How Much Does it Cost to Refinance a Mortgage?

Keen on refinancing your home loan? You could save a lot of money by doing so if the conditions are right. But that brings up an important question: How much does it cost to refinance?

ClosingCorp reports that the average mortgage refinance will set you back $2,375 in closing costs. In general, refi closing expenses typically equate to between 2 percent and 5 percent of your new loan balance. Case in point: If you refi a $300,000 loan, you might be expected to fork over between $6,000 and $15,000 in fees and expenses at settlement. But you can also get a better deal by shopping around.

Key Takeaways

- Closing costs for refinancing can include loan origination, appraisals, title insurance, property taxes, and homeowners insurance, potentially totaling thousands of dollars.

- You can lower refinancing costs by comparing lenders, improving your credit score, negotiating fees, or choosing a streamline or no-closing-cost refinance.

- Your break-even point is reached when the savings from a lower interest rate exceed the refinancing costs, which can be calculated by dividing total closing costs by monthly savings.

- Refinancing is usually beneficial when the long-term savings, such as a lower rate or consolidating debt, outweigh the costs involved.

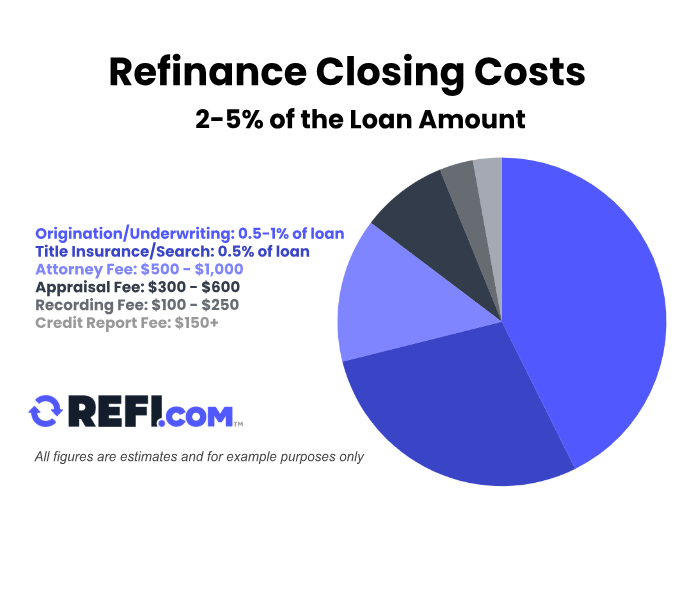

Refinance Closing Costs

Every mortgage refinance comes with closing costs. These include the fees charged by your lender to prepare, process, and underwrite your loan and expenses paid to other entities to cover different services and documents required.

Let’s take a closer look at common closing costs that refinance borrowers are responsible for.

| Type of Fee | Estimated Cost |

| Origination/Underwriting | 0.5 – 1% of the loan amount |

| Title Insurance/Title Search | 0.5% of the loan amount |

| Attorney Fee | $500 – $1,000 |

| Appraisal Fee | $300 – $600 |

| Recording Fee | $100 – $250 |

| Credit Report | $150+ |

Origination/Underwriting Fee: 0.5-1% of the Loan Amount

The lender’s origination/underwriting fee covers the lender’s administrative expenses, including processing the loan application, underwriting the financing, and more. This often equates to 0.5% to 1% of the loan balance.

Title Insurance/Title Search: 0.5% of the Loan Amount

When you refinance, you get a new mortgage loan. Your refinance lender will require protection – in the form of title insurance – against any potential title issues with the property. Even if you had title insurance in place when you bought the home, your refi lender needs assurance that their stake in the property is safeguarded from any unforeseen title problems in the future. Title insurance can set you back about 0.5% of your refinance loan amount.

A title search will also need to be conducted to investigate your home’s public records, verify your ownership, and identify any claims or liens. Expect to fork over between $75 and $200 for this service.

