Refi Without Your Spouse: How Hard Is It?

Yes, you can refinance to remove your spouse from the mortgage, but only if you qualify on your own and your spouse agrees to be removed.

By definition, refinancing replaces your existing mortgage with a new mortgage: The current mortgage gets paid off, and you start fresh with a new loan. Usually, the new loan offers something your old loan doesn’t — like lower payments, less interest, or access to home equity.

Another thing a new loan could offer: A way to get your spouse off the loan.

Who Needs To Refinance Without a Spouse?

Refinancing without your spouse could solve several problems, such as:

- Allow divorcing couples to divide the home’s value and detangle their financial lives

- Free a spouse from the mortgage debt so they can buy an investment property or co-sign on an adult child’s mortgage

- Simplify estate planning — to leave the home to your children instead of your spouse, for example

Whatever the reason, there’s typically only one guaranteed way to get a spouse off a mortgage: Paying off the loan. When you don’t have enough cash to pay off the entire balance, you can pay off the loan by rolling the debt into a new loan — aka refinance.

The Biggest Challenge: Qualifying on One Income

When you purchased or last refinanced the property, chances are you used your and your spouse’s combined income to qualify for the loan. Now, you’ll have to qualify using the remaining spouse’s income alone.

For example, you might qualify for a $3,000-per-month payment with a combined $10,000 in monthly household income. But if you make $6,000 alone, you may not qualify for the same payment.

Plus, if rates have increased since you purchased, the payment could rise substantially.

How we source rates and rate trends

Rates based on market averages as of Dec 02, 2025.Product Rate APR 15-year Fixed Refinance 5.37% 5.42% 30-year Fixed Refinance 6.35% 6.37%

In these cases, you may need to work out an agreement for divorce situations. Work with your lawyer and financial planner for potential solutions to keep your spouse on the loan until such a time as you can refinance alone.

Check out our full guide to refinancing after a divorce for more information.

Does My Spouse Have to Sign Anything?

Yes — if your spouse is currently on the mortgage or on the title to the home, they’ll likely need to sign documents to complete the refinance.

Even though you’re applying for a new loan in your name alone, your spouse’s cooperation is usually required for two main reasons:

1. They’re on the Current Mortgage

If your spouse is a co-borrower on the existing loan, the lender needs their permission to release them from liability. This typically means signing documents during the refinance process that confirm:

- They are aware of the refinance.

- They agree to be removed from the new loan.

2. They’re on the Deed (Title)

Removing someone from the mortgage doesn’t automatically remove them from ownership of the home. If your spouse is listed on the property title, they’ll also need to sign a quitclaim deed (or similar document) to transfer ownership to you — otherwise, they still legally own part of the home, even if they’re no longer on the loan.

Check out our guide to quitclaim deeds and refinancing to learn more.

3. You Live in a Community Property State

In community property states lenders may require your spouse to sign a spousal consent or waiver form, even if they’re not on the mortgage or the title. This helps the lender verify that the property isn’t considered joint marital property.

Community property states are:

- Arizona

- California

- Idaho

- Louisiana

- Nevada

- New Mexico

- Texas

- Washington

- Wisconsin

Can I Use a Streamline Refinance to Remove a Spouse?

If you have an FHA, VA, or USDA loan, you may have heard of a streamline refinance — a simplified refi option that requires less paperwork, no appraisal, and sometimes no income verification.

However, streamline refinances typically do not allow you to remove a co-borrower from the loan. These programs are designed for speed and ease — not to change who’s legally responsible for the mortgage.

There are very limited exceptions. For example:

- If the co-borrower is deceased.

- Or if the remaining borrower can prove they’ve made the last 6 to 12 months of payments on their own, and meet other program guidelines.

Even in these cases, approval to remove a spouse is not guaranteed, and many lenders will require a full refinance with income and credit review to change the borrower structure.

What About Just Asking The Lender To Remove Your Spouse’s Name?

It’s a long shot. But you could ask your lender about a loan assumption or a loan modification to remove your spouse’s name without refinancing.

You can ask, but lenders don’t have to say yes. And if they do consider your request, they may need to see documentation — like a divorce decree or pay stubs showing you can afford the loan by yourself.

And lenders may also charge a fee — 1 percent of the loan balance, for example — to complete a loan modification or assumption.

6 Ways to Save Money When You Refinance Without a Spouse

Can you save money while refinancing to remove a spouse? Possibly. This will depend on your unique personal finances, the type of refi you get, and current market conditions.

None of us can change current market conditions. We can only wait for conditions to change. If you can’t wait to refinance, you’ll have to deal with today’s mortgage market.

Within this context, though, there are other ways to save money while refinancing:

1. Borrow Only What You Need

When refinancing to remove a spouse, the loan amount you choose matters. The more you borrow, the more you’ll pay in interest over time. If your goal is simply to replace the current mortgage, you’ll likely want a rate-and-term refinance.

But in many situations — especially during a divorce — you may need to borrow more than the current balance to buy out your spouse’s share of the equity. This is where a cash-out refinance comes in.

A cash-out refinance lets you tap into the equity you’ve built in the home by borrowing more than you owe and receiving the difference in cash. That money can be used to compensate your spouse for their share of the home, per the divorce agreement.

Here’s how it plays out:

Suppose you and your spouse bought your home for $300,000 and now owe $235,000 on the loan. If the home is now worth $400,000, you have $165,000 in equity. To buy out your spouse’s share, you may need to refinance for something like $315,000 — enough to pay off the $235,000 loan and give your spouse $80,000 in equity.

On the other hand, if a buyout isn’t needed, you may choose to borrow less, keeping your monthly payments down and avoiding extra costs like mortgage insurance (which often applies when borrowing more than 80% of your home’s value).

