How to Tap Home Equity: Refi, HELOC, or Home Equity Loan?

According to the Federal Reserve, residential property owners have a cumulative $34.5 trillion in home equity. For most, their primary residence is their single greatest source of wealth. So, it should come as no surprise that when they need access to cash, this is the first place they turn.

Tapping into home equity is typically accomplished with

- A cash-out refinance

- A home equity loan

- Or a home equity line of credit (HELOC).

We’ll cover the pros and cons of all three options to help you determine the best route for taking equity out of your home.

Key Takeaways

- Cash-out refinances replace your current mortgage and provide you with a lump sum of cash at closing.

- Home equity loans are second mortgages, which let you access your equity without replacing your existing loan.

- HELOCs are designed for borrowers who plan to access their equity multiple times over a multi-year period.

What Is Home Equity?

Home equity is the portion of your property’s worth that you own outright. Calculating your home equity is easy: just take its total current value and subtract the amount you owe on any associated mortgages.

For example, if your home is valued at $400,000 and your mortgage balance is $250,000, you have $150,000 in home equity.

This equity grows in two ways:

- Principal reduction: The amount of your mortgage balance that you’ve paid off.

- Value appreciation: The amount that your home has increased in value since you purchased it.

Say, using our previous example, that you bought your home for $300,000 with a zero-down mortgage. Since then, you’ve paid off $50,000 of your loan, leaving you with the current $250,000 balance. That $50,000 is equity you’ve gained through principal reduction.

At the same time, your home’s value has increased from $300,000 to $400,000. That’s $100,000 in equity that you’ve built through value appreciation.

Why Take Equity Out of Your Home?

Before we go over the methods for how to get equity out of your home, let’s talk about why someone would want to do so.

The reality is that you can take equity out of your home for any reason you choose. There’s no restriction on how you can use the funds – it’s your money, after all.

There are some common reasons, however, that homeowners tend to tap into their built-up equity:

- Consolidating high-interest debts

- Renovating or making home improvements

- Purchasing a second home or investment property

- Paying off unexpected expenses such as medical bills

- Funding college tuition or other life events

- Starting a business or making other high-return investments

Risks of Using Home Equity

Accumulated equity is yours to use as you see fit, but doing so comes with its share of risks. By taking equity out of your home, you’re reducing your ownership stake in the property.

Since you’re borrowing more than you owe, you’ll likely see your monthly costs increase. If you run into financial hardship and are unable to afford these new, larger payments, you increase your risk of foreclosure.

Plus, building equity can be a lengthy process. If you borrow against your home’s value now, it may be quite a while before you’re able to do so again. In recent history, we’ve seen home prices grow by 8% or more annually. Over the long term, however, appreciation of 3% to 5% per year is more reasonable to expect.

Cash-Out Refinance

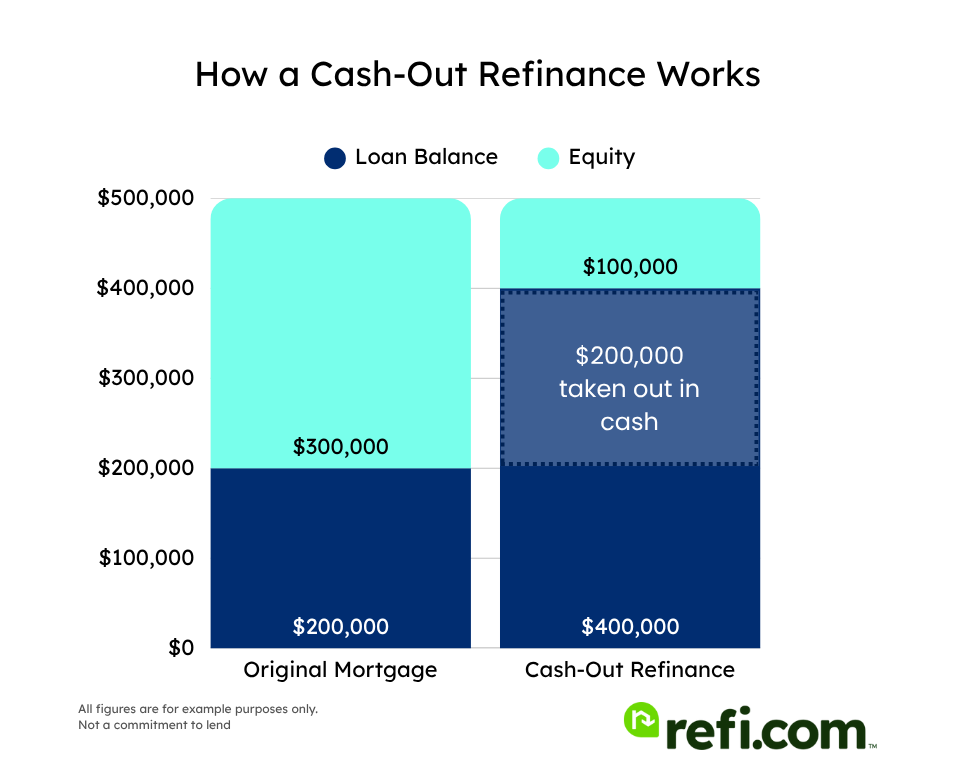

A cash-out refinance involves taking out a new mortgage that is larger than the one you currently have, with the difference, minus closing costs, being disbursed to you as part of the closing process.

