What Is a Rate-and-Term Refinance?

A rate-and-term refinance is the most common type of mortgage refinance. This straightforward option replaces your existing mortgage with a new one that ideally offers better terms, such as a lower interest rate, a different loan term, or both.

Unlike specialized refinance options like cash-out, streamline, or renovation refinances, a rate-and-term refinance simply aims to improve your loan terms without cashing out equity or skipping steps.

- A rate-and-term refinance replaces your current mortgage.

- This type of refi can change a mortgage loan’s interest rate, loan term, or other loan details, such as loan types or co-borrowers, but can’t give you cash back

- A rate-and-term refinance normally comes with lower rates and fees than a cash-out refinance

Benefits of a Rate-and-Term Refinance

Most homeowners get rate-and-term refinances to save money by lowering their interest rate or monthly payments. However, refinancing can also create other advantages.

Here are the most common reasons to get a rate-and-term refi:

To Lower Your Interest Rate

Mortgage interest is a huge expense for home buyers. For example, on a $400,000 loan, at 7.5% over 30 years, the lender would collect more than $600,000 in interest charges — assuming the buyer paid off the loan as scheduled.

Lowering that 7.5% rate by half a percentage point to 7% would knock about $40,000 off the loan’s lifetime finance charges. A rate of 6% would save about $135,000 compared to 7.5%. You can see why people get excited when interest rates fall.

However, the savings created by lower interest rates play out slowly in the form of lower monthly payments. Refinancing to a lower interest rate can open the door to years, or even decades, of savings.

Here’s a look at how refinance rates are trending:

How we source rates and rate trends

Rates based on market averages as of Dec 02, 2025.Product Rate APR 10-year Fixed Refinance 5.21% 5.26% 15-year Fixed Refinance 5.37% 5.42% 30-year Fixed Refinance 6.35% 6.37%

Can you refinance without changing your interest rate?

Some refinancing homeowners can keep their current mortgage rates the same and still save money. Refinancing to a shorter loan term, for example, cuts into long-term interest charges even when the mortgage rate stays the same.

A refinance can also achieve other goals, including eliminating a co-borrower or bypassing mortgage insurance requirements. More on that below.

Still, borrowers who want to achieve these types of goals should also be sensitive to interest rates. Best case scenario: They can meet refinance goals while also saving on interest charges.

To Lower Your Monthly Payments

A mortgage loan’s interest rate is a huge factor, but it doesn’t exist in a vacuum. The loan’s term, which measures the number of years until the loan is paid off, also affects the monthly payment amount.