Check out our guide to cash-out refinances for divorce buyouts to learn more.

2. Improve Your Credit Score First

If you know you’ll need to refinance soon, start working on your credit score now. A thorough credit restoration could take many months or even years. But every point helps. And it’s especially important to avoid lowering your credit score.

Here’s how: Try to pay down, or pay off, credit cards — but leave the paid-off accounts open. Make sure you’re paying existing debts on time, even student loans. Don’t borrow for a car or take out any other loans.

See how much an auto loan can impact your refinance eligibility.

3. Get A Different Co-Borrower If You Need One

Yes, you want your spouse off the loan, but would you consider adding another co-borrower or co-signer? If you’re struggling to get approved for a new mortgage by yourself, adding another responsible borrower — somebody with better income or credit than yours — could put you over the top.

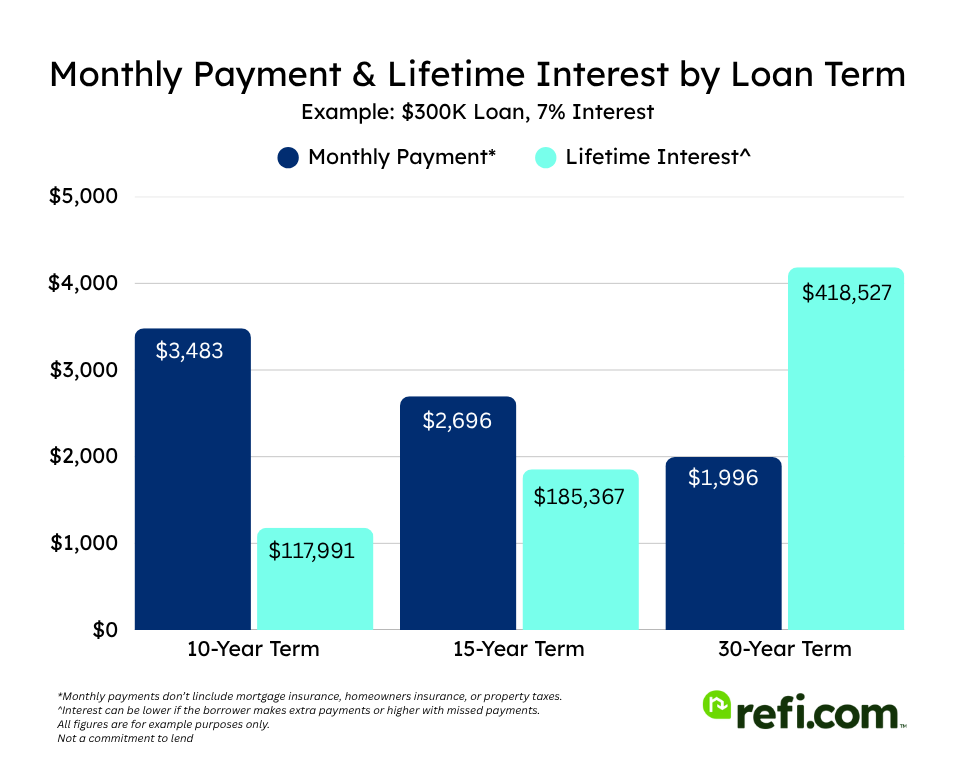

4. Consider A 15-Year Fixed Loan

If long-term savings are your goal and you can afford the higher payments, consider refinancing into a 15-year mortgage. If you can afford the payments, you’ll save significantly on lifetime interest costs.

- A $300,000 30-year mortgage at 7% costs about $418,000 in interest over those three decades.

- The same $300,000 loan balance paid over 15 years would require about $185,000 in interest.

That’s a potential savings of around $230,000 in interest if both loans are paid to term. This math doesn’t reflect the lower interest rates lenders can offer on 15-year fixed loans.

5. Consider An ARM

You’ll hear horror stories about adjustable-rate mortgages, or ARMs. Most of these stories come from the big housing market collapse back in 2008 when a lot of people got burned by that era’s poorly regulated ARMs.

An ARM starts with a fixed rate for a pre-set period which normally ranges from three to seven years. Then, when this initial period ends, the loan’s rate adjusts to match the market at that time. Then, the loan’s rate changes each year until it’s paid off.

Sounds risky? It is, compared to a fixed rate loan, but in the right hands, ARMs can save money.

First, ARMs lock a lower interest rate than a 30-year fixed during that initial fixed-rate period. Second, when the rate adjusts, it could adjust downward — depending on the market at that time. If it does go up, the federal government caps how high it can climb.

How we source rates and rate trends

Rates based on market averages as of Dec 02, 2025.Product Rate APR 5/6 Arm (refinance) 6.06% 6.08% 7/6 Arm (refinance) 6.00% 6.03%

6. Shop Around

In any rate climate — whether rates resemble the historic lows we saw during the pandemic or those incomprehensible double-digits of the 1980s — shopping around with different lenders can create savings.

This is especially true in our current market where online lenders compete with local credit unions and big-name banks.

Mortgage borrowers worry a lot about rates. Understandably so. But lender fees — like loan origination fees, credit report fees, appraisal fees, and so on — affect the cost of borrowing, too.

Related: Should You Refinance With the Same Lender or Choose A Different One?

Ready to Refinance Without Your Spouse? Get Started Today

Refinancing to remove a spouse from your mortgage can help simplify your finances, but it’s important to ensure you qualify on your own and choose the right loan option.

Whether you’re looking to lower your loan balance, secure a better rate, or explore alternatives like loan assumptions, the right strategy can make a big difference.

We’re here to help. Start your refinance process today and take the next step toward financial independence. Get started here.