How Loan-to-Value Ratio Affects Your Refinance — And How to Improve It

When you refinance your mortgage, one of the most important numbers lenders look at is your loan-to-value ratio, or LTV. This number compares how much you owe on your home to how much it’s worth. It plays a big role in whether you can refinance, what kind of terms you qualify for, and how much cash you can take out.

Whether you’re trying to lower your rate, shorten your loan term, or tap into your home equity, understanding your LTV can help you make smarter decisions. Here’s what to know.

Key Takeaways

- Your LTV affects refinance approval, rates, and cash-out limits.

- Rising home values can lower your LTV, improving your refinance eligibility.

- Improving your home before applying may help you qualify.

What Is Loan-to-Value (LTV) Ratio?

Your LTV is the percentage of your home’s value that’s financed by your mortgage. It’s calculated like this:

Loan Amount ÷ Home Value × 100 = LTV

For example, if your home is worth $100,000 and your refinance loan is $80,000, your LTV is 80%.

If you have a second mortgage, lenders may calculate a combined loan-to-value ratio (CLTV), which factors in all your mortgage debt.

Think of LTV as the reverse of a down payment: the more equity you have, the lower your LTV. Most lenders want to see some equity left in your home after refinancing, especially if you’re taking cash out.

What Affects Your LTV When Refinancing?

Your LTV depends on two things:

- The size of your new loan (plus any second mortgages)

- The appraised value of your home

Loan Amount

If you’re applying for a cash-out refinance, most lenders cap your LTV at 80%. That means you need to keep at least 20% equity in your home after cash is taken out.

With a rate-and-term refinance, you don’t take cash out—you simply replace your existing loan, usually to get a better rate or change your loan term. These typically allow for higher LTVs:

- Conventional loans: Up to 95-97%

- FHA loans: Up to 97.75%

- VA and USDA streamline loans: No LTV limit

Streamline refinances are simplified programs for existing FHA, VA, or USDA loans. They typically don’t require a new appraisal, which means your current LTV doesn’t matter, making them ideal if your home value has dropped.

Home Value

Your home’s appraised value is a big part of your LTV.

Even if you started with a low down payment—say 3% or 5%—you may have built up more equity than you think. Home values in many parts of the country have risen sharply in recent years, meaning your home could be worth significantly more than when you bought it. That appreciation works in your favor by lowering your current LTV.

If it’s been a few years since your purchase, it may be worth checking recent sales in your area or speaking with a lender to get a sense of your current home value.

Related: Refinance Appraisal Checklist: 18 Tips for a High Appraisal

While you can influence your home’s condition, you can’t control the market. Broader housing trends, economic shifts, and even natural disasters can impact your home’s value.

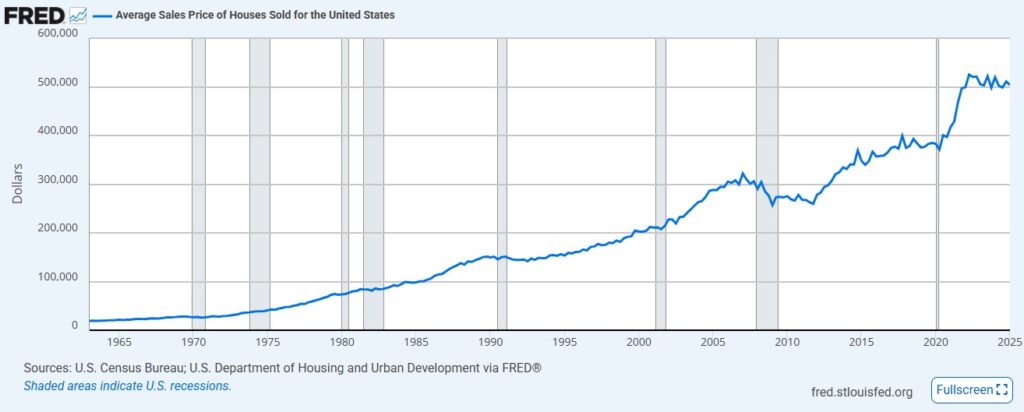

While home values can fluctuate in the short term, the long-term trend has been upward. According to historical data from the Federal Reserve Bank of St. Louis, U.S. home prices have steadily increased over the past 60+ years—with only a few notable dips, such as during the Great Recession.

