VA Streamline (IRRRL) Guidelines & Rates 2025

The Bottom Line

A VA Streamline Refinance offers eligible Veterans and service members a hassle-free way to secure better loan terms when mortgage rates drop.

By replacing your existing VA loan with one that has a lower interest rate and improved payment terms, you can benefit from a simplified process—no income verification, appraisal, or bank statements required.

What is a VA IRRRL?

A VA IRRRL (pronounced “Earl”), also called a VA Streamline Refinance, allows current VA loan holders to refinance into a new VA loan to improve their rate and payment if rates drop.

The program is one of the best refinance options in the U.S.: It requires no tax returns, pay stubs, or W2s. The applicant does not need to supply bank statements, and a credit check may not be required, though this varies by lender.

Additionally, lenders typically don’t require an appraisal, so you may qualify even if your home value has dropped or the home no longer meets VA minimum property standards.

If rates have dropped since you first bought your home, an IRRRL can be an easy way to lower your monthly payment.

VA IRRRL Mortgage Rates

The average rate for 30-year fixed VA refinance loan for December 02, 2025 has increased to 5.68% compared to last week's rate of 5.64%. The average rate for 15-year fixed VA refinance loan for December 02, 2025 has increased to 5.33% compared to last week's rate of 5.24%. The average rate for 30-year fixed VA jumbo refinance loan for December 02, 2025 has increased to 5.75% compared to last week's rate of 5.71%.

| Product | Rate | APR |

|---|---|---|

| 30-year Fixed Va Refinance | 5.68% | 5.82% |

| 15-year Fixed Va Refinance | 5.33% | 5.54% |

| 30-year Fixed Va Jumbo Refinance | 5.75% | 5.88% |

How we source rates and rate trends

As its name implies, the main point of an Interest Rate Reduction Refinance Loan is to lower your interest rate.

VA IRRRL rates can be even lower than the already low VA loan rates. Obtaining a lower interest rate may not always be the primary reason for a VA IRRRL, though. Many VA homeowners use an IRRRL to switch from an adjustable to a fixed-rate mortgage.

While VA home loans are known for having some of the lowest interest rates on the market, rates vary from lender to lender. Some of the variables that can impact your rate include the loan amount, the property location, the term of your loan, and sometimes, your credit score.

Benefits of a VA IRRRL

The VA Streamline Refinance comes with many advantages that aren’t available with other refinances.

Some of the biggest advantages that make this loan one-of-a-kind include:

- Lower interest rates. One of the primary appeals of the VA IRRRL is the potential to obtain a lower interest rate. A lower rate can mean a reduced monthly mortgage payment and substantial savings over the life of the loan.

- Potentially no out-of-pocket costs. VA IRRRL closing costs are typically lower than other types of loan programs and can usually be rolled into the new loan, as opposed to having to pay these costs upfront.

- Simplified process. As the name implies, the VA Streamline Refinance program is designed to be simple and streamlined, with fewer paperwork requirements and formalities than traditional refinancing options. This makes the refinance process faster and more convenient.

- No appraisal needed. In most cases, VA IRRRLs do not require a new appraisal. This saves time and money because refinance appraisals typically take weeks and cost over $500.

- No minimum credit score requirement. While some lenders have minimum credit score requirements for a VA Streamline Refinance, many do not, making this type of refinance more accessible to more VA homeowners.

- No income verification. This refinance program typically does not require employment or income verification, simplifying the approval process.

- No need to provide a DD-214. Your current VA loan serves as proof of eligibility.

- Potential for lower monthly payments. With the help of a lower interest rate and potentially extending the loan term, the VA IRRRL can mean lower monthly mortgage payments for Veteran homeowners.

- Assumable loan. Like other VA loans, the IRRRL can be assumed by another qualified veteran, or in some cases, even non-veterans. This can be a huge selling point if you decide to sell your home.

- Reduced funding fee. The funding fee for a VA Streamline Refinance is generally lower than the fee for a new VA purchase loan or a standard VA refinance, making this type of refinance a more cost-effective option.

