Refinancing Inherited Property to Buy Out Heirs: What You Need to Know

This article is for informational purposes only and should not be considered legal or tax advice. Always consult an attorney or tax professional for guidance specific to your situation.

Inheriting a house with siblings or other relatives can be both a financial opportunity and an emotional challenge. One heir may wish to keep the family home for sentimental or practical reasons, while the others prefer a fair share of its value in cash.

A buyout, specifically refinancing the inherited property to pay off co-heirs, is a common solution that can help preserve family relationships and avoid contentious court battles. When you refinance, the heir who wants the home can gain full ownership and prevent a forced sale of the property. In the process, they take on a new mortgage and use the funds to compensate the other heirs for their inherited shares.

Below, we’ll break down everything you need to know about refinancing an inherited property to buy out heirs, including how the process works, steps to take, and important financial considerations.

Key takeaways:

- If you inherit a home with a mortgage and co-heirs, you generally have three paths: keep the house (by assuming or refinancing the mortgage), sell it and split the proceeds, or co-own it (for example, as a rental).

- A cash-out refinance may let you replace the inherited home’s existing mortgage with a new loan large enough to cover the old balance plus a lump sum to pay the other heirs their fair share.

- Establish legal ownership of the home through the estate or probate process before refinancing. To avoid disputes, all heirs should agree on a fair buyout amount (usually based on an appraised value).

Inheriting a Home With a Mortgage

If you’ve inherited a home with a mortgage and want to keep it, you’re likely wondering what happens next, especially when other heirs are involved.

Are you responsible for the mortgage?

Heirs do not become responsible for the mortgage automatically. The mortgage is the responsibility of the estate until the loan is assumed or refinanced. Heirs may continue to pay the mortgage to keep it in good standing, but it doesn’t affect their credit if they don’t.

It’s possible to assume an FHA, VA, or USDA loan, but only under the right circumstances, and only if the lender allows it. Check with your lender right away on the feasibility of an assumption.

Do you need to refinance immediately?

You do not always need to refinance immediately. Some loans, like FHA and VA, can be assumed under certain circumstances. This may be a short-term option, but if other heirs want their share, you will likely need to refinance to buy them out.

Is there a deadline?

Timeline-wise, you typically have until the estate is settled (which can take months or longer) to arrange finances and decide whether to keep or sell the home. But the mortgage must be paid during this period.

If no one pays, the lender can initiate foreclosure after a few missed payments, regardless of probate status. Thus, even if you haven’t decided on refinancing, make sure someone (the estate or an interested heir) is covering the mortgage in the interim.

What is the legal process and documentation needed?

If the property isn’t in a trust, probate (the court-supervised process of validating a will and transferring assets) is usually required to transfer ownership.

The chain of events that follows will depend on whether you’re the executor or just an heir. As executor, you have the authority to work with the lender and manage the property, including paying the mortgage from estate funds. If you’re an heir but not the executor, you will need to coordinate with them or with the court-appointed administrator if there’s no will.

You will need documents such as a death certificate, a will, and possibly a court order naming you as the personal representative/new owner.

Should you hire a lawyer?

Hiring a lawyer is not always needed, but it is highly recommended, especially if there are multiple heirs and any disagreements.

Alternative Options if You Want to Keep the Home

1. Refinance and buy out heirs

This is the most common solution for solo ownership.

2. Assume the loan and co-own

Works short-term, but co-ownership needs clear agreements.

3. Sell the property

Often, the simplest solution, if no one can afford the house alone, is to sell it. The proceeds first pay off any remaining mortgage, and the rest is divided among heirs as dictated by the will or state law.

4. Walk away

Heirs are not obligated to accept an inherited house. If the home is underwater (mortgage exceeds value) or too burdensome, heirs can let the lender foreclose.

Walking away won’t affect heirs’ credit unless they assumed or refinanced the loan. However, they will lose any equity in the property.

The Buyout Process

The buyout process starts by determining the home’s worth and then obtaining the money to pay for each heir’s share of it.

Since most people do not have that kind of cash ready to go, they turn to cash-out refinancing to get the funds they need. Short-term inheritance loans also exist to help with this, though they aren’t always recommended since they have a much higher interest rate than refinance options.

How to Calculate the Buyout Amount

Buyout Amount = (Appraised Value – Mortgage Balance) x (Heirs to be Bought Out ÷ Total Heirs)

Example:

- Home value after appraisal: $400,000

- Mortgage balance: $160,000

- Number of heirs: 3 (including you)

Step 1: Calculate Equity

$400,000 − $160,000 = $240,000 equity

Step 2: Calculate Buyout Amount

$240,000 × (2 ÷ 3) = $160,000 total to buy out two heirs (or $80,000 per heir)

Note that the formula is a general guideline and legal/financial professionals should be consulted for fair valuation and dispute resolution. The formula does not take into account liens, taxes owed, required repair costs, or unequal distributions.

Does everyone need to agree?

All heirs must agree to the buyout. If no agreement can be reached, any heir can petition the court for a forced sale.

