Mortgage Recast vs. Refinance: How They Differ and How to Choose the Best Option

Whether you want to take advantage of a lower interest rate, liquidate home equity to pay for home improvements, or significantly shorten your mortgage term, refinancing can make a lot of sense. But it’s not your only option. You may want to consider a mortgage recast instead, depending on your financial goals.

The least you need to know:

- A mortgage refinance replaces your existing loan with a new one, potentially allowing you to secure better terms, but it comes with closing costs.

- A mortgage recast involves making a large lump sum payment toward your current loan, reducing monthly payments without changing the interest rate or loan term, and typically requires lender approval.

- Refinancing is ideal for those seeking long-term savings, loan term adjustments, or cash-out options, while recasting is better for borrowers who prefer to keep their current interest rate and avoid high closing costs.

- Alternatives to refinancing or recasting include making extra principal payments, pursuing a loan modification, using a home equity line of credit, or considering other financial investments.

Recasting vs. Refinancing: The Basics

A mortgage refinance involves replacing your current mortgage loan with a new one. This allows you to capitalize on a lower interest rate, change the loan’s terms, or access your home’s equity.

With a mortgage recast, on the other hand, you make a large payment toward the principal on your existing mortgage. Then, your lender will recalculate your monthly payments using only the new lower balance while keeping your existing interest rate and term intact. Think of it as a simple way to lower your monthly payment without refinancing.

Here’s a handy table that breaks down the differences between a refinance and a recast:

| Feature | Recast | Refinance |

| Lowers monthly payment | Yes | Yes |

| Changes interest rate | No | Yes |

| Requires large lump-sum | Yes | No |

| Closing costs | Small fee (~$200-$500) | Higher fees (2-5% of loan) |

| Good for paying off faster | No | Yes |

| Good for accessing home equity? | No | Yes (cash-out refi) |

Types of Refinances and How to Use Them

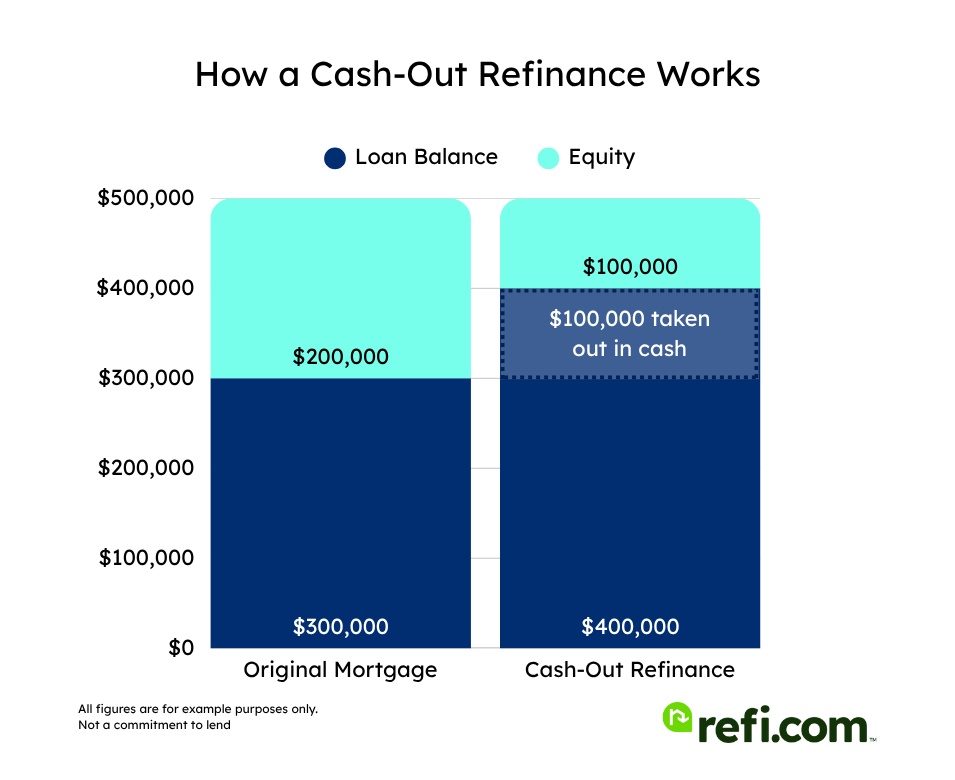

There are several different types of refinancing to choose from. These include a cash-out refinance, which allows you to borrow more than you currently owe, enabling you to liquidate home equity and pocket the difference in cash at closing.

