Can You Refinance a VA Loan?

Fact-checked by Peter Warden.

Yes, you can refinance a VA loan. VA loans may be refinanced into new VA loans — or they can be refinanced into other types of mortgages, including conventional or FHA loans. Refinancing into a different kind of mortgage means you’ll lose the unique benefits of your VA loan.

VA homeowners who want to keep the benefits of a VA loan have two choices: the VA IRRRL (Streamline Refinance) or the VA Cash-Out Refinance.

Key Takeaways:

- Refinancing replaces an existing VA loan with a new mortgage loan.

- VA borrowers can refinance into a new VA loan or a different type of loan.

- The VA’s two refinance programs have different purposes.

- VA refinances come from private lenders authorized by the VA, so rates vary by lender.

- For homeowners with VA loans, VA refinances are often the best deal.

How Soon Can You Refinance a VA Loan?

The Department of Veterans Affairs requires a 210-day waiting period, known as a seasoning period, before starting a VA loan refinance application. The seasoning period begins on the day of the current loan’s first payment.

Completing this seasoning period isn’t the only requirement for refinancing. Applicants must also qualify for the refinance. Requirements differ between the VA’s two refinance loan options discussed below, and approval can vary from lender to lender.

The VA’s seasoning period doesn’t apply to VA borrowers who want to refinance into a different type of mortgage, such as a conventional loan. Since they’re leaving the VA loan program, these borrowers follow the new loan’s rules.

Your Two VA Refinance Options

Borrowers with VA loans can choose any type of refinance loan. Those who want to keep a VA loan have two VA refinance choices:

- The VA IRRRL Streamline

- The VA Cash-Out Refinance

The VA IRRRL creates a faster, simpler way for many VA loan holders to save money by cutting their interest rate or securing more favorable terms. The cash-out refi allows borrowers to access their home equity in cash.

VA Interest Rate Reduction Refinance / Streamline Refinance

VA IRRRL (Interest Rate Reduction Refinance Loan) is a streamline refinance program. Streamline borrowers can usually skip the credit check, the home appraisal, and other time-consuming (and expensive) steps in the refinancing process.

Here’s a common IRRRL scenario: A borrower who closed a new VA loan in January starts seeing headlines the following June that interest rates have started dropping. By September, average mortgage rates are a full point below the rate the borrower locked in back in January.

Through the IRRRL program, this borrower can get a new loan that locks in current rates without paying full closing costs or completing the full underwriting process. To get the VA’s OK, the new IRRRL must provide the borrower a new benefit, such as a lower interest rate, lower payments, or moving from an adjustable rate to a fixed interest rate.

The VA IRRRL refinances only existing VA loans, and the refinance can’t generate cash back from equity — with a couple of exceptions:

- An IRRRL can unlock enough equity to cover some closing costs, most commonly the VA Funding Fee.

- An IRRRL can include up to $6,000 for energy-efficient improvements to the home.

VA borrowers who need more cash back from home equity should use the VA Cash-Out Refinance.

VA Cash-Out Refinance

Unlike the IRRRL, cash-out borrowers can get money from home equity added to their loan amount. This means they get a check at closing that they can use for any purpose, such as consolidating debt, renovating the home, or making a down payment on another property.

Since it’s a full refinance, the VA’s Cash-Out Refinance requires full underwriting for the borrower, along with a new appraisal to re-evaluate the home’s value. In other words, it’s a complete mortgage do-over.

In fact, compared to most other cash-out refinances, the VA’s program lets borrowers access more cash from their equity. Some VA-authorized lenders approve new loan sizes that match or even exceed the home’s value. Not every lender approves 100% loan-to-value (LTV) mortgages, and not every borrower qualifies for one, but the VA doesn’t prohibit them.

So, the owner of a $300,000 home who owes $200,000 on the current mortgage could borrow the full $300,000, meaning the homeowner could pay off the existing loan’s $200,000 balance with the new refinance and take the leftover $100,000 home from closing. A typical conventional lender would cap the loan size at $240,000 to $250,000, leaving $40,000 to $50,000 to take home as cash back.

As with any cash-out refi, this cash back must be repaid through the new mortgage’s monthly payments. It’s not the same as taking money out of savings.

