How to Refinance an Investment Property

Are you considering refinancing your investment property but aren’t sure where to start? You’re not alone. Census data shows that 68.7% of rental properties are owned by individual investors, with many newer landlords having little experience refinancing residential real estate apart from their own homes.

But while the mortgage options and eligibility requirements to refinance an investment property can differ from primary residences, the overall experience is much the same.

Key Takeaways

- Refinancing an investment property is a lot like refinancing your personal home, although you’ll likely encounter stricter borrower requirements.

- Mortgage companies offer a variety of refinance options for investment properties, including rate-and-term, cash-out, and renovation refinances.

- You can use the income generated by your rental property to help you qualify for your new loan.

Can You Refinance an Investment Property?

Yes, you can refinance an investment property, both single-family homes and multi-unit residences, regardless of whether you have long-term tenants or offer short-term rentals through platforms such as Airbnb and Vrbo.

However, while plenty of lenders offer investment property refinances, they’ll typically have stricter requirements than if you were refinancing your primary residence.

This can include needing a:

- Higher credit score

- Lower debt-to-income (DTI) ratio

- Greater amount of existing equity

- Larger balance of reserve funds

Note: Government-backed mortgages – loans insured by the FHA, VA, and USDA – are designed for owner-occupied homes and typically aren’t available for investment properties. There are a couple of exceptions, though, which we’ll cover a little further down.

Why Refinance an Investment Property

Investors seek to refinance their investment properties for all sorts of reasons.

Some hope to reduce their monthly costs to improve cash flow and pocket more of their rental income. Others want to borrow against their built-up equity to consolidate debt or make a big-ticket purchase, such as a new vehicle or family vacation.

It’s also common for investors to use the proceeds from a cash-out refinance to buy another home and expand their investment portfolio. The typical down payment on a rental property is 27.4%, according to the National Association of Realtors, and refinancing can be a good source of those funds.

Want to make significant repairs or improvements to command a higher level of rent? Refinancing can provide you with the resources to do so without needing to come out of pocket for tens of thousands of dollars.

Investment Property Refinance Strategies

Property owners have a variety of refinance strategies available, each suited to meet different refinancing goals. Let’s go over some of the most popular investment property refinance options.

Rate-and-Term Refinance

Rate-and-term refinances allow you to lower your monthly payments by reducing your interest rate or extending the term of your loan. They can also be used to switch between fixed-rate and adjustable-rate mortgages, providing payment stability or allowing you to adapt to changing market conditions.

Want to shorten your repayment schedule to pay off your mortgage and own your investment home free and clear sooner? You can use a rate-and-term refinance for that, too.

If interest rates have dropped, your financial situation has improved, or you’ve gained considerable equity in your property since you took out your current loan, a rate-and-term refinance can be an effective way to reduce your monthly mortgage costs.

Note: Refinancing can lead to higher finance charges over the life of the loan.

