Student Loan Cash-Out Refinances: What You Need to Know

Student debt is currently at an all-time high, with 42.7 million individuals owing a cumulative $1.7 trillion in federal student loans, according to Education Data Initiative. With the average borrower on the hook for nearly $38,400, many property owners are turning to their built-up equity to alleviate their student debt burden.

There are two common options for using your home’s equity to consolidate your student loans: a standard cash-out refinance and Fannie Mae’s student loan cash-out refinance program. We’ll go over the pros and cons of each, as well as a few other options that may be worth considering.

Key Takeaways

- A standard cash-out refinance lets you pay off some or all of your student loan debt while providing maximum flexibility in how you use your equity.

- Fannie Mae’s student loan cash-out refinance program offers lower rates but has stricter guidelines and limits on how funds can be used.

- Rolling your student loans into your mortgage can lower your overall monthly payments but may cause you to forfeit federal protections on your student debt.

Consolidating Student Debt Into Your Mortgage

A student loan cash-out refinance allows you to roll some or all of your student debt into your home’s mortgage. This can simplify your finances by consolidating multiple monthly obligations into one single payment.

Plus, student debt often has a 10-year repayment period. Rolling your educational loans in with your mortgage can stretch out that term and reduce the amount you’re required to pay each month.

If you are currently locked into a high rate on your student loans, consolidating them into your mortgage may even save you money in interest.

Standard Cash-Out Refinance

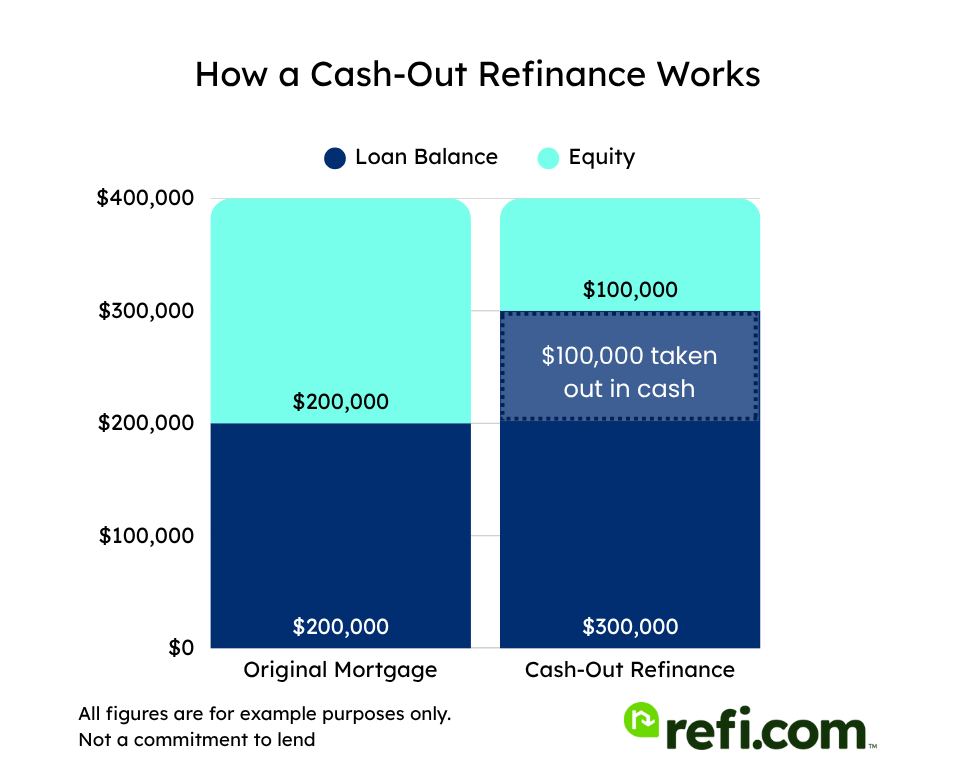

A standard cash-out refinance allows you to take out a new mortgage for an amount larger than you currently owe, use these funds to satisfy your existing loan, and then receive the difference back in cash as part of the closing process.For example, if you currently have a $200,000 mortgage balance and do a cash-out refinance for $300,000, you would receive the difference of $100,000 – minus closing costs – as a lump sum payment.

These funds can then be used in whatever manner you choose – including to pay down or pay off your student loan debt.

You can also use a cash-out refinance to consolidate other debts, such as:

- Credit cards

- Auto loans

- Medical bills

The proceeds from a cash-out refinance aren’t just limited to consolidating debt, though. You could use some of the funds to pay your student loans and then put the remainder towards:

- Home improvements and repairs

- Major purchases such as a new vehicle or family vacation

- Making a down payment on a second home or investment property

- Funding other investments or business ventures

Cash-Out Refinance Options

Most homeowners opt for a conventional cash-out refinance, although some government-backed programs – such as the FHA and VA – offer these types of loans as well. Let’s take a quick look at how these three options differ.

