Using Home Equity to Buy Land

There are plenty of great reasons to purchase vacant land: perhaps you’re planning to build your dream home, maybe you want to buy the parcel adjacent to your current residence, or you could simply be making an investment that you’ll sell for a profit down the line.

However, financing a land buy tends to be more complicated than taking out a traditional mortgage. As such, many people choose to utilize the equity they’ve built up in their current home to fund their land purchases.

- You can convert your built-up equity into funds to buy land with a cash-out refinance, home equity loan, or home equity line of credit.

- Using home equity may help you negotiate better terms in your purchase agreement and simplify the land buying process.

- Other potential financing options include land loans, construction loans, and personal loans.

Leveraging Home Equity

Homeowners can use their built-up equity for any number of different reasons. Most often, this tends to be a purpose that improves their overall financial situation, such as:

- Consolidating high-interest credit card debt

- Making improvements or additions to their home

- Purchasing a second home or an income-generating rental property

Sometimes, though, leveraging home equity can be a practical way to finance vacant land. However, it’s crucial to be aware of your options – both for accessing your home equity as well as the other land financing strategies available – and consider the pros and cons of each before making a decision.

Ways to Access Home Equity to Purchase Land

You can use your existing home equity – whether from your primary residence, a second home, or an investment property – to fund your land purchase. Let’s take a look at the three most common ways to do so.

Cash-Out Refinancing

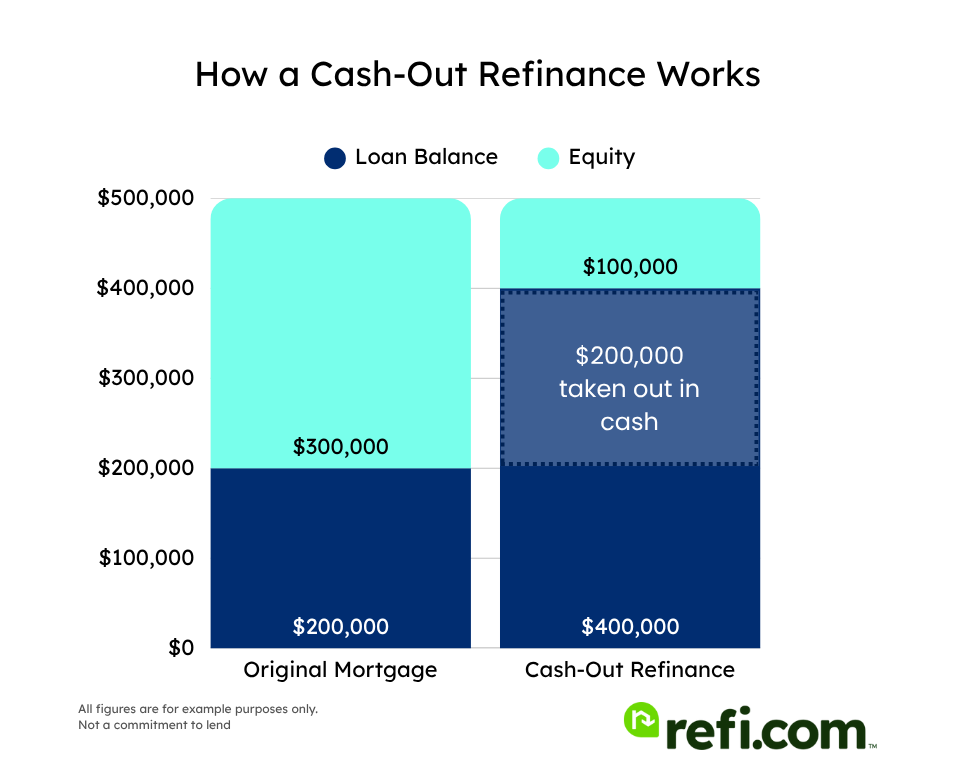

A cash-out refinance replaces your current mortgage with a larger home loan. The difference, minus closing costs, is returned to you as a lump sum of cash. Because it acts as your primary mortgage, a cash-out refinance will typically have a lower interest rate than any of the other land financing options we’re going to cover.

However, a cash-out refinance replaces your existing loan. So homeowners with a low rate may want to consider other options, especially if the amount they need to borrow is minimal relative to their present loan balance.

Most mortgage providers will let you do a cash-out refinance for up to 80% of your home’s value when borrowing against your primary residence. Limits for second homes and investment properties will be lower. You’ll also need a minimum credit score ranging from 620 to 680, or even higher, when working with a conventional lender. However, FHA lenders may be able to approve cash-out applicants with a score as low as 580.

