Should You Refinance to a 15-Year Mortgage?

- You can save tens of thousands of dollars in interest by refinancing to a 15-year term.

- Your monthly payments will be much higher, meaning 15-year terms are only an option for those with spare cash flow.

Is it a good idea to refinance to a 15-year mortgage? It typically is if you can afford to do so.

Why? Well, to start with, you’ll be free of your mortgage in 15 years, half the time a 30-year refinance would mean. But, as importantly, you’ll stand to save a serious amount of money. Borrowing large sums over long periods means piles of interest payments. Halving the time you borrow should slash the total cost of your loan.

Nevertheless, 15-year terms mean cramming repayments into 180 months rather than the 360 of a 30-year loan. And that means that each payment will be higher. So, this solution isn’t for those who are already struggling to stay within their household budgets.

Get started here to run the numbers with a Refi.com loan expert.

Pros and Cons of a 15-Year Mortgage

Here’s a list of pros and cons when you refinance to a 15-year mortgage.

Pro: Long-Term Savings On Interest

This is the main reason people choose a 15-year term. Compared with a 30-year loan, the savings are startling. You can calculate your estimated potential savings using our refinance calculator.

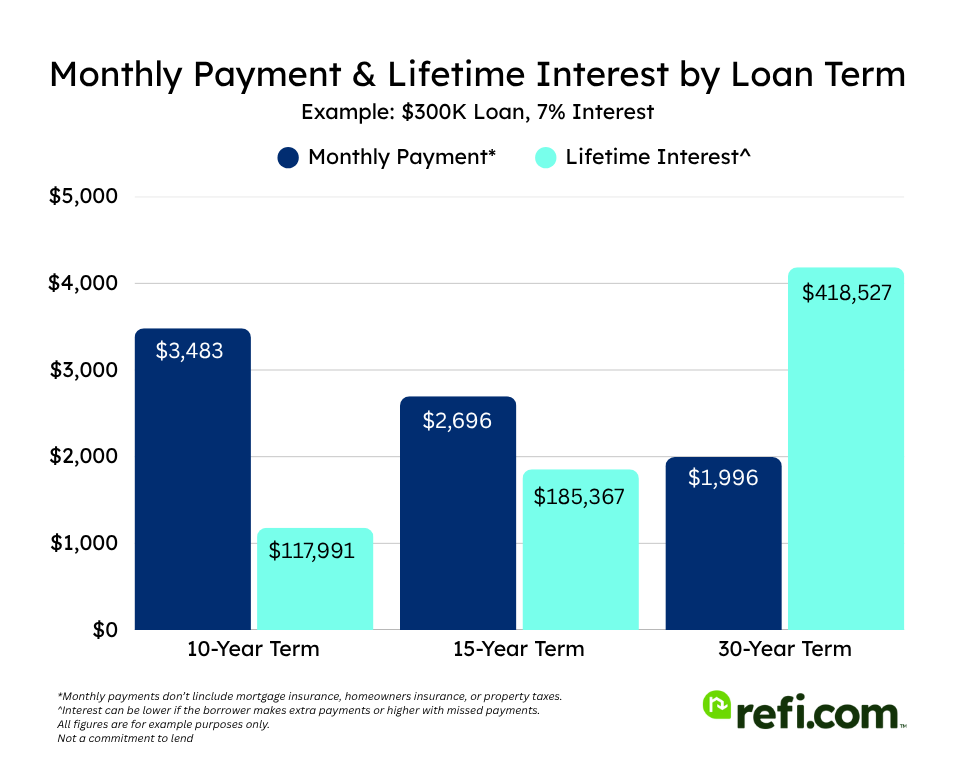

Here’s an example of how mortgage interest pans out across different loan terms:

Consider a $300,000 loan at 7% interest, for example.

- A 30-year mortgage comes with a monthly payment of about $1,996 and a total lifetime interest cost of roughly $418,527.

- With a 15-year mortgage, your monthly payment rises to $2,696, but your total interest drops to around $185,367.

- If you go even shorter with a 10-year term, your monthly payment increases to $3,483, yet your total interest plummets to about $117,991.

This visual comparison says it all. The shorter your loan term, the less you’ll pay in interest over time. For many homeowners, the extra few hundred dollars a month for a 15-year mortgage can translate into well over $200,000 in lifetime savings.

If you can comfortably manage the higher monthly payment, a 15-year term is one of the most effective ways to build equity faster and keep more of your money in the long run.