This historical growth is one reason many homeowners eventually regain equity, even after a market downturn. So if your home’s value has temporarily declined, maintaining your property and staying patient can pay off over time.

Source: Federal Reserve Bank of St. Louis

What Happens If Your LTV Is Too High?

If your mortgage balance is close to (or higher than) your home’s value, you may be limited in your refinance options.

Negative equity, also known as being “underwater”, is when you owe more than your home is worth. It can make it nearly impossible to refinance with a conventional lender. Your best bet might be a cash-in refinance for a conventional loan or a streamline refinance if you already have a government-backed loan.

After the 2008 housing crash, special high-LTV refinance programs were introduced (like Fannie Mae’s HIRO and Freddie Mac’s Enhanced Relief Refinance), but they’ve since been paused. At the height of the Great Recession in 2009, over 1 in 4 U.S. homeowners with a mortgage were underwater.

Still, markets recover. Keeping your home in good shape ensures you’re ready to act when values rebound.

Related: I’m Underwater on My Mortgage. Can I Still Refinance?

How Closing Costs Affect LTV

Refinance closing costs usually run 2% to 5% of your new loan. Many refinance types allow you to roll these into your refinance loan, increasing your balance but saving you the upfront costs. Doing so increases your loan amount and your LTV. So, in borderline cases, rolling your closing costs into your loan can make you ineligible for a refinance.

Paying closing costs out of pocket can help prevent this.

How Cash-Out Affects Your LTV

When you do a cash-out refinance, the amount of cash you take out is added to your new loan balance. This increases the “loan” side of the LTV equation—and the more cash you pull, the higher your LTV will be.

Most lenders cap cash-out refinances at 80% LTV. That means you need to leave at least 20% of your home’s value untouched. For example, if your home is worth $300,000, your new mortgage—including the cash you take out—usually can’t exceed $240,000.

If you want to take out more equity than your LTV allows, you may need to wait until your home appreciates or pay down your mortgage further first.

LTV Limits by Loan Type

| Loan Type | Max LTV (Rate-and-Term) | Max LTV (Cash-Out) |

| Conventional | 95-97% | 80% |

| FHA (from FHA) | No limit (Streamline) | 80% |

| FHA (from other) | 97.75% | 80% |

| VA | No limit (Streamline) | 90-100% (varies by lender) |

| USDA | No limit (Streamline) | No cash-out allowed |

How Other Financial Factors Affect LTV Limits

Even if your LTV falls within a program’s maximum, lenders may require a lower LTV depending on your overall financial profile.

For example, if your credit score is borderline or your debt-to-income ratio (DTI) is high, a lender may approve your refinance only if you keep more equity in the home, which means accepting a lower LTV limit.

Other factors that can influence your approved LTV include:

- Credit history and score

- Employment and income stability

- Existing monthly debt obligations

- Past bankruptcies or foreclosures

In short: the stronger your overall financial picture, the more flexibility you may have with your LTV. If your application is borderline, shopping around with different lenders could make a difference.

LTV and Your Loan Terms

The lower your LTV, the safer you look to lenders. That could mean:

- A better interest rate & lower monthly payments

- No mortgage insurance (once you hit 80% LTV on conventional loans)

If you have an FHA loan, you pay mortgage insurance for the life of the loan. Refinancing into a conventional loan once your LTV drops below 80% could eliminate that cost.

How to Improve Your LTV

If your LTV is too high, here are a few ways to bring it down:

- Pay down your mortgage with extra payments

- Increase your home’s value through upgrades or repairs

- Pay closing costs out of pocket instead of rolling them in

- Pay off second mortgages or HELOCs

If you think your appraisal came in too low, ask your lender about getting a second opinion—just be prepared to cover the cost.

Final Thoughts

Your loan-to-value ratio can make or break your refinance. The good news? There are ways to improve it—and options even if it’s not perfect.

Ready to refinance? Refi.com is here to help. As a trusted lender, we’ll walk you through your options and help you find the right loan for your goals. Start your application today.