Good and Bad Reasons to Tap Home Equity in 2025

Tapping into your home equity can be a smart financial move—or a risky one. When used thoughtfully, it offers a low-interest way to fund big expenses or improve your financial health. But because your home serves as collateral, it’s important to borrow for the right reasons.

In this guide, we break down the best and worst reasons to tap home equity, whether through a home equity loan or a HELOC.

- Use home equity to build long-term value—great examples include home improvements, education, or starting a business with a clear plan.

- Avoid using home equity for short-term splurges or everyday cash flow problems, which could put your home at risk if you fall behind on payments.

- Cash-out refinances and home equity loans are best for one-time costs, while HELOCs are better for flexible or phased expenses. But, each option requires discipline to manage responsibly.

Three Ways to Tap Home Equity

Before we dig into what you should (and shouldn’t) use equity for, let’s quickly review your options:

1. Home Equity Loan

- Lump-sum loan with a fixed interest rate and monthly payment

- Best for one-time expenses with a clear cost

- Typically repaid over 5 to 30 years

- Great option if you’re happy with your current mortgage and don’t want to refinance

Check out our guide to home equity loans to learn more.

2. HELOC (Home Equity Line of Credit)

- Revolving line of credit with a variable interest rate

- Interest-only payments during a draw period (usually 5–10 years)

- Repayment phase follows, with principal + interest

- Best for ongoing or unpredictable costs, such as tuition, phased home improvements, or medical bills

- Like a home equity loan, it leaves your existing mortgage untouched

Check out our guide to HELOCs to learn more.

Both HELOCs and home equity loans create a second mortgage, meaning you’ll make payments on top of your existing mortgage—and risk foreclosure if you fall behind.

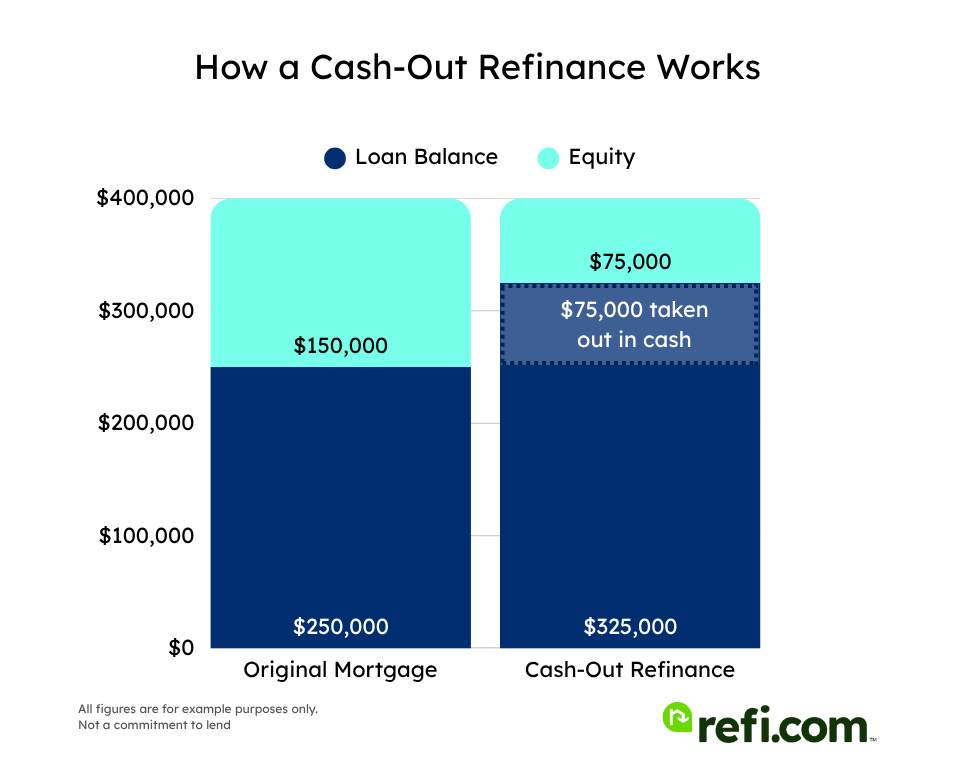

3. Cash-Out Refinance

- Replaces your existing mortgage with a new, larger one

- You receive the difference between your old loan and the new loan as a lump sum

- Best for larger expenses like full-home renovations or paying off high-interest debt across multiple sources

- Also useful if you want to change your mortgage terms, like switching from an ARM to a fixed-rate loan or shortening your repayment timeline

Unlike home equity loans and HELOCs, a cash-out refinance modifies your original mortgage.

It might be a smart move if your new rate is favorable or you’re looking to simplify your finances. But if you locked in a low mortgage rate in recent years, you’ll likely want to preserve that rate—making a home equity loan or HELOC a better fit.

| Option | Best For |

| Home Equity Loan | One-time expenses with fixed costs and the need for predictable payments |

| HELOC | Flexible or phased expenses like tuition or multi-stage renovations |

| Cash-Out Refinance | Large balances, major renovations, or borrowers looking to change mortgage terms |

Good Reasons to Use Home Equity

Experts agree: home equity is best used to improve your financial position or enhance the value of your home.

That might mean investing in property upgrades, eliminating high-interest debt, funding education, or weathering a financial emergency.

These are all uses that help preserve your long-term financial health—or even grow your wealth.

Home Improvements

Using equity to invest back into your home is widely seen as one of the smartest moves. Renovations like kitchen upgrades, bathroom remodels, or new roofs not only enhance comfort—they can increase your home’s value.

If you sell down the line, you may recoup some or all of the cost. And if the project qualifies as a “substantial improvement,” your interest could be tax-deductible.

