Can I Get a HELOC After Refinancing?

Yes, you can get a home equity line of credit (HELOC) after refinancing your mortgage. There’s no universal rule that prevents it—but some lenders may require you to wait a few months before applying. That’s especially true if you just completed a cash-out refinance or your credit score took a temporary dip during the process.

If you need extra funds for a renovation, debt consolidation, or another major expense, a HELOC can still be an option—even shortly after a refinance. This guide explains what to expect, when to apply, and how a recent refinance might affect your eligibility.

- You can get a HELOC after refinancing, but some lenders may require a short waiting period—often around six to twelve months—before approving your application.

- Your eligibility for a HELOC depends on factors like home equity, credit score, and debt-to-income ratio, all of which may be affected by your recent refinance.

- A HELOC can be a flexible, lower-cost alternative to a cash-out refinance, but it’s best suited for borrowers with stable finances and a clear purpose for the funds.

How Soon After Refinancing Can You Get a HELOC?

Here’s the good news: There is no federally required minimum time you have to wait after refinancing before pursuing a HELOC. However, some lenders require what’s called a “seasoning period” following a refi before they will approve a HELOC. This period can span from six to 12 months after you close on your refinance loan.

Lenders typically want to see that your financial situation is stable after a refinance and that you’re not taking on too much risk by over-leveraging your home. Waiting at least six months before applying for a HELOC can give your credit score time to recover and allow you to build more equity, improving your chances of approval.

In practice, waiting a few months allows your credit score to recover from the hard inquiry during the refinance process, improving your chances of securing a favorable HELOC offer. Fortunately, some lenders may waive this seasoning requirement and waiting period entirely if your financial profile is particularly strong.

3 Key Factors That Affect HELOC Eligibility After a Refinance

Many criteria can impact your ability to qualify for a HELOC, including your earnings, job stability, and credit and payment history. But three of the biggest factors are the amount of equity you have in your home, your credit score, and your debt-to-income ratio (DTI).

How a Refinance Can Impact Your Eligibility

Many criteria can impact your ability to qualify for a HELOC, including your earnings, job stability, and credit and payment history. But three of the biggest factors are the amount of equity you have in your home, your credit score, and your debt-to-income ratio (DTI). Here’s a breakdown of each of these three.

