How to Get Rid of FHA Mortgage Insurance

The most common way to get rid of FHA mortgage insurance is by refinancing into a conventional loan once you’ve built enough equity. But depending on when your FHA loan originated and how much you put down, you may be able to have the insurance removed automatically—no refinancing required.

In this guide, we’ll walk through the rules for FHA mortgage insurance cancellation, how refinancing works, and what to consider before making a move.

Key Takeaways

- FHA loans require two types of mortgage insurance: an upfront premium (UFMIP) and an annual premium (MIP) paid monthly.

- The most common way to remove FHA mortgage insurance is by refinancing into a conventional loan once you’ve built enough equity.

- Depending on your down payment and when your loan originated, MIP may cancel automatically.

A Quick Refresher on FHA Mortgage Insurance

Before discussing FHA PMI removal, it’s important to understand the two types of mortgage insurance you pay on FHA loans.

- Upfront Mortgage Insurance Premium (UFMIP): You pay this fee upfront at closing or roll it into your loan amount, and you can’t remove it.

- Annual Mortgage Insurance Premium (MIP): You pay this annual fee monthly as part of your mortgage payment. Most borrowers want to remove MIP to lower their monthly mortgage payments.

Mortgage insurance on FHA loans differs significantly from conventional loans’ private mortgage insurance (PMI). With conventional loans, PMI is only required if your down payment is less than 20%. You can cancel your mortgage insurance once your loan-to-value (LTV) reaches 80% – oftentimes through a combination of principal payments and appreciation.

Mortgage insurance on FHA loans works differently. Every borrower must have mortgage insurance on their loan, regardless of the down payment.

Savings from Removing Mortgage Insurance

Mortgage insurance is required because it protects the lender if you fail to make payments on your mortgage. However, it’s an expense that most people want to avoid because their monthly mortgage payments will be lower without it.

Let’s walk through the numbers to help you understand the cost of MIP and the amount you could save with FHA PMI removal.

The UFMIP you pay when you close your home loan equals 1.75% of your loan amount. If you’re borrowing $300,000, this would be $5,250. You won’t be able to avoid this fee, but you can pay it fully at closing or roll it into your loan amount.

Then, you’ll be required to pay MIP each month. For loans with less than 5% down and a term longer than 15 years—which is most FHA Loans—MIP equals 0.55% of your loan amount annually but is paid monthly.

Based on your $300,000 loan, your MIP would be $1,650 per year or $137.50 per month (300,000 * 0.55% ÷ 12).

Most people want to know how to get rid of PMI on an FHA loan to avoid this extra monthly fee.

Here’s a breakdown of what you might be paying based on your loan amount:

| Loan Amount | UFMIP | MIP (paid monthly) |

| $250,000 | $4,375 | $115 |

| $300,000 | $5,250 | $138 |

| $350,000 | $6,125 | $160 |

| $400,000 | $7,000 | $183 |

MIP rates vary by down payment and loan term. Many borrowers pay between 0.50% and 0.55% annually.

Remove FHA Mortgage Insurance by Refinancing to a Conventional Loan

One of the most common ways to remove mortgage insurance on an FHA loan is by refinancing to a conventional loan. This replaces your FHA loan with a conventional loan with new mortgage terms and interest rate. However, if your LTV is lower than 80%, you can avoid paying mortgage insurance going forward.

However, when you refinance to a new loan, you go through the entire underwriting process again. Whether you use the same lender or choose a different one, they review your income, credit, and financial profile to ensure you qualify.

Even though refinancing to a conventional loan is a great way to remove MIP from an FHA loan, you need to consider a few things.

Conventional Loans Have Stricter Eligibility Requirements

Conventional and FHA loans are very similar. However, because the federal government backs FHA loans, the eligibility requirements are more relaxed.

For example, FHA loans can be available to borrowers with credit scores as low as 500 (though many lenders require stricter minimums). For conventional loans, lenders require your credit score to be at least 620.