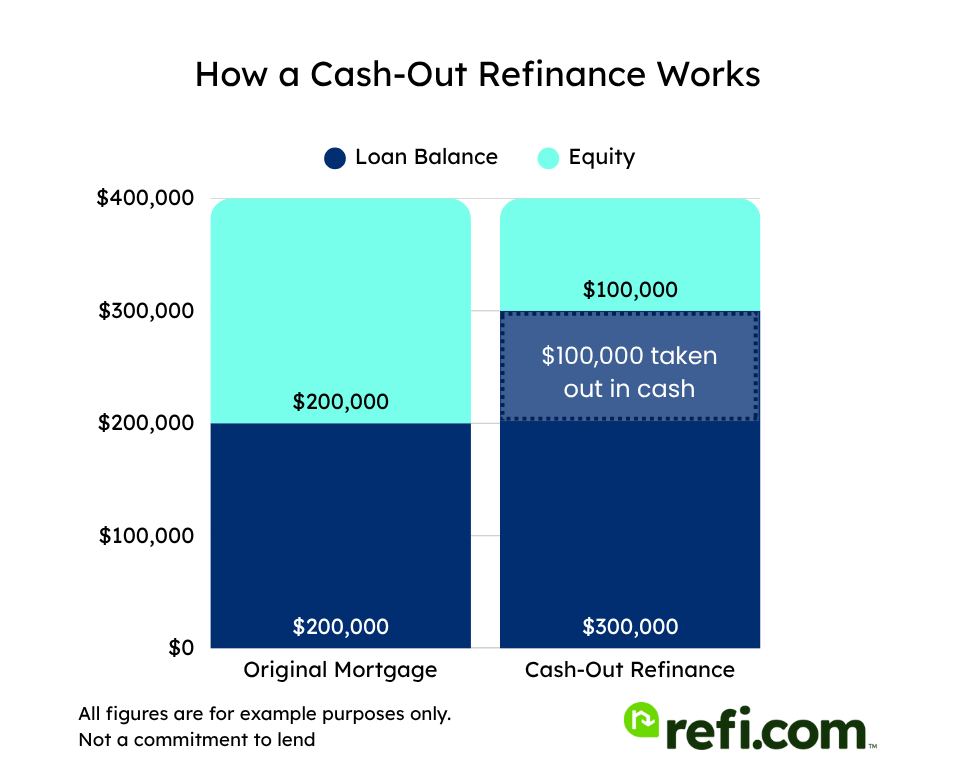

Cash-Out Refinance

A cash-out refinance offers the same ability to adjust the terms of your mortgage as a rate-and-term loan but with one added benefit: you can borrow against your property’s built-up equity and receive a lump sum of cash as part of the closing process.

These funds can be used for just about anything you choose, such as:

- Consolidating other high-interest debts (the most common reason for a cash-out refi, according to the Consumer Financial Protection Bureau)

- Expanding your portfolio by investing in more real estate

- Making a big-ticket purchase such as a new vehicle or family vacation

- Paying for a major life event like a wedding or college tuition

- Funding improvements to your rental property or primary residence

- Seeding a new separate business venture

Keep in mind, however, that because you’re increasing the size of your mortgage, cash-out refis typically have tougher eligibility requirements and slightly higher interest rates than rate-and-term alternatives.

Renovation Refinance

Thinking about a cash-out refinance to make improvements to your investment property? You might want to consider a renovation refinance instead. Popular options for investors include the Fannie Mae HomeStyle Renovation and Freddie Mac CHOICERenovation mortgages.

These loans typically have lower interest rates than a cash-out refi. Plus, since the loan-to-value (LTV) ratio of renovation refinance mortgages is based on the property’s as-completed appraisal, you’ll have access to more funds for repairs.

However, there are a few downsides to consider:

- Only single-family investment homes qualify. Fannie Mae and Freddie Mac guidelines do not allow for renovation loans on investment properties with multiple residential units.

- Funds can only be used to renovate the subject property. You cannot receive money back at closing or make improvements to your primary residence or a different investment home.

- Unlike a cash-out refinance, a renovation refinance comes with greater lender oversight. This involves getting the improvement plan signed off on prior to closing and having the work completed by approved licensed contractors who will be paid directly by your mortgage company.

Refi.com does not currently offer renovation refinance loans.

DSCR Refinance

DSCR refinances are an option for property investors with strong cash flow who may struggle to qualify under traditional lending guidelines. These investment-focused mortgages are centered around your home’s debt service coverage ratio (DSCR) – the ability of the property’s net operating income (NOI) to cover its ongoing debt obligations.

Lenders measure your investment property’s DSCR by dividing its NOI by its total debt expenses. A ratio of 1 would represent a home with a net income equal to its debt obligations. Lenders typically look for a DSCR of at least 1.25.