There’s also a “cash-in” refinance, in which you bring extra money to the table to pay down your loan balance and qualify for a better interest rate. If you have a VA loan, USDA loan, or FHA loan, you may qualify for a streamline refinance, which can be accomplished more quickly than normal and with less paperwork. A no-closing cost refi, meanwhile, saves you from having to pay closing costs (which are bundled into the rate or principal borrowed).

But the most common type of refinancing is a rate-and-term refinance, which we will cover over the rest of this article. With a rate-and-term refinance, you pay off and replace your current mortgage with a new loan that has a lower interest rate and/or a shorter or longer loan term.

How we source rates and rate trends

Rates based on market averages as of Dec 02, 2025.Product Rate APR 15-year Fixed Refinance 5.37% 5.42% 30-year Fixed Refinance 6.35% 6.37%

This is ideal for borrowers who want to lower their monthly payment or pay off their loan faster.

You can choose to refinance with your existing lender or shop for a new one.

Refinance Eligibility

To refinance, you’ll need to qualify, just like you did for the original mortgage loan. Here are some of the eligibility requirements:

- A good credit score (620 or higher for conventional loans, 700 or higher for a lower rate)

- A stable income and job history

- A home appraisal to confirm the property’s value

- A low debt-to-income (DTI) ratio (ideally below 43%)

- A maximum loan-to-value (LTV) ratio of 97% (for a conventional rate-and-term refi)

- A clean title

- Sufficient homeowners insurance

- No history of recent bankruptcy or foreclosure

Refinance Costs and the Break-Even Period

Refinancing will come with closing costs, similar to what you paid for your first mortgage.

These closing costs can amount to between 2% and 6% of the loan amount. While a lower rate or shorter term may be ideal, it’s critical to ensure that you can afford the closing costs involved.

Case in point: if you want to refinance to a new $300,000 loan, expect to pay between $6,000 and $18,000 in closing expenses.

You’ll also want to consider the breakeven point. This is the amount of time it will take for the savings generated from a lower monthly payment after refinancing to cancel out the costs paid upfront.

“For instance, if you pay a total of $3,000 in closing costs to refinance on your monthly payment is lowered by $100, your breakeven point would be about 30 months,” notes Dennis Shirshikov, a professor of finance and economics at City University of New York/Queens College.

Using that same example, it wouldn’t make sense to sell your home before that 30-month mark. So it’s best to stay put until you at least reach the breakeven point.

Refinance Example

Let’s say you took out a $300,000, 30-year loan at a 7.25% fixed interest rate. Eight years later, you have $270,000 left to pay off. Your monthly principal and interest (P&I) payment is currently $2,047.

If you refinanced that remaining $270,000 at a 6% fixed interest rate over 30 years, your monthly P&I payment would drop to $1,619, saving you over $400 per month. Here, you’d be resetting and adding an extra 8 years to your repayment schedule but benefitting from over $5,000 in mortgage savings annually.