1. Home Equity: Do You Have Enough?

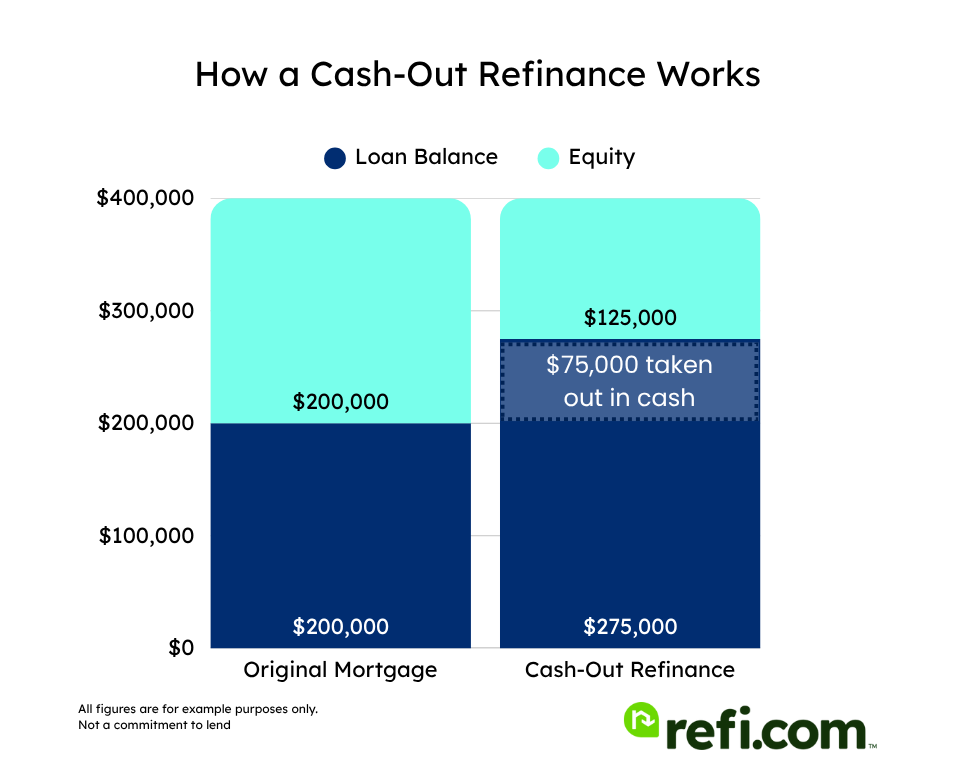

If you recently completed a cash-out refinance, this reduces the equity accrued in your home, which could limit the amount you would qualify for via a HELOC. A cash-out refi decreases your home equity by replacing your existing mortgage with a larger loan, allowing you to take out part of your equity as cash.

Minimum equity requirements: To be approved for a HELOC, you usually need at least 15% to 20% equity accrued in your home, though this can vary depending on the lender. If your equity drops below 20%, many lenders may hesitate to offer a HELOC because there is less cushion in the event of a loan default.

Be aware that, to be approved for a HELOC, you usually need at least 15% to 20% equity accrued in your home. However, this can vary depending on the lender.

2. Debt-to-Income Ratio: Can You Handle More Debt?

Second, if your refinance was a cash-out refinance, it may have increased your total loan balance, which may raise your monthly mortgage payment and, thus, your debt-to-income (DTI) ratio. Lenders use your DTI to assess how well you can manage monthly payments, and a higher ratio could make it harder to qualify for a HELOC.

Your DTI is calculated by dividing your total monthly debt payments by your gross monthly income (your income before taxes and deductions). Different lenders have different DTI limits for HELOCs, but many cap it around 43%.

To calculate your DTI, add up all your monthly debt payments and divide them by your gross monthly income. For example:

| Debt | Payment |

| Mortgage | $1,500 |

| Car loan | $400 |

| Credit Card Min. Payments | $100 |

| Total Debt Payments | $2,000 |

| Gross Income | $6,000 |

| DTI Ratio | 33% |

The highest DTI ratio that lenders typically permit for a HELOC will vary by lender but is generally around 43%.

3. Credit Score: How Will Your Refinance Affect It?

Refinancing a mortgage can affect your credit score both in the short and long term. When you apply, the lender performs a hard inquiry. This may temporarily lower your score by around 5 to 10 points, though your score typically bounces back within a few months.

Additionally, a refi closes your old mortgage and opens a new one; this could reduce the average age of your credit accounts, slightly lowering your score, especially if the old account was one of your oldest.

Many HELOC lenders require a credit score of at least 660 to 700, though some may accept scores as low as 620. Refi.com typically requires a 620 credit score.

When Does It Make Sense to Get a HELOC After Refinancing?

Generally, it might be a good idea to get a HELOC after a recent refinance in the following cases.

You Have a Low First Mortgage Rate

A HELOC can be a smart financing option nowadays for the right candidates, according to Ralph DiBugnara, president of Home Qualified.

HELOCs are second mortgages, where the first mortgage is not changed. This has become more desirable recently because of the large number of homeowners who have low rates on their first mortgage. HELOCs operate as a credit card on your home. You only pay on what you spend – not the total credit line you have available – and you can take money off that line for, in many cases, 10 years.

After those 10 years, that line of credit is closed, and there is commonly a 10-year payback period.

If, after refinancing your first mortgage, you still want access to the remainder of your available equity without paying on the whole amount, a HELOC makes a lot of sense.

When You Want To Access Additional Cash

Getting a HELOC after refinancing can be worthwhile if your home’s equity has increased. Your equity goes up as you continue to pay down your mortgage principal balance and after you make key home improvements that increase your home’s value.

With time, continued mortgage payments and home appreciation can increase your equity, boosting your chances of qualifying for a HELOC.

