When to Refinance a Mortgage

- Refinancing can improve your financial situation by lowering your interest rate, removing PMI, or changing the loan term.

- Refinancing might not be beneficial if you plan to sell soon, expect rates to drop, or cannot afford closing costs.

- Before refinancing, evaluate factors like rates, costs, and the break-even point. Don’t rush the decision.

Refinancing your mortgage can be a smart financial decision for many reasons, from lowering monthly payments to tapping into home equity for large expenses, but timing is key.

Understanding both when and why refinancing is a smart choice can make a significant difference. Let’s explore the best reasons to refinance and when it isn’t the right time.

Top Reasons to Refinance

Refinancing a mortgage offers several benefits that can improve your financial outlook. Here are some top reasons homeowners consider refinancing:

- Enhancing financial flexibility: Refinancing can give you more control over monthly payments and loan terms.

- Tailoring loan terms to current needs: Refinancing allows for modifications to loan conditions to better fit your situation, like moving from an adjustable-rate mortgage to a fixed rate.

- Accessing equity: If you have built equity in your home, refinancing can unlock cash for essential expenses, like home renovations or other significant investments.

Refinancing can suit some homeowners more than others. For example, homeowners who bought when interest rates were high are prime candidates for refinancing.

“If your current rate is significantly higher than the prevailing market rates, refinancing could be advantageous,” explains financial advisor and investor Sana Kheir, co-founder of Mayfair Properties.

Another group that could benefit from refinancing is homeowners who bought or refinanced with lower credit scores than they have now. A higher credit score makes you more likely to qualify for lower interest rates.

If you plan to stay in your home for several more years, refinancing could also make sense, as you’ll have time to offset closing costs (which we cover later) and enjoy significant long-term savings.

When to Refinance

There are several scenarios in which refinancing could make sense, and the reasons go well beyond just interest rates.

However, there are several things to consider before deciding to refinance, including both your short-term and long-term goals. Additionally, consider whether refinancing will save you money, allow you to accomplish other important financial goals, or both.

Here are additional reasons to consider when refinancing:

Lower Your Interest Rate

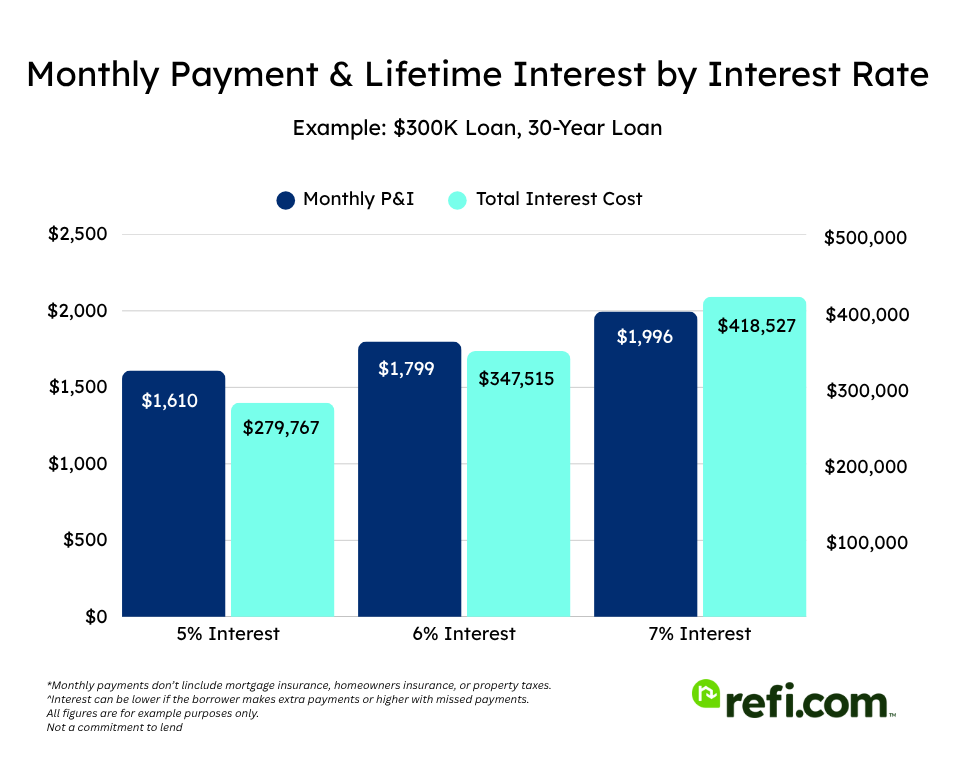

One of the primary reasons for refinancing is for a lower interest rate. A better rate can lower your monthly payment, save you thousands in interest over the loan’s life, and free up cash for other uses.