In this scenario, you’d end up paying more in lifetime interest costs: around $479,000 total over 38 years, compared to around $437,000 over 30 years for the original loan with no refinance. This is just one of the costs to keep in mind with refinancing. Lifetime interest costs can also be lowered by paying extra principal with the savings you get from refinancing.

| Original Loan | Refinance Loan | |

| Loan Amount | $300,000 | $270,000 |

| Interest Rate | 7.25% | 6% |

| Term | 30 years | 30 years |

| Combined Time to Pay Off Home | N/A | 38 years* |

| Monthly P&I Payment | $2,047 | $1,619 |

| Lifetime Interest | $436,750 | $312,763 |

| Combined Lifetime Interest | N/A | $478,903** |

*This includes the first 8 years on the original mortgage + the refinance loan’s 30-year term

**This includes $166,140 in interest paid during the first 8 years + the new 30-year mortgage’s $312,763 of lifetime interest

How a Recast Works

Again, a mortgage recast requires paying a lump sum toward your existing mortgage, after which your lender recalculates your monthly payment based on the lower balance but without changing the loan term or interest rate.

Here’s how to qualify:

- Your lender must permit recasting (not all lenders do).

- Your lump sum payment usually must be at least $5,000 to $10,000.

- Your existing loan must be current – meaning you’ve made payments on time with no delinquencies.

Keep in mind that mortgage recasting isn’t automatic, it isn’t offered by all lenders, and some lenders might have limits as to how many times you can recast your loan. Many lenders will charge a servicing fee for mortgage recasting, often ranging between $150 and $500.

Unlike a refinance, a recast doesn’t involve getting a new loan. Your current terms, including interest rate, remain intact.

Recast Example

Assume you took out a $300,000 loan over 30 years at a 4% fixed interest rate. That means your monthly principal and interest payments would be $1,432. After making 10 years of payments, your balance would drop to $240,000. If your lender allows a mortgage recast and you make a $40,000 lump sum payment, that would reduce your loan balance to $200,000.

Consequently, your new monthly payment would drop to $1,194 – saving you $238 monthly. Your existing loan – including its term and rate – wouldn’t change in any other way.

How to Choose Between a Recast and Refinance

Now that you better understand the differences between a refinance and a recast, it’s natural to wonder: Which option is best for me? The answer will depend on different factors. Let’s drill down into each of these next.

When Refinancing Is Best

You’re a better candidate for refinancing if:

- You desire a lower interest rate to save money over the long term. This should save significant dollars otherwise paid in interest, unless you choose a longer loan term.

- You want to change your loan term, making it shorter or longer. A shorter loan term may save you thousands in interest but increase your monthly payments. A longer loan term should lower your monthly payments but increase the total amount of interest paid.

- You want to pull cash out of your home equity (which requires choosing a cash-out refinance).

- You plan to remain in your home for at least the time it takes to recoup your closing costs (the breakeven period).

- You want to reset your mortgage following a major life event like a death or divorce.

- You meet the lender’s requirements regarding credit score, DTI, LTV, and more.

When a Recasting Is Best

Recasting is often the better choice if:

- You can afford to pay a large lump sum of cash. If you have received a large cash payment, such as a bonus or inheritance, you can apply it toward your loan principal and reduce the amount you owe.

- You like your current loan interest rate and don’t want to change it. In many cases, borrowers look to lower their monthly payment but cannot because mortgage rates have gone up since they last closed on their loan. In this case, it doesn’t make sense to refinance.

- You desire lower monthly payments but don’t want to pay high closing costs.

- You don’t want to reset your loan term and, therefore, pay more in total interest over the life of the loan.

- You plan to move. When you sell one house to purchase another, you can use the equity from your sale toward your new home. But what happens if your old home doesn’t close before you sign on your new one? A recast can help you reduce your new mortgage payments after the sale of your old house closes. Once you receive the funds from the sale of your home, you can make a lump sum payment and ask your lender to recast your loan.

- You meet the lender’s requirements, including having sufficient equity in your home and a strong payment history.

The Bottom Line

When it comes to refinancing or recasting, there is no one-size-fits-all answer.

“It’s smart to carefully evaluate your individual financial circumstances, including your liquidity needs and future objectives, before making a choice,” says Shirshikov.

Your best decision will depend on your financial goals, how long you plan to remain in your home, and your need for flexibility. When in doubt, consult an experienced mortgage professional to better determine the right fit for your situation.

Fact-checked by Tim Lucas.