A VA cash-out refi can replace any type of mortgage, not just an existing VA loan.

Reasons to Refinance a Mortgage

To justify its cost, your refinanced loan should be better than your existing mortgage in some way. This typically means the new loan saves money, either immediately, over time, or both.

There are several ways a new loan could save money:

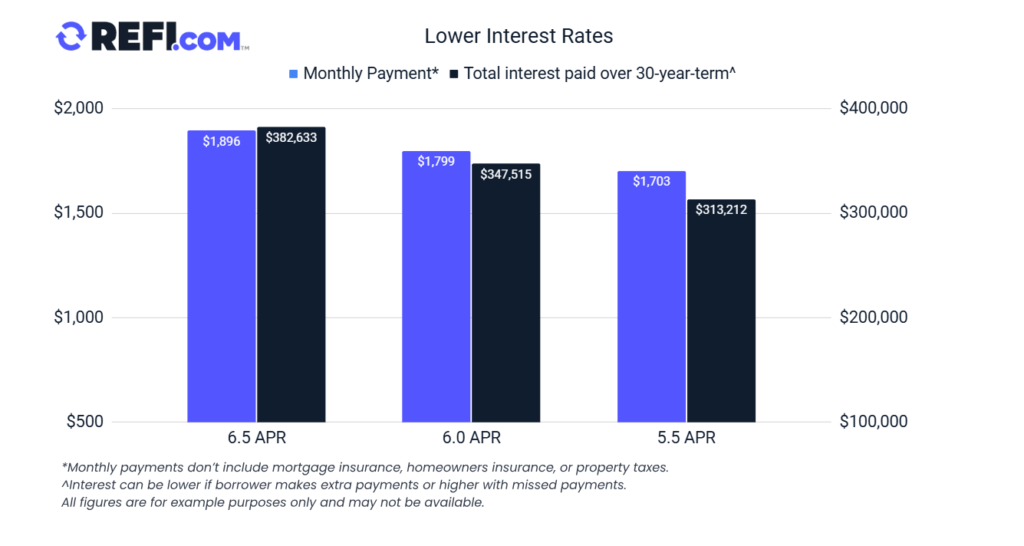

Lower Interest Rates

Shaving just a fraction of a percentage point off your mortgage rate can save thousands of dollars over time, especially when your current mortgage is less than two years old. Here’s an example:

| $300,000 loan (30-year fixed) | Monthly payment* | Total interest paid over 30-year term^ |

| At 6.5 APR | $1,896 | $382,633 |

| At 6.0 APR | $1,799 | $347,515 |

| At 5.5 APR | $1,703 | $313,212 |

^Interest can be lower if borrower makes extra payments or higher with missed payments.

All figures are for example purposes only and may not be available.

As you can see, a small decrease in the interest rate creates huge decreases in the interest paid over time. Here’s a quick look at how VA refinance interest rates have been trending:

How we source rates and rate trends

Rates based on market averages as of Dec 02, 2025.Product Rate APR 15-year Fixed Va Refinance 5.30% 5.52% 30-year Fixed Va Refinance 5.68% 5.82% 30-year Fixed Va Jumbo Refinance 5.74% 5.87%

A word of caution: Before jumping at a chance to save, check your most recent mortgage statement to find out how much interest you still owe. The longer you’ve had the current loan, the less you save by refinancing because you’ve already been paying toward the total interest on the mortgage. The older the loan, the more you’ve already paid.