Refinancing to a lower rate can also allow you to shorten your loan term without substantially increasing your monthly payments, a key benefit for those looking to pay off their mortgage faster.

Here’s a look at how refinance rates are trending:

How we source rates and rate trends

Rates based on market averages as of Dec 02, 2025.Product Rate APR 10-year Fixed Refinance 5.21% 5.26% 15-year Fixed Refinance 5.37% 5.42% 20-year Fixed Refinance 6.05% 6.08% 30-year Fixed Refinance 6.35% 6.37%

Remove Mortgage Insurance

If you currently have an FHA loan, you’re most likely paying mortgage insurance. Unlike a conventional loan that allows removing mortgage insurance after reaching 20% equity, FHA loans require mortgage insurance premiums (MIP) regardless of the size of your down payment.

You need to make a down payment of 10% or more for them to expire after 11 years. Otherwise, you’ll pay them for your mortgage’s entire lifetime.

Whether you have a conventional loan or an FHA loan, getting rid of MIPs or private mortgage insurance (PMI) can reduce your monthly mortgage payments. Refinancing from an FHA loan to a conventional loan, assuming you have adequate equity in your home, could eliminate mortgage insurance entirely.

Shorten or Lengthen the Loan’s Term

Refinancing can also allow you to adjust the loan term to suit your current financial goals.

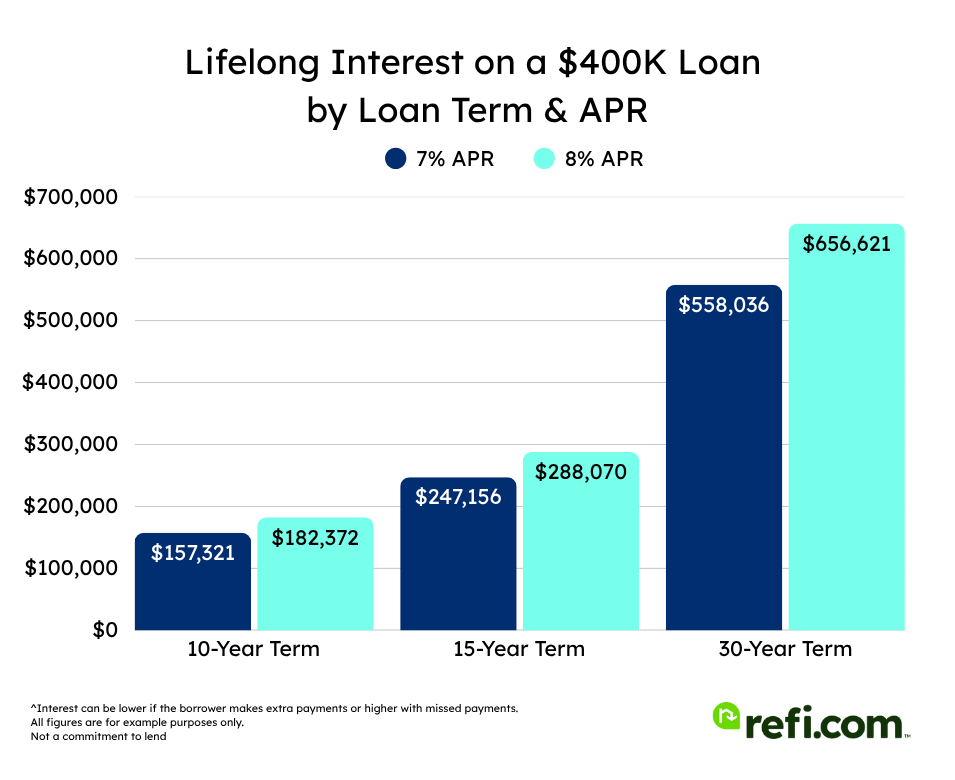

For instance, refinancing from a 30-year mortgage to a 15-year loan may come with a lower interest rate and faster payoff, though the monthly payment may be higher.

Conversely, extending the loan term (for example, from a 15-year mortgage to a 30-year mortgage) can reduce monthly payments and create more room in your budget, though it means paying more in interest over the life of the loan.

Convert from an ARM to a Fixed-Rate Loan (or Vice Versa)

Adjustable-rate mortgages (ARMs) offer a lower initial rate, but this rate may increase over time.

If you have an ARM and are concerned about rising interest rates, refinancing into a fixed-rate mortgage can provide stability.

