Is It a Good Idea to Refinance to a Shorter-Term Mortgage?

Suppose you have two choices for lunch: raw broccoli or a candy bar. You know that broccoli is better for you – it’s obviously the healthier option – but the candy bar is easy to eat and far more palatable.

Shorter-term mortgages are the same: their higher monthly payments can make them a little tougher to stomach, but they’re definitely better for your long-term financial health.

However, a shorter refinance term may not be right for everyone. I’ll walk you through the pros and cons like I do with all my clients so that you can make the most informed decision possible.

Highlights:

- Shorter-term mortgages come with higher monthly payments but reduce the amount you pay toward lifetime interest.

- Homeowners typically qualify for lower interest rates with shorter-term refinance loans.

- Some borrowers opt to make additional principal payments as an alternative to shortening their loan term.

Why Refinance to a Shorter Term?

There’s no question that a 30-year loan is by far the most common type of mortgage. Data shows that more than 90% of purchase loans have 30-year terms, and in my experience, that holds true for refinances as well.

If I do ten refinances in a month, maybe one or two of them will have a shorter term.

However, the folks who ultimately refinance into a shorter-term loan usually share some common traits and motivations for doing so.

These are typically the savvy homeowners who are goal-oriented and thinking proactively. They usually have a little extra discretionary income and know that paying their home off sooner can save them big on long-term interest.

They’re generally thinking about the future benefits rather than the present costs. Doing a 15-year or 20-year loan is kind of like making an investment.

I often compare it to someone who is just starting their career and weighing the benefits of contributing to a 401(k). They’re probably thinking, “Do I really want to do this? It will take money out of my paycheck that I could spend today.”

With a shorter-term mortgage, you may be paying more now, but you’ll reap the benefits – just as with a 401(k) – a little further down the road.

Pros and Cons of Choosing a Shorter-Term Loan

Although there are some pretty compelling benefits to refinancing into a shorter-term loan, doing so also has its downsides. Let’s outline a few of the biggest pros and cons before going over them each in a little more detail.

| Advantages of a Shorter Term | Disadvantages of a Shorter Term |

| Significant lifetime interest savings | Higher monthly payments |

| Build equity/pay off your home faster | Tougher to meet DTI requirements |

| Shorter terms have lower rates | Less flexibility in your budget |

Shorter Term Refinance Pros

Thirty-year loans may be the most affordable option, but that doesn’t make them the best. Let’s take a closer look at some of the benefits associated with refinancing into a shorter term.

Significant Lifetime Interest Savings

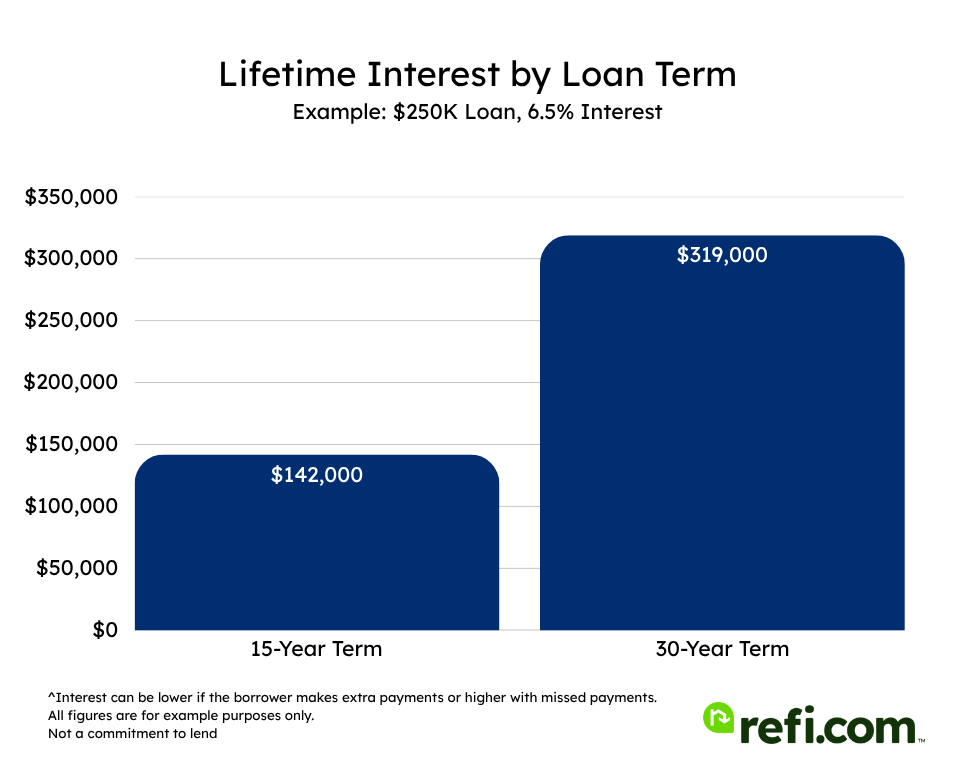

Interest can really add up when you’re paying it for decades. Refinancing to a shorter mortgage term may save you hundreds of thousands of dollars over the life of your loan.