Which VA refinance can lower interest rates: IRRRL and Cash-Out Refinance

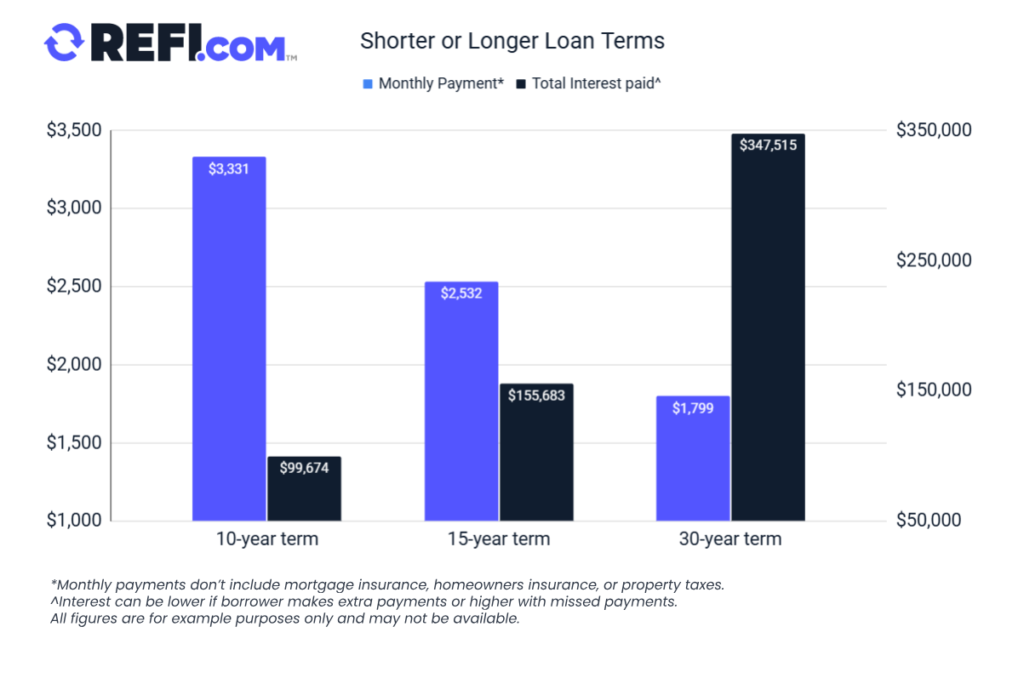

Shorter (or Longer) Loan Terms

Longer-term mortgages, such as 30-year loans, charge lower monthly payments when compared to shorter-term mortgages like a 10- or 15-year loan. But there’s a tradeoff: longer terms charge more interest over the life of the loan. See below:

| $300,000 mortgage at 6% | Monthly payment* | Total interest paid^ |

| 10-year term | $3,331 | $99,674 |

| 15-year term | $2,532 | $155,683 |

| 30-year term | $1,799 | $347,515 |

^Interest can be lower if borrower makes extra payments or higher with missed payments.

All figures are for example purposes only and may not be available.

Refinancing out of a 30-year loan and into a 15-, 12-, or 10-year loan can save a borrower hundreds of thousands of dollars — if the borrower can afford the higher monthly payment.

On the other hand, someone who’s struggling to keep up with their 15-year mortgage payments could get immediate relief by refinancing into a longer term. Yes, the longer term will accrue a lot more interest, but this can be money well spent if the new loan lets the borrower avoid foreclosure.

Later on, this borrower could make extra payments on the loan’s principal to reduce the total mortgage interest paid over time.

Which VA refinance can change loan terms: IRRRL and Cash-Out

Other Reasons to Refinance

While most homeowners refinance to save money on interest or monthly payments, there are other reasons:

- To get a fixed rate: People with adjustable-rate mortgages or other types of financing intended to be temporary often refinance to get fixed-rate loans.

- To eliminate mortgage insurance: FHA and USDA mortgages usually charge mortgage insurance premiums for the life of the loan. Refinancing away from those programs can eliminate these extra monthly payments since VA loans don’t require monthly mortgage insurance payments.

- To get cash out: Cash-out refinancing borrows money from the value already built up in the home. The benefit? Much lower borrowing costs compared to personal loans and credit cards. Another way to do this is to add a second mortgage, like a home equity loan or a home equity line of credit (HELOC), while also keeping the original mortgage in place.

Which VA refinance can accomplish these goals: VA borrowers can use the IRRRL to lock in a fixed rate; any borrower who qualifies for the VA loan program can use the VA cash-out loan to eliminate mortgage insurance or get cash back.

Can You Refinance a VA Loan to a Conventional Loan?

Yes, VA borrowers can refinance their mortgages into conventional loans, the most popular type of mortgage.

Reasons to Refinance to a Conventional Loan

But here’s a better question for VA borrowers: should you refinance a VA loan into a conventional loan? VA loans maximize homebuying power for Veterans, military members, and surviving military spouses who qualify for the program.

