Florida Mortgage and Refinance Rates

Current Florida Mortgage Rates

Average market rates for December 03, 2025 in Florida are 6.22% for 30-year fixed purchase and 6.27% for 30-year fixed refinance

| Product | Rate | APR |

|---|---|---|

| 30-year Fixed Purchase | 6.22% | 6.24% |

| 30-year Fixed Refinance | 6.27% | 6.29% |

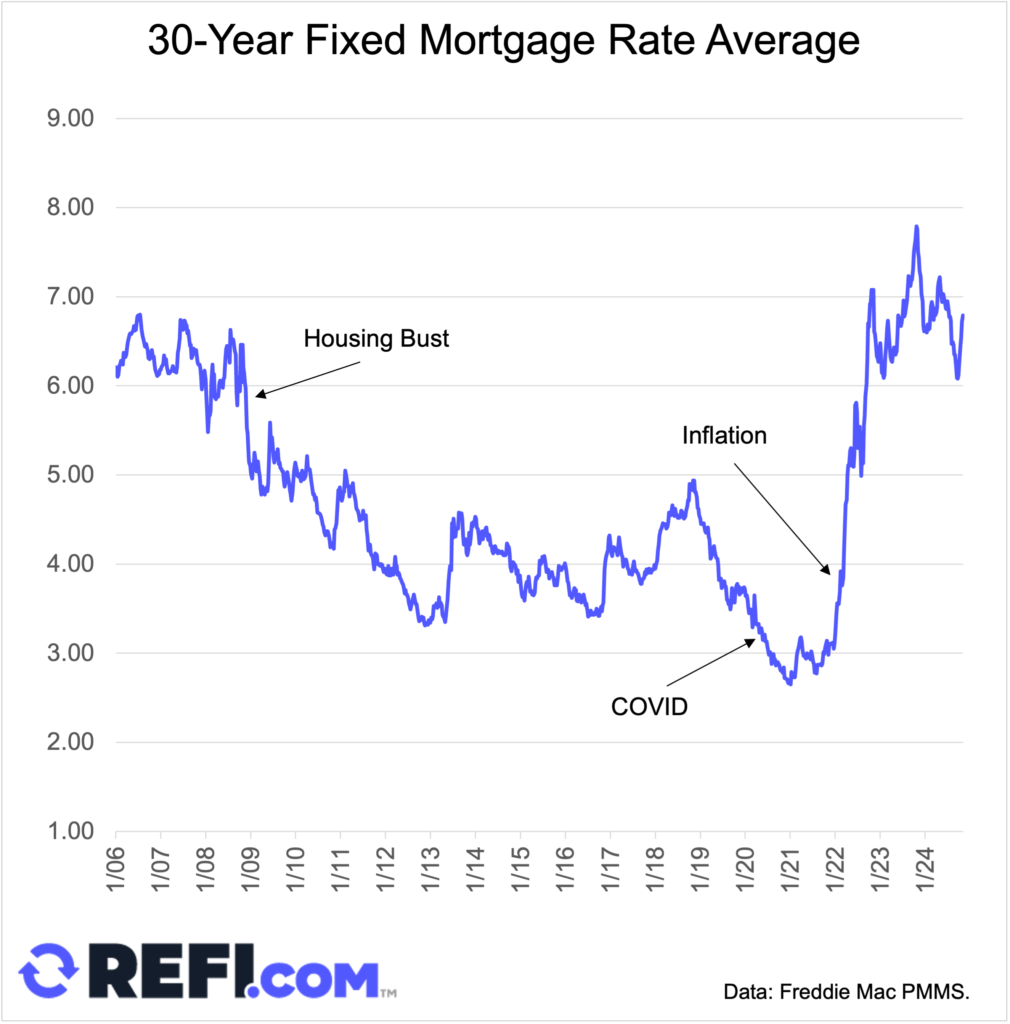

Mortgage Rate Trends in Florida

| Product | Rate | APR |

|---|---|---|

| 30-year Fixed Purchase | 6.22% | 6.24% |

| 30-year Fixed Refinance | 6.27% | 6.29% |

Florida Housing Market

The National Association of Realtors® publishes quarterly updates on the housing market in Florida. The edition covering the third quarter of 2024 suggests a trend toward a buyer’s market.

