Limited Cash-Out Refinance: What It Means and Why You Might Have One

A limited cash-out refinance is one where cash isn’t the intention, only an incidental byproduct of paying off one loan with another.

It’s nearly impossible to “guess” the exact loan you’ll need to cover the balance of your existing loan at the time of closing on a refinance, plus things like closing costs.

That’s why most lending agencies allow you to receive a limited amount of cash back on your refinance – typically up to $2,000 – even though the refinance’s purpose isn’t cash.

Key Takeaways

- Limited cash-out refinances come with lower rates than cash-out refinances.

- The cash you receive at closing, if any, is unintentional.

- A limited cash-out refinance is not a good product for those seeking cash from their home equity.

What Is a Limited Cash-Out Refinance?

A limited cash-out refinance is a loan where the main point is to lower your rate or change some other term of the loan, not get cash.

That’s why a limited cash-out and no-cash-out refinance is known in the mortgage business as a “rate-and-term” refinance.

Sometimes, a small amount of money is freed up on closing. It could come from rounding, escrow refunds, prepaid interest adjustments or similar accounting anomalies. With a rate-and-term refinance, any sum over the allowed amount, typically $2,000, must be used to reduce the balance of the new mortgage. Additional funds cannot typically be paid to the borrower, says Freddie Mac.

Cash back limits

Fannie Mae caps the amount you can get at “the lesser of 2% of the new refinance loan amount or $2,000.” However, Freddie Mac’s rule is different: “up to the greater of 1% of the new refinance mortgage or $2,000.” In Freddie-speak, this is a no-cash-out refinance, even though it’s the same as Fannie’s limited cash-out refinance.

In addition, you can pay off any second mortgages used to purchase the home, and you may add the limited cash-out refinance’s closing costs to your new mortgage’s balance. However, be aware that doing so will see you pay interest on that for the rest of the time your mortgage exists.

You don’t need to retain a lot of equity with a limited cash-out refinance.

Government-backed loans (FHA, VA, USDA) have streamline refinancing options, which are only available for rate-and-term refinances, often allowing even less cash back. However, these can be quicker and less costly than most refinances, and sometimes require no credit, income and debt checks.

Learn more:

