Mortgage Refinancing: What It Is, How It Works, and When to Do It

- Mortgage refinancing allows homeowners to replace their current loan with a new one, potentially offering lower interest rates, modified terms, and/or access to home equity.

- Common reasons to refinance include lowering interest rates, removing mortgage insurance, converting to a fixed-rate loan, or tapping into home equity for major expenses.

- While refinancing offers financial benefits, it may also increase total interest costs, reset loan terms, or reduce home equity, so carefully consider the timing.

Mortgage refinancing means replacing your current home loan with a new one that has its own interest rate and term. Homeowners refinance to lower their monthly payments, shorten their loan term, access cash from their home equity, or adjust their loan structure to better fit their financial goals.

If you’ve been paying down your mortgage for a while, refinancing might offer an opportunity to reset your home financing in a way that works better for your changing needs—and potentially save money over the long term.

Refinancing can seem complex at first glance. How does it actually work? What happens during the process, and who benefits most from doing it?

Whether you’re looking to lower your rate, access home equity, or adjust your loan terms, understanding your options and the steps involved will help you make a more informed financial decision.

What is Mortgage Refinancing?

Mortgage refinancing involves replacing your current mortgage with a new loan that has its own term and interest rate. The goal is typically to secure better financial terms, modify the loan structure, or access home equity.

| Product | Rate | APR |

|---|---|---|

| 30-year Fixed Refinance | 6.35% | 6.37% |

| 30-year Fixed Fha Refinance | 5.56% | 6.77% |

| 30-year Fixed Usda Refinance | 5.56% | 5.70% |

| 30-year Fixed Va Refinance | 5.68% | 5.82% |

How we source rates and rate trends

“With a refinance, you are essentially paying off your old loan with a new one, which can potentially save you money over time or make monthly payments more affordable,” explains Dennis Shirshikov, a professor of finance and economics at City University of New York/Queens College.

You can refinance with your existing lender or a new lender. The process can often take 30 to 45 days and involves several steps as well as meeting eligibility requirements, which we will cover shortly.

Reasons to Refinance a Mortgage

There are many good reasons for borrowers to consider refinancing their mortgage loans. Let’s explore each of these common motives and goals.

Lower Your Interest Rate

Perhaps the biggest reason many borrowers choose to refinance is to lower their interest rate. A lower rate can reduce monthly payments and result in significant savings on total interest costs.

How we source rates and rate trends

Rates based on market averages as of Dec 02, 2025.Product Rate APR 15-year Fixed Refinance 5.37% 5.42% 30-year Fixed Refinance 6.35% 6.37%

“For example, if you have a 30-year mortgage at a 7% interest rate and current rates drop to 6%, refinancing could reduce your monthly payments significantly,” adds Shirshikov.