- Conventional Cash-Out Refinance: Conventional guidelines require a credit score of at least 620, although most lenders will look for 640 to 680 or even higher. Refi.com requires a 660 credit score for a conventional cash-out refinance. Debt-to-income ratios can be as high as 45%, but some lenders may enforce a lower cap. For a single-family home, you’ll need to have at least 20% equity left over after cashing out your funds.

- FHA Cash-Out Refinance: FHA guidelines allow for cash-out refis with a credit score of 500, although most lenders, including Refi.com, require 620 or higher. You might get approved for an FHA cash-out with a DTI as high as 45-50%, but lower is generally recommended. Similar to conventional loans, FHA lenders require you to keep at least 20% remaining equity in your home.

- VA Cash-Out Refinance: The VA does not specify a minimum credit score for the loans it insures, but you’ll have the best luck getting approved with a score of 620 or better. Plan to need a DTI of 41% or below, although lenders may accept higher ratios. In most cases, you can get a VA cash-out refinance for up to 90% of your home’s value, with a few mortgage companies offering full 100% LTV loans.

Note: Compared to basic rate-and-term refinances – which do not allow you to receive cash back – cash-out refinances typically come with slightly higher interest rates to account for the added risk that lenders incur when loaning more money than you currently owe.

Fannie Mae’s Student Loan Cash-Out Refinance

One popular alternative to a standard cash-out refinance is Fannie Mae’s student loan cash-out refinance program.

These mortgages – designed to help pay off student loan debt – aren’t treated like a traditional cash-out refinance. This means you’ll likely be able to secure a lower interest rate, which can translate into lower monthly payments.

The trade-off, however, is that your cash-out is essentially limited to the funds used to pay your student debt. You don’t have as much freedom to choose how to use your equity as you would with a standard cash-out refinance.

Fannie Mae’s student loan cash-out refinance remains ideal, however, if your primary refinancing goal is to consolidate your student loans into your mortgage.

Sound like a good option? There are some other rules and eligibility criteria for the Fannie Mae program that you’ll want to keep in mind:

- You must be approved for the loan through Fannie Mae’s automated Desktop Underwriting (DU) platform – manual underwriting is not allowed.

- At least one student loan obligation must be paid off in full through the refinance, and that debt must belong to one of the borrowers on the mortgage. You can’t make a partial student loan payment (although if you have more than one student loan, you don’t need to pay them all off), and you cannot use the funds to pay someone else’s – like a family member’s – student loan debt.

- You cannot wrap in second-position liens, such as HELOCs and home equity loans unless they were used to help you purchase your property. Subordinate mortgages originated after taking ownership of your home are not eligible. The one exception is Property Assessed Clean Energy (PACE) loans or other types of financing used solely for energy-efficient home improvements.

- You are allowed to receive as much as 2% of your new mortgage (up to a maximum of $2,000) back in cash as part of the closing process.

- Closing costs can be included in your new loan, similar to a standard cash-out refinance.

Note: Refi.com does not offer student loan cash-out refinances. This information is included for informational purposes.

Comparing the Two Options

Let’s take a side-by-side look at how standard cash-out refinances and the Fannie Mae student loan cash-out refinance program stack up.

| Standard Cash-Out Refinance | FNMA Student Loan Cash-Out Refinance | |

| Use of Funds | Any use you choose | Student loan payoff only |

| Interest Rates | Higher | Lower |

| Flexibility | High | Limited |

| LTV Limits | 80% for most borrowers | 80% for most borrowers |

| Closing Costs | Can be included | Can be included |

| Overall Cost | Higher | Cheaper |

Should You Roll Your Student Loans Into Your Mortgage?

So, is it a good idea to roll your student loans into your mortgage? That depends a lot on your individual situation and financial needs.

Refinancing your student debt into your home loan means converting unsecured debt into debt that’s secured by collateral (your home). While defaulting on student loans can lead to wage garnishment and other issues, defaulting on your mortgage can lead to foreclosure.

Rolling your student loans into your mortgage can also cause you to lose federal protections and payment options such as income-driven repayment (IDR) plans and loan deferment or forbearance.

However, consolidating your student loans with a cash-out refinance can lead to lower overall monthly debt obligations for many homeowners. If you’re finding yourself with little cash left over after paying your bills, rolling your student loans into your mortgage may offer some much-needed leeway when it comes to your monthly finances.