Why would you want to refinance an investment property with a DSCR loan? The main advantage is flexibility. Since these mortgages focus on the investment’s income, it can be possible to refinance even if you have a:

- Low credit score

- High level of personal debt

- Less established equity

DSCR refinances come as both rate-and-term and cash-out loans. Refi.com does not offer DSCR refinances.

Requirements for Refinancing an Investment Property

Refinancing an investment property often means meeting stricter criteria than if you were taking out a loan for your primary residence.

The reason? Investments are riskier because borrowers in financial trouble are more likely to stop paying on a rental than their own home.

To combat this risk, lenders have more stringent guidelines to ensure that applicants are better qualified to refinance rental property.

Some standard requirements include:

- Credit score of 680 or higher (often 720+ for cash-out refinances)

- Maximum DTI ratio of 45%, although 36% or below is preferable

- At least 25% equity in the home, with multi-unit investors needing 30% remaining equity for a cash-out transaction

- At least six months of housing expenses in reserve after closing (up to 12 months in some cases) – investors with multiple financed properties may need even more

While there are hard limits with many of these requirements, mortgage companies often have the flexibility to make exceptions for borrowers with other positive compensating factors.

For example, some lenders may be willing to approve an investor with a credit score of 640 who has a DTI of 30% and 50% equity in their home. Likewise, someone with a debt-to-income ratio of 50% but a credit score of 800 may also be able to obtain approval.

Streamline Refinances for Rental Properties

A streamline refinance is a unique rate-and-term refi that does not generally require the borrower to verify their income, undergo a detailed credit check, or obtain a new appraisal on their home. However, conventional lenders don’t offer streamline refinances, meaning that most investment properties are not eligible for this type of loan.

There is one exception, though.

Rental owners who already have an FHA or VA-backed mortgage on their investment property are eligible for streamline refinances through these government agencies. This typically applies to borrowers who took out their current loans while they were living in the home, fulfilled the one-year occupancy requirement, and later converted the property into an income-generating investment.

Check out our guides to learn more about the FHA streamline and the VA streamline.

Documentation Needed to Refinance an Investment Property

The documentation needed to refinance an investment property through a conventional lender is similar to what you’d need to refinance your primary residence. For most borrowers, this will include:

- Proof of employment and income, such as recent pay stubs, W-2 forms, and filed tax returns; mortgage companies generally want to see two years of stable income history

- Two months of bank/investment account statements showing you have the funds to cover closing costs and any required reserves

- Documents pertaining to your current loan, including recent mortgage statements

- Proof of suitable homeowner’s insurance coverage

However, since you’re probably going to want to use the income generated by your investment property to help you qualify for your new loan, your lender will also ask for:

- Copies of current leases on your property

- Two years of Schedule E (Form 1040) tax filings showing relevant income receipts and expenses

You can use the income from both long-term and short-term (such as Airbnb or Vrbo) rentals to qualify for your refinance. However, some lenders may be more hesitant when it comes to rental properties without binding lease agreements.

Tips for Refinancing Your Investment Property

Since lenders have stricter requirements for investment properties than when it comes to primary residences, the best thing you can do to improve both your chances of being approved and the interest rate you’re quoted is to make your financial profile as low-risk as possible.

This means keeping eligibility factors in good standing by:

- Building a high credit score

- Paying off debts to improve your DTI

- Avoiding taking out or cosigning on other loans prior to refinancing

- Keeping healthy balances in your bank and investment accounts

You’ll also want to highlight the financial health of your investment property by maintaining comprehensive documentation, ensuring you’re charging market-level rent, and minimizing investment expenses (without sacrificing maintenance and upkeep).

Is Refinancing Your Investment Property Worth It?

Whether you want to lower your monthly payments to improve cash flow, change the rate structure of your loan, or access your rental home’s equity to expand your investment portfolio, refinancing your current mortgage can be an effective way to achieve your financial goals.

Ready to take the next step in refinancing your investment property? Apply today with Refi.com to see what mortgage options and rates you qualify for!