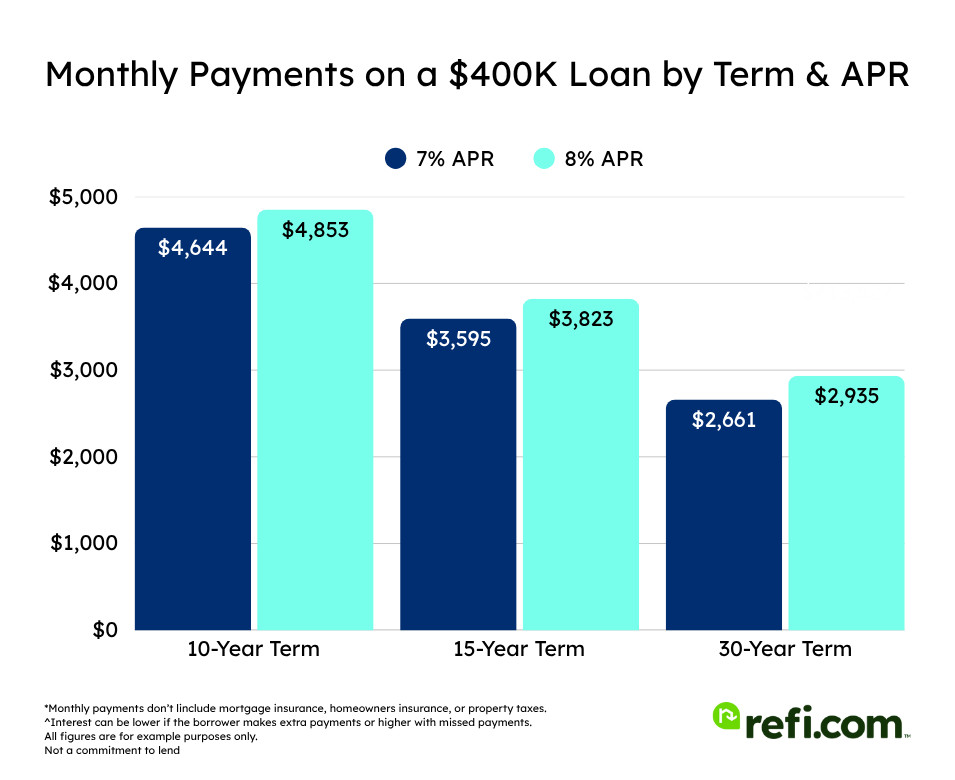

For most refinancing borrowers, a new 30-year term creates the lowest monthly payments. This chart shows how much a $400,000 loan’s payments can vary, at the same interest rate, because of the loan’s term:

| $400,000 loan | 10-year term | 15-year term | 30-year term |

| Monthly payment* at 7% APR | $4,644 | $3,595 | $2,661 |

| Monthly payment* at 8% APR | $4,853 | $3,823 | $2,935 |

All figures are for example purposes only and may not be available.

Longer terms can make the same home significantly more affordable month to month. However, these immediate savings will cost more in the long run in the form of lifelong interest charges.

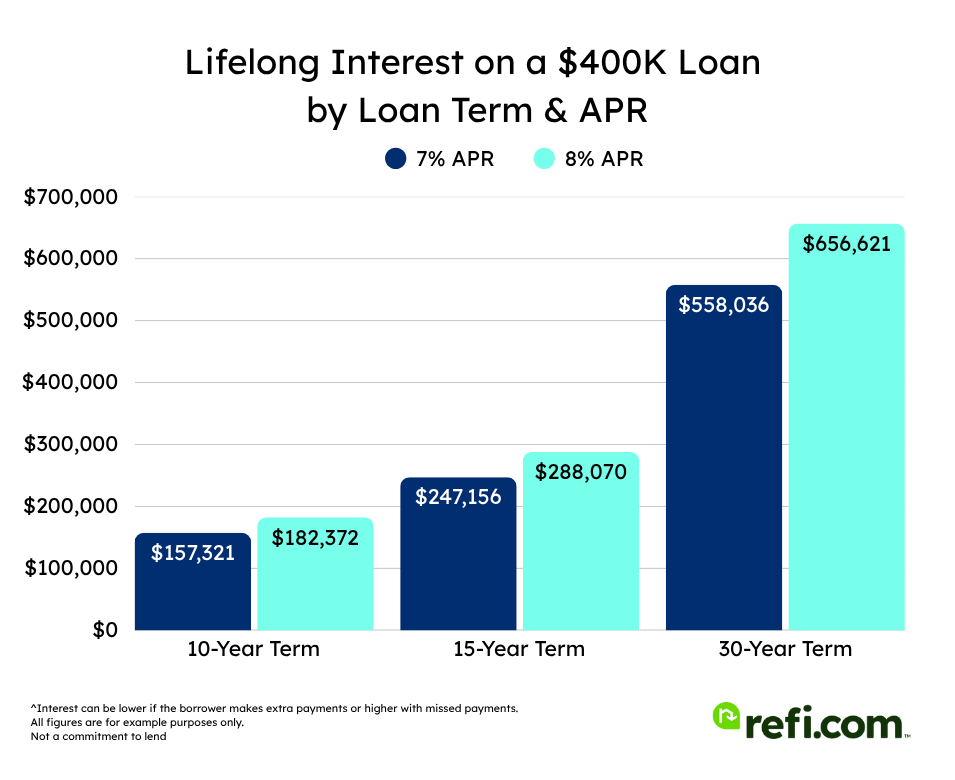

To Shorten the Length of Your Loan

Shorter loan terms typically raise monthly payments, but in exchange, the borrower pays less in interest over the life of the loan.