FHA loans often allow higher debt-to-income ratios (DTI)—up to 56.99% in some cases—while conventional loans generally prefer DTIs of 43% or lower, though they may go higher with strong credit, income, or assets.

Time the Refinance With Interest Rates

Even though your primary goal might be removing mortgage insurance to lower your monthly payment, you must consider interest rates. If interest rates have risen since you first took out your mortgage, the increase in interest on the new loan may negate the savings from removing mortgage insurance.

If you’re considering refinancing from an FHA to a conventional loan, compare current interest rates with your existing rate. This way, you can determine your new payments without mortgage insurance and with a new interest rate.

Here’s a quick look at how interest rates are trending for FHA vs. conventional:

| Product | Rate | APR |

|---|---|---|

| 30-year Fixed Fha Refinance | 5.56% | 6.77% |

| 30-year Fixed Refinance | 6.35% | 6.37% |

How we source rates and rate trends

Use our refinance calculator to see how your payment may change with a refinance.

Refinancing Means a New Loan Term

When you refinance from an FHA loan to a conventional loan, you adjust to new loan terms. A conventional loan’s terms depend on the lender, but the most common terms are 10-, 15-, 20-, or 30-year loans.

The terms you choose can affect how long it takes to pay off your mortgage and the total interest you pay. If you decide to refinance to a 30-year loan, you can lower your monthly payment, but you may end up paying more in interest over the life of your loan.

However, if you refinance from a 30-year to a 15-year loan, your monthly payment will likely increase, even if you can eliminate mortgage insurance. But the good news is you can pay off your loan sooner, paying less total interest.

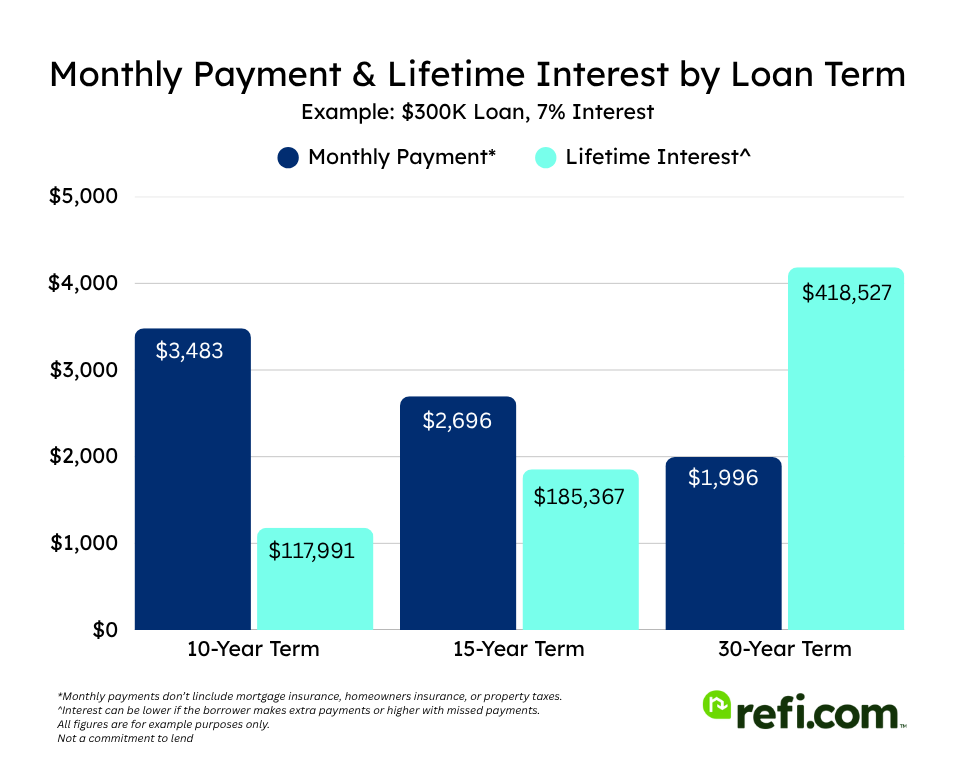

Here’s a look at what your monthly payments and lifetime interest costs may look like on a $300,000 loan based on your term length:

| Term | Monthly P&I Payment | Lifetime Interest |

| 15 Years | $2,613 | $170,398 |

| 20 Years | $2,237 | $236,813 |

| 25 Years | $2,025.62 | $307,686 |

| 30 Years | $1,896 | $382,633 |

Assumes a 6.5% interest rate. All figures are for example purposes only and may not be available. Not a commitment to lend.