Pro: Building Equity Faster

When you take out a mortgage, most of your early payments go toward interest rather than the amount you actually owe (your principal). That’s especially true with longer loan terms. For a $300,000 mortgage at 7% interest, even by year 10 of a 30-year loan, the majority of your payment still covers interest — roughly $19,600 toward interest and only about $5,800 toward principal. It can take 15 to 20 years before more of your payment starts going toward what you owe instead of interest.

A 15-year mortgage flips that balance much sooner. With the same loan amount and interest rate, you’ll start paying more toward your principal than interest by around year five. By year 10, you could have paid off about half your loan balance.

And, if you need the funds, you may be able to tap more of your equity with a cash-out refinance, a home equity loan, or a home equity line of credit (HELOC).

Pro: Lower Interest Rates Than Longer-Term Loans

Loans with shorter terms typically come with lower interest rates. Mortgage rates change daily and sometimes more often, so check with a lender for current rates.

How we source rates and rate trends

Rates based on market averages as of Dec 02, 2025.Product Rate APR 15-year Fixed Refinance 5.37% 5.42% 30-year Fixed Refinance 6.35% 6.37%

Con: Higher Monthly Payments

The main drawback of a 15-year mortgage is the higher monthly payment. Using our $300,000 loan example at 7% interest, the 15-year payment comes out to about $2,696 per month, compared with $1,996 for a 30-year loan. That’s a difference of roughly $700 every month.

The key is finding a balance between saving on interest and keeping your monthly payments manageable.

Con: Less tax relief

The less you pay in mortgage interest, the less you’ll be able to deduct from your federal tax bill — assuming you itemize deductions. This isn’t an issue for most borrowers.

After all, you’d probably rather pay less than be able to claim back a proportion of what you pay. And, anyway, most people don’t itemize their deductions. It’s possible that some, however, have highly complex tax affairs and value this deduction. If so, consult your tax professional for advice.

For a full explanation of the tax implications, read IRS Publication 936 — Home Mortgage Interest Deduction, and run your scenario by a licensed tax pro before filing.

Con: Closing Costs

This isn’t specific to 15-year refinances. Whatever the term of your refinance, it will come with closing costs. And these aren’t cheap. On a $300,000 refi, you can typically expect to pay between 2% and 5% of your loan amount in closing costs.

Lenders often offer special deals that require you to come up with no cash for closing costs. Federal regulator, the Consumer Financial Protection Bureau (CFPB), explains: “There are two ways lenders can do this. One way is by charging you a higher interest rate and giving you a credit to cover the cost of making the loan.

The other option is to add the closing costs to your loan amount. A higher interest rate will mean you pay more over time, and a higher loan amount will increase your payments and reduce your equity.

So, in the long term, you’ll be better off funding closing costs from your savings. But not all of us have that sort of spare cash lying around. You should shop with both rate and closing costs in mind.

Shortening Your Loan Term vs. Paying Extra Principal

If 15-year rates are higher than your current 30-year rate, you can create your own 15-year mortgage by making larger payments on your existing mortgage. But timing matters. If you’re early in your loan, refinancing could maximize interest savings. If you’re well into your mortgage, extra principal payments might be a better option since most interest has already been paid, and you’ll avoid closing costs.

If you go the extra principal payments route, just make sure your lender applies all your additional early payments to your principal balance (the amount you owe) rather than across the principal and interest. A call and follow-up letter should achieve that. Many online mortgage portals allow you to specify where your extra contributions go.

Simply use an amortization calculator to find out the required extra monthly payment needed to retire your loan in 15 years.

When It Makes Sense to Refinance to a 15-Year Loan

If you want to reduce your interest bill, it pretty much always makes sense to opt for a 15-year term over a 30-year loan. But only if you can comfortably afford the higher monthly payments. However, once you’ve made your choice, you have to stick with it.

Your lender will expect you to keep up with the payments you signed up for. Your monthly payments will be significantly higher than if you had stuck with a 30-year loan. This may pose an issue down the line if any unexpected events impact your income.

Your higher monthly costs may not leave room for additional homeownership expenses, such as renovations or unexpected repairs and maintenance. And, if life takes a sudden, unexpected turn for the worse, you might have to refinance yet again to get yourself out of trouble with a 30-year mortgage.

Unfortunately, that would mean another unpleasant dose of closing costs, if you can qualify for the loan at all. So, you might want to think twice about a 15-year term if you have health issues that might deteriorate or if your job or industry is less secure than most.

Ready to Start Your 15-Year Refinance?

If you’re ready to explore how much you could save with a 15-year refinance, Refi.com makes it easy to get started. We specialize in refinancing and can help you determine whether a 15-year term is the right move for your financial situation.

Start your refinance application with Refi.com today and take the first step toward mortgage freedom and significant interest savings.