How It Works

With a cash-out refinance, you’re replacing your existing loan. This allows you to reestablish the terms of your mortgage while also tapping into your equity. With a cash-out refi, you can adjust your interest rate, repayment schedule, and the borrowers who are on the loan.

Qualifying for a Cash-Out Refinance

The guidelines for qualifying for a cash-out refinance will depend on the program you refinance through. Conventional cash-out refis require a credit score of at least 620, although most lenders will want to see a score of 680 or higher. Refi.com requires a 660 credit score for a conventional cash-out refinance.

You may be able to qualify for an FHA cash-out with a credit score as low as 580, but these will come with upfront and ongoing fees. Refi.com requires a 620 credit score for an FHA cash-out refinance.

Both of these options limit cash-outs to 80% of your home’s current appraised value and will require a maximum debt-to-income (DTI) ratio between 45% and 50%, depending on the lender.

Homeowners who qualify for a VA cash-out refinance may encounter more flexibility regarding their credit score and debt ratio. The majority of VA lenders will allow borrowers to access up to 90% of their home’s value.

When a Cash-Out Refi Makes Sense

A cash-out refinance typically makes the most sense when your existing mortgage’s interest rate is similar or higher than market rates, and when you need to access a substantial amount of your home equity.

It can also make sense if you use the cash to pay off high-interest debt, even if your rate is going up. Check your blended rate across all loans to see if raising your mortgage rate is worth it.

Pros and Cons

| Pros of a Cash-Out Refinance | Cons of a Cash-Out Refinance |

| Interest rates are generally lower than home equity loans or HELOCs | Homeowners with below-market interest rates will have to refinance higher |

| Repayment is typically stretched over a 30-year term | Resetting your mortgage adds to your lifetime interest costs |

| Can adjust the terms of your mortgage since you’re replacing the original loan | Closing costs run between 2% and 6% of the total loan amount |

Home Equity Loan

Home equity loans are a type of second mortgage that works alongside your current loan. This allows you to retain your existing mortgage while still receiving a lump sum of cash from the equity you’re tapping into.

How It Works

With a home equity loan, you are not replacing your existing mortgage. Instead, you’re taking out a second loan – complete with its own separate payment – that’s secured by the equity you’re withdrawing from your home.

Home equity loans commonly have higher interest rates and shorter repayment lengths than cash-out refinances.

Qualifying for a Home Equity Loan

Lending rules are more varied for home equity loans than with cash-out refinances, as these second mortgages do not conform to the guidelines established by Fannie Mae and Freddie Mac. This means that individual lenders set their own requirements and have more leeway when approving applicants.

However, you’ll still likely need a credit score of at least 620, with 680 or higher preferred by most mortgage companies. DTI limits vary by lender, but it’s best to stay under 50% for the best chances of approval.

One noteworthy advantage of home equity loans is that you can usually access a higher percentage of your home’s equity. It’s not uncommon to be able to borrow up to 85% or 90% (combined with the amount you owe on your first mortgage) of your property’s value. Some lenders may even be willing to loan more.

Best Uses for a Home Equity Loan

Home equity loans are generally the preferred option for borrowers who have a low interest rate on their first mortgage and don’t want to give it up. They can also be a good choice when you only need to tap into a modest amount of equity and don’t want to pay closing costs on a whole new first mortgage.

Additionally, because of their higher loan-to-value limits, borrowers who may not have enough equity to do a cash-out refi may find better luck when applying for a home equity loan.

Pros and Cons

| Pros of a Home Equity Loan | Cons of a Home Equity Loan |

| As a second mortgage, home equity loans do not replace your existing interest rate | Interest rates are usually higher than with a cash-out refinance |

| May be able to access a higher amount of your home’s equity | Tapping into more equity can further increase your total mortgage payments |

| Closing costs are lower than with a cash-out refi | Repayment periods are generally shorter, often ranging from five to 20 years |

Home Equity Line of Credit (HELOC)

A home equity line of credit is another type of second mortgage that does not replace your existing loan. Unlike home equity loans, which provide you with a lump sum of cash, HELOCs allow you to tap into your equity as many times as needed over a multi-year period.

How It Works

HELOCs have two distinct phases: the draw period, which usually spans five to 10 years, during which you can make multiple withdrawals from your equity, and the repayment period, which generally lasts 10 to 20 years, during which you repay the borrowed funds.