Attorney Fee: $500-$1,000

It can be a smart move to hire a lawyer to review your loan and legal documents and protect your interests during loan settlement at closing. One isn’t required in every state, though. Anticipate a $500 to $1,000 or higher charge for these services.

Appraisal Fee: $300-$600

Lenders require an appraisal to assess your home’s current value. A new home appraisal is often required when refinancing a mortgage, especially if you change the loan type or choose a cash-out refinance. But it may not be needed if you are only changing the loan’s term, interest rate, payment structure, or monthly payment, if the home was appraised within the past year, or if you are getting an FHA, VA, or USDA streamline refinance loan. Appraisal costs often range from $300 to $600 or more.

Learn about the different types of streamline refinance options at the links below:

Recording Fee: $100-$250

A recording fee is an expense charged by local and state governments to ensure that the new mortgage loan and other legal documents are properly recorded in the public record. Recording fees often cost between $100 and $250.

Credit Report Fee: $150+

Your refinance lender will need to pull your credit report and carefully review your creditworthiness. This fee can amount to $150 or more.

Property Taxes: Varies Based On Local Taxes and Time of Year

You may need to pay property taxes at closing on your refi loan if the closing happens near your property tax due date. But this isn’t a true fee: you would pay this even if you didn’t have a mortgage. Moreover, you’ll get a check from your current lender a few weeks after closing the refinance with any unused portion of prepaid taxes on your current loan.

Collecting taxes upfront prevents unpaid taxes and safeguards both you and the lender from tax lien issues. What you pay in property taxes will depend on your home’s assessed value, when you close, and how often and when your county collects taxes.

Optional Discount Points: 0-2% of the Loan Amount

Discount points, an optional expense often referred to as “mortgage points,” are a one-time fee that allows you to buy down your interest rate and lower it by 0.125% to 0.25%. The cost is often roughly 1% of the loan amount per point. For instance, if you buy one point for a $400,000 refi loan, it could cost you around $4,000.

Homeowners Insurance: Varies By Location

As with property taxes, you may need to pay a full year’s homeowners insurance premium at closing. This will satisfy your lender that your homeowner’s insurance policy coverage will be fully paid up and in effect. Your homeowner’s insurance bill at settlement will depend on many factors, but consider that the average American pays $1,754 annually or around $146 per month for coverage.

Other Ways Refinancing Can Cost You

Other Ways Refinancing Can Cost You

Closing costs aren’t the only expenses to consider. Refinancing can have hidden costs that affect your finances over time.

Extended Loan Terms: If you extend your loan term—such as refinancing a 20-year mortgage back into a 30-year term—you might lower your monthly payment but pay significantly more in interest over the life of the loan. This can potentially cost tens of thousands of dollars extra, even though your monthly payments feel more manageable.

Reduced Home Equity: Cash-out refinancing reduces your equity stake in your home. When you borrow against your home’s equity, you’re left with less financial flexibility and potentially higher debt if home values decline.

Mortgage Interest Deduction: “The deductibility of your mortgage interest could be more limited, especially if you are refinancing a primary home to fund non-home-related personal expenses, which are not tax-deductible,” cautions Dennis Shirshikov, a professor of economics and finance at City University of New York/Queens College.

How to Lower Your Refinance Costs

The good news is that, by doing your homework, you can often pay less than average for many of the common closing costs described earlier. Here’s a list of best practices recommended by the experts.

Shop Several Lenders

Shopping around with multiple lenders is one of the most effective ways to reduce your refinancing costs. As with buying a new car, getting multiple quotes allows you to do an apples-to-apples comparison and negotiate better terms. Look for the best combination of interest rate, loan terms, and total fees—not just the lowest rate.

Improve Your Credit Score

Improving your credit score before applying for a refinance can save you thousands of dollars. A higher credit score helps you secure a lower interest rate, which reduces both your monthly payment and total interest paid over the life of the loan. Even a small improvement in your score can make a meaningful difference in the rates you’re offered.