For example, if you’re refinancing a $250,000 loan balance for 30 years at a rate of 6.5%, you’ll pay nearly $319,000 in lifetime interest. That same loan over 15 years will result in around $142,00 in interest payments, cutting your overall financing costs by more than half.

Build Equity/Pay Off Your Home Faster

On top of saving on your interest payments, you’ll also be building equity and paying off your home faster.

When you take out a 30-year mortgage, around 85% of your early payments go toward interest costs. Depending on your rate, it can take 10 to 15 years – or even longer – before the majority of your payments are applied to your principal balance.

With a shorter loan term, you begin building more equity in the very first month and reach that flipping point far sooner.

Shorter Terms Have Lower Rates

Another advantage of reducing your mortgage term is that you’ll likely qualify for a better interest rate. This is due to the lower risk associated with faster repayment and the fact that lenders don’t have to anticipate rate trends as far into the future.

I’ll go over how your loan term can impact your interest rate in more detail in just a minute, but know that you may be able to shave off a full percentage point in some scenarios.

How we source rates and rate trends

Rates based on market averages as of Dec 02, 2025.Product Rate APR 15-year Fixed Refinance 5.37% 5.42% 30-year Fixed Refinance 6.35% 6.37%

Shorter Term Refinance Cons

Now that we’ve talked about the primary benefits of refinancing into a shorter mortgage term, let’s look at a few of the downsides and why doing so may not be the right option for every homeowner.

Higher Monthly Payments

I want to start by addressing the number one downside of a shorter-term refinance: it comes with larger monthly payments.

Let’s use that previous example of a $250,000 refinance at 6.5%. The monthly principal and interest payments with a 30-year term would be $1,580. Reducing the term to 20 years would result in monthly payments of $1,864, while a 15-year loan would equate to a monthly cost of $2,178.

In this scenario, cutting your repayment term in half would require you to pay nearly 40% more every month.

Tougher to Meet DTI Requirements

Since your monthly payments will be higher with a shorter-term refinance, it can be tougher for some borrowers to meet their lender’s debt-to-income (DTI) requirements.

Say that the lender you’re working with allows for a maximum front-end DTI of 35%. Here’s a quick chart showing how much monthly qualifying income you’ll need to meet the requirement for varying loan terms:

| Loan Term | Monthly Payment | Monthly Income Needed |

| 30-Year | $1,580 | $4,514 |

| 20-Year | $1,864 | $5,326 |

| 15-Year | $2,178 | $6,223 |

Keep in mind, however, that we’re only using your principal and interest payment for this calculation. In reality, your full housing expenses would also include your property taxes, homeowners’ insurance, and any applicable HOA dues, which would push your true necessary income even higher.

Less Flexibility in Your Budget

When you refinance into a shorter term, you’re locked into those larger payments for the life of your mortgage. This can lead to financial stress when borrowers become temporarily unemployed or see a reduction in their income.

On the flip side, if you refinance into the typical 30-year repayment period, you’ll have more flexibility in your budget while retaining the option to pay extra toward your mortgage if and when you choose.

Are Shorter-Term Mortgages Easier to Qualify For?

Sometimes, clients that I speak with have the misconception that shorter-term mortgages are easier to qualify for. They think that since they’ll be paying more each month, lenders will be willing to accept a lower credit score, a higher DTI limit, or other things like that.

That’s not the case – you still need to meet the same lender requirements as with any other loan. I say that as a very broad generalization, though, because there are some situations where you may receive a little bit of concession with a shorter loan term.

One example of this is a borrower I recently assisted in refinancing their manufactured home.

We were attempting to secure an approval through Fannie Mae’s software-based underwriting system. However, the homeowner had a DTI of around 45% and I couldn’t get the green light with a 30-year term. But when we switched over to 25 years, we received approval because the system considered a 25-year mortgage marginally less risky.

With a shorter refinance term, borrowers may have a slightly better chance of getting approved, but it won’t make a substantial difference in most cases. Lenders aren’t going to move the other goalposts, but they may trade one minor risk for another.

Examples of Refinancing Into a Shorter Term

Apart from the monthly payments, shorter-term loans sound great in theory, but how do they actually pan out in practice?

Let’s work through a couple of hypothetical scenarios that are representative of typical situations I see.

Example #1: $394,000 Refinance for a Well-Qualified Borrower

For the first example, let’s assume someone wants to refinance her $394,000 loan balance. They are a well-qualified applicant – high credit score, low DTI, and good equity. She has plenty of leeway in her budget and she wants the best value, not necessarily the lowest monthly payments.

