Can You Refinance a Home Equity Loan?

So, you used a home equity loan to tackle a big goal, maybe to consolidate debt, pay for home improvements, or put down a second home payment.

That was a smart move, since leveraging your home’s value to borrow money can save thousands in finance charges.

But now the project’s done and the money’s spent. You’ve achieved the loan’s goal. All that’s left is the loan’s monthly payment — a payment that seems like it’ll be with you for years. The good news is, you still have options. For example, refinancing a home equity loan could help pay off debt sooner and pay less interest along the way.

Check your home equity loan eligibility here.

- Home equity loans can be refinanced.

- The best home equity loan refinances save more money than they cost.

- Saving money with a refi depends on interest rates, closing costs, and loan terms.

- Comparing rates and fees from several lenders is the best way to save.

How Does a Home Equity Refinance Work?

A home equity loan refinance simply replaces your current home equity loan with a new one — usually at a different interest rate, loan term, or both. The new loan pays off your old balance. Then, you make payments on the new loan instead.

People typically refinance to secure a lower interest rate, reduce their monthly payments, or change the duration to pay the loan back. Some borrowers also use the refinance to combine other debts (like credit cards or personal loans) into one payment at a lower rate.

Think of it like trading in your old loan for a new one that better fits your financial situation.

How Often Can You Refinance a Home Equity Loan?

You can refinance a home equity loan any time a lender approves you for a new loan, but this doesn’t mean you should refinance.

Refinancing costs money upfront in the form of closing costs, which include appraisal fees, lender’s fees, and legal fees. While you typically pay these costs upfront, the savings from a refinance accumulate gradually over the course of years.

Benefits of Refinancing a Home Equity Loan

Refinancing a home equity loan resets the loan’s debt into a new loan. It’s a do-over. Borrowers typically choose to refinance a home equity loan to save more money, but some other benefits of refinancing a home equity loan include:

- Receive More Cash Back: Refinancing a home equity loan can also allow you to tap into additional cash, but this is only possible if your home has gained enough value to support more borrowing. In other words, your lender will look at your home’s current value compared to how much you still owe on your mortgages and home equity loan. If your equity has grown — maybe because you’ve paid down your balances or your home has appreciated in value — you may be able to borrow more than you currently owe and pocket the difference as cash at closing.

- Eliminate a Co-Borrower: Refinancing pays off the current home equity loan, ending your financial connection to the co-borrower on the loan. The new loan won’t need a co-borrower at all if you now have the income and credit score to qualify for the new refi by yourself.

Here are ways a home equity loan refinance can help you save money:

1. Lowering the Loan’s Monthly Payment

Borrowers can lower their monthly payments by refinancing to a longer loan term or by locking in a lower rate.

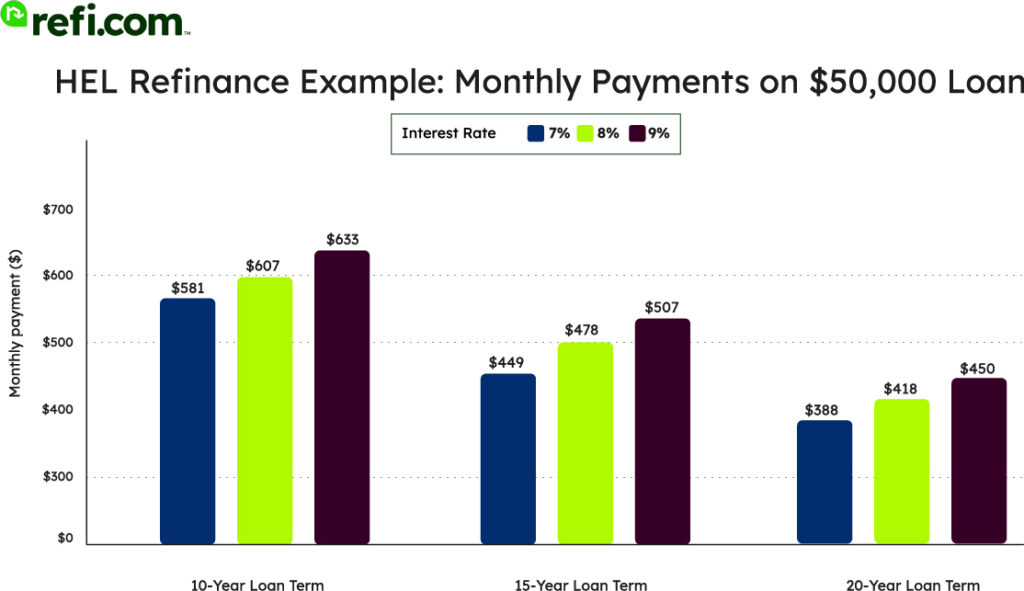

For example, let’s compare the payments on a $50,000 home equity loan at different terms and rates:

