What Is a Cash-Out Refinance and How Does It Work?

- A cash-out refinance replaces your existing mortgage with a new, larger loan, allowing you to pocket the difference in cash.

- Most lenders let you borrow up to 80% of your home’s value, minus what’s owed on your current mortgage.

- It’s best to use the money for value-adding investments like home improvements or debt consolidation since you’re using your home as collateral.

If you’ve built up equity in your home over the years, you might be sitting on a valuable financial tool without realizing it. A cash-out refinance lets you tap into that earned equity by replacing your current mortgage with a new, larger loan — putting the difference in your pocket as cash.

You can potentially get better terms on your new mortgage while also accessing the money tied up in your home for home improvements, consolidating high-interest debt, and other financial goals. But like any financial decision, it’s crucial to understand how it works and whether it’s the right choice for your situation.

What Is a Cash-Out Refinance?

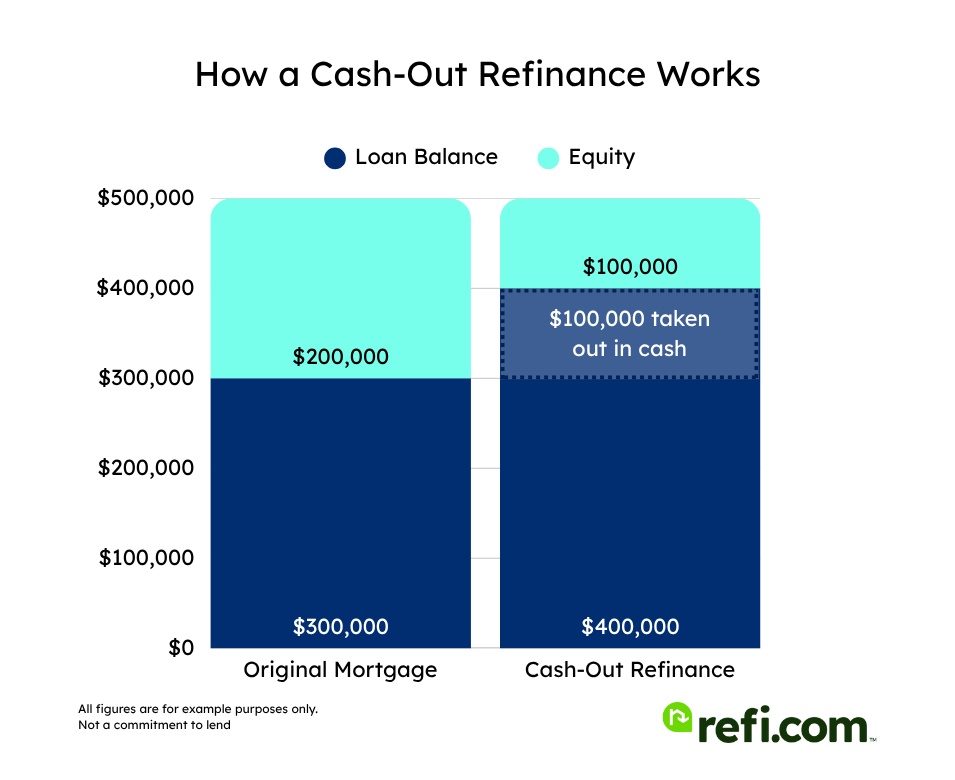

A cash-out refinance is a type of mortgage refinance where you replace your current loan with a new, larger one and take the difference in cash. The amount you can borrow depends on how much equity you’ve built in your home. You can use the funds for virtually anything — from home renovations to paying down debt or funding major expenses.

Experts often recommend putting the money toward value-adding investments, such as remodeling your home or consolidating high-interest debt, to improve your overall financial health.

How Much Cash Can You Get?

Most lenders allow you to borrow up to 80% of your home’s value, though some loan types, like VA cash-out refinances, may allow you to tap 100% of its value. Here’s how to calculate your maximum cash-out amount:

- Multiply 80% by your home’s current value

- Subtract your current mortgage balance

- Subtract closing costs

For example, if your home is worth $500,000:

- 80% x $500,000 = $400,000

- Current mortgage balance = $300,000

- $400,000 – $300,000 = $100,000 maximum cash-out amount (minus closing costs)

Adjusting Your Terms with a Cash-Out Refinance

As with all refinancing, you’re taking out a new mortgage with a cash-out refi. That means your interest rate will change along with your loan term and monthly payment. And unless you shorten your term, you’re restarting the clock on interest payments if you take out a longer loan term than what you currently have.

