Loan Estimates When Refinancing: What They Are and How to Compare Them

Refinancing your mortgage means replacing your current home loan with a new one. So, while your goal may be to lower your rate, change your term, or tap into equity, the process often looks and feels a lot like getting a mortgage for a home purchase.

That means you’ll encounter many of the same documents, timelines, and steps, including the Loan Estimate.

While the core purpose of this document stays the same, there are a few key differences in how it applies to a refinance, especially when it comes to costs and cash to close.

Understanding what to expect upfront can help you feel more confident and in control as you move forward. It can also help you compare loan estimates from several lenders to ensure you get the best deal.

Key Takeaways:

- Loan Estimates outline key refinance costs like interest rate, monthly payment, and cash to close.

- Refinancing gives you more time to compare lenders and negotiate better terms than purchasing.

- Don’t just chase the lowest rate—compare fees, loan terms, and break-even points.

What is a Loan Estimate in a Refinance?

A Loan Estimate is a standardized document that outlines the key details of your potential refinance offer. It provides a clear, concise snapshot of what a new loan from a particular lender will cost, including:

- Loan amount

- Interest rate

- Projected monthly payment

- Closing costs

- Total cash needed to complete the transaction (cash-to-close)

Lenders are required to provide a Loan Estimate within three business days after you submit a loan application with enough information to begin the evaluation process. While Loan Estimates are not binding, they allow you to easily compare offers from different lenders and identify the most cost-effective path forward.

If you’re refinancing, the Loan Estimate is your first real look at how much you’ll save—or spend—by replacing your current mortgage. It also helps you identify whether costs such as closing fees or mortgage points will be paid out of pocket or rolled into your new loan balance.

Even if you’ve refinanced before, reviewing the Loan Estimate carefully is crucial. Lending fees and interest rates can vary widely between lenders, so knowing how to read and compare your estimates puts you in control of the process.

Why Loan Estimates Matter When Refinancing

Refinancing your mortgage isn’t just about getting a lower rate; it’s about making a strategic financial move. A Loan Estimate empowers you to:

- Understand the true cost of refinancing

- Compare offers from multiple lenders

- Identify whether fees are negotiable or avoidable

Loan Estimates are especially helpful when you’re deciding between different types of refinance loans—such as rate-and-term, cash-out, or switching from an FHA to a conventional loan. They help you compare apples to apples.

You Have More Time to Shop Around When You Refinance

One of the often-overlooked benefits of refinancing is that you control the timeline, and that gives you more power as a borrower.

When you’re buying a home, your lender typically can’t issue a Loan Estimate until you’re under contract on a property. From there, you’re often working under a tight 30-day closing window, which limits your ability to shop around or negotiate.

With a refinance, however, you already own the property. That means lenders can give you accurate Loan Estimates upfront, without the pressure of a pending closing date. You can take your time to:

- Get estimates from multiple lenders

- Compare rates, fees, and terms

- Ask questions

- Decide when (or if) to move forward

This added flexibility makes it easier to negotiate and ensures you have a clearer picture of your options. In short: when you refinance, you’re in the driver’s seat—so make sure to use that leverage to get the best deal.

Understanding the Loan Estimate Form

Here’s a breakdown of the major sections you’ll see in a refinance Loan Estimate.

All images are sourced from the Consumer Financial Protection Bureau using an example loan.

Borrower and Lender Information

Basic info about you and the lender providing the estimate. Helps you track and organize estimates if you request more than one.

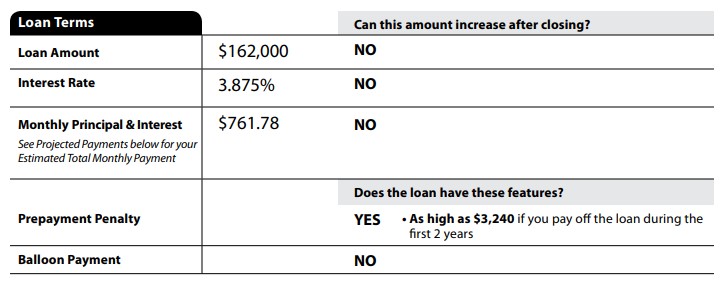

Loan Terms

Includes:

- Loan amount

- Interest rate

- Whether the rate is fixed or adjustable

- Length of the loan (e.g., 15 or 30 years)

- Prepayment penalties or balloon payments (if any)

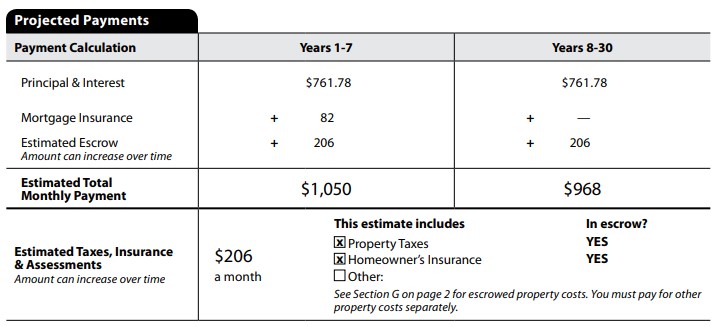

Projected Payments

Shows your expected monthly payment, broken down by:

- Principal & interest

- Mortgage insurance (if applicable)

- Property taxes and homeowners insurance (if escrowed)

This helps you estimate your total monthly housing cost under the new loan.