Negotiate Closing Costs

Just as you would politely haggle with a new car dealer on price, don’t be afraid to request lower fees from your lender, title company, attorney, or other entity involved in the loan closing.

“Some lenders may waive or reduce fees, such as application or origination charges, to win your business,” Shirshikov says.

Please note that your loan-to-value (LTV) ratio can affect the closing costs you are charged. A higher LTV usually leads to pricing adjustments—such as a slightly higher rate or points—rather than higher third-party fees.

Consider Paying Discount Points upfront

You can lower your interest rate by around 0.125% to 0.25% for each discount point you opt to pay at closing. This produces more affordable monthly payments over the life of your refinance loan. However, you’ll need to come up with more cash at closing. That means this strategy is only worth it if you expect to stay put in your residence long enough to recoup (via lower interest paid) the costs of any points paid.

Use a Streamline Refinance

FHA Streamline, VA IRRRL, and USDA Streamline-Assist refinances often don’t require a new appraisal and use simplified documentation, which can reduce closing costs.

What About No-Closing Cost Refinances?

There’s yet another way to pay less for closing costs: Choose a “no-closing-cost refinance.”

A no-closing-cost refinance allows you to avoid paying upfront costs out-of-pocket, but the expenses don’t disappear—they’re covered in other ways. Typically, the lender will either roll the closing costs into your loan balance or charge a slightly higher interest rate.

Case in point: Instead of paying $5,000 upfront in closing costs, you might accept a 0.25% higher interest rate, or agree to increase your loan amount to cover the $5,000. This route can be enticing if you lack cash on hand or plan to refinance or sell your home within a few years. But it has its drawbacks, too.

“While this option reduces upfront costs, it often results in higher monthly payments or total costs over the life of the loan. It’s best suited for borrowers who need immediate cash flow flexibility or who plan to sell their property in the short term,” advises Shirshikov.

How to Calculate if Refinancing Is Worth It

Wondering if pulling the trigger on a mortgage refinance is your best move? To help answer that question, look closer at different factors that can help you make a more informed decision.

Breaking Even

Your “break-even point” is reached when your refinance costs are offset by your total savings—primarily interest savings—after accounting for any costs you rolled into the loan or changes to the loan term.

For example, if your closing costs total $6,000 and you save $200 per month on your mortgage payment after refinancing, it would take you 30 months to reach your break-even point (6,000 ÷ 200 = 30).

To calculate your break-even point:

- Add up your total closing costs.

- Calculate your monthly savings by subtracting your new monthly payment from your current payment.

- Divide your closing costs by your savings amount. Using the aforementioned example, divide $6,000 by $200 to get a breakeven point of 30 months.

You can also try a break-even calculator.

Factors That Impact the Cost

What you will pay to refinance your mortgage loan depends on a variety of factors, including your:

- Chosen lender: Every lender charges different fees and rates.

- Loan amount and term: The more you need to borrow and the longer your loan’s term, the higher your costs may be.

- Refinance type: A rate-and-term refinance can be less costly than a cash-out refi.

- Credit rating: A higher credit score can equate to lower rates and fees.

- Loan-to-value ratio: This is a percentage calculated by dividing the loan amount by the property’s appraised value or purchase price, with a lower ratio indicating less risk for the lender and a higher ratio suggesting more risk.

When to Refinance

Refinancing is worth it typically when the long-term savings outweigh the costs.

“For example, reducing your interest rate by even 1% on a $300,000 loan can save $200 or more per month, which adds up significantly over time,” says Shirshikov. “It’s also beneficial to refinance when you can consolidate high-interest debt or switch from an adjustable-rate mortgage to a fixed-rate loan for greater stability.”

Cash-out refinancing can also be worthwhile if you are using the funds for strategic purposes, such as home improvements that increase your property’s value.

Ready to see how much you could save with a refinance? Get started with Refi.com today to explore your options and receive a personalized rate quote—with no obligation.