Check out the effects in this graph and table:

| $400,000 loan | 10-year term | 15-year term | 30-year term |

| Lifelong interest due at 7% APR | $157,321 | $247,156 | $558,036 |

| Lifelong interest due at 8% APR | $182,372 | $288,070 | $656,621 |

As you can see, 30-year terms give lenders a lot more time to charge interest. This translates into higher borrowing costs.

Moreover, the graph above compares terms at the same interest rate. In reality, average interest rates on 15-year loans tend to be lower than average rates for 30-year fixed-rate mortgages, which increases savings on the same refinanced loan balance.

Related: Should You Refinance to a 15-Year Mortgage?

To Change Your Loan Type

A rate-and-term refinance can change the type of loan you’re in.

For example, let’s say you used a 7/1 adjustable-rate mortgage (ARM) to buy your home six years ago. Now, the ARM’s interest rate is about to increase for the first time. The monthly payment will increase. Then, the ARM’s rate will change every year to match market conditions.

You’d rather lock in an interest rate and be done with it. You can refinance the ARM into a fixed-rate mortgage. This is a common reason to get a rate-and-term refinance.

How we source rates and rate trends

Rates based on market averages as of Dec 02, 2025.Product Rate APR 3/6 Arm (refinance) 5.69% 5.69% 5/6 Arm (refinance) 6.06% 6.08% 7/6 Arm (refinance) 6.00% 6.03%

To Add or Remove Someone from the Loan

Borrowers who needed co-signers to get mortgage approval — or borrowers who got approved jointly with a spouse — may want to remove one of their co-borrowers later. This often requires a rate-and-term refinance.

To eliminate the co-borrower, the person who’s staying on the mortgage will have to qualify for the new loan using only their individual income and credit score.

Related: Refinance Without Your Spouse: How Hard Is It?

To Eliminate Mortgage Insurance Payments

You may also want to remove FHA mortgage insurance by refinancing into a conventional loan.

Most buyers who use FHA or USDA loans will pay mortgage insurance premiums for the life of the loan. FHA mortgage insurance typically costs nearly $140 per month on a $300,000 loan.

Refinancing into a conventional loan can eliminate this extra fee. This strategy works only when the homeowner already has built up 20% equity in the home. For a home valued at $300,000, that means you’d need to pay the loan balance down to $240,000 before refinancing to eliminate FHA mortgage insurance premiums.

You can reach 20% equity by paying down the loan over time, as a result of the home appreciating, or a combination of both.

To Take Advantage of Improved Personal Finances

Homeowners who have improved their credit score or debt-to-income ratio (DTI) since buying their home may be able to qualify for a better interest rate now. Rate-and-term refinancing opens a new loan based on the borrower’s current financial profile.

Refinancing could help someone who has increased their income, paid off a lot of consumer debt, or fixed credit reporting errors since closing their current loan.

Rate-and-Term Refinance Requirements

Qualifying for a rate-and-term refinance will resemble qualifying for your initial mortgage. Here are the variables to think about before applying:

Seasoning Requirements

Typical lenders won’t allow a refinance if you just bought the home a couple of months ago. Your current loan will need to age, or “season,” a little first. Seasoning requirements vary by loan type:

- USDA loans: Homeowners must make 12 monthly payments before applying for a refi.

- FHA and VA loans: Homeowners must wait 210 days since the due date of their first mortgage payment and make six consecutive monthly payments before refinancing.

- Conventional: Varies by lender for rate-and-term refinances.

Completing the seasoning period allows homeowners to apply for a refinance; it won’t guarantee loan approval.

