Should I Refinance with a Credit Union, Bank, Mortgage Broker, or Mortgage Lender?

If you’re considering refinancing your mortgage, you might feel overwhelmed by the sheer number of lender options available. Should you stick with your current bank or explore other lenders, like credit unions, mortgage brokers, or online mortgage lenders? Each lender type has its own strengths and weaknesses, and the right choice depends on your financial goals and personal preferences.

In this article, we’ll help you weigh your options by exploring the pros and cons of different lender types, along with how to match your refinance type to the lender that fits your needs.

Highlights

- Different lender types—credit unions, banks, brokers, and mortgage lenders—offer unique advantages and drawbacks, so aligning their strengths with your refinance needs is essential.

- The reason for your refinance, such as lowering your interest rate, eliminating PMI, or taking cash out can help determine the best lender for your situation.

- Comparing multiple lenders and improving your credit profile before applying can save significant money over the life of your refinance.

Comparing Credit Unions, Banks, Mortgage Brokers, and Mortgage Lenders

| Pros | Cons | |

| Credit Union | Lower rates Personalized service Fewer fees | Limited membership Fewer products |

| Bank | Convenience Broader product lineup Integrated services | Higher costs Slower service |

| Mortgage Broker | Easier to compare lenders Access to niche products | Loss of control Possible broker fees |

| Mortgage Lender | Specialize in mortgages Faster processing | Limited physical presence Potential outside loan servicing |

Refinancing With a Credit Union

Credit unions are nonprofit organizations. They earn money to cover their operating costs, but they don’t face pressure to earn a profit. This allows credit unions to pay higher savings rates — and to offer more competitive mortgage rates — to their members.

Pros Of Using A Credit Union

- Savings: No pressure to profit = possibility for lower refinance rates

- Local: Many credit unions are locally or regionally owned

- Customer care: Many credit unions excel at in-person customer service

- More savings: Along with lower rates, credit unions may also charge lower loan origination fees and other fees

Cons Of Using a Credit Union

- Lack of access: Some credit unions limit membership. Some welcome only military members or only public employees, for example. But some credit unions welcome the general public into membership

- Product lineup: Credit unions won’t always have every mortgage type. If you’re planning to get a niche product — a USDA Streamline Refi, for example — you may need to shop somewhere else

- Fewer branches: On average, credit unions have fewer branches and ATMs, though most now have online banking. This can make branch and ATM access less important

Credit unions are best for: A credit union member who wants a conventional or, if available, an FHA mortgage refinance at a competitive rate and from a friendly face.

Refinancing With a Bank

Most Americans pass dozens of banks in their daily travels. Whether they’re locally owned or part of a big national brand, these banks specialize in everyday financial products like checking and savings accounts. Banks also provide loans, including mortgages and refinances.

Pros of Using a Bank

- Access: The biggest banks have branches and ATMs in most shopping centers and downtown areas.

- Broader product lineup: Banks usually offer a wide variety of government-sponsored and conventional loans.

- Seamlessness: You could apply for the loan — and eventually make payments — in the same app where you see your checking account balance.

Cons of Using a Bank

- Higher costs: The need to make a profit can drive up borrowing rates and fees compared to credit union loans.

- Anonymity: Some banks have millions of borrowers; being one in a million isn’t always a good thing.

- Experience level: Because banks offer a wide range of financial services, mortgage lending may not always be their primary focus—but many still have experienced loan officers who handle refinances regularly.

- Slow pace: Application processing can take longer at a big bank.

Banks are best for: Homeowners who want to keep things simple by using the same bank they already use. But remember, the bank could sell your mortgage to a loan servicer after you close the refi.

Refinancing With a Mortgage Broker

A broker is a go-between, connecting borrowers with several, or maybe even a dozen, lenders. Then the borrower can pick the best refinance deal from the list of options. The best brokers know which lenders will match up best with the borrower. The best brokers find deals that borrowers couldn’t find on their own.

Pros of Using a Mortgage Broker

- Easier to compare: Customers can see several loan quotes at once, making it easier to compare loans side by side, saving time.

- Product lineup: With more choices, borrowers are more likely to find a lender with their ideal refinance type.

- An independent expert: Ideally, a broker has inside knowledge but is not committed to a single mortgage lender.

Cons of Using a Mortgage Broker

- An extra step: After the borrower chooses a lender, the borrower may still need to apply with that lender, and the details shown by the broker may not always be the same as the final details.

- Loss of control: Having a go-between can save time, but it can also limit options.

- Broker’s fee: Borrowers may not pay their broker directly, but that doesn’t always mean the broker’s fee isn’t worked into the new loan in some other way.