Alternatively, sometimes ARM rates are significantly lower, so you might consider switching from a fixed rate to an ARM to take advantage of the lower initial rate and monthly payments.

Tap Equity to Pay for Large Expenses

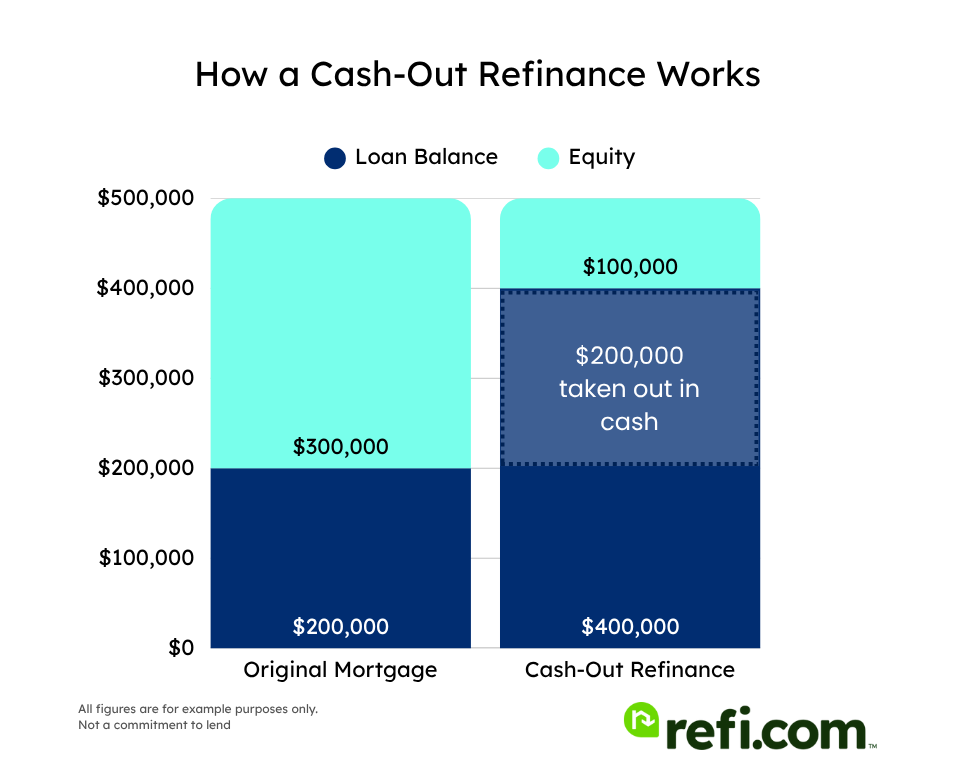

Two types of refinancing options exist: a rate-and-term refinance or a cash-out refinance. A cash-out refinance allows you to take cash out from the equity you’ve built in your home.

This can be a practical choice if you need funds for significant expenses, like home improvements, education, or consolidating high-interest debt. Cash-out programs, such as the FHA Cash-Out Refinance or VA Cash-Out Refinance, provide great options for eligible homeowners.

However, it’s important to use cash-out refinancing wisely. It’s generally advisable to use this money for investments that add value, such as home improvements, rather than for unnecessary expenses or quickly depreciating items.

Consolidate Debts

Refinancing to consolidate debt can simplify finances and may lower interest rates on high-interest debts, such as credit cards or personal loans.

By rolling these debts into a new mortgage with a lower interest rate, you can save on interest in the short term and reduce the number of monthly bills to manage.

However, use caution when turning unsecured debt (like credit cards) into secured debt tied to your home. It’s easy to get carried away by continuing to run up credit card debt and using the equity in your home as a safety net.

Change to a Different Type of Loan

Switching loan types can be advantageous if you qualify for better rates or terms under the new program. Further, if you have a government-backed loan, refinancing to a similar government-backed loan is usually even easier.

FHA loans offer unique incentives for homeowners interested in refinancing, as do VA mortgages for eligible Veterans and active-duty service members. USDA loans are great for low-to-moderate-income buyers in rural areas.

These three government-backed mortgages provide streamline refinancing options that involve less paperwork and quicker processing time.

Alternatively, if you currently have an FHA loan, refinancing to a conventional loan might allow you to eliminate mortgage insurance payments. Eligible Veterans and active-duty service members may benefit from refinancing to a VA loan with no mortgage insurance and typically lower rates.