Alternative Options

Although the standard cash-out refinance and Fannie Mae’s student loan cash-out refinance programs are effective ways to consolidate your student debt, you may have other mortgage-related alternatives.

Home Equity Loans

Home equity loans (HELOANs) are a type of second mortgage that allow you to tap into your equity while keeping your current loan intact. Like a cash-out refinance, you will receive a lump sum of cash as part of the closing process, which you can use however you see fit – including to pay off your student loans.

Home equity loans typically have lower closing costs since you aren’t refinancing your entire mortgage balance. However, they usually come with interest rates that are higher than those quoted for a cash-out refi.

Borrowers most commonly opt for a home equity loan when they’re locked into a highly favorable interest rate with their first mortgage or when they only need to borrow a small amount relative to the size of their current loan.

Check out the Refi.com blended rate mortgage calculator to see how a HELOAN could impact you and your monthly mortgage costs.

HELOCs

A home equity line of credit (HELOC) is similar to a home equity loan in that it’s a second-position lien on your property that does not replace your current mortgage.

Unlike a home equity loan, however, a HELOC does not provide you with a lump sum of cash all at once. Instead, you’ll receive access to a line of credit, similar to a credit card, that you can use over time as you see fit.

Borrowers would typically opt for a HELOC over a HELOAN when they plan to pay off student debt now but anticipate needing further access to their home equity within the next few years.

HELOCs begin with an initial draw period – often five to ten years – where you’re only required to pay interest on the balance you’ve accumulated up until that point. This is followed by a repayment period, typically ten to twenty years, where you’ll be responsible for making both principal and interest payments.

Note: While most home equity loans have a fixed-rate interest structure, like a standard mortgage, HELOCs typically come with a variable rate that fluctuates based on changing market conditions.

Employer-Sponsored Student Loan Repayment

Some employers choose to offer student loan repayment programs as part of their employee benefits package to attract and retain talent. This often comes in the form of a one-time sign-on bonus or recurring monthly payments to help pay down your debt while you remain employed.

In some cases, employers may contribute towards your retirement savings account as an incentive for you to use a portion of your paycheck to satisfy your student loans instead.

Keep in mind that the funds provided through employer-sponsored student loan repayment programs are largely treated as taxable income. The CARES Act of 2020 included a provision for up to $5,250 in annual tax-free employer loan payments, but that benefit is currently set to expire at the end of 2025.

Private Student Loan Refinances

Many private lenders offer student loan refinances that allow you to consolidate multiple student loans and adjust their interest rates and terms. This process is similar to refinancing your home – you obtain a brand-new loan with the funds used to satisfy your existing debt.

This can be a good option if you currently have a below-market mortgage rate or if you don’t have enough equity in your home to qualify for a cash-out refinance.

Refinancing your student loans with a private lender allows you to keep the debt unsecured rather than converting it into secured debt backed by your home. However, refinancing student loans may eliminate federal benefits such as the ability to enroll in income-driven repayment plans.

Private student loan refinance rates can vary drastically based on your financial profile and the lender you choose and can be higher than a cash-out refinance as they aren’t backed by collateral.

Federal Student Loan Forgiveness Programs

Some borrowers may qualify for partial or complete student loan forgiveness through one of the numerous federal student loan forgiveness programs.

A few of the most common include:

- Public Service Loan Forgiveness (PSLF) Program: Designed for government employees and individuals employed by non-profit organizations. Borrowers who have made at least 120 monthly student loan payments while working for a qualifying employer may be able to have the remainder of their student debt forgiven.

- Teacher Loan Forgiveness (TLF) Program: Provides up to $17,500 in loan forgiveness for individuals who complete five consecutive years of employment teaching in a designated low-income school or educational service agency.

- Total and Permanent Disability (TPD) Discharge: Loan forgiveness program for individuals with physical or mental health issues that severely limit their ability to work. Acceptable documentation for a TPD discharge can include a service-connected VA 100% disability rating, eligibility for Social Security Disability Insurance (SSDI) or Supplemental Security Income (SSI), or certification by a qualified medical professional.

Final Thoughts

Student loans can be a sizable monthly burden for some borrowers. Thanks to recent appreciation in property values, however, many homeowners now have the additional equity necessary to wrap their student debt into their monthly mortgage payments.

While both standard cash-out refinances and Fannie Mae’s student loan cash-out refinance program can be effective ways to roll your debts into one simple monthly payment, they may not be the right solutions for everyone.

If you’re ready to take the next step and find out exactly how a cash-out refinance to consolidate student loan debt could affect your budget and monthly debt payments, apply with Refi.com for a loan estimate customized for you.