While your loan is in the draw period, you’re typically only responsible for making interest payments on the amount of equity you’ve accessed up until that point. Once the loan converts into the repayment period, you’ll make monthly principal and interest payments for the remainder of the term.

Unlike cash-out refinances and home equity loans, which often have fixed rates, HELOCs tend to be adjustable-rate mortgages with payments that can fluctuate over time.

Qualifying for a HELOC

Qualifying for a HELOC is much like qualifying for a home equity loan. You’ll normally want to have a credit score of 680 or higher, although it may be possible to find lenders who will approve scores of 620 or even lower.

Similarly, it’s common to find HELOC lenders willing to let you borrow up to a combined 90% or more of your home’s current appraised value.

When a HELOC Makes the Most Sense

HELOC borrowers are usually homeowners who anticipate needing to access their property’s equity more than once within a few years. This could be for a long-term renovation project, funding a business start-up, or covering ongoing medical expenses.

Pros and Cons

| Pros of a Home Equity Line of Credit | Cons of a Home Equity Line of Credit |

| You can withdraw funds as needed over an extended period | Variable interest rate can cause your payments to increase as the market changes |

| Interest-only payments during the initial draw phase | Accessing a significant portion of your equity can result in higher overall mortgage costs |

| Often lower closing costs than cash-out refinances or home equity loans | Some HELOCs may have annual fees, even if you don’t run a balance |

HELOC vs. Home Equity Home vs. Cash-Out Refi: Key Differences

| Cash-Out Refinance | Home Equity Loan | HELOC | |

| Access to Equity | Lump Sum | Lump Sum | Ongoing Withdrawals |

| Replaces Current Loan? | Yes | No | No |

| Interest Rate Type | Fixed | Fixed | Variable in most cases |

| Interest Costs | Lower | Higher | Fluctuates |

| Maximum Loan-to-Value (LTV) | 80% in most cases | 90%+ | 90%+ |

| Loan Length | Up to 30 years | Commonly found with five to 20-year terms | Five to 10-year draw/10 to 20-year repayment |

| Closing Costs | Higher | Lower | Lower (waived by some lenders) |

Which Option Is Right for You?

We’ve gone over the pros and cons and key differences between cash-out refinances, home equity loans, and HELOCs, but how do you choose which option is right for you? Let’s take a look at a few real-world considerations to see how the loans compare.

1. Your Current Mortgage Rate

Your current mortgage rate is one of the most significant factors in choosing the best option for tapping your home’s equity. If you’re presently locked into a low interest rate – especially if it’s far below what’s currently available – you’ll likely want to consider a home equity loan or HELOC to keep your existing rate intact.

2. Lump Sum Needs

If you need a lump sum of cash – such as for consolidating debt or making home improvements – you’ll probably want to go with a cash-out refinance or a home equity loan. Your current interest rate will still play a prominent role in the decision, but so will the amount of equity you need to access.

Homeowners seeking a sizable lump sum – say 25% or more of their property’s value – may be more inclined to go with a cash-out refi due to the comparatively lower interest rates. On the other hand, if you only need to withdraw a small amount, a home equity loan may be more sensible due to its lower closing costs.

3. Ongoing Expenses

Not exactly sure how much you’ll need or think you’ll want to tap into your equity multiple times within the next few years? In that case, you’ll probably be better off with a HELOC, as you can access your line of credit at any point during the draw period, which generally lasts between five and 10 years.

4. Changing Your Mortgage Terms

Need to get equity out of your home and change the terms of your mortgage at the same time? In this case, you’re likely limited to a cash-out refinance since the other two options are secondary loans that do not replace your existing mortgage.

One scenario for this is during a divorce when one spouse needs to pay off the other’s share of home equity while simultaneously removing the departing partner from the mortgage.

Tax Considerations

It’s common for homeowners to be concerned about the tax implications of tapping into their built-up equity. The good news, however, is that all of these options are loans you’re obligated to repay, meaning that income tax is not owed on the withdrawn funds.

The downside, though, is that you may not be able to deduct the additional interest you pay from your taxes. Broadly speaking, only interest payments on cashed-out equity used to fund renovations and home improvements are considered deductible for tax purposes.

Keep in mind, though, that the tax code is a complex topic. Be sure to seek professional guidance if you’re unsure how taking equity out of your home will impact your individual finances.

Get Equity Out of Your Home With Refi.com

All three methods we’ve covered can be effective ways for taking equity out of your home, with each suited to different borrowing needs.

Homeowners wanting to access a large amount of funds often opt for a cash-out refinance. At the same time, home equity loans and HELOCs may appeal to borrowers who are currently locked into a favorable interest rate or only need to tap a relatively small portion of their home’s value.Ready to take the next step?

Apply with Refi.com for a personalized breakdown of all of the available options for accessing your home’s equity.