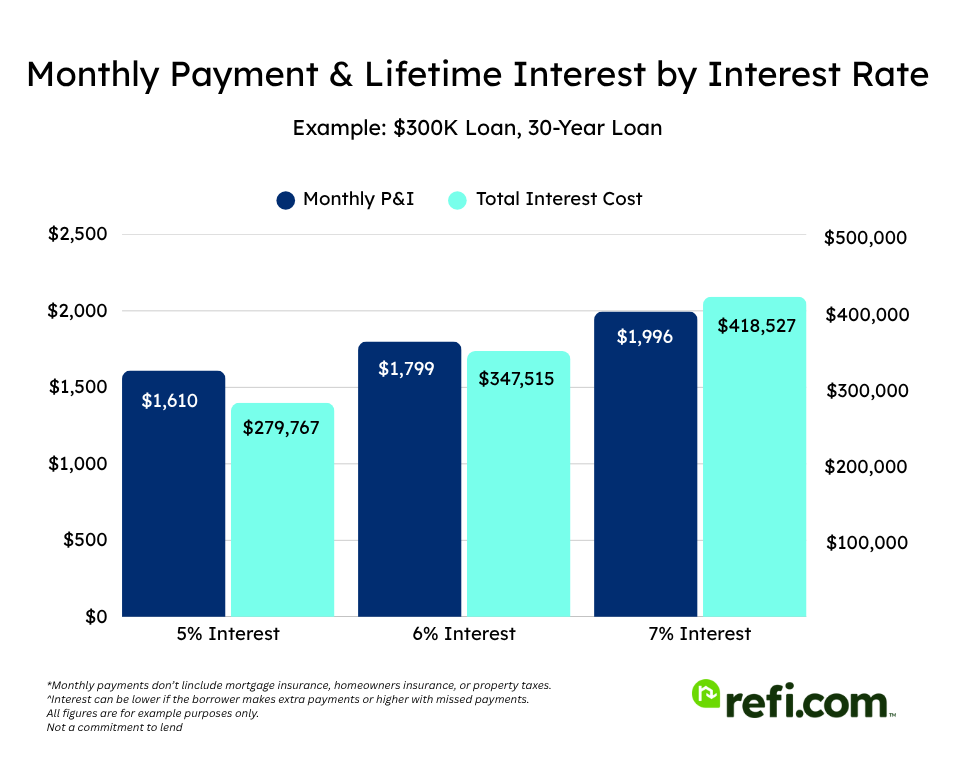

For example, let’s take a look at monthly principal and interest payments and lifetime interest costs on a $300K loan by interest rate:

| Interest Rate | Monthly P&I Payment | Lifetime Interest Costs |

| 5% | $1,610 | $279,767 |

| 6% | $1,799 | $347,515 |

| 7% | $1,996 | $418,527 |

Adjust Terms

Refinancing can also let you adjust the loan duration. For example, refinancing from a 30-year to a 15-year term helps you pay off the loan faster and reduces interest, but may increase monthly payments.

Conversely, extending the term lowers monthly costs, useful if financial circumstances have shifted.

Convert Loan Types

If you currently have an adjustable-rate mortgage (ARM), you’re aware that your interest rate can fluctuate over time, often leading to higher mortgage payments.

However, refinancing that ARM to a fixed-rate loan can offer payment stability, especially if you anticipate rising interest rates.

Consolidate Debts

Debt consolidation refinancing is a strategy where borrowers can combine high-interest debts—like credit cards or personal loans—into their mortgage. This is often accomplished with a cash-out refinance, which allows you to tap into your home’s equity to pay off these debts.

The advantage is that mortgage rates are typically lower than those of other consumer debts, which can reduce your overall interest costs and simplify your monthly payments into a single mortgage bill.