Note: Refi.com requires a 660 credit score for conventional cash-out refinances and a 620 credit score for FHA cash-out refinances.

Home Equity Loans

Home equity loans are a type of second mortgage that sits alongside your current loan rather than replacing it, while still providing a lump sum of cash as part of the closing process.

Although interest rates may be slightly higher than with a cash-out refinance, homeowners locked into a below-market rate on their primary mortgage may still come out ahead with a home equity loan.

Loan-to-value limits are often higher with home equity loans than they are with cash-out refinances. Many mortgage companies permit borrowers to tap as much as 90% of their home’s value. However, plan to need a credit score of at least 680 in a lot of cases.

Check out the Refi.com blended rate mortgage calculator to see how a home equity loan could work out for you.

Home Equity Lines of Credit (HELOCs)

HELOCs are another type of second mortgage that does not replace your existing loan. Unlike a home equity loan, HELOCs provide you with access to a revolving line of credit that you can tap into multiple times throughout the loan’s draw period.

A home equity line of credit may make sense for borrowers who don’t know exactly how much they’ll need for their land buy, or who plan to use their equity for other purposes – such as improving or building on the land – within the next few years.

Loan limits and eligibility requirements are generally similar for HELOCs as they are for home equity loans, with many lenders allowing you to tap as much as 90% of your property’s value. A minimum credit score of 680 is a common requirement but varies by lender.

Note: While home equity loans typically have a fixed interest rate – similar to most standard mortgages – HELOCs tend to come with adjustable rates, which can fluctuate over time.

Pros of Using Home Equity to Buy Land

Why do many property owners choose to use their existing home equity to buy land? Here are just a few of the benefits.

Potential for Investment Growth

Purchasing vacant land can often be a savvy investment. As with all types of real estate, land can appreciate over time, and improving or developing land can significantly increase its value.

While growth will depend on a myriad of factors, using your home equity to buy land could result in far greater returns than the interest costs associated with financing the purchase.

Possible Tax Advantages

The IRS does not allow you to deduct interest costs on land that you plan to build on in the future, although some deductions are available once construction begins.

However, buyers planning to hold their land as a speculative investment can deduct interest payments up to the amount of their cumulative net investment income. Keep in mind, though, that tax laws are complex and constantly in flux. Be sure to speak with a tax professional to understand the implications fully.

Leverage for Better Terms

Since using your existing home equity to purchase land effectively makes you a cash buyer, you’re more likely to be able to leverage better purchasing terms than if you were to rely on niche land financing.

This could potentially save you a notable amount on the purchase price and may allow you to negotiate concessions from the seller to help cover some or all of your closing costs.

Speed and Flexibility

Many times, using your home equity to finance a land purchase can be simpler and have fewer holdups than obtaining a standard land loan.

This is partly because you can secure your cash-out refinance, home equity loan, or HELOC prior to finding the land you want to buy, and also because land loans are a unique product that typically requires more information about the borrower and the parcel being purchased.

Risks and Considerations

Although it is often cheaper and easier to fund a land purchase with home equity, there are some risks and considerations to take into account when deciding on a financing method.

Risk of Increased Debt and Home Foreclosure

The biggest downside of utilizing home equity to buy land is the added debt load and increased risk of foreclosure. Since you’re essentially using your current property as collateral to fund your purchase, failing to make your new, larger mortgage payments could result in the lender foreclosing on your existing home.

Real Estate Market Volatility

Real estate can be volatile, especially when talking about raw and unimproved land. While buying property can often be a good investment, the value of vacant land is not guaranteed to increase over time.

Land values in low-demand areas may not rise nearly as quickly as other real estate investments, such as a developed rental property.

Liquidity Concerns

Generally speaking, vacant land cannot be liquidated as quickly as developed real estate. If you were to choose to sell your land – or more crucially, if you needed to sell to get access to the funds – it may take months or even years to find a buyer, depending on local market conditions and the desirability of your parcel.

Fluctuating Interest Rates

Borrowers tapping into their home equity with an adjustable-rate loan – most common when taking out a home equity line of credit – may encounter fluctuating interest rates if overall market conditions change.

This could be a positive if rates decrease, but could also result in higher-than-anticipated monthly payments if interest rates rise in the future.

Alternatives to Using Home Equity

Using home equity can be an effective strategy for buying land, but it isn’t your only option. Let’s walk through some of the alternatives that are worth considering as well.