Home Equity (Loan-to-Value Ratio)

There’s no need for a down payment since you already bought the home, but refinancing homeowners will need enough home equity to qualify for the new loan. Equity is the part of the home’s value that’s not currently financed.

Lenders measure equity through Loan-to-Value Ratio, or LTV. This number compares the current mortgage’s size to the home’s value. A homeowner with a $300,000 mortgage on a $400,000 home, for example, would have an LTV of 75%.

How much home equity, measured through LTV, does the lender need to approve a rate-and-term refinance? The answer varies by loan type:

- FHA refinance: 2.25% equity / 97.75% LTV

- Conventional refinance: 3% to 5% equity / 95% to 97% LTV (20% equity to avoid mortgage insurance)

- VA and USDA refinances: 0% equity / 100% LTV

As a new mortgage’s balance decreases and the home value increases, equity grows. If you bought your home recently — in the past year, for instance — and made a small down payment, you probably won’t have 20% equity yet.

Naturally, making a large down payment, such as 20% of the home price, opens the loan with existing equity. In markets where home values accelerate quickly, equity can grow faster.

How do I find my LTV for a mortgage refinance?

To measure your LTV for a refinance, you’ll compare:

- An up-to-date value of your home, and

- Your current mortgage’s principal balance from a recent statement

For example:

- $300,000 home value

- $250,000 loan

Divide your loan balance by your home value ($250,000 / $300,000) = 83% LTV.

Remember that the LTV on the new loan may rise if you roll in closing costs. New loan:

- $300,000 home value

- $255,000 loan (closing costs rolled in)

- 85% LTV

Note that rolling in closing costs may push you over the 80% threshold. In that case, try to pay closing costs out-of-pocket to avoid mortgage insurance.

What if I get my home’s value wrong?

An inaccurate appraised value will create an inaccurate LTV. If you overestimate your home’s value, your LTV will be artificially low, making you think your home has more equity than it does.

Home values can be hard to identify. An independent appraiser sets the official value lenders use. If you bought in the past year, the home value used for your current mortgage should be a good starting point.

You can estimate your home’s value by looking at automated valuation models (AVMs) on real estate websites. Keep in mind AVM values can be artificially high. Compare your AVM value to recent sales prices for similar homes in your neighborhood.

Homeowners could hire their own appraiser to assess the value of their home. This should provide a more accurate value than your own estimates. However, the lender will still hire its own appraiser during the underwriting process. The lender will use its appraiser’s value of your home, not yours.

Credit Score

Credit scores for a rate-and-term refinance vary by loan type and by lender, just as they do with purchase loans. For government-backed refinances, lenders often impose stricter requirements on top of the minimums the government agencies require:

- FHA loans: 580 (note: Refi.com requires a 620 FICO for an FHA rate-and-term)

- Conventional loans: 620

- VA loans: 620 is typical; VA doesn’t set official minimums

- USDA loans: 640 is typical; USDA doesn’t set official minimums

With a conventional refinance, borrowers with higher FICO scores, usually 720 or higher, can secure lower rates and save more money. Government-insured loans, like FHA, USDA, and VA loans, tend to offer more similar rates to all borrowers who qualify.

Debt-to-Income (DTI) Ratio

Lenders compare your monthly income to your existing debt obligations to see whether you can afford the new loan. Debt-to-income ratio, or DTI, distills your monthly spending power to a number.

Lenders measure two types of DTI:

- Front-end DTI: This ratio compares your housing expenses to your gross monthly income. Housing expenses include the principal and interest, mortgage insurance, homeowners insurance, HOA dues, and property taxes, also called PITI (payment, interest, taxes, insurance)

- Back-end DTI: This ratio compares your monthly gross income to what you owe on current debt payments, including student loans, credit card minimum payments, car payments, and your full housing expense (everything included in front-end DTI)

Most rate-and-term refinances will check your back-end DTI.