- Transparency: Some borrowers can’t get past the idea that the broker could be showing deals that benefit the broker and not necessarily showing the borrower’s best option.

Mortgage brokers are for: A homeowner who doesn’t mind giving up some control over the shopping process in exchange for doing less of the legwork. Even then, borrowers should always find a broker they trust.

Refinancing With a Mortgage Lender

Mortgage lenders are the ones actually issuing the money, similar to a bank, unlike mortgage brokers. Lenders specialize in mortgage loans, including refinances.

Pros of Using a Mortgage Lender

- Experience: Since loan officers at mortgage lenders work only on mortgage loans, they can become experts faster.

- Product lineup: Most lenders offer most refinance options, though few lenders can offer every possible loan.

- Speed: Lenders get borrowers to closing day faster on average. Many also have efficient online application.

Cons of Using a Mortgage Lender

- Less access: Some direct lenders have brick-and-mortar offices, but many operate online only, meaning customer service happens over the phone or via chat.

- Outside servicer: Many mortgage lenders sell the servicing rights to investors or third parties, meaning borrowers may make payments to a different company after closing.

Mortgage lenders are best for: Homeowners who want to refinance quickly and also want to apply and submit documents online.

The Reason for the Refinance Should Inform Borrowers’ Decisions

Sometimes, finding the right type of lender depends on the reason for the refinance. Common refinance reasons include:

Lowering Your Interest Rate

One of the most popular reasons to refinance is to secure a lower interest rate, which can save thousands of dollars over the life of the loan and reduce monthly payments.

Best lenders: Credit unions often offer lower rates to members, while mortgage lenders with online platforms may close faster, making them ideal if rates are fluctuating.

Streamline refinance option: If you have an FHA, VA, or USDA loan, a streamline refinance may lower your rate with reduced documentation. Some lenders waive income verification and use a simplified credit review, but requirements can vary. Direct mortgage lenders specializing in government-backed loans are your best bet.

How we source rates and rate trends

Rates based on market averages as of Dec 02, 2025.Product Rate APR 30-year Fixed Refinance 6.35% 6.37% 30-year Fixed Fha Refinance 5.56% 6.77% 30-year Fixed Usda Refinance 5.56% 5.70% 30-year Fixed Va Refinance 5.68% 5.82%

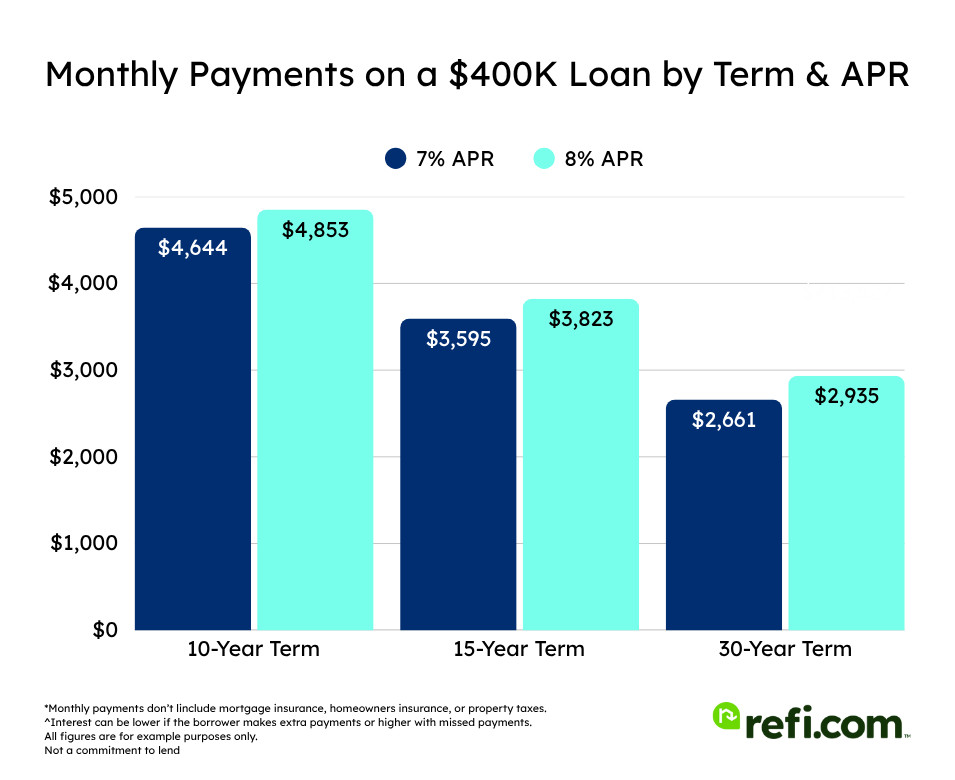

Shortening the Loan Term

Switching from a 30-year mortgage to a 15-year term can help you pay off your home faster and save on long-term interest costs.