Learn more about streamline refinance options here:

VA streamline refinance / Interest Rate Reduction Refinance Loan (IRRRL)

When Not to Refinance

There are times when refinancing may not be the best choice. If refinancing won’t save you money over time or your plans include moving soon, it might set your financial goals back.

Consider the following circumstances before committing to a refinance.

You Plan to Sell Your Home Soon

If you plan to sell your home within the next few years, refinancing might not be worthwhile. Although refinancing could lower your interest rate and monthly payments, it often takes several years of these reduced payments to recover the money spent on closing costs.

The closing costs for a refinance typically include fees ranging from 2% to 5% of the loan amount, potentially adding up to several thousand dollars. Selling your home shortly after refinancing could mean you don’t have enough time to break even on those upfront costs, resulting in a potential financial loss.

If a sale is on the horizon for you, the savings from refinancing to a lower interest rate won’t outweigh the costs.

Rates Might Drop Again

Interest rates can fluctuate significantly in a volatile market. If rates are expected to decrease soon, it might be wise to hold off on refinancing.

Keep an eye on rate trends and economic indicators to determine the right time. Many financial websites and tools can help you track interest rate movements, and some even offer alerts for rate drops.

You Can’t Afford the Closing Costs

Refinancing can come with considerable closing costs, typically 2-5% of the loan amount. While many types of refinancing allow you to roll closing costs back into the loan, some don’t.

If you don’t have the funds to cover these costs and can’t roll them into the loan, it might be better to hold off until you can comfortably afford them.

Your Credit or Finances Have Worsened

If your financial situation or credit score has declined since you first took out your mortgage, refinancing might result in a higher interest rate or unfavorable terms.

In such cases, it’s best to focus on improving your credit and financial position before refinancing.

Lender Safeguards

Any type of home financing can be complex and expensive. It’s crucial to ensure that refinancing your mortgage truly benefits you.

For this reason, many states and even the federal government require a defined benefit for you to help protect against predatory lending practices. Lenders follow various rules and regulations to ensure mortgage borrowers benefit from refinancing.

If you’re a resident of states with homeowner protection laws, there must be a tangible net benefit to any refinance you undertake.

This restriction also applies to loans backed by certain federal agencies, such as the Department of Veterans Affairs (VA) or the Federal Housing Administration (FHA).

- FHA’s net tangible benefit rule: This rule requires that FHA refinances offer a tangible benefit to the borrower, such as lowering the monthly payment or moving to a more stable loan type (an ARM to a fixed-rate mortgage, for example).

- VA’s recoupment period rule: The VA requires that the benefit of refinancing, such as a lower rate or better terms, is clear and that you should recoup the closing costs within 36 months.

These safeguards provide an additional layer of protection, ensuring that refinancing genuinely benefits the homeowner.

Other Factors to Consider

Before refinancing, consider these additional factors that may affect your decision.

Break-Even Point

An important consideration for a mortgage refinance is knowing how long it takes to break even.

The break-even point for a mortgage refinance is when your savings equal the closing costs you paid. Before spending thousands on refinancing, calculate if and when you’ll recoup those costs.

Here’s an example of how to determine the break-even point:

Suppose refinancing lowers your monthly mortgage payment by $200, but doing so means paying $4,000 in closing costs. To determine how long it will take to break even, simply divide the closing costs by the monthly savings.

- $4,000 / $200 = 20

In this example, you’d reach the break-even point in 20 months (a little over a year and a half). If you plan to sell before then, you won’t recover the closing costs from the monthly savings.

Check out our refinance break-even calculator to explore more.

An Almost Paid Off Mortgage

If you’ve already paid off most of your original mortgage, it may be beneficial to stay with your current loan or refinance to a shorter term to meet your financial goals. Refinancing resets the loan term, potentially leading to higher overall interest costs.

Your Future Plans

If you’re planning to move, start a business, or fund another major life event, refinancing may or may not align with those goals. Be sure to carefully assess your personal finances, long-term financial goals, and lifestyle choices.

Market Conditions

Consider current economic trends and interest rate forecasts. A fixed-rate mortgage might be preferable in a rising-rate environment, while an ARM could be advantageous when rates are stable or falling.

The Bottom Line

Refinancing can be a powerful tool to help homeowners save money, access equity, or improve loan terms, but it’s important to weigh all factors before making a decision.

Evaluate your reasons for refinancing, consider the current rate environment, and don’t rush into a decision. By taking the time to assess your current needs and future plans, you can ensure refinancing is a wise financial decision.

When you’re ready to explore refinancing options, start by checking current rates and speaking with a trusted mortgage advisor.