- No prepayment penalty. Borrowers can pay off their VA IRRRL early without facing any penalties.

VA Streamline Refinance Guidelines & Eligibility

The qualifying criteria for a VA Streamline Refinance are easier than those for most other refinances. However, certain requirements must still be met.

Existing VA loan: To be eligible for a VA IRRRL, you will need to have an existing VA home loan. You won’t have to supply Form DD-214 since your current VA loan proves eligibility.

Waiting period: You must have a current VA loan that’s been open for a minimum of seven months (210 days).

Timely payments: Borrowers must have a history of making timely mortgage payments, with no more than one 30-day late payment within the past 12 months.

Must benefit the Veteran: The refinance must result in a “net tangible benefit”, such as a lower interest rate, a lower monthly payment, or converting an adjustable-rate mortgage to a fixed-rate.

If the payment rises: Refinancing from an adjustable rate to a fixed rate could raise your payment. If the payment rises by more than 20%, income verification is required.

No cash-out: The VA IRRRL is meant for “rate-and-term” refinancing only. This type of refinance does not allow for cash-out refinancing.

Funding fee: In most cases, VA IRRRLs require a funding fee. The funding fee is less than most other types of VA loans and can be included in your new loan.

Occupancy: While veteran homeowners must certify that they previously occupied the property, there are no occupancy requirements for an IRRRL. Unlike the initial VA loan, your home does not need to be your current, primary residence.

VA IRRRL Funding Fee

The VA funding fee is a one-time charge that most VA borrowers must pay when obtaining a VA loan. The same holds true with a VA Streamline Refinance.

The VA funding fee for an IRRRL is generally 0.5% of the loan amount, significantly lower than the 2.15% that most veterans pay for the initial VA loan. For example, if the loan amount is $200,000, the funding fee would be $1,000. The fee can be rolled into the loan amount or paid out-of-pocket.

Exemptions: Many Veterans are exempt from paying the funding fee, including Veterans receiving compensation for service-connected disabilities and surviving spouses of Veterans who died as a result of service.

How a VA Streamline Works

Like all refinances, a VA IRRRL gives you an entirely new mortgage — with a new interest rate, a new loan term, and the ability to add or remove borrower(s).

The most common goal of an IRRRL is to lower your interest rate and monthly payment. But your loan term also plays a big role in both your monthly costs and total interest paid over time.

You’ll typically restart a 30-year loan, but you can also choose a shorter term or make extra payments to reduce your long-term interest.

Here’s how that plays out in two scenarios:

Examples: 30-Year vs. 15-Year VA IRRRL

Example 1

- Original loan: $300,000 at 7% for 30 years

- After 11 years: Refinance $250,000 balance at 6% for new 30-year term

| Original Loan | Refinance Loan | |

| Loan Amount | $300,000 | $250,000 |

| Interest Rate | 7% | 6% |

| Term | 30 years | 30 years |

| Combined Time to Payoff Home | N/A | 41 years* |

| Monthly P&I Payment | $1,996 | $1,499 |

| Lifetime Interest | $418,527 | $289,595 |

| Combined Lifetime Interest | N/A | $504,368** |

*This includes the first 11 years on the original mortgage + the refinance loan’s 30-year term

**This includes $214,773 in interest paid during the first 11 years + the new 30-year mortgage’s $289,595 of lifetime interest

The borrower saves nearly $500 per month, but adds 11 years to their payoff timeline and about $86,000 in total interest. However, if they apply the $500 monthly savings toward principal:

- New payoff time: 21 years, 11 months

- Total lifetime interest: $305,917

Example 2

Refinance $250,000 balance at 6% for a new 15-year term.

| Original Loan | Refinance Loan | |

| Loan Amount | $300,000 | $250,000 |

| Interest Rate | 7% | 6% |

| Term | 30 years | 15 years |

| Combined Time to Payoff Home | N/A | 26 years* |

| Monthly P&I Payment | $1,996 | $2,110 |

| Lifetime Interest | $418,527 | $129,736 |

| Combined Lifetime Interest | N/A | $344,509** |

*This includes the first 11 years on the original mortgage + the new mortgage’s 15-year term

**This includes $214,773 in interest paid during the first 11 years + the new 15-year mortgage’s $129,736 of lifetime interest

This option increases the payment by about $100/month but saves $74,000 in interest and shaves 4 years off the loan.