| Interest rate* | 10-year term payment | 15-year term payment | 20-year term payment |

| 7% | $581 | $449 | $388 |

| 8% | $607 | $478 | $418 |

| 9% | $633 | $507 | $450 |

A longer term can help achieve the goal of lower monthly payments; however, the longer term will charge more interest over time, as discussed below.

2. Potential to Owe Less Lifetime Interest

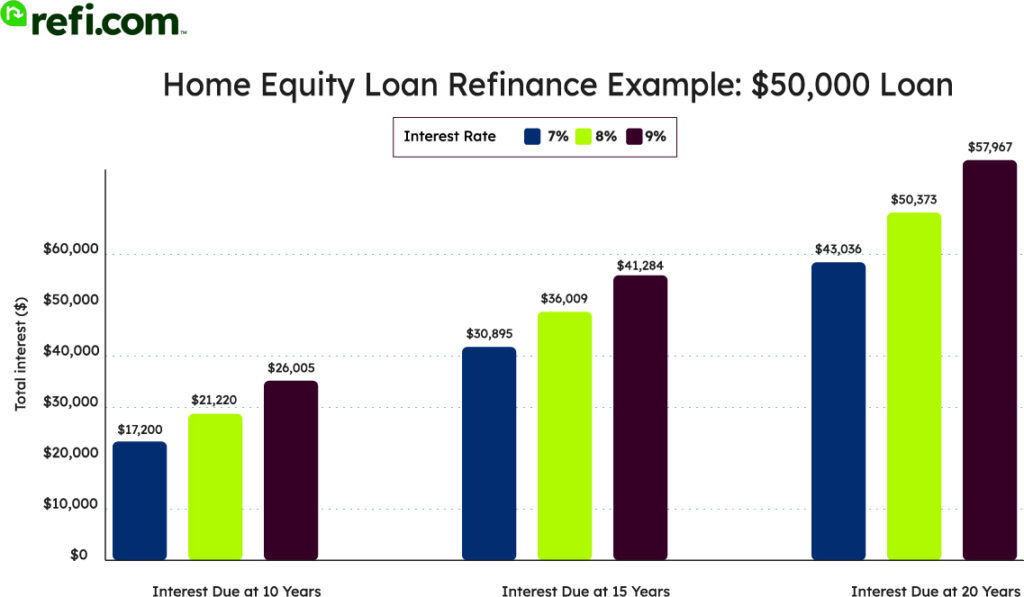

A longer loan term lowers monthly payments on the same amount of debt. But, keeping the debt for a longer term gives the lender more time to charge interest. This chart shows the lifetime interest charged on a $50,000 loan:

| Interest rate* | 10-year total interest due | 15-year total interest due | 20-year total interest due |

| 7% | $17,200 | $30,895 | $43,036 |

| 8% | $21,220 | $36,009 | $50,373 |

| 9% | $26,005 | $41,284 | $57,967 |

As the chart shows, longer loan terms increase the total interest paid, even at the same interest rate. Borrowers can also reduce the total interest paid by paying off a loan early, assuming the loan has no early payoff fee.

3. Combining Loan With Other Debt

Consolidating a home equity loan with other mortgage debt can lower monthly payments on the debt. Because home equity loans usually carry lower rates than credit cards or personal loans, refinancing allows borrowers to consolidate multiple debts into one loan with a single, more manageable payment. This not only simplifies repayment but can also reduce the total amount you spend on interest.

For example, say you have a $25,000 home equity loan at 9% and $10,000 in credit card balances at 20%. Together, those debts might cost you over $700 per month in payments. If you refinance into a new $35,000 home equity loan at 7% with a 15-year term, your monthly payment could drop to around $315, cutting your monthly obligations by nearly half while moving the high-interest credit card debt into a much lower rate loan.