Additionally, you can switch loan types, such as moving from an FHA loan to a conventional cash-out refi, or ditching an adjustable-rate mortgage for a more predictable fixed-rate loan.

How Does a Cash-Out Refinance Impact Your Monthly Payments?

You might be thinking, “Higher loan balance means higher payments.” But, that’s not necessarily true. The impact a cash-out refinance has on your monthly payment will be based on several factors, including:

- How your interest rate changes. Lowering your interest rate often comes with lower payments.

- Repayment terms. Refinancing resets your loan term. While you can often choose between several different term lengths, refinancing into a new 30-year loan could lower your payment.

- How much equity you cash out. You don’t have to cash out the maximum amount. The less you borrow, the less your payment will be. And, even if you do the full 80% cash-out, that’s still only 80% of the home’s value. If you originally put less than 20% down, you may still be borrowing less than your original loan amount.

Let’s take a look at an example of a homeowner with a mortgage balance of $220,000 left on a $285,000 loan. In this scenario, the house they bought for $300,000 has appreciated to $350,000.

| Loan Terms | Original Purchase | New Cash-Out Loan |

| Value | $300,000 | $350,000 |

| Loan to Be Refinanced | N/A | $220,000 |

| Loan Amount | $285,000 | $280,000 |

| Cash Out | N/A | $60,000 |

| Interest Rate | 7% | 5% |

| Principal & Interest | $1,896 | $1,503 |

In this example, the homeowner lowered their interest rate, reset the loan term to 30 years, and received a smaller initial loan balance ($280,000 instead of the original $285,000). In the process, they lowered their monthly payment by nearly $400 while still pocketing $60,000.

Alternatively, let’s look at a scenario where the homeowner had a lower interest rate to begin with, but needs a cash-out refinance during a period of higher interest rates to address an unexpected financial need.

In this example, the homeowner has paid a $380,000 mortgage down to $300,000 and their $400,000 home has appreciated to $500,000.

| Loan Terms | Original Purchase | New Cash-Out Loan |

| Value | $400,000 | $500,000 |

| Loan to Be Refinanced | N/A | $300,000 |

| Loan Amount | $380,000 | $400,000 |

| Cash Out | N/A | $100,000 |

| Interest Rate | 4.5% | 7% |

| Principal & Interest | $1,925 | $2,398 |

In this scenario, the homeowner raised their interest rate significantly and took the max cash-out. Even with a reset loan term of 30 years, their monthly P&I payment still increases by over $400.

Each borrower’s individual scenario will be different, so be sure to run your numbers thoroughly before moving forward.

Common Uses for a Cash-Out Refinance

While there are no restrictions on what you can use cash-out refinancing for, financial experts recommend you put the money toward investments that will improve your financial situation. However, if you use a cash-out refinance for any purpose other than to “buy, build, or substantially improve” your home, you won’t be able to deduct the mortgage interest paid on the cash-out amount, according to the IRS.

Here’s a closer look at some savvy ways to use the funds:

- Home Improvements: Redoing your kitchen, updating bathrooms, or adding square footage can increase your home’s value, modernize your spaces, and add more usable living space.

- Debt Consolidation: Credit card interest rates are often north of 20%. If you’re drowning in high-interest credit card debt, tapping your home’s equity to pay off those bills can add more room to your monthly budget for other expenses. Plus, the interest rate on a cash-out refinance (around 7% to 8% at the time of writing) is significantly lower than current credit card rates.

- Education Expenses: Funding college tuition or professional development programs can be a great investment in your future — and your earning potential. You might be able to score a lower interest rate through a cash-out loan versus a student loan.

- Real Estate or Business Investments Tapping equity to invest in a new business or a rental property that can pay for itself might also be a good use of cash-out funds with the right investment decisions.

- Emergency Expenses: While not ideal, cash-out funds might help you cover unexpected large expenses at lower borrowing rates than you’d get for a personal loan or by putting those items on a credit card.

Step-by-Step Guide to How a Cash-Out Refinance Works

1. Evaluate Your Need and Eligibility

Before starting the cash-out refi process, ask yourself:

- How much cash do you need?

