13 Important Questions to Consider Before Refinancing

Refinancing your mortgage can have many benefits. If interest rates have dropped, it can help you reduce your monthly mortgage payment.

It can also allow you to pay off your mortgage sooner. However, even though there are a lot of benefits to refinancing, it’s a big task, and it’s important to make sure it’s the right move for your financial situation. You’ll also likely have many refinancing questions along the way.

Keep reading as we dig into some of the most important questions to ask when refinancing your mortgage.

- Refinancing can help lower your monthly mortgage payment, shorten your loan term, or access home equity for various financial needs.

- Key factors to consider include interest rates, loan options, closing costs, and eligibility requirements such as credit score and home equity.

- Refinancing isn’t always beneficial—carefully weigh the costs and long-term savings to determine if it’s the right choice for you.

1. What Benefit Will I Get Out of This Refinance?

The biggest reason why most people refinance their mortgages is to save money. But that’s not the only reason. Here are some of the most commonly cited drivers for refinancing:

- Lower their monthly mortgage payment by lowering their interest rate and/or extending their loan term

- Lower lifetime interest costs by lowering their interest rate and/or shortening their loan term

- Access equity as cash for debt consolidation, home improvement projects, etc.

- Speed up the mortgage repayment process by shortening their loan term

- Eliminate FHA mortgage insurance by refinancing to a conventional loan

- Add or remove borrowers

- Add predictability to their repayment by refinancing from an adjustable-rate mortgage to a fixed-rate mortgage

Note that refinancing may result in higher finance charges over the life of the loan.

2. What Type of Loan Should I Refinance Into?

Refinancing is your chance to adjust your mortgage – this even includes the type of loan.

When refinancing, you’ll have multiple loan options, and the right one depends on your financial goals and eligibility:

- Conventional Loan – Ideal for those with strong credit and at least 3% equity; can eliminate FHA mortgage insurance. Read more about conventional loan refinance options here.

- FHA Loan – A good option for borrowers with lower credit scores; requires mortgage insurance. Learn about FHA refinance options here.

- VA Loan – Available to eligible veterans and service members; offers competitive rates and no PMI. Learn about VA refinance options here.

- USDA Loan – Designed for eligible rural homeowners; income and location limits apply. Streamline options exist for current USDA borrowers. Learn about USDA loan refinance options here.

- Jumbo Loan – Used for refinancing high-value properties above conventional loan limits. Learn about refinancing a jumbo loan here.

Your choice should align with your financial situation and long-term goals.

How we source rates and rate trends

Rates based on market averages as of Dec 02, 2025.Product Rate APR 30-year Fixed Refinance 6.35% 6.37% 30-year Fixed Jumbo Refinance 6.82% 6.84% 30-year Fixed Fha Refinance 5.56% 6.77% 30-year Fixed Usda Refinance 5.56% 5.70% 30-year Fixed Va Refinance 5.68% 5.82%

3. When Should I Refinance My Loan?

Many people wonder when the best time to refinance a mortgage is. The answer depends on several factors.

Have interest rates recently dropped? If so, you might be able to refinance today and lower your monthly mortgage payment. However, if you believe they could continue to fall, you might want to wait a little longer.

Another instance when it might make sense to refinance sooner rather than later is if you’re currently in an adjustable-rate mortgage and the fixed-rate period is about to end. Refinancing into a fixed-rate mortgage can give borrowers a more predictable monthly mortgage payment.

Because property values have increased significantly, many homeowners have more equity in their homes today than they did several years ago. If you’re currently paying for mortgage insurance but now have more than 20% equity in your home, refinancing today can help you eliminate your mortgage insurance payments.

Rather than trying to time the absolute bottom, run a break-even analysis and consider a float-down option if your lender offers one.

4. What Are My Options For Refinancing?

Before you refinance, it’s important to understand what type of refinance is best for your situation. While many different types of refinances are available, here are a few of the most popular.

Rate-and-Term Refinance

This is probably the most popular type of mortgage refinancing. With a rate-and-term refinance, you’ll change either the interest rate, the term on the loan, or both. For example, a rate-and-term refinance would be used if you want to take advantage of lower interest rates. It can also be used if you wish to switch from a 30-year loan to a 15-year loan or vice versa.