Land Loans

Land loans are a type of niche financing intended specifically for buying vacant land. Interest rates will usually be higher than with home equity mortgages, and you’ll likely need to put a significant amount of money down – sometimes as much as 35% or more – towards your purchase.

There are three primary types of land loans available:

- Raw Land Loans: These loans are used for purchasing raw land that lacks existing access to infrastructure, such as roadways or utilities. Often used for speculative land purchases, raw land loans will require a considerable down payment and have the highest interest rates.

- Unimproved Land Loans: Unimproved land loans are for properties with minimal access to infrastructure – such as direct roadway access – but with little else in the way of utilities or other improvements. Terms will be slightly better than with raw land, but still expect to need a sizeable down payment and to be quoted a high interest rate.

- Improved Land Loans: Improved land loans are for parcels with direct road access and nearly all required infrastructure already in place. You’ll commonly encounter improved land loans when purchasing in a planned subdivision or with properties that have previously held a home. These land loans are the least risky for lenders, but still come with less favorable terms than if you were to use home equity.

Note: Banks and other financial institutions supervised by the FDIC must follow federal guidelines requiring a minimum down payment of 35% of raw land, 25% on unimproved land, and 15% on improved land loans.

Construction Loans

Construction loans are used to purchase land and finance the cost of constructing a home. If you’re planning to buy land and begin building soon after, a construction loan will typically offer better rates and require a lower down payment than a basic land loan.

Keep in mind, though, that a construction loan involves more lender oversight when it comes to selecting a builder and the pace of the progress. This means that you’ll already need to have a construction agreement and tentative timeline in place to be approved for financing.

Many lenders offer “single-close” construction loans, which let you finance your land buy and build, and then automatically convert into a long-term mortgage once work is complete. These loans tend to have better terms than a “double-close” construction loan, which must be refinanced when the property becomes move-in ready.

Personal Loans

Personal loans are a type of unsecured debt that is not tied to real estate at all. Instead, lenders qualify borrowers based on their overall creditworthiness, similar to applying for a credit card.

Since personal loans are unsecured, they tend to have higher interest rates and shorter repayment periods, as the lender has minimal recourse if you were to stop making your payments.

The upside of personal loans, however, is that they can often be funded within a matter of days, generally making them faster than any other financing option we’ve talked about. This can prove ideal for land buyers who need quick access to a moderate amount of cash and plan to repay – or refinance – the loan in short order after acquiring a property.

When to Use Home Equity for Land

So, is using your home equity to finance a land purchase the right decision? Here are a couple of things to think about first.

Assess Your Financial Stability

If your finances aren’t secure and you don’t have a healthy cash flow, you should probably not be using your home equity to buy land – especially as a long-term investment.

That’s because tapping into your equity will typically increase your monthly mortgage payments, whether through a cash-out refi or by taking on a second loan.

Not only will this require more leeway in your monthly debt-to-income calculations, but it will also increase the risk of financial hardship if you don’t have solid emergency savings and job security.

Market and Interest Rate Conditions

Real estate and interest rate markets are constantly changing. In some situations, it may make more sense to hold off on tapping into your home equity if you believe that land prices or interest rates may decrease in the near future.

FAQ: Buying Land With Home Equity

Still trying to decide if you should use your existing home equity to purchase land? Here are direct answers to a few of the most frequently asked questions.

Can I Use Equity From a Rental Property?

Yes, you can use equity from a rental or investment property to finance your land purchase. However, lenders will typically have more stringent requirements and allow for a lower maximum loan-to-value ratio when using a home that isn’t your primary residence.

What If I’m Buying Land in a Different State?

Your home equity is yours to do with as you choose. Since your loan is secured by the value of your existing property, you can use the funds in whatever manner you decide – including buying land in a different state.

Can I Deduct Interest on a Loan Used for Land I Don’t Intend to Build On?

If you’re purchasing land as an investment with no plans to build on it, the IRS may allow you to deduct interest payments up to your annual net investment income. Tax guidelines are complex so be sure to consult a qualified professional for guidance on your individual situation.

Access Your Home Equity to Finance Your Land Purchase

Existing home equity can be a great way to finance a land buy with lower interest rates and a more straightforward process than taking out a specialty land loan.

However, utilizing home equity means you’re using your current property as collateral for your purchase. As such, it’s crucial to assess your financial preparedness and ensure you’ll be able to comfortably afford your new payments.If you’re ready to discover how much equity you can tap into and how doing so will affect your monthly mortgage payments, begin the lending process with Refi.com today.