Cons of Refinancing a Home Equity Loan

The costs of a refinance can be difficult to measure because they come from several different places, but learning how these borrowing costs work will help you get a better deal.

1. Closing Costs

Closing costs pay for various services required to close the new loan. These costs include fees the lender charges, such as loan origination and processing fees. You may be able to negotiate these fees.

Collectively, closing costs usually range from 3% to 6% of the loan amount. A $50,000 refinance means $1,500 to $3,000 in closing costs.

Borrowers can roll these costs into their loan amounts, but this method cuts into the size of the loan and means paying interest on these fees for years or even decades.

2. Resetting the Loan Term

When you refinance, you often restart the clock on your loan term. For example, refinancing a 10-year home equity loan into a new 15- or 30-year term may reduce your monthly payment but increase the total interest paid over the life of the loan. Even if your rate is lower, stretching out the repayment period can be costly in the long run.

3. Risk of Foreclosure

If you refinance into a new home equity loan or roll it into your primary mortgage, your home remains collateral. But if you previously made separate payments and now consolidate everything into a single, larger mortgage, defaulting on this new loan could put your home at greater risk. Essentially, you increase your dependency on one payment to keep your home.

How to Qualify For a Home Equity Loan Refinance

Refinancing a home equity loan means replacing your existing home equity loan with a new one. For this to work, you and your home must qualify for the new loan.

Home Equity Requirements

First, let’s see whether your home qualifies for more equity-backed financing. This depends mostly on your current equity position.

If your home’s value has increased since you took out your current home equity loan (and if you’ve also been making all the payments on the loan, reducing its balance), you likely have enough equity to refinance.

How to Calculate Your CLTV (Combined Loan-to-Value)

- Find your home’s current value.

- Check recent sales of similar homes in your neighborhood.

- Use an online home value estimator as a starting point.

- For the most accurate number, consider a professional appraisal.

- Add up your mortgage balances.

- Include your primary mortgage balance (what you still owe).

- Add any home equity loan or home equity line of credit (HELOC) balances.

- Calculate your CLTV.

- Divide your combined mortgage debt by your home’s current value.

- Multiply the result by 100 to get a percentage.

CLTV Example Calculation:

- Home value: $400,000

- Primary mortgage balance: $200,000

- Home equity loan balance: $50,000

Combined mortgage debt = $200,000 + $50,000 = $250,000

CLTV = $250,000 ÷ $400,000 = 0.625

CLTV = 0.625 × 100 = 62.5%

Typical lenders won’t approve a loan if it pushes CLTV higher than 85%.

Borrower Eligibility Requirements

Having enough equity to support a refinance clears the first hurdle. Next, you need to qualify as a borrower. Like a primary mortgage, this depends greatly on credit score, income level, and current debt load.

- Credit score: Requirements may be higher for home equity loans than primary mortgages. Some home equity lenders want to see scores of 680 or higher. Scores above 720 qualify borrowers for the best interest rates.

- Income and debt: Lenders also review your debt-to-income ratio (DTI) to confirm you can comfortably handle the new payment. For most home equity refinances, lenders prefer a DTI of 43% or lower.

In short, refinancing isn’t automatic. You need to show lenders that your finances still meet their standards. You can check your home equity loan refinance eligibility here.

Should You Get a Home Equity Refinance?

Closing costs are a good investment only when the new loan’s savings outweigh its costs. It’s the borrower’s job to compare costs to savings.

As you compare costs to savings, ask yourself the following questions:

How Long Should You Keep the Loan to Save Money?

If closing costs are $3,000 and the loan saves $100 a month, it would take 30 months of regular payments to balance out the cost. After those 30 months, each additional month with the loan would add to the loan’s savings. Use this breakeven calculator to model scenarios.

Is There a Prepayment Penalty for Paying Off Your Existing Loan?

Prepayment penalties on the old loan will cut into the next loan’s potential to save. If your old lender charges this fee, count it in the costs.

How Much Interest Remains On Your Current Loan?

Check your second loan’s statement to see how much of the loan’s lifetime interest you’ve already paid. Depending on the loan’s age, you may have already paid more than half of the interest. Factor that variable into your cost-vs-savings analysis.

The savings on your new loan should be enough to compensate for all these costs and then some.

Alternatives To a Home Equity Loan Refinance

Besides a typical home equity loan rate-and-term refinance, you have several other options for refinancing your home equity debt.