Limited cash-out vs. cash-out refinance

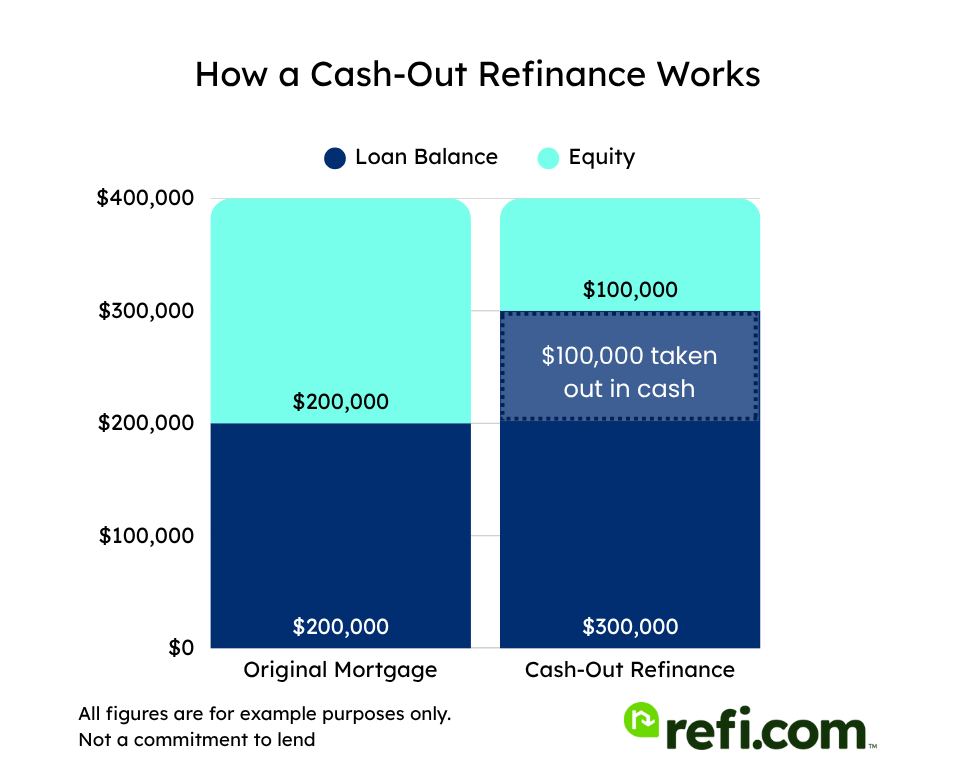

A standard cash-out refinance lets you tap the equity you’ve built up in your home. That’s the amount by which your home’s market value exceeds your current mortgage balance.

Homeowners in the United States shared about $35 trillion in home equity in March 2024, so many can access significant sums of money. However, lenders impose caps on the amount individuals can borrow, and most require the borrower to retain 20% of the home’s value in equity when they undertake a cash-out refinance. Think of it as a 20% down payment.

Cash-out refinances often come with higher rates and stricter eligibility requirements than other sorts of refinances. So, you might have to meet higher standards than those of other loans regarding:

- Your credit score

- The reliability of your income

- The size of your existing debt burden, aka your debt-to-income ratio (how much you have to pay on cards and other loans each month as a proportion of your income)

- Your equity position. Typically, lenders require you to retain at least 20% equity (i.e., a maximum 80% loan-to-value ratio) after a cash-out refinance.

It’s when applicants fall down on one or more of those that a lender might invite them to take a limited cash-out refinance instead.

Comparing Refinance Options

Here’s a table that lays out the main characteristics of the different sorts of refinances:

| Rate-and-term/Limited Cash/No Cash | Cash-out | |

| Cash out | Incidental amounts only, typically $500-$2,000 maximum | Up to 80% of the home’s value, including the existing mortgage |

| Qualifying | Easier | Harder |

| Closing costs | Low with streamline. Typically, 2%-5% of the loan value otherwise | Typically, 2%-5% of the loan value. You can roll these up within the new loan |

| Debt-to-income ratio | 45%-50%, depending on loan type. No max on streamline | 43% |

| Loan-to-value ratio | Around 97%. No max on streamline or VA | 80% |

| Credit score | 580-620 depending on loan type | 620+ |

Keep in mind that lenders, like Refi.com, often have their own requirements on top of program minimums.

Why Would You Get a Limited Cash-Out Refinance?

What might trigger your being offered a limited cash-out refinance or your applying for one? Various scenarios could apply, including:

- You refinanced to lower your rate or to change the term — and your final loan structure just happens to leave a small amount to refund.

- You rolled up closing costs or prepaid taxes within your new mortgage.

- Your loan was sold to Fannie Mae or Freddie Mac, and they classify your scenario as “limited cash-out” even though you didn’t ask for cash.

You don’t have to take the money provided for in a limited cash-out refinance. If you’ve no urgent need for it, you can ask your lender to apply it as a principal curtailment. Or, simply send the extra money as a one-time principal reduction at first payment. Often, lenders must re-underwrite the loan and send it back through the process for any loan amount changes, even reductions.

Final Thoughts

If you ended up with a limited cash-out refinance, you’re not alone—and there’s usually no cause for concern. This type of refinance is often just a technical label for a standard rate-and-term refinance that happens to result in a small amount of cash back at closing.

Whether that extra money comes from rounding, escrow adjustments, or other closing-related calculations, it’s typically incidental and well within program guidelines. You can use the funds, apply them to your loan balance, or simply hold onto them—it’s up to you.

In short, a limited cash-out refinance usually means your loan is working as intended, with a little flexibility built in. Are you ready to refinance your mortgage? Start your application with Refi.com here.