Learn more: Refinance vs. Paying Extra Principal

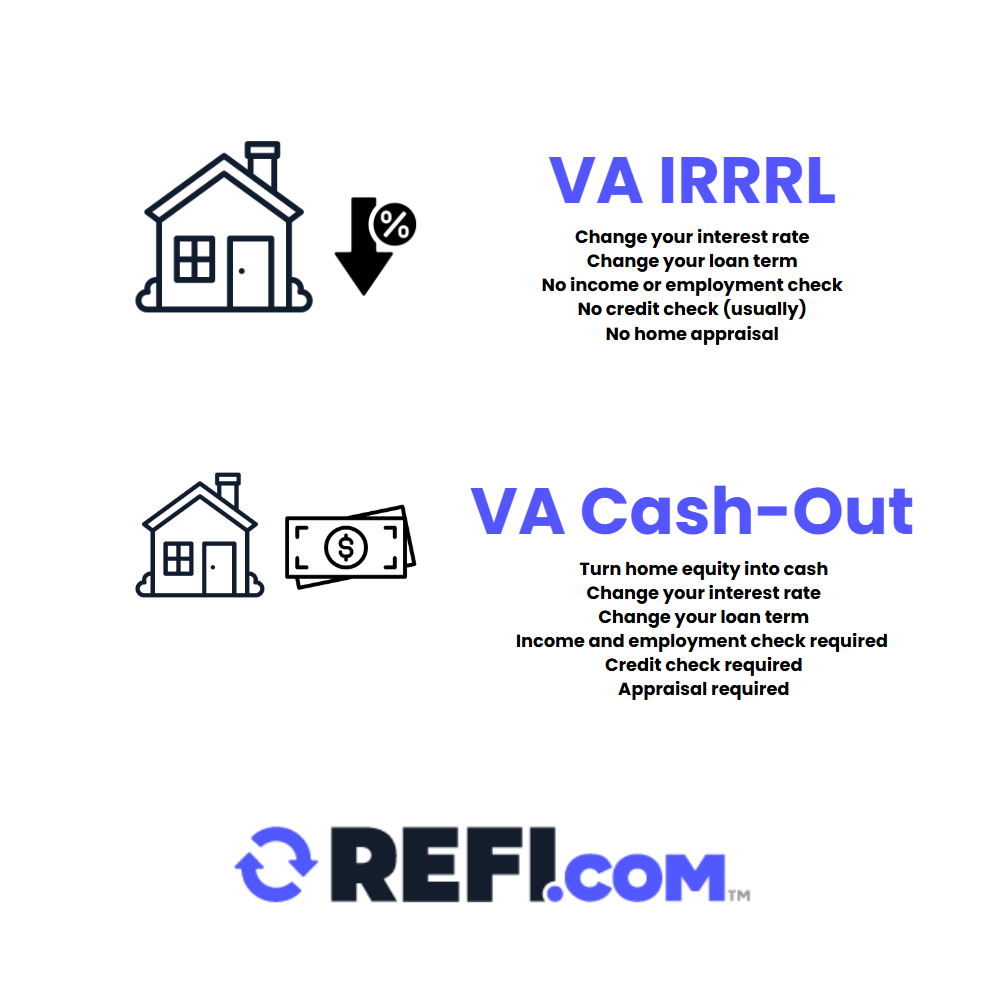

VA Streamline vs VA Cash-Out Refinance

Generally, you should use a VA Streamline unless you need cash back at closing.

| VA IRRRL | VA Cash-Out | |

| Cash back | No cash back allowed unless reimbursing for energy-efficient improvements ($6,000 max) | Cash-out up to 100% of the home’s value (but varies by lender) |

| Rate | The refinance must reduce the rate, unless switching from an ARM to a fixed-rate | No rate reduction required |

| Qualification | No income, asset, or employment documentation | Full documentation required |

| Appraisal | No appraisal | New appraisal required |

| Equity required | No equity verification or requirement | Adequate equity required to pay off existing loan and provide cash back |

| Current loan | Must be a VA loan | Can refinance any loan type |

| Rates | Lower rates than cash-out | Higher rates than IRRRL |

Check out our guide to the VA cash-out refinance for more information on taking cash out with a VA loan.