Cash-Out Refinance

Cash-out refinancing combines two or more smaller mortgages into one larger mortgage while also generating cash back.

- Pro: You can simplify mortgage debt by consolidating multiple loans into one while also generating more cash.

- Con: A large loan amount requires higher closing costs.

Say you have a $50,000 home equity loan and a $150,000 primary mortgage, each with its own monthly payment. A cash-out refi would combine these two loans into a $200,000 mortgage with only one payment. Plus, if the house is worth $300,000, you’d have enough equity to add another $40,000 in cash back. You could use this cash for any purpose.

Cash-out refinancing works best when the new loan improves your position on both the home equity loan and the primary mortgage.

HELOC Loan

HELOCs (home equity lines of credit) harness home equity to secure a credit line. HELOCs feature a credit limit and allow homeowners to withdraw funds up to that limit while only paying interest on that month’s balance.

A home equity loan borrower could open a HELOC and transfer the home equity loan’s balance to the HELOC.

Borrowers can pay down HELOC balances and reuse the balance during the credit line’s draw period. This means homeowners could re-use the loan after paying down some or all of its initial balance. After the draw period ends, usually within 10 years, the remaining loan balance is cemented into a traditional loan with regular payments.

- Pro: HELOCs often charge lower monthly payments that repay only interest during their draw periods.

- Con: A HELOC’s variable interest rate and fluctuating balance create irregular payments. The interest rate changes with market conditions, meaning it could increase.

Refinancing into a HELOC works best for homeowners who plan to pay off the initial home equity balance and then reuse the credit line for another project.

Primary Mortgage Refinance

Refinancing a home equity loan with your primary mortgage resembles cash-out refinancing: You combine two loans into one.

- Pro: This method’s single monthly payment should cost less than the current two loan payments combined, providing relief.

- Con: Extending mortgage debt over a longer term gives the lender more time to charge interest.

Unlike a cash-out refi, the new loan pays off both mortgages without generating cash back.

Say you have a $150,000 primary mortgage balance and a $50,000 home equity loan balance, you could combine both into one $200,000 mortgage.

Refinancing a home equity loan into a primary mortgage works best for homeowners who can use the new loan to improve their position on both their current loans.

Can You Refinance a Primary Mortgage and Keep Your Home Equity Loan?

Yes, homeowners can keep their current home equity loans while refinancing the home’s primary mortgage. Someone happy with their home equity loan’s rate and term but unhappy with their primary mortgage may want to do this.

The home equity lender must accept a second lien position behind the new primary mortgage. Almost all home equity lenders should be willing to do this.

Pay Extra on Principal

Keeping the same home equity loan and paying extra money on its principal balance can save money without paying closing costs for a new loan. Making regular payments on principal, in addition to making the loan’s monthly payments, pays off the loan sooner.

Ensure your lender knows to apply the extra prepayments to your principal balance.

Paying off a loan sooner reduces the time the lender has to charge interest on the balance.

For example, on a 20-year home equity loan of $50,000 at 8% interest, the regular monthly payment would be about $418. Paying an additional $100 monthly would pay off the loan seven years early, saving almost $20,000 in interest charges.

Reverse Mortgage

Homeowners 62 and older can use reverse mortgages to pay off a home equity loan, assuming the home no longer has a primary mortgage balance (or has a very small primary mortgage balance). Reverse loans require no payments, but their interest accrues anyway, and loan balances must be repaid when the home sells or the homeowner passes away.

Home Equity Investment (HEI)

HEIs let someone else invest in your home’s equity. You receive a lump sum of cash, which you could use to pay off the home equity loan. In exchange, the investor owns a percentage of your home equity — a stake that would grow as your home value increases.

Home Sale

One surefire way to pay off mortgage balances is to sell the home. If you are already considering moving to a different region or downsizing, selling is the obvious solution; otherwise, it’s probably not the best idea.

As you can see, these methods come with trade-offs: some require loss of the home, loss of equity, or both. For most homeowners, a home equity loan refinance will perform better. It has a built-in way for the borrower to reclaim control of the home’s equity.

What to Do Next

If you’ve ever bought a car, furniture, or even a pair of shoes, you already know how to shop for a new home equity loan refinance: compare products and prices.

Loans are more abstract than cars, shoes, and furniture, so comparing them might seem more confusing at first. However, the potential savings can be enormous.