current primary loan must be at least 12 months old

- An on-time payment history with no 60-day late payments within the past year

How we source rates and rate trends

Rates based on market averages as of Dec 01, 2025.Product Rate APR 30-year Fixed Fha Refinance 5.54% 6.75% 30-year Fixed Refinance 6.35% 6.37%

Home Equity Loan or HELOC

Home equity loans and home equity lines of credit (HELOCs) are types of second mortgages that allow you to access your property’s equity without refinancing your existing loan. Since these are not conforming loans, each lender has the freedom to set their own restrictions on non-occupant co-borrowers.

Some of the benefits of taking out a home equity loan or HELOC can include:

- More flexible qualification requirements

- Access to a higher level of equity, with 85% and 90% LTV limits common

- Lower closing costs than refinancing your entire mortgage balance

- The ability to hold onto primary loans with a favorable interest rate

“It’s smart to explore a Home Equity Line of Credit (HELOC) if a full refinance isn’t ideal. I’ve seen a lot of success stories with people tapping into their home’s equity without resetting their entire mortgage,” states Faiza Ahmed, founder of Property Mesh.

Portfolio Loans From Local Banks/Credit Unions

FHA and conventional cash-out refinance loans are commonly packaged and sold to institutional investors on the secondary mortgage market. Portfolio loans, on the other hand, are retained “on the books” of local banks and credit unions.

Since these loans aren’t being sold, mortgage providers offer more flexibility when setting requirements for their borrowers. Many portfolio lenders will allow non-occupant co-borrowers, even on cash-out refinances.

Leverage Other Assets

If you can’t qualify for a cash-out refinance, whether because of eligibility guidelines, restrictions on non-occupant co-borrowers, or equity limitations, consider leveraging other assets to access the cash you need.

For most homeowners, this could include borrowing against an investment portfolio or retirement savings account. Some companies even offer cash-out refinances on automotive loans.

Sell and Buy Again Jointly

If you need cash in the short term and have no other alternative, your best option may be to sell your current home and then jointly buy another property with your co-borrower.

For example, if you owe $225,000 on your $300,000 home, liquidating the property would allow you to access the $75,000 in equity minus selling-related expenses. You could then apply again for a new FHA purchase loan on another residence with your non-occupant co-borrower.

If you were to buy another $300,000 home, you would only need to put $10,500 (3.5%) down, allowing you to use the remaining funds for your immediate cash needs.

Keep in mind, however, that in addition to selling-related expenses, you’d also be responsible for paying closing costs on your new loan. In some cases, there may be tax implications as well.

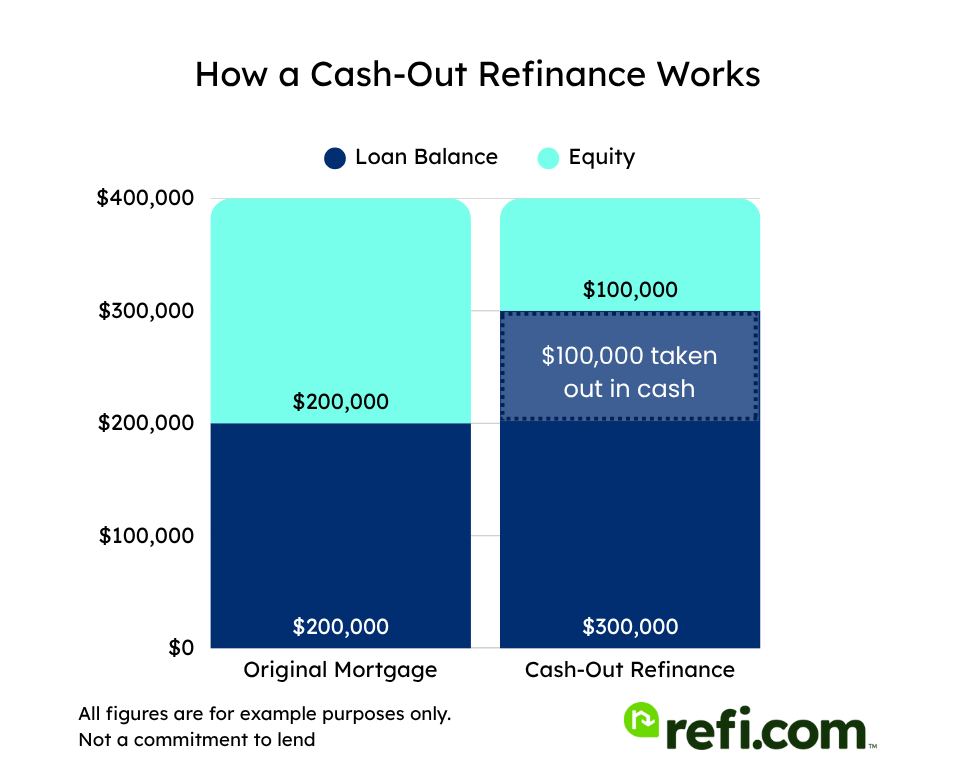

How a Cash-Out Refinance Works

How, exactly, does a cash-out refinance work? The process is simple: you apply for a larger loan than you currently have and use the funds to pay off your original mortgage. The amount left over – the equity you’re “cashing out” – is disbursed to you as a lump sum a few days after closing.

As we’ve mentioned, the guidelines for a cash-out refinance tend to be stricter than with a purchase loan, including higher credit score requirements, lower LTV allowances, and other loan-specific limitations such as non-occupant co-borrower restrictions.

Tips for How to Use the Funds From a Cash-Out Refinance

When you tap into your built-up equity with a cash-out refinance – regardless of whether it’s an FHA cash-out refi or a loan issued by conventional lenders – you can use the money in just about any manner you see fit.

While your options are nearly limitless, many borrowers choose to use the funds from a cash-out refinance to:

- Make home improvements

- Pay off credit card balances

- Consolidate high-interest debts

- Cover college tuition or other major life expenses

- Purchase a second home or investment property

Final Thoughts

Program guidelines do not allow applicants to qualify for an FHA cash-out refinance with the help of a non-occupant co-borrower. However, other options, including a conventional cash-out refi, can be more accommodating. Many homeowners may even be eligible for an FHA-backed loan on their own, thanks to the program’s relaxed lending standards.

If you’re ready to find out how much of a cash-out refinance you can qualify for, take the next step and begin the application process today.