Refinancing Options to Buyout Other Heirs

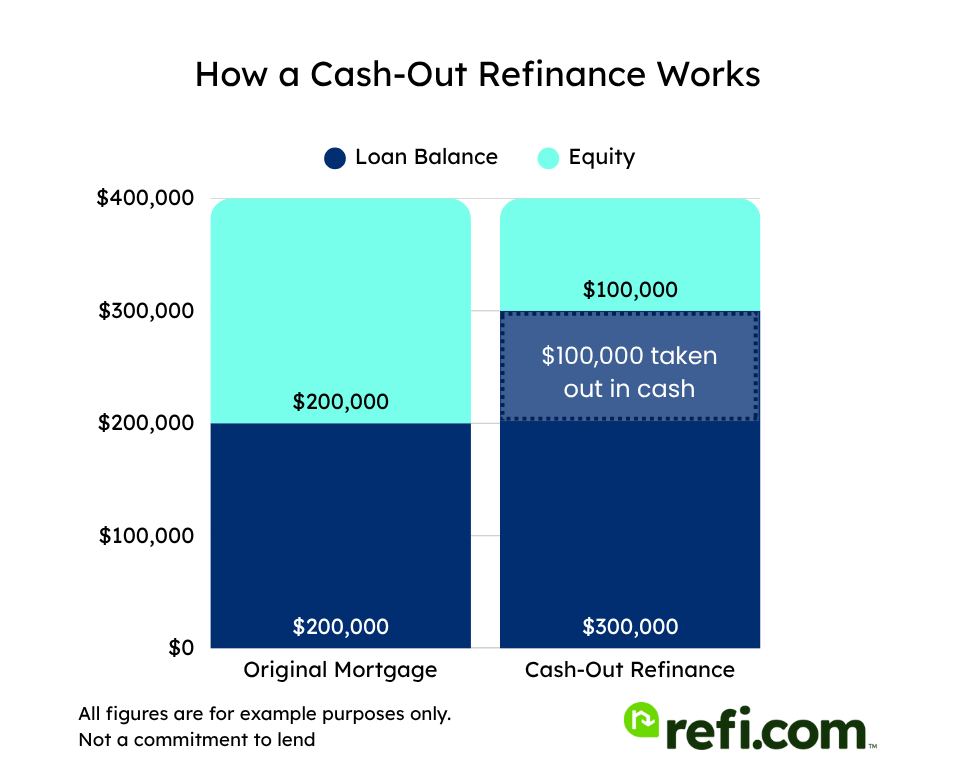

You will likely need a cash-out refinance on the inherited property to pay off your co-heirs and become the sole owner.

A cash-out refinance is a loan that replaces any existing mortgage with a new, larger mortgage, allowing you to “cash out” a portion of the home’s equity in the form of a lump sum at closing. You can then use that lump sum to pay the other heirs for their shares.

This is often the most cost-effective way to raise money because mortgage interest rates tend to be lower than personal loans or other financing methods, and the debt is secured by the property.

How It Works

Let’s say the home is worth $400,000 and has a $100,000 mortgage. If you qualify, you could refinance into a new $320,000 loan (80% loan-to-value, the typical maximum for cash-out).

You would pay off the $100,000 loan and use the remaining $220,000 less closing costs to compensate the other heirs. If this isn’t enough cash, you could try taking out a home equity line or loan or otherwise come up with the shortfall.

At closing, they sign over their shares, and you become the sole owner.

Qualifying for a Cash-Out Refinance

Getting approved is like qualifying for any mortgage. Lenders will look at your credit score, debt-to-income ratio (DTI), and the home’s value. Most won’t let you borrow more than 80% of the home’s appraised value.

If you currently own another home with a mortgage and have an average income, your DTI will be too high for lenders, potentially affecting your approval.

Mortgage options (conventional, FHA, VA)

An inherited property refinance doesn’t have to be with the same lender or the same type of loan as the original mortgage. You can shop around and choose the best refinance product for your situation.

Conventional

This is a standard mortgage from a bank or mortgage company, not backed by the government. It is great for borrowers with strong credit and at least 20% post-refinance equity. One benefit is that if you keep at least 20% equity, you won’t owe private mortgage insurance (PMI) on a conventional refinance.

FHA

If your credit or DTI is a bit weaker, an FHA loan might be an option for you.

FHA cash-out refinances allow higher risk tolerances (e.g., higher DTIs, lower credit scores) because the loan is insured by the government, but it limits you to 80% LTV and requires mortgage insurance.

There is no minimum occupancy requirement before you apply for an FHA loan on an inherited home, unless you’ve rented out the home. Then you need to occupy it as your primary residence for 12 months before applying for an FHA cash-out refinance.

VA

A VA cash-out refinance can be extremely powerful if you’re a veteran or service member and the property can be your primary residence.

VA loans offer possibly the highest LTV (up to 100% in some cases) and often have lower interest rates than conventional loans. This could allow you to borrow a larger portion if needed to pay off heirs.