Access Home Equity in Cash

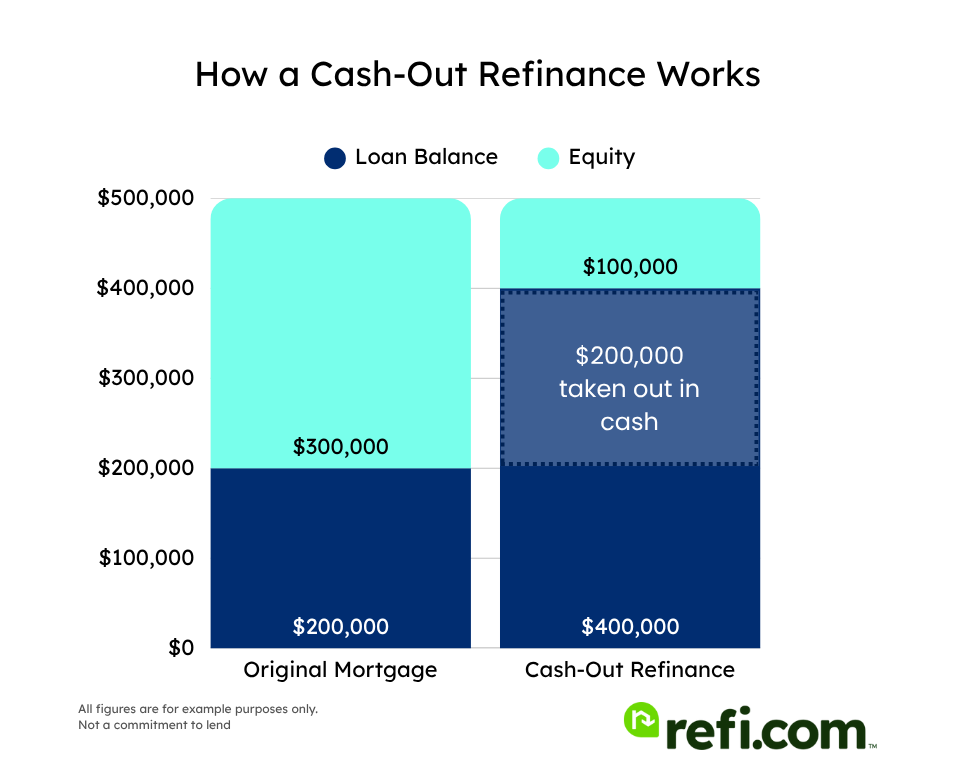

A cash-out refinance allows homeowners to replace their existing mortgage with a new, larger loan and receive the difference in cash at closing. Essentially, you’re borrowing more than you currently owe and pocketing the extra funds.

A cash-out refinance can provide funds for significant expenses, like home improvements, which can boost your home’s value and may yield returns in the future. Similarly, you might want to invest in further education, which might later lead to a higher salary.

Here’s how the math works: Let’s say your home is appraised for $500,000 and you owe $200,000 on your mortgage. That means you have about $300,000 in home equity.

If you go conventional, you may be approved for a cash-out refi up to 80% of the appraised value of your home—or $400,000. Paying off your existing mortgage would leave you with $200,000 in cash.

According to VA guidelines, VA cash-out refinances can be done for up to 100% of the home’s appraised value. However, most lenders cap this at 90%.

Remove Mortgage Insurance

If you have an FHA loan, you’re required to pay mortgage insurance, often for the life of the loan. However, if your FHA loan was issued before June 3, 2013, or you made at least a 10% down payment, your mortgage insurance can end after 11 years.

This differs from a conventional loan, where you get to cancel conventional private mortgage insurance (PMI) once you reach 20% equity.

This makes refinancing to a conventional loan an attractive option once you’ve reached at least 20% equity in your home. By making the switch, you can eliminate mortgage insurance entirely and potentially reduce your monthly payments.

Even if you started with a conventional loan and paid PMI due to a down payment of less than 20%, refinancing after reaching that 20% equity threshold can remove this expense. This becomes particularly appealing when property values appreciate substantially, since your equity position increases along with your home’s value.

Pros and Cons of Refinancing

The primary benefits of refinancing include:

- Lowering your interest rate – If rates have dropped or your financial situation has improved since you took out your original loan, you may qualify for a better rate, which directly reduces your interest costs.

- Reducing monthly payments – This can be accomplished by lowering your rate, extending your loan term, or both.

- Shortening your loan term – Refinancing to a 15-year mortgage instead of a 30-year, for example, means you’ll pay less in overall interest over the life of the loan.

- Tapping into equity for financial goals – A cash-out refinance lets you access funds for home renovations, education expenses, major purchases, or other financial objectives.

- Gaining payment stability – Switching from an adjustable-rate mortgage (ARM) to a fixed-rate loan locks in predictable monthly payments, protecting you from future rate increases.

On the downside, refinancing can have its drawbacks, such as:

- Closing costs – Fees like lender charges, appraisal costs, and title insurance can total 2-5% of the loan amount, taking years to recoup through savings. If you’re planning to move in the near future, these closing costs might outweigh the benefits.

- Higher monthly payments – Refinancing to a shorter term, like a 15-year mortgage, could result in higher monthly payments, potentially straining your budget.

- Higher total interest costs – Extending your loan term may lower monthly payments but increase the total interest you pay over time, raising the overall cost of the loan.