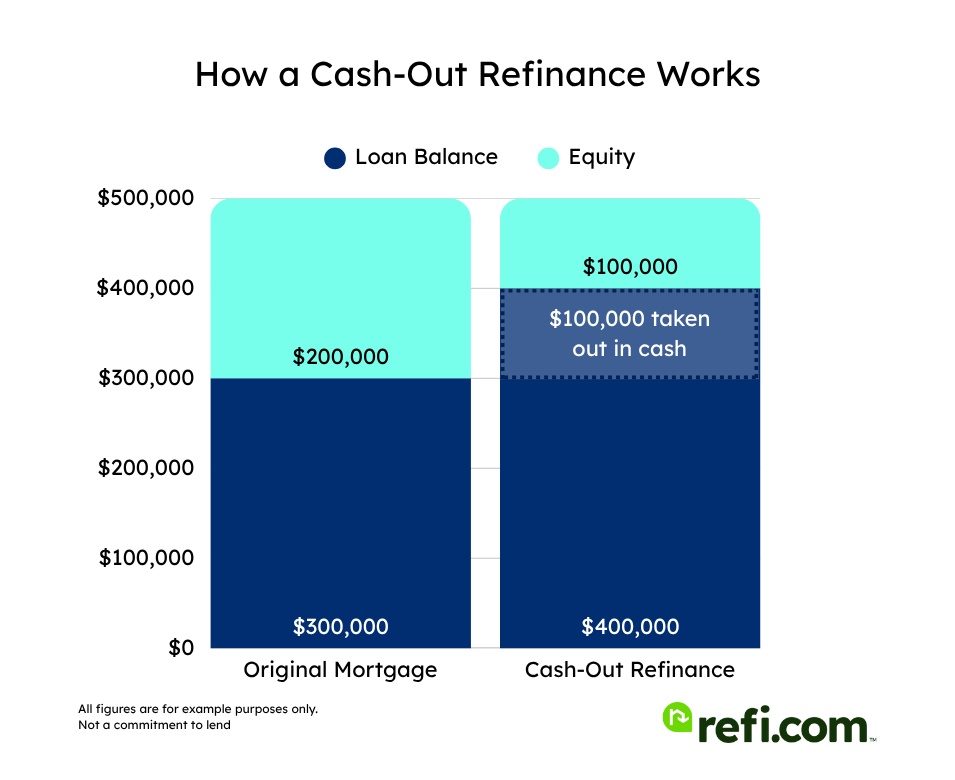

Cash-Out Refinance

If you want to access some of the equity in your home, you could use a cash-out refinance. The new loan amount would be for more than your current principal balance, and the difference would be given to you in cash. This could be used to pay off high-interest debt, complete a home improvement project, or for another use. The FHA and VA both have their own versions of cash-out refinances.

Streamline Refinance

If you have an FHA, VA, or USDA loan, you can choose to go through a streamline refinance. This can help you avoid some of the necessary paperwork and, in some cases, bypass needing an appraisal. Unfortunately, streamline refinancing is not available for conventional loans.

Learn more about these government-backed streamline refinance programs below:

- VA Streamline Refinance / Interest Rate Reduction Loan (IRRRL)

- FHA Streamline Refinance

- USDA Streamline Refinance

Renovation Refinance

A renovation refinance, such as the FHA 203(k) refinance loan, allows homeowners to finance home improvements into their refinance. This is beneficial for those who want to remodel or repair their home while taking advantage of a single loan.

5. Should I Buy Points to Lower My Rate?

Mortgage points, also known as discount points, are upfront fees paid to the lender in exchange for a lower interest rate.

- How they work: One point typically costs 1% of your loan amount and can reduce your interest rate by around 0.25%.

- When it makes sense: Buying points can be beneficial if you plan to stay in your home long enough to recoup the upfront cost through lower monthly payments.

- When to avoid: If you plan to move or refinance again in the near future, paying for points may not be worthwhile.

Calculate your months-to-break-even: (Cost of points) ÷ (Monthly payment savings). If you’ll keep the loan longer than that, points can pencil out.

6. Am I Eligible for a Refinance?

If you’re thinking about refinancing, the process will be very similar to when you took out your original mortgage. Only streamline refinances allow you to skip some steps, such as appraisals and sometimes credit, employment and income checks.

You’ll need to go through the underwriting process to ensure you’ll be a good borrower. Here are a few qualifications you’ll need to meet.

Credit Score

Lenders will require you to have a certain credit score when applying. However, the exact score will depend on the product and lender you’re using.

For conventional loans, a credit score of at least 620 is often required. To get the best rates possible, your score must be closer to 760.