Emergencies

Unexpected medical bills, job loss, or helping a family member through a crisis can justify using home equity—especially if you need access to a large amount quickly and want to spread out repayment over time.

Keep in mind that you may no longer qualify for the loan if you lose your job. That’s why it’s a good idea to open a zero-balance HELOC while you have a job if you see shaky employment in your future.

Debt Consolidation

Refinancing high-interest debt using your home equity can be a smart way to save on interest and simplify your finances. Whether you use a home equity loan, HELOC, or cash-out refinance, the key is having a clear strategy and repayment plan.

While a cash-out refinance might raise your mortgage interest rate, it can still offer substantial monthly savings—especially for homeowners with large balances on high-interest credit cards or personal loans.

For many borrowers, the overall savings outweigh the cost of a higher mortgage rate.

One way to evaluate the trade-offs is by calculating your blended interest rate—a weighted average of the interest rates across all your current debts.

For example, someone with a $200,000 mortgage at 4% and $40,000 in credit card debt at 22% has a blended rate of 7%. A HELOC or cash-out refinance might reduce their blended rate.

Pro: You’ll likely pay far less in interest than with credit cards or personal loans—and may free up hundreds in monthly cash flow.

Caution: Don’t treat your cleared credit cards as free space to spend. Without a firm payoff plan, you could end up deeper in debt.

Education Expenses

Some homeowners use equity to help pay for college. This can be especially helpful if federal or private student loan terms are unfavorable. HELOCs work well here since tuition is typically paid in installments—you only borrow what you need.

Launching or Growing a Business

Tapping equity to fund a business can make sense if you have a clear plan and expect returns that outweigh the cost of borrowing. Just make sure your income is stable enough to keep up with loan payments if things take longer than expected.

Bad Reasons to Use Home Equity

Luxury Purchases (Cars, Boats, Jewelry, Vacations)

Equity should be used to build long-term value—not to fund depreciating assets or short-term splurges. Taking on long-term debt for something that loses value (or disappears altogether) is rarely worth the risk.

Monthly Budget Gaps

Using home equity to patch monthly shortfalls is a red flag. If your budget is already stretched thin, adding another payment could make things worse. Unlike defaulting on a credit card, falling behind on a home equity loan or HELOC puts your house at risk.

Speculative Real Estate or Investments

Banking on your home’s value always rising—or trying to fund investment properties or risky ventures—can backfire if the market cools. If home values drop, you could end up underwater (owing more than the home is worth).

Lenders can also freeze or reduce HELOC access if your home’s value declines significantly.

Borrowing More Than You Need

If you’re approved for more than you actually need, don’t feel obligated to use it all. Taking extra “just in case” opens the door to overspending—and you’ll still pay interest on the full amount with a home equity loan.

For HELOCs, make sure your draw plan includes early principal payments. Waiting until the repayment phase can create payment shock when interest-only payments jump.

Credit Score Blind Spots

Taking out a large home equity loan can temporarily lower your credit score, which may affect future borrowing. Make sure you understand the short-term impact and how repayment behavior can help recover your score over time.

Related: What Credit Score Do You Need to Refinance Your Mortgage?

Risks of Tapping Home Equity

Borrowing against your home comes with serious consequences if not managed properly. Here’s what to keep in mind:

- Foreclosure risk: Defaulting on a home equity loan or HELOC could result in the lender initiating foreclosure, just like with a primary mortgage.

- Home value declines: If the housing market dips, you could find yourself owing more than your home is worth—especially if you borrowed near your maximum allowed equity.

- Loss of flexibility: Tapping equity now means you may have fewer options later if you want to refinance, sell, or tap more equity for future needs.

- HELOC access freezes: In some cases, lenders may freeze or reduce your HELOC if your home value drops significantly, cutting off access to the remaining credit line.

Being aware of these risks can help you decide whether tapping into equity is truly the best move—or whether you should explore other options.

How to Apply for a Home Equity Loan, HELOC, or Cash-Out Refinance

Ready to move forward? Here’s how to get started:

Check your equity

Use an online calculator or speak to a lender to estimate how much you can borrow.Compare your options

Review rates and terms across home equity loans, HELOCs, and cash-out refinances.Shop lenders

Don’t settle for the first offer. Compare multiple lenders to find the best rates, fees, and terms.Apply online

Gather your documentation, get prequalified, and submit your application.

Alternatives to Tapping Home Equity

If you’re unsure about borrowing against your home, or if the risks feel too high, here are a few alternatives to consider:

- Save gradually: For home upgrades or tuition, consider creating a dedicated savings plan—even if it takes longer, it avoids debt entirely.

- Borrow from family or friends: If available, this can offer more flexible repayment terms—just be sure to formalize the agreement in writing to avoid future conflicts.

- Personal loans: While they usually have higher rates than home equity products, they don’t require your home as collateral.

- Grants or low-interest assistance programs: For home improvements, some local or federal programs offer funding or financing options that don’t require tapping equity.

- Cut back or defer: If the expense isn’t urgent, delaying your project or scaling it down could eliminate the need to borrow altogether.

These options aren’t always ideal—but they can help protect your home and reduce long-term financial risk if equity borrowing doesn’t feel like the right fit.

See How Much Equity You Can Access

Tapping your home equity can be a smart move when it’s used strategically. Focus on high-impact, value-building goals like renovations, education, or debt consolidation with a clear payoff plan. Avoid using equity for impulse purchases or to cover chronic budget gaps.

Whichever route you choose—a home equity loan, HELOC, or cash-out refinance—borrow only what you need, and make a plan to repay it. Because at the end of the day, your home is on the line.

Want to see how much equity you can access? Start your application with Refi.com today.