Following are stats compared to a year earlier.

- Number of closed sales had inched down by 2.6%

- Median sale price had risen only 0.2%: To $414,990 from $414,000

- Dollar volume of all home sales had fallen to $37.2B from $38.2B

- Number of active listings jumped by 39.6%, to 95,943 homes from 68,726

These figures could represent an opportunity for buyers, especially first-time ones.

In the third quarter of 2024, achieving a sale took an average of 84 days. And that was up from 70 days one year earlier.

This might mean that motivated sellers will be more willing to negotiate with buyers over price and other concessions.

Florida Purchase Rates

| Product | Rate | APR |

|---|---|---|

| 15-year Fixed Purchase | 5.36% | 5.40% |

| 15-year Fixed Jumbo Purchase | 6.11% | 6.14% |

| 30-year Fixed Purchase | 6.22% | 6.24% |

| 30-year Fixed Jumbo Purchase | 6.81% | 6.83% |

Florida First-Time Buyer Programs

Here are some of the state’s programs designed to help people get onto the first rung of the housing ladder:

- Florida Housing Finance Corporation’s Hometown Heroes Program — Up to $35,000 (5% of purchase price) as a silent second mortgage. No interest and you need only repay when you sell, refinance or finish paying down your loan

- Miami-Dade Economic Advocacy Trust’s Homeownership Assistance Program (HAP) — Up to $28,000 for a second mortgage like the Hometown Heroes Program. But this is forgiven after 20 years provided you remain in residence the whole time

- Hallandale Beach Community Redevelopment Agency’s First-time HomeBuyer Program — Up to $100,000 for buyers whose income is between 50% and 120% of the Broward County median income guidelines. Up to $10,000 for those with higher incomes. And a $5,000 extra incentive for first responders, teachers and nurses

- HUD’s Good Neighbor Next Door Program — Law enforcement officers, teachers (pre-kindergarten through 12th grade) firefighters and emergency medical technicians can buy homes in designated revitalization areas with a 50% discount on the purchase price. You must remain in residence for 36 months

All these programs have conditions. So click the links to check eligibility and loan or grant terms

We’ve only scratched the surface of the many down payment assistance programs available to first-time borrowers in Florida. Do a web search for more.

Florida Mortgage and Refinance Rates vs National Averages

Mortgage rates move daily or more often. So, it’s no surprise that things that are true most of the time aren’t true all the time.

But, typically, Florida refinance rates tend to be a bit lower than the national average. Each year, a federal regulator compiles anonymized data for every new mortgage across the country under the Home Mortgage Disclosure Act.

HMDA data show the average rate in Florida across all types of mortgages as 6.81% in 2023. The same figure nationwide was 6.97%.

How much do mortgage rates vary by state? In June 2024, MarketWatch cited a study by Curinos that found that Vermont had about 0.40% higher mortgage rates than Hawaii.

Why do mortgage rates vary by state? There are several reasons.

A state whose inhabitants have lower-than-average credit scores would tend to have higher mortgage rates. One with a large population and many lenders might benefit from sharper competition. And one whose residents tend to shop around multiple lenders for the lowest rate could skew the average lower.

Meanwhile, lenders might have to charge higher rates in highly regulated states to account for the cost of complying with strict regulations.