An Appraisal Could Reveal More Equity Than You Think

Most lenders require an appraisal of your home as part of the refinance process to help them understand its worth compared to the loan amount you’re applying for. Because homes have been appreciating quickly over the past several years, you might find that you have a lot more equity in your home than you thought.

If this happens, you could use a cash-out refinance to eliminate mortgage insurance and tap equity in the home as cash, which you can then use to complete a home improvement project or pay off high-interest debt.

Refinancing Comes With Costs, So Know When You’ll Break Even

Refinancing a mortgage doesn’t come without a cost. As part of the process, you must pay closing costs on the new loan. Depending on your lender, this could be anywhere from two to six percent of your loan amount.

Before moving forward, make sure you understand your breakeven point, or how many months you need to stay in the home for the cost of refinancing to be worth it. If you plan to stay longer, refinancing will be beneficial. However, if you feel you might move before the breakeven point, refinancing might not make sense.

Shop Around

Just like when you initially purchased your home and shopped around for lenders, it’s essential to shop around when refinancing. However, don’t just look at the interest rate each offers.

Pay close attention to the APR, which includes the interest rate and fees. Some lenders offer a lower rate but have high fees attached to the loan.

What If You Refinance to Conventional Before You Have 20% Equity?

You don’t need to wait until you have 20% equity to refinance from an FHA loan to a conventional loan, but you may still be required to pay private mortgage insurance (PMI) on the new loan.

Conventional loans typically require PMI if your loan-to-value (LTV) ratio is above 80%. The difference, however, is that conventional PMI can eventually be canceled once your LTV reaches 78%—either automatically or by request once you hit 80%.

That makes it more flexible than FHA mortgage insurance, which can last the full life of the loan depending on when your FHA mortgage originated and how much you put down.

So even if you don’t yet have 20% equity, refinancing could still make sense if:

- You’re getting a better interest rate than your current FHA loan.

- You want to switch to a shorter loan term.

- You’re planning to hit 20% equity soon and want the option to remove PMI later.

Just be sure to run the numbers, taking into account the cost of PMI, the new rate, and any closing costs, to ensure the refinance makes financial sense.

Some FHA Loans Have Mortgage Insurance Canceled Automatically

Depending on your current loan, it’s possible that mortgage insurance could be canceled automatically without needing to refinance. However, eligibility for automatic mortgage insurance cancellation depends on when you took out your loan and either the equity you’ve built or the size of your down payment.

Here are the rules for automatic FHA mortgage insurance cancellation based on your loan origination date.

| MIP Automatically Cancelled | Loan origination date between Jan. 2001 and June 3, 2013, MIP will be canceled once your LTV reaches 78%* |

| Loan origination date after June 3, 2013, down payment ≥ 10%, MIP will be canceled after 11 years | |

| MIP for the life of the loan | Loan origination date between July 1991 and Dec. 2000 |

| Loan origination date after June 3, 2013, down payment < 10% |

*Must be a 30-year loan, and you must have made 5 years of payments

The Bottom Line

Mortgage insurance is a necessary expense for many FHA borrowers, but it doesn’t have to stay with you for the life of the loan. While FHA loans come with mortgage insurance premiums that are typically part of your monthly payment, there are strategies to eliminate them.

Ultimately, removing mortgage insurance or exploring other loan products is a personal decision that depends on your financial goals, equity position, and the cost-benefit of refinancing. Be sure to evaluate all your options and consult a trusted lender to find the best solution for your needs.

Are you ready to refinance your mortgage? Start your application with Refi.com here.