How to calculate your back-end DTI

- Add up your new (PITI), credit card minimum payments, car loan and other payments

- Divide your total debt by your before-tax monthly income.

- Multiply the answer by 100

Let’s do the math if your total monthly debt is $3,000 and your gross monthly income is $9,000: $3,000 divided by $9,000 equals 0.33. Multiply 0.33 x 100 to get 33% DTI.

What are DTI requirements to refinance?

Lower DTIs mean you have more room in your budget for a new loan, making you more qualified as a borrower. Benchmarks for DTIs vary by loan type, and generally include:

- Conventional: 45% is the standard cap, but some borrowers may qualify with up to 50% with strong compensating factors

- FHA: 43% is the standard cap, but some borrowers may qualify with up to 56.9% with strong compensating factors.

- VA: 41%, though some borrowers may qualify with higher DTIs with strong compensating factors.

- USDA: 41%

Is your DTI too high? Before refinancing, try paying off a loan or consolidating a few debts into a lower monthly payment.

Mortgage Payment History

Making on-time payments on your current mortgage will help your eligibility for a rate-and-term refinance.

Conventional refinance lenders, for example, will check your mortgage payment history for the past 12 months. If you’ve missed a payment or fallen more than 60 days late, the lender may not approve the refinance.

Missed or late payments complicate underwriting for government-backed refinances, too. VA lenders, for example, will likely ask for a written explanation of any late or missed payment in the past 12 months. FHA rate-and-term applications will also attract more scrutiny when the borrower has three or more 30-day late payments, one 60-day and one 30-day late payment, or one 90-day late payment.

How Much Does a Rate-and-Term Refinance Cost?

The upfront cost for a rate-and-term refinance ranges from about 2% to 5% of the loan amount. For a $400,000 loan, this translates to $8,000 to $20,000.

These costs, known as closing costs, include a variety of fees, including legal fees, lender fees, appraisal fees, and other upfront costs required to close the loan. Refinancers may also pay prorated homeowners’ insurance premiums and property taxes, but you would have to pay these whether you were refinancing or not

Is refinancing worth the cost?

When the new loan saves more money than it costs, refinancing will be worthwhile. For example, if the refi creates $120,000 in interest savings over the next 30 years, paying $12,000 in closing costs should be a good investment.

However, if the borrower sells the home next year, after saving only $4,000 on the new loan so far, the $12,000 in closing costs would have been misspent. Nobody can predict the future, but it’s still smart to consider whether you’ll keep the home long enough to benefit from the refinance’s savings. This is called the break-even point.

Calculate your potential break-even point with our calculator.

Can I roll closing costs into the loan?

Some lenders will allow borrowers to include closing costs into the loan, if the extra costs don’t push the loan amount beyond its allowable limits. For example, if a lender allows 95% LTV on a $400,000 home, the maximum loan size would be $380,000.

Let’s say the current mortgage balance to be refinanced is $375,000. This scenario would leave room for only $5,000 in closing costs. If the current mortgage balance were $350,000, the borrower would have more room — up to $30,000 — to roll in closing costs.

Some loan types, like the FHA Streamline refinance, do not allow the refinancer to roll in closing costs at any LTV level.

Financing closing costs makes them more expensive since the borrower will pay interest on the closing costs.

Will the lender pay closing costs?

It’s a popular promotion for lenders to say they’ll pay closing costs on behalf of the borrower. This is often referred to as a “no-closing-cost refinance“. This usually means the lender pays these costs in exchange for a higher interest rate. This can still be worthwhile, especially for cash-strapped borrowers. Still, borrowers should be aware they’re paying costs, only in a different form.

Rate-and-Term Refinance vs. Other Refinance Types

Rate-and-term refinancing isn’t the only option for homeowners who want to save money with a new mortgage.