- What will you use it for?

- Can you afford the new monthly payments?

- Do you have enough equity?

- Do you have enough money in emergency savings to cover your new payment if you unexpectedly lose your job or income?

2. Shop for Lenders

Don’t just go with your current mortgage servicer. Get quotes from at least three or four different lenders to ensure you’re getting the best deal. It’s wise to work with a lender experienced in the specific type of cash-out refinance you’re considering — whether it’s conventional, FHA, or VA — to ensure a smooth process and favorable terms. As you shop around, compare these items:

- Interest rates

- Closing costs

- Lender fees

- Cash-out limits

- Appraisal requirements

- Homeowners insurance rates

3. Apply for a Cash-Out Refinance

The application process mirrors a regular mortgage application. You’ll need to provide:

- 30 days’ worth of pay stubs

- Last two years of federal tax returns

- Most recent 60 days of bank statements

- Information about your current mortgage

- Property information and proof of homeowners’ insurance

4. Close on Your Loan

Closing typically takes 30-45 days. You’ll need to:

- Pay closing costs (usually 2-5% of the loan amount)

- Sign final paperwork

- Review all terms carefully

5. Receive Your Funds

You’ll typically receive your money within three business days after closing. The funds usually arrive via wire transfer to your bank account. Important note: The cash you receive isn’t taxable income — it’s a loan that must be repaid.

Requirements to Get a Cash-Out Refinance

Conventional lenders typically look for:

- Minimum credit score of 620 or higher (though requirements vary by lender and loan type. Refi.com requires a 660 credit score.)

- Debt-to-income ratio below 43%

- At least 20% equity remaining after the cash-out

- On-time payment history on your current mortgage

- Stable employment and income history for the last two years

Types of Cash-Out Refinances

You have a few options when choosing a cash-out refinancing loan type. For example, if you have a conventional loan and ample equity, you might choose to stick with a conventional cash-out refinance, or switch to an FHA loan if you don’t qualify for a conventional program.

Each loan type has its own requirements, benefits, and limitations. Your choice will depend on factors like your credit score, how much equity you want to tap, and whether you’re willing to pay mortgage insurance.

Here’s a breakdown of your options:

Conventional Cash-Out Refinance

Conventional cash-out refinancing is the most common type of refi loan. The best part? You can use it on primary residences as well as second homes and investment properties. Here are other key borrowing requirements:

- Typically requires good credit (620+), but 700+ gets you the best rates

- Maximum 80% LTV ratio on primary residences, and up to 75% LTV on second homes and investment properties with higher credit scores

- Allows DTI ratio up to 43% (and up to 45% for well-qualified borrowers)

- At least six months of seasoning on current mortgage

- Cash reserves to cover two to six months of new loan payments, depending on property type

FHA Cash-Out Refinance

FHA cash-out refinances offer more flexibility on qualifying requirements but tend to have higher borrowing costs and stricter occupancy rules. Here are other borrowing guidelines:

- More lenient credit requirements (580+). Refi.com requires a 620 credit score.

- Maximum 80% LTV ratio

- Requires lifetime mortgage insurance

- Good option for borrowers with lower credit scores

- Must be for primary residence that you’ve lived in for one year

- Property must meet FHA safety and habitability standards

- Upfront Mortgage Insurance Premium (UFMIP): 1.75% of base loan amount; annual MIP: 0.50-0.75% of loan amount, depending on loan term and LTV

- MIP is required for the life of the loan if LTV > 90%

VA Cash-Out Refinance

VA cash-out refinances offer great benefits for eligible service members and veterans, including competitive mortgage rates, no down payment and no mortgage insurance requirements. Here’s the lowdown on this cash-out option:

Eligibility Requirements:

- Valid Certificate of Eligibility (COE)

- Meet service requirements (90 consecutive days during wartime, 181 days during peacetime, or 6 years in National Guard/Reserves)

- Current or former spouse of service member who died in the line of duty or from a service-connected disability

Property Requirements:

- Up to 100% loan-to-value ratio* (one of the few programs allowing this)

- Must be owner-occupied or previously owner-occupied

- Home must meet VA property standards

*Not all lenders offer this. Many lenders cap it at 90%.