Remember that this is only true if you are a veterans who is eligible for a VA loan and qualify for the new payment.

Steps to Refinance an Inherited Home

1. You Should Have Legal Ownership

You won’t be approved to refinance the home if you do not have legal authority over the home. This means you’ll have to have the title in your name or be authorized through a will, trust, or court.

Gather important documents, such as the death certificate, will/trust paperwork, and signed buyout agreements, to help you.

2. Figure Out the Buyout Amount

Using our formula from earlier, you’ll be able to quickly determine how much you need to pay each heir to become the home’s sole owner.

3. Look into your Refinance Options

Now it’s time to find the right refinance loan for your buyout by comparing mortgage products and lenders.

Most people use cash-out refinance to pay the existing mortgage and their co-heirs. Be sure to mention this is an inherited property and a buyout situation, since some lenders specialize in that.

During this stage, you’ll also want to gather the paperwork needed to apply. Typically, for a mortgage application, you need recent pay stubs, W-2s, possibly tax returns (if self-employed), bank statements, proof of homeowners insurance, and inheritance documentation.

It’s a good idea to get pre-approved for the refinance before you commit to the buyout with the other heirs. A pre-approval will tell you how much the lender is willing to loan you, and under what terms; this way, you won’t promise more to others than you can borrow.

Finally, select the lender and loan program that offers the best combination of a good interest rate and favorable terms for your needs.

4. Apply for the Refinance Loan

Once you have a lender chosen, you will submit a formal mortgage application (if you haven’t already done so as part of the pre-approval process). You should inform them that the property is inherited and you are buying out co-heirs.

The lender will order a new appraisal and review your credit, income, and debt-to-income ratio. You will also provide supporting documents, such as the will, proof of inheritance, and a draft buyout agreement, to them. Once the loan is approved, you will schedule the closing.

5. Close the Loan and Disburse Funds

At closing, the new mortgage is finalized. You’ll sign the loan paperwork, and your co-heirs will sign over their shares of the property. The title company will distribute the agreed-upon buyout funds to each heir and record the new deed in your name.

From then on, you are the sole owner and solely responsible for the mortgage.

Tax Implications

Refinancing an inherited home to buy out heirs comes with several tax considerations, but most are in your favor.

The biggest advantage is the stepped-up basis (capital gains tax). When you inherit a property, its tax basis resets to the home’s market value at the time of the original owner’s death. If your co-heirs sell you their share at that value, they typically owe no capital gains tax.

Gift tax could apply if a sibling agrees to sell their share for significantly less than its worth. If the discount exceeds the annual exclusion ($19,000 in 2025), they may need to file a gift tax return, even if no tax is ultimately due.

Property taxes may increase if the home is reassessed, especially in states like California. Check local rules if you’re concerned about rising costs after the title transfer.

Federal estate tax only applies to very large estates (over $13.99 million in 2025), but some states have their own inheritance taxes, especially on transfers to siblings.

Check with a tax advisor on whether mortgage interest and property taxes are deductible. Most interest is only deductible if used for improvements.

As with any tax strategy, always check with a licensed tax professional to take the best possible steps.

Refinancing Alternatives

If refinancing to buy out your co-heirs isn’t feasible, other ways exist to resolve shared ownership.

1. Sell the Property

The easiest way to proceed when you cannot refinance the home is to sell it and split the proceeds. This avoids needing a loan and works best if no one can afford the house or if tensions make co-ownership impossible.

2. Co-Own and Rent It Out

If at least two heirs are on board, you can turn the home into a rental property and split the income. This keeps the property in the family and may buy time until one heir is ready to buy out the others, but it only works if family relations are strong and business-minded.

3. Live-In with Installment Payments

A creative compromise (short of a full buyout or sale) could be an arrangement where one heir occupies the home and effectively pays rent or installment payments to the others for their shares.

For example, you move into the house and agree to pay your siblings a certain amount each month or year, perhaps equal to what rent would be or based on a loan amortization. This is kind of like the siblings financing the buyout for you instead of a bank.

You’d eventually want to refinance or pay them off in a lump sum (say, within a few years or when you can qualify), but in the meantime, they get income and you get to stay in the house.

4. Inheritance Loan or Cash Advance

If you need fast cash to pay off heirs, a short-term loan can help. These often come with higher fees and should be used carefully.

5. Keep Co-Owning

Lastly, one alternative is not doing a buyout at all, at least for now. All heirs would continue to co-own the home. You could all use it (perhaps as a vacation home if no one moves in, or one person lives there rent-free, which might be seen as using part of their inheritance if agreed).

This usually isn’t stable long-term, as circumstances change, and it can breed resentment if it is not equal. But in some families, co-ownership for a period works fine.

Ready to take the next step?

Refinancing an inherited property to buy out other heirs can feel overwhelming, but you’re not alone. Whether you’re just exploring your options or ready to move forward, Refi.com is here to help.

Start your refinance application today or connect with a loan specialist to find the right path forward.