How to Get a VA IRRRL

Like any other type of refi, a VA IRRRL means you are replacing your existing mortgage with a new loan. Fortunately, the steps are easier and more straightforward than most other refinance loans.

1. Shop Lenders

To find a VA-approved lender, shop around among mortgage companies, private banks, and credit unions. You can go with your current lender or a new one.

Compare rates, terms, and fees carefully.

2. Apply

Borrowers start the process by applying through a VA-approved lender. Unlike conventional refinancing options, the VA Streamline Refinance typically requires less documentation.

Related: Do conventional streamline refinances exist?

3. Provide necessary information to your lender

While the VA IRRRL generally requires minimal documentation, your lender may still request certain items to process your refinance. This could include a current mortgage statement, a copy of your homeowner’s insurance policy, or other basic information. Some lenders may also pull a credit report, even if it’s not strictly required by VA guidelines.

Requirements vary by lender, so be ready to provide any documents they ask for.

4. Pay Closing Costs or Roll Them Into the Loan (if allowed)

While closing costs are associated with the VA Streamline Refinance, these can often be rolled into the new loan, meaning you won’t necessarily have any out-of-pocket expenses.

IRRRL Closing Costs

Closing costs will be somewhere around 2-4% of the loan amount. Most borrowers will also be charged a VA funding fee equal to 0.5% of the loan balance, though it can often be rolled into the loan. Some Veterans may be exempt. It’s important to understand that refinancing may result in higher finance charges over the life of the loan.

When considering whether to refinance, be sure to weigh your closing costs against your monthly savings. For example, if you save only $25 per month and closing costs are $7,000, it would take over 23 years to break even — likely not worth it. But if you save $250 per month with $3,000 in costs, you’d break even in just one year.

This is known as the break-even period and it’s a crucial calculation when deciding whether or not a refinance will be worth it.

For example, if your potential refinance has a break-even period of 3 years but you intend to move within the next year or two, refinancing wouldn’t be a smart move. It will cost you more than you stand to save.

Pros and Cons of the VA IRRRL

| Pros | Cons |

| Lower mortgage interest rates | New rate must be lower or changing an ARM to fixed |

| Lower funding fee | No cash-out allowed |

| Potential for lower monthly payments | Funding fee and closing costs apply |

| Faster closing time | Employment and credit may be checked, depending on lender guidelines |

| No credit check | |

| No employment or income check | |

| No appraisal |

Removing a Borrower with an IRRRL

Generally, you can remove a non-veteran from the loan during the IRRRL process if an eligible veteran remains in the home and on the loan.

In cases where the non-veteran is keeping the home after divorce, the non-veteran could assume the loan. The veteran’s entitlement would remain tied to the loan.

The best option is often for the remaining non-veteran spouse to refinance into a conventional loan.

Refinancing an Investment Property

You may be able to use a VA IRRRL to refinance a property that is now used as a rental, as long as it was originally purchased with a VA loan and you occupied it as your primary residence at that time. The VA allows refinancing in this scenario, even if you’ve since moved out and are now renting the property.

However, not all lenders allow IRRRLs on investment properties (or are familiar with this guideline), so you may need to shop around.

Final Words On The VA IRRRL

The VA Streamline Refinance program offers a valuable opportunity for veterans and active-duty service members looking to refinance their existing VA loan with improved terms and minimal hassle.

This refinance program can be a smart financial move for eligible veterans, offering the potential for lower interest rates, reduced monthly payments, and a simplified process. Ready to move forward? Get started with your refinance here.