Best lenders: Mortgage lenders and banks often have competitive options for shorter terms, especially if you have strong credit.

Reducing Monthly Payments

Extending your loan term or refinancing to a lower interest rate can make monthly payments more affordable.

Best lenders: Credit unions and banks can offer personalized options to lower payments, while mortgage lenders may provide faster approvals for time-sensitive refinances.

Streamline refinance option: For those eligible, streamline refinancing offers a straightforward way to reduce monthly payments without extensive documentation.

Eliminating Private Mortgage Insurance (PMI)

Borrowers with conventional loans or FHA loans often refinance to eliminate PMI or FHA mortgage insurance premiums once they’ve built up enough equity.

Best lenders: Credit unions or banks with a focus on conventional loans are ideal. Brokers can also help compare options from multiple lenders.

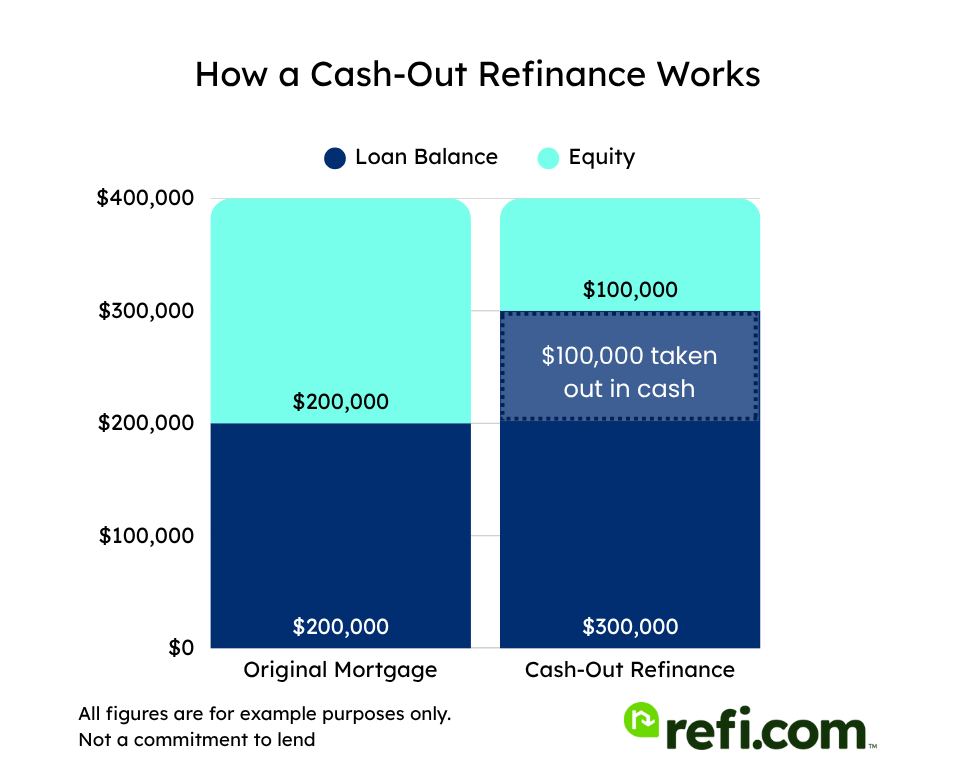

Accessing Home Equity

A cash-out refinance allows you to tap into your home’s equity for renovations, debt consolidation, or other financial needs.

Best lenders: Mortgage brokers can help shop around for cash-out refinance deals, while mortgage lenders may offer faster approvals.

Removing a Co-Borrower

Divorce, separation, or other life events may require removing a co-borrower from the loan.

Best lenders: Any lender can assist, but borrowers with government-backed loans may benefit from streamline refinancing through a direct lender.

Getting the Best Deal on Your Refinance

If there’s a mortgage refinance in your near future, start planning now by polishing up your credit profile. Make other debt payments, like credit card and student loan payments, on time. Pay down credit card balances if you can.

When it’s time to apply for the refinance, be sure to compare at least three different lenders. Compare online lenders to local banks and credit unions. Work with a broker if you don’t want to spend this time comparing loan rates and fees.

The money you save can add up to thousands of dollars, or more, over the life of a loan.