HUD permits FHA refinances with credit scores as low as 500 when you have at least 10% equity, and 580+ for higher LTVs. Many lenders add overlays (often 600–620+). For example, Refi.com currently requires a minimum 620 FICO for FHA refinances.

Equity

The amount of equity you need to refinance depends on the loan type and the kind of refinance you’re pursuing:

- Rate-and-Term Refinance: Minimum equity requirements vary, but some conventional programs allow refinances with as little as ~3% equity on owner-occupied, single-unit homes (subject to underwriting and lender overlays). VA generally permits higher loan-to-value ratios, making them accessible options for eligible borrowers with limited equity.

- Cash-Out Refinance: Conventional and FHA lenders usually cap cash-out refinances at 80% loan-to-value (LTV), meaning you’ll need at least 20% equity remaining after taking cash out. VA guidelines allow up to 100% LTV, though many lenders impose stricter limits.

- Streamline Refinance: If you already have an FHA, VA, or USDA loan, streamline programs may not require a specific equity minimum since the refinance is limited to reducing your rate or adjusting terms.

Related: How much equity do you need to refinance?

Debt-to-Income Ratio

Debt-to-income (DTI) is how much your monthly debt payments are compared to your total income. Debt could include mortgages, car payments, student loans, credit cards, and more.

Lenders typically want to see your DTI at no more than 43%, but this varies by lender and loan program. And, compensating factors can also influence this.

Waiting Period

While the required amount of time will vary between lenders and loan program, most will require at least six months since you established your mortgage or last refinanced before you can refinance again. We cover waiting periods in further detail below.

Related: How soon can you refinance your mortgage?

7. What Are the Drawbacks to Refinancing?

While refinancing has many benefits, there are some negatives that you must be aware of before proceeding.

Closing Costs

When you refinance a mortgage, closing costs will be involved. Typically, this can be anywhere from 2% to 5% of the loan amount. Before moving forward with a refinance, it’s best to understand if the savings will be worth the cost. This can be done by figuring out the breakeven point – how many months it will take before the savings are greater than the cost.

If you’re not planning to stay in the home past the break-even point, then refinancing might not be worth it.

Drop in Credit Score

Because lenders will perform a hard inquiry on your credit report, there will be a slight drop in your credit score. Usually, the decrease is small and temporary.

FICO generally treats multiple mortgage inquiries within a shopping window (often ~45 days) as one inquiry for scoring purposes.

You Could End Up in Additional Debt

If you plan to cash out some of your equity to pay off debt, make sure you have a plan to avoid putting yourself into the debt situation again. The last thing you want is to continue spending more than you should and end up back in debt.

8. What Kind of Equity Do I Need To Have For Refinancing My Mortgage?

When refinancing your mortgage, most lenders require a specific amount of equity in the home. The exact amount will depend on the lender and the loan product.

For conventional mortgages, you’ll typically need at least 3% equity in your home. However, if you’re doing a cash-out refinance, lenders will require at least 20% equity after the refinance is complete. That means, if you own a home valued at $400,000, you must have no less than $80,000 equity left in the home after the cash is taken out.

The requirements are usually the same with FHA loans; however, with a VA loan, you can cash out up to 100% of the equity, meaning there are no requirements. This varies by lender.

9. When Can You Refinance a Loan?

If you recently took out or refinanced your mortgage and are thinking about doing it again, you should understand there are rules around “loan seasoning.” Depending on your specific loan, you might need to wait a certain number of days before you can refinance.

Let’s take a look at the requirements for common loan products.

| Rate-and-Term/Streamline | Cash-Out | |

| Conventional | No official waiting period. Varies by lender | 12 months |

| FHA | 210 days since first payment’s due date/6 consecutive on-time payment | 12 months |

| VA | 210 days since first payment’s due date/6 consecutive on-time payments | 12 months |

| USDA | 12 months/12 consecutive on-time payments | N/A |

| Jumbo | No official waiting period. Varies by lender. | No official waiting period. Varies by lender. |

10. Should I Refinance With the Same Lender?

One of the most important things you can do when refinancing is to compare lenders so you can find the best possible mortgage rates. Many also wonder if you can use the same bank to refinance your mortgage.

Luckily, the answer is yes. Your current lender should be one of the first you contact. Because they want to retain your business, they may be willing to give you a discount on your interest rate.

But, you should also shop around to at least three lenders, in total, to ensure you find the best deal. Be sure to ask questions like:

- Do you offer rate locks?

- Who will service the loan?

- How much are closing costs?