Still, there are some reasons VA loan holders may want to exit the program, including:

- To turn the home into a rental property: The VA homebuying program helps qualifying Veterans buy primary residences, not investment properties. A Veteran who wants to turn a primary residence into a rental home may need to refinance — freeing up their VA loan benefit to buy another primary residence.

- To transfer the home to a new owner: After a divorce, a non-Veteran ex-spouse who’s keeping the home can’t keep the benefits of the VA loan. To keep the home, the non-Veteran ex-spouse must refinance into a conventional or FHA loan.

The FHA loan program offers another alternative for some VA borrowers, but this program also requires borrowers to live in their homes, so it won’t finance investment properties.

Reasons not to Refinance to a Conventional Loan

Many VA borrowers should stay in the VA family by using a VA-insured refinance. These situations include:

- Recent borrowers who made no down payment: Refinanced conventional loans charge private mortgage insurance (PMI) premiums to borrowers with less than 20% in home equity. If you made no down payment on your current VA loan and got the loan within the past few years, you probably do not meet this 20% threshold. You’d have to buy PMI, which could cost a couple hundred dollars a month.

- Borrowers with credit challenges: By insuring their loans, the VA insulates borrowers from the effects of their lower credit scores. Refinancing to conventional sheds this benefit, meaning borrowers with lower credit scores could pay more or fail to qualify.

- Borrowers who just want a lower rate: If you’re a VA homeowner whose only goal is to save money by changing your mortgage rate or loan term, the VA’s IRRRL is ready-made for this purpose and is faster and cheaper than other options.

Most homeowners with VA loans should consider refinancing with another VA-backed loan unless they have a compelling reason to leave the VA program.

Do You Have to Use the Same Lender?

Homeowners do not have to refinance with the lender they used to buy the house. That original lender may offer the best deal on a refinance, but it might not. It’s best to shop around with at least two other lenders to see your options.

Many think all mortgage lenders charge the same amount, but every lender is different. They’re different even when underwriting the same type of loan, such as a VA refinance.

Costs vary with VA loans and refinancing since the VA itself doesn’t lend the money to new and refinancing homeowners; instead, it insures banks, credit unions, and online lenders so they can lend more freely to Veterans. Lenders have a lot of leeway with this system. The VA does, however, limit how much lenders can charge.

As the tables above show, shaving just a quarter or a half of a percentage point from a mortgage rate can save thousands — enough money to justify spending a couple of hours comparing rates.

How to Refinance Your VA Loan

Here’s how to refinance your VA loan:

1. Decide Which Type of Refinance Loan You Need

This answer mostly depends on your goals and your financial profile:

- If you can get a lower rate now than when you bought the home: a VA Streamline Refinance (IRRRL) is a great fit.

- If you need to borrow cash back from home equity: Consider the VA Cash-Out Refinance. Another option is to get a home equity loan or HELOC and keep your current VA loan as it is.

- If you need to exit the VA program because of a divorce: You need a conventional refinance. FHA could also help if the borrower plans to live in the home.

Facing another scenario? Talk to your lender. They can help guide you through your unique situation and find the best refinance solution.

2. Compare Rates With At Least Three Different Lenders

When you know which refinance to get — or even if you’re still unsure — start comparing rates from lenders. With the internet, this is much easier than a few decades ago. You can get multiple estimates in one sitting. If you’re sticking with the VA loan program, stick with lenders specializing in VA loans.

Check rates from local credit unions, too. Sometimes, this means an in-person visit to a neighborhood branch. If you’re sticking with the VA, ensure the credit union is VA-authorized first.

3. Make the Application

Now, it’s time to take the next step and make the loan application official. You need pay stubs, tax forms, bank statements, some ID, and a recent mortgage statement showing your current balance. It never hurts to have the escrow balance from your current lender on hand, along with your annual property tax and homeowners insurance payment amounts and due dates.

4. Follow Loan Officer’s Guidance

The lender you apply to then assigns a loan officer or team to guide you through the process, all the way to closing your new loan. Your job is to respond to requests for more information as quickly as possible.

Ready to Get Started?

When mortgage rates start to fall, this can be a great time to start thinking about refinancing. Get started here.