She would likely chooose a 15-year refinance, since those rates tend to be lower. Here’s how the numbers work out using example interest rates. Keep in mind that all rates and payments are for example purposes only.

| Loan Term | Interest Rate | Monthly Payment | Lifetime Interest |

| 15-Year | 5.99% | $3,323 | $204,080 |

| 20-Year | 6.25% | $2,880 | $297,166 |

| 25-Year | 6.625% | $2,691 | $413,352 |

| 30-Year | 6.99% | $2,619 | $548,713 |

The example 15-year refinance offers a full 1% rate reduction over a 30-year term. The borrower is spending around $700 more per month, but she’ll wind up saving nearly $350,000 in interest payments.

Example #2: $220,000 Refinance for Cost-Conscious Borrowers

Our last example was of a borrower solely focused on her long-term savings. But not everyone has an extra $700 in their budget to put toward their home payment. Thankfully, you can still take advantage of some of the benefits of a shorter refinance term without going to a 15-year loan.

Let’s take a look at a hypothetical couple who want to refinance their $220,000 mortgage. They qualify with a healthy income level and credit scores in the low to mid-700s. These homeowners opt for a 20-year loan because it provides the best value while still leaving some leeway in their budget.

| Loan Term | Interest Rate | Monthly Payment | Lifetime Interest |

| 15-Year | 6.55% | $1,922 | $126,048 |

| 20-Year | 6.75% | $1,673 | $181,472 |

| 25-Year | 7.15% | $1,576 | $252,809 |

| 30-Year | 7.35% | $1,516 | $325,666 |

All figures are for example purposes only.

By going with a 20-year loan term, this couple’s monthly payments increased by only a little over $150 compared to a 30-year refinance. Taking another five years off their repayment schedule would have cost around $250 more.

At the end of the day, they still shortened their loan term by ten years and will save over $144,000 by the time it’s paid off.

What About Making Extra Payments Instead?

One alternative to reducing your loan term is to make extra principal payments.

This technique allows you to repay your mortgage faster and reduce your overall interest costs without being required to make larger payments each month. You retain flexibility in your budget but can still reap some of the benefits of a shorter repayment schedule by choosing when and how much extra to contribute.

However, there are downsides to this approach:

- Not all lenders make it as easy as logging into your account and choosing “principal payment only.” You may need to contact your mortgage company to confirm that the payment is being applied to your principal balance.

- You don’t get the interest rate savings associated with a shorter loan term. Even if you’re making the same payment as you would on a 20-year loan, you’ll still accrue interest at the 30-year rate, which will add to your overall costs.

Ultimately, I tell my clients to take the route that makes them the most comfortable. If you’re not sure about locking into the larger payments, or if your DTI may be too high to qualify for a shorter term, then putting extra toward your principal is still better than just making the minimum monthly payment.

Biweekly Payments: Another Option

Another option that I’ve seen become more prevalent in recent years is for homeowners to make payments biweekly rather than monthly. Here, borrowers make half-sized payments every other week—often in sync with their paychecks—and end up making 26 half-payments a year instead of 12 full ones.

This results in one extra full-sized payment annually, which leads to a slightly faster loan payoff. Many people I speak with choose this schedule because it helps them better budget their funds by aligning due dates with when they get paid.

Talk with your lender and make sure they know you want to do a biweekly payment schedule, though, or else it won’t have the same effect.

When It Makes Sense to Refinance to a Shorter Term

So, when does it make sense to refinance to a shorter term? That ultimately depends on your budget and payment tolerance. You should always have a serious conversation with your loan officer and review all the options before committing to a shorter repayment schedule.

However, if you have the discretionary income to comfortably make the larger payments, a shorter term is generally a good idea. You’ll wind up paying your loan off sooner and will save a fortune in interest by the time you do.

But don’t think that your only choice for a shorter mortgage term is 15 years. Many of my clients opt for a 20-year refinance because it offers the best of both worlds. You’re getting a lower rate and saving on interest, and while you may not be paying your loan down as quickly as you could, you’re still shaving 10 years off the standard 30-year loan.

Here’s one common tactic if you’re on the fence: Try it first before committing. Make the higher payment on your current loan for a few months and see how it feels. If you’re not putting a strain on your budget, then it may be a great idea to go for the shorter refinance because you’ll be able to save extra by securing a more favorable interest rate.

The Bottom Line

Refinancing into a shorter-term mortgage comes with several major benefits, but be sure to fully understand the ramifications. Namely, you will be locked into higher monthly payments.

However, if you’re able to manage this additional expense, even a five or ten-year term reduction can significantly slash your interest costs and help you build equity faster.

Ready to see exactly how much a shorter-term mortgage would run you? Apply with Refi.com today for a personalized loan estimate.