- Reduced equity – A cash-out refinance lowers your ownership stake in your home, which can be risky if property values drop. You could end up owing more than your home is worth.

- Loan term reset – Refinancing to another 30-year term restarts the loan clock, potentially postponing full homeownership if you’ve already paid down your mortgage for several years. (Note: you can refinance to a shorter term to avoid this.)

- Temporary credit impact – Refinancing involves a hard credit inquiry, which can lower your credit score temporarily, and the new loan will reduce the average age of your credit accounts.

When to Refinance

Refinancing is generally favorable when interest rates drop, you’ve built significant home equity, or your credit score has improved, allowing you to secure a lower rate or eliminate PMI. Major life events, such as income increases or changes in debt, may also make refinancing advantageous.

As a rule of thumb, refinancing becomes worthwhile when rates have dropped by at least 0.5 to 1.0 percentage points from your current rate. The timing is also right if your credit score has improved substantially since you took out your original mortgage and you have at least 20% equity built up in your home.

Types of Mortgage Refinances

Refinancing comes in many different flavors that borrowers can choose from. Here’s a rundown of your options.

Rate and Term Refinance

A rate-and-term refinance is when you replace your existing mortgage with a new one that changes your interest rate, loan term, or both — without taking out extra cash.

Cash-Out Refinance

A cash-out refinance lets you take out a new mortgage for more than you owe on your current loan and receive the difference in cash at closing.

This is a popular strategy for borrowers seeking to fund major expenses like a home improvement project, tuition, debt consolidation, business opportunity, or medical bills, but it reduces home equity and may require a slightly higher interest rate than a rate-and-term refinance.

Streamline Refinance

A streamline refinance is a simplified option for government-backed loans that helps eligible borrowers lower their rate or adjust terms with less paperwork.

It involves minimal paperwork and often doesn’t require an appraisal, making it a quick option to adjust interest rates or loan terms.

Learn more about each streamline refinance option below:

Renovation Refinance

A renovation refinance combines your mortgage and renovation costs into a single loan, using your home’s post-renovation value to determine borrowing limits.

This is beneficial if you’re looking to increase your home’s value through upgrades and prefer to roll the renovation costs into your mortgage instead of taking on separate financing like a personal loan or home equity line of credit.

Cash-In Refinance

A cash-in refinance lets you pay down a portion of the principal when refinancing, which can help reduce the loan balance, secure a lower rate, or avoid PMI.

Mortgage Refinance Programs

There are different refinance programs to be aware of that further differentiate your options. You can refinance within the same loan program (such as FHA to FHA) or switch to a different program entirely (like FHA to conventional). Let’s take a look at each.

Conventional Refinances

Designed for traditional home loans, a conventional refinance offers adjustments to the interest rate, term, or cash-out options and typically requires a good credit score and a manageable debt-to-income (DTI) ratio.

FHA Refinances

FHA refinancing options cater to borrowers with lower credit scores or limited equity, offering several pathways to adjust their loan terms. Options include the FHA streamline refinance, the FHA cash-out refinance, and more.

USDA Refinances

USDA refinance programs are designed for eligible rural homeowners who already have a USDA-backed mortgage. These refinance loans can help lower interest rates or adjust loan terms while maintaining affordable payments. USDA refinances typically feature simplified paperwork and limited out-of-pocket costs.

Some programs, such as the Streamlined Assist option, don’t require a new appraisal, though others may.

Cash-out refinancing is not available through USDA programs.

VA Refinances

VA refinance options, such as the Interest Rate Reduction Refinance Loan (IRRRL) and VA cash-out refinance, provide eligible veterans, military members, and surviving spouses with a streamlined process, minimal paperwork, and competitive rates.

How to Refinance Your Mortgage

Eager to get the refinance process started? Here are the usual steps involved, from beginning to end.

1. Shop Refinance Lenders

Start by gathering quotes from multiple lenders to compare rates, closing costs, and terms carefully. The more lenders you get rate quotes and offers from, the more likely it is that you’ll find the best deal.