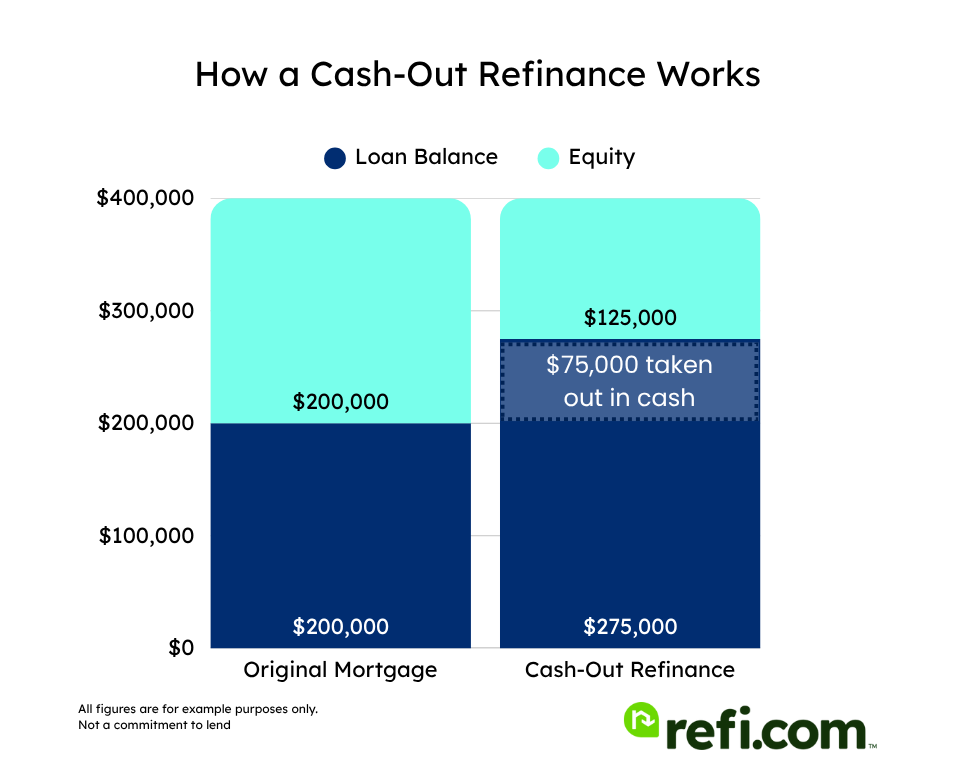

Cash-Out Refinance

Cash-out refinancing opens a new mortgage that:

- Pays off the current mortgage

- Adds in money from equity which the borrower receives at closing

For example, the owner of a $400,000 home who owes $300,000 on the mortgage might get a $320,000 cash-out refinance. The new loan would pay off the $300,000 mortgage balance. The homeowner would receive the additional $20,000 at closing.

All major loan types except USDA loans offer cash-out refinancing. Conventional and FHA cash-out refinance lenders require borrowers to leave at least 20% of the home’s equity in the home. To follow this rule, the maximum loan size on a $400,000 home would be 80%, or $320,000.

Some VA lenders can go up to 100% LTV, meaning the owner of a $400,000 home could get a $400,000 mortgage, maximizing cash back from equity.

Since loan sizes for cash-out refinances are larger, closing costs can be higher.

Streamline Refinance

Streamline Refinancing borrowers can usually skip the home appraisal, the credit check, and other underwriting steps, saving time and money.

However, only government-backed loan programs — FHA, USDA, and VA — offer this choice.

Streamline refinances are designed, specifically, to lower a loan’s rate, change its term, or refinance out of an adjustable rate. They work only within the same loan program: An FHA Streamline Refinance works only for an existing FHA loan, and so on.

Borrowers who want to remove a co-borrower can use a Streamline Refinance, but the borrower remaining on the loan will need to show enough income and credit to qualify as an individual borrower.

Ready to Get Started?

Interest rates change with market conditions, but not every lender offers the same rate to every borrower.

In high-rate markets, it’s even more important to find the lender who looks most favorably on your refinance application.

To do this, you’ll need to compare rates from a variety of lenders. Get started here.