Financial Requirements:

- No minimum credit score from VA (though VA lenders typically require 580-620)

- Debt-to-income ratio flexibility (often up to 41%, but can be higher with compensating factors)

- Stable income and employment

- No late payments in the last 12 months

- Must pay VA funding fee (varies from 2.15% to 3.3% depending on use)

Special Considerations:

- Can be used to refinance any type of loan into a VA loan

- No monthly mortgage insurance required

- Option to roll closing costs into loan

- Must recertify occupancy if refinancing primary residence

No USDA Cash-Out Refinance

The USDA does not offer cash-out refinancing on its loans so if you’re looking to do one, you’ll need to choose from one of the above options. Alternatively, you can read about the USDA loan refinance options here.

Pros and Cons

All refinance options come with pros and cons that you should weigh before moving forward. For a cash-out refinance, the main pros and cons are:

Pros:

- Access to potentially large sums of money

- Lower interest rates than personal loans or credit cards

- Interest may be tax-deductible

- Opportunity to improve mortgage terms

- Flexible use of funds

Cons:

- Reduces your home equity

- Higher monthly payments

- Risk of foreclosure if you can’t make payments

- Closing costs can be significant

- Longer loan term means more interest paid over time

Cash-Out Refinance Alternatives

Before committing to a cash-out refinance, consider these alternatives:

Home Equity Line of Credit (HELOC)

A HELOC works like a credit card: You’re approved for a maximum credit limit and can borrow against it as needed during the “draw period,” typically 10 years. During this time, you only pay interest on the amount you borrow (not the full line). A HELOC uses your home equity as collateral, which makes it a second mortgage.

HELOCs are helpful when you need flexibility or have ongoing expenses like a home renovation project where costs might change. Since you keep your existing mortgage intact, HELOCs make sense so you can maintain a low interest rate.

The main catch? HELOCs usually have variable interest rates, so your payments could increase if rates go up. Additionally, after the draw period ends, you enter the repayment period and must pay back the principal plus interest.

Home Equity Loan

A home equity loan provides a lump sum with a fixed interest rate and fixed monthly payments. Unlike a HELOC, you get all the money upfront and start paying interest on the full amount immediately. However, like a HELOC, a home equity loan uses your home equity as collateral, making it a second mortgage.

Home equity loans are ideal for one-time, fixed expenses where you know exactly how much you need. The fixed interest rate provides payment stability, which can make budgeting easier. Like HELOCs, your existing mortgage stays the same.

However, home equity loans typically carry higher interest rates than cash-out refinances because they’re second liens, meaning they get paid after your primary mortgage if you default.

A home equity loan can be a strong alternative to a cash-out refinance when current interest rates are higher than your existing mortgage rate, allowing you to tap into home equity without refinancing your entire loan.

Compare Cash-Out Refinances Vs. HELOCs Vs. Home Equity Loans

| Feature | Cash-Out Refinance | HELOC | Home Equity Loan |

| Interest Rate | Usually lowest | Variable, typically higher | Fixed, typically higher than cash-out refi |

| Payment Structure | Single monthly payment to lender | Interest-only payments during draw period; principal and interest during repayment period | Fixed monthly payments |

| Disbursement | Lump sum | As needed (up to credit line) during draw period, about 10 years | Lump sum |

| Impact on First Mortgage | Replaces it completely | Keeps it intact (second mortgage) | Keeps it intact (second mortgage) |

| Closing Costs | 2% to 5% of loan amount | 0% to 5% of loan amount, depending on the lender | 0% to 5% of loan amount, depending on the lender |

| Best For | Long-term financing needs when your existing mortgage rate is higher than current market rates | Ongoing projects or uncertain expenses when your existing first-lien mortgage rate is low | Fixed, one-time expenses when your existing first-lien mortgage rate is low |

Is a Cash-Out Refinance Right for You?

A cash-out refinance can be a wise use of the equity you’ve built in your home in certain situations. A cash-out refi makes the most sense when:

- You plan to stay in your home long-term.

- You can get a lower interest rate than your current mortgage.

- You have a specific purpose for the money.

- You can comfortably afford the new, higher payments.

- The benefits outweigh the closing costs.

Consider your long-term financial goals, current mortgage terms, interest rates, and intended use of the funds. Remember, you’re using your home as collateral; make sure the benefit is worth the risk of potentially losing your home if you can’t afford payments in the future.

Ready to get started? Apply for a cash-out refinance with Refi.com today.