When You Need Flexibility

It can also make sense to get a HELOC following a refinance if you need flexibility for future expenses. For example, if you have refinanced to a lower interest rate but still have significant equity left in your home, you can use a HELOC to fund a home renovation, consolidate high-interest debt, or cover unexpected expenses like costly medical bills.

Indeed, a HELOC can be ideal for paying for many different things, such as a kitchen or bath redo, home addition, major home repair, college tuition, wedding expenses, funding a new business, purchasing an investment property, and paying down medical debt. Your HELOC funds can be used for virtually any legal purpose without restriction.

Borrowers who want access to liquid cash without taking on the full debt immediately, as they would in a cash-out refinance, are good candidates for a HELOC.

When You Don’t Want to Refinance Yet Again

Considering that you recently closed on a refinance loan, a HELOC is also a better choice than pursuing a cash-out refinance so soon after your last refinance. That’s because closing costs for a HELOC are usually much lower than for a cash-out refi, with some having little to no closing costs and some lenders even waiving them.

In contrast, a cash-out refinance typically comes with closing costs that range from 2% to 6% of the loan amount, depending on the lender and loan terms.

But It’s Not a Good Idea If…

On the other hand, a HELOC is generally not advisable if you plan to use the cash for discretionary spending on items like a costly getaway trip, a luxury purchase, a new vehicle, or just to have extra pocket money. Remember that you’ll have to put your home up as collateral for the HELOC, and you could lose your property if you default.

Also, there may be better financing options that are less costly.

Additionally, if you have inconsistent earnings, poor job security, a high DTI, or a low equity position in your home, you’re not a good candidate and will likely be turned down by lenders. And be aware that HELOCs typically have adjustable rates, so if you don’t think you’ll be able to pay off the balance relatively quickly, you may not want to incur the risk of costly interest rates.

Things to Consider Before Getting a HELOC

Prior to committing to a HELOC, think carefully about the total cost of borrowing, including the interest rates and possible fees. HELOC rates are tied to the prime rate, which will probably be slightly higher than the market rate and fluctuate with the market.

In a higher mortgage rate environment, HELOCs can become very expensive.

Because of the unpredictability of your future HELOC rate, which could increase your payments over time, you should also evaluate your future income. In addition, check your home’s current equity: If your home value decreases after you take out a HELOC, you could owe more than your house is worth, putting you at risk for being underwater on your loans.

It’s important, as well, to check whether the combined debt from your refinance and HELOC will push your DTI ratio higher than preferred, as this could limit your financial flexibility in the future.

As is true of any financial choice, you need to carefully evaluate your own personal situation to determine if applying for a HELOC makes sense based on your needs, goals, and risk tolerance.

Speaking with a mortgage professional can help you review your options and make an informed decision.

Other Ways to Access Home Equity

This isn’t a case of all-or-nothing: A HELOC is far from your only option when you need extra funds. The pros recommend the following alternative ways to tap into your home’s equity:

- A cash-out refinance. Here, you can refinance your mortgage and take out equity as cash, although this means resetting your mortgage and paying 2% to 6% in refinance closing costs. But you will likely pay a lower rate—and a fixed one, at that—than you would for a HELOC.

- A home equity loan. This option also liquidates home equity but provides a lump sum at closing with a fixed interest rate instead of a revolving credit line with variable rates. And, as with a cash-out refi, you may pay closing costs ranging from 2% to 6%.

- A reverse mortgage. Available to homeowners aged 62 or older, this allows you to convert part of your home’s equity into cash without selling. You can receive the money as a lump sum or in monthly payments, and the interest rate can be either fixed or adjustable. You don’t have to pay back the loan until you sell your home, refinance, move out permanently, or pass away. At that time, you or your heirs will need to pay off the loan and any interest all at once.

Taking the Next Step

Now that you’re more aware of how a HELOC works, eligibility requirements, and when it’s worth it, you can make a more informed decision about this financing option. If you’re determined to get a HELOC, prepare to complete a few key steps.

Think a HELOC might be right for you? Start exploring your options with Refi.com today.