If you have a specific loan type in mind, such as a VA loan, be sure to look for lenders who specialize in this type of financing.2. Calculate the Costs & Savings

Once you have a few offers, assess the potential savings by running the numbers. Consider the interest rate, monthly payments, and closing costs, then calculate how long it will take to break even on the costs of refinancing.

Be sure to verify eligibility requirements, such as credit score, income, and equity, before moving forward.3. Apply for the Refinance

After choosing a lender, submit a formal application, which may require financial documents and, for some loans, a property appraisal. Then, you’ll await an underwriting decision.

Ready to apply with Refi.com now? Get started here.4. Close Your Loan

After being approved, you’ll proceed to closing, where you’ll review and sign final loan documents. This is also when closing costs are paid.

Once the closing is complete, your new loan replaces the original mortgage and you’ll begin making payments based on the new terms.

The Rules of Refinancing

To qualify for a refinance, you’ll generally need a solid credit score, steady income, and enough home equity to meet your lender’s requirements. The process is similar to when you first bought your home, except equity requirements replace down payment requirements.

Rules around refinancing—such as how often you can refinance or how soon after your initial loan—will vary by lender and loan type.

The truth is, you can refinance your mortgage as often as you qualify and can cover the closing costs. However, most loans require a waiting period between refinances, typically between 6 to 12 months, with additional specific rules for government-backed loans.

Before applying, it’s important to ensure you meet the standard eligibility requirements. Here’s a breakdown by loan type:

Conventional Refinances

Generally, you’ll need a credit score of at least 620, a debt-to-income (DTI) ratio below 50% (though 43% is preferred), and at least 3-5% equity in your home. Keep in mind that having 20% or more equity will help you avoid PMI and secure better rates.

FHA Refinances

According to FHA guidelines, the minimum credit score is 580. However, most lenders—including Refi.com—require a higher score, with Refi.com’s minimum set at 620.

For the best terms, aim for a DTI of 43% or lower and an LTV of 97.75% or less for rate-and-term refinancing and 80% or less for cash-out.

FHA Streamline refinances usually don’t require income verification or an appraisal, meaning LTV and DTI aren’t recalculated in most cases. However, if a credit-qualifying streamline is used, lenders may review these factors.

VA Refinances

The VA doesn’t set a specific credit score requirement, but most lenders look for a score of 620 or higher. The ideal DTI is below 41%, and the LTV can be as high as 100%.

If you have a VA loan currently, you may be eligible for a VA Streamline (IRRRL) refinance, which typically doesn’t require an appraisal or income documentation. However, some lenders may request them based on internal policies or specific loan circumstances.

USDA Refinances

USDA refinances are only available to homeowners who currently have a USDA loan. These “USDA Streamline” loans typically do not require an appraisal. The lending limit is determined by the current loan size.

Similar Options

Of course, a mortgage refi isn’t necessarily your only choice here. Alternative options to refinancing include:

- Mortgage recasting: With recasting, you make a lump-sum payment toward the principal, reducing monthly payments without changing your loan’s interest rate or term.

- Loan modification: Offered to those facing hardship, loan modification changes the terms of the existing loan and may impact credit, though it does not replace the loan.

- Home equity loan: A home equity loan provides access to home equity in a lump sum payout at closing without changing the primary mortgage, though it usually comes with a higher interest rate.

- Home equity line of credit (HELOC): A revolving line of credit that allows you to borrow against your home equity as needed. Unlike a lump-sum loan, you can draw funds at the time of your choosing, making it a flexible option for ongoing or unpredictable expenses.

The Bottom Line

There are a lot of moving parts involved with a mortgage refinance. That’s why it’s important to do your homework ahead of time, check interest rates regularly, and understand your available options as well as the process from beginning to end and what’s required to qualify.

Ready to take the next step? Refi.com’s loan officers can help you explore your refinance options, compare rates, and guide you through the process from application to closing.

See what you qualify for today and discover how refinancing could work for your financial goals.