11. How Many Times Can I Refinance My Loan?

Theoretically, you could refinance as many times as you want as long as you wait the required amount of time and can afford the closing costs. However, even though you could refinance, it’s important to ensure it’s worth the cost beforehand. Determine how much refinancing will cost and what your savings will be.

If the numbers make sense, then refinancing would be a smart move.

12. What Will Refinancing Do To My Monthly Payment?

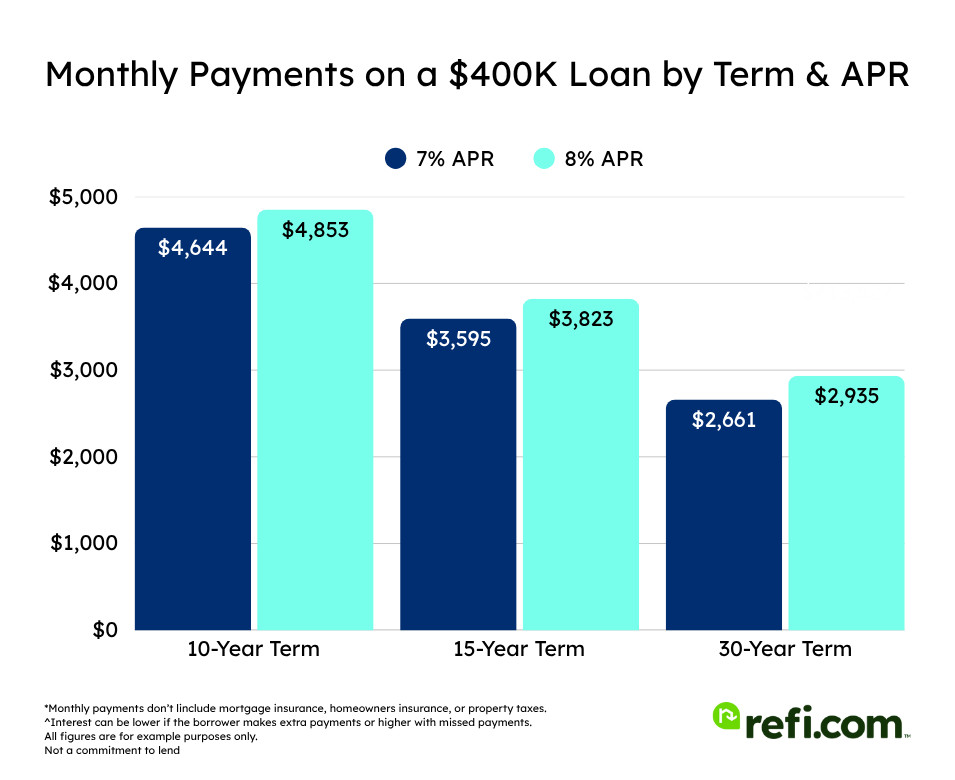

When you refinance your mortgage, the impact on your monthly payment will depend on several factors, such as your interest rate, the new term, and whether or not you take cash out.

If you go through with a rate-and-term refinance and lock in a lower interest rate, your monthly payment will likely be reduced.

However, if you change the terms of your loan from 30 years to 15 years, your mortgage payment will likely increase.

If you’re completing a cash-out refinance, your principal balance will be increasing since you’re pulling equity out of your home. This has the potential to increase your monthly payment.

However, if you’re also locking in a lower interest rate, this could reduce the amount your monthly payment goes up.

Check out our refinance calculator to see what a refinance could do for your monthly payment.

13. Will the Benefits Outweigh the Costs?

While refinancing offers many advantages, it’s crucial to ensure that the long-term savings justify the costs. Consider:

- Closing costs: Typically 2-5% of the loan amount.

- Break-even period: Calculate how long it will take to recoup closing costs through lower monthly payments.

- Loan term changes: A longer loan term could increase total interest paid, even with a lower rate.

- Future plans: If you plan to move soon, refinancing may not be worth it.

Ultimately, refinancing should align with your financial goals, providing meaningful savings or benefits over time.

Learn more about the pros and cons of refinancing and how to balance them here.

Final Thoughts on Refinancing

Refinancing your mortgage can offer a path to lower monthly payments, access to your home’s equity, or a shorter loan term. However, it’s essential to approach the process with clear goals and a strong understanding of your financial position.

Take the time to weigh the benefits and costs, evaluate timing, and carefully compare lender offers to find the best fit for your needs. With the right planning and guidance, refinancing can be a valuable tool to enhance your financial stability and make the most of your home investment.

When you’re ready to get started, get a quote with Refi.com.