Florida Refinance Rates

| Product | Rate | APR |

|---|---|---|

| 15-year Fixed Refinance | 5.34% | 5.38% |

| 15-year Fixed Jumbo Refinance | 6.09% | 6.12% |

| 30-year Fixed Refinance | 6.27% | 6.29% |

| 30-year Fixed Jumbo Refinance | 6.82% | 6.84% |

Florida ARM Rates

| Product | Rate | APR |

|---|---|---|

| 5/6 Arm (purchase) | 6.06% | 6.09% |

| 5/6 Arm (refinance) | 6.04% | 6.06% |

| 5/6 Jumbo Arm (purchase) | 5.87% | 5.88% |

| 5/6 Jumbo Arm (refinance) | 5.91% | 5.92% |

How we source rates and rate trends

Florida Mortgage Rate Projections

Mortgage rates typically fall when the economy’s weaker and rise when it’s stronger. Rates also tend to rise in inflationary environments.

Mortgage rate experts were forecasting that mortgage rates would gently drift lower, at least through 2025.

But with Donald Trump’s recent election win, mortgage rates could head higher, not lower. He has proposed a series of inflationary policies, including tariffs and corporate tax cuts. As for now, 2025 is a large unknown for mortgage rates.

Drive Down Refinance Rates By Shopping For Refi Lenders

Federal regulator the Consumer Financial Protection Bureau (CFPB) reckons, “Mortgage data shows that borrowers could save $100 a month (or more) by choosing cheaper lenders.”

In other words, you could save $1,200 every year just by shopping around different lenders for the lowest rate. That surely must apply to refis as well as purchase mortgages.

Here are the golden rules of mortgage and refinance shopping:

- Get your finances in as good shape as possible before you approach lenders

- Decide on the loan you want — Fixed or adjustable rate; 10-, 15-, 20- or 30-year term

- Choose the type of loan you want to refinance to — Conventional, FHA, VA or USDA

- If you’re unsure about the last two, ask a lender for no-obligation guidance

- The CFPB suggests you “get at least three preapprovals.” It goes on, “Contact banks, credit unions, and organizations that might specialize in your situation—like first-time home buyers, veterans, public service workers, or others.”

- Compare the quotes (“loan estimates”) you get carefully

- Don’t think those loan estimates are written in stone. Call the lenders and try to negotiate, playing them off against each other

Top Refinance Lenders in Florida by Volume

- Rocket Mortgage, LLC: 4,032 loans

- PNC Bank: 2,020 loans

- Bank Of America: 1,783 loans

- Pennymac Loan Services, LLC: 1,757 loans

- American Advisors Group: 1,662 loans

- Truist Bank: 1,620 loans

- Nationstar Mortgage LLC: 1,569 loans

- Wells Fargo Bank: 1,533 loans

- Vystar: 1,529 loans

- Freedom Mortgage Corporation: 1,485 loans

Top Purchase Lenders in Florida by Volume

- Rocket Mortgage, LLC: 13,965 loans

- DHI Mortgage Company, Ltd.: 10,702 loans

- Crosscountry Mortgage, LLC: 9,641 loans

- Lennar Mortgage, LLC: 8,489 loans

- Caliber Home Loans, Inc.: 7,860 loans

- Loandepot.com, LLC: 6,800 loans

- Movement Mortgage, LLC: 5,647 loans

- Fairway Independent Mortgage Corporation: 5,642 loans

- Mortgage Research Center, LLC: 5,469 loans

- Paramount Residential Mortgage Group, Inc.: 5,263 loans

Top Cash-Out Refinance Lenders in Florida by Volume

- Rocket Mortgage, LLC: 22,125 loans

- Loandepot.com, LLC: 5,797 loans

- Nationstar Mortgage LLC: 4,475 loans

- Freedom Mortgage Corporation: 4,221 loans

- Pennymac Loan Services, LLC: 3,843 loans

- Wells Fargo Bank: 3,270 loans

- Vystar: 2,249 loans

- Caliber Home Loans, Inc.: 2,137 loans

- Flagstar Bank, Fsb: 2,061 loans

- Amerisave Mortgage Corporation: 2,031 loans

Most Common Mortgage Types in Florida

- Conventional: 241,589 loans

- FHA: 51,561 loans

- VA: 34,969 loans

- USDA: 1,295 loans