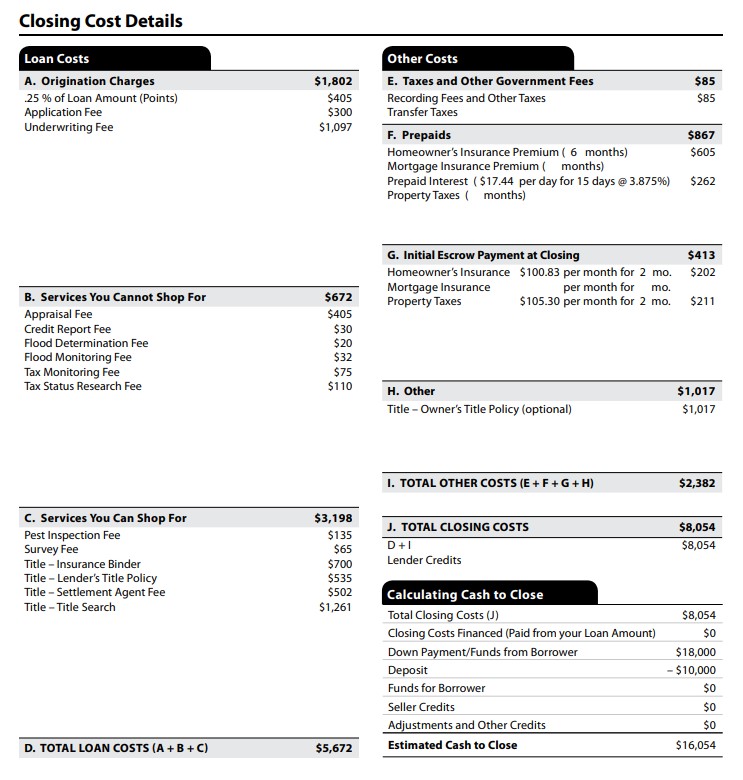

Closing Costs

An itemized list of:

- Origination charges

- Appraisal and credit report fees

- Title services

- Prepaid interest, or mortgage points

- Escrow funding

Refinance borrowers may have the option to roll these costs into the loan.

Cash to Close

This section reflects the total amount you need at closing, including any payoff to your current lender. In a cash-out refinance, this section also shows how much equity you’ll receive in cash after closing.

How to Get a Loan Estimate

Getting a Loan Estimate is straightforward:

- Choose a lender (or a few).

- Provide basic application details, including:

- Your property address

- Estimated home value

- Current loan balance

- Desired loan purpose (rate-and-term, cash-out, etc.)

- Submit consent to receive a Loan Estimate.

You don’t need to commit to a lender to receive a Loan Estimate, and there’s typically no fee involved at this stage—aside from a possible credit report charge.

Loan Estimate Expiration and Lock Periods

Once issued, your Loan Estimate is typically valid for 10 business days. After that, the offer may change based on rate fluctuations or updated financial info.

You can preserve the offer by indicating your intent to proceed within the expiration window. Once you do that, your lender will guide you toward locking your rate and moving forward with underwriting.

How to Compare Loan Estimates

When reviewing multiple Loan Estimates, don’t just zero in on the interest rate. Look at the bigger picture:

Focus On:

- Loan terms: Fixed vs. adjustable? 15 vs. 30 years?

- Origination fees: Are you paying points or junk fees?

- Total closing costs: Can these be rolled into the loan?

- Break-even point: How long until the savings outweigh the upfront costs?

Refinancing to lower your payment only makes sense if you’ll stay in the home long enough to reach your break-even point, so that’s a key number to consider.

It’s important to note that refinancing may result in higher finance charges over the life of the loan.

Loan Estimates vs. Closing Disclosures

A Loan Estimate is not your final refinance contract. It’s a preliminary document designed for comparison and transparency.

The Closing Disclosure is your final loan document, listing the actual terms and dollar amounts you’ll see at the closing table. It’s delivered at least three days before closing, giving you one last chance to confirm everything.

Common Refinance Mistakes to Avoid

Refinancing is a powerful tool—but only when done wisely. Here are pitfalls to watch out for:

- Failing to shop around: Always get estimates from at least 2–3 lenders.

- Focusing only on rate: Low rates can come with high fees.

- Ignoring break-even math: Will you stay in the home long enough to benefit?

- Not asking questions: Clarify anything you don’t understand—this is your money.

- Missing deadlines: Letting a Loan Estimate expire can mean missing out on a good rate.

Still Have Questions About Refinancing?

Whether you’re refinancing to lower your payments, eliminate mortgage insurance, or tap equity, understanding your Loan Estimate is key to making a smart decision.

At Refi.com, we specialize in helping homeowners navigate the refinance process with confidence. Start your refinance application today.