Refinancing From a 15-Year to a 30-Year Mortgage

Buyers often opt for a 15-year mortgage to build equity faster and own their homes sooner. However, a 15-year term comes with larger payments than a typical 30-year loan, and some borrowers eventually decide to do a 15-year to 30-year refinance to reduce their monthly costs.

Can I Refinance From a 15-Year to a 30-Year Mortgage?

The short answer is yes, you can refinance a 15-year mortgage into a 30-year mortgage. Depending on your loan balance, rate, and terms, doing so could save you hundreds of dollars on your regular monthly mortgage payment.

If you currently have a shorter mortgage and are looking into your 15 vs 30 year mortgage options, it might make sense to stretch your payments over a longer term. In some scenarios, extending your loan may even be necessary for your refinance to be approved.

But whether you’re looking at a refinance to give your budget a little breathing room or to simply provide you with more control over your money, here are seven reasons refinancing from a 15-year to a 30-year mortgage might be right for you.

1. Lower Your Monthly Payments and Improve Cash Flow

Perhaps the most noteworthy benefit of doing a 15-year to 30-year refinance is that you could have a much lower monthly payment. Check out the 15 year vs 30 year mortgage calculator to see for yourself. Even though a larger share of your payment will go toward interest, a 30-year loan lets you repay your principal over twice the time.

What does this mean when comparing the numbers? Here are three situations and how they could play out.

Keep in mind that extending your loan term often comes with higher lifetime interest costs and that refinancing can lead to higher finance charges over the life of the loan. Be sure to run the numbers to get the full picture of costs.

You’re Refinancing to the Same Interest Rate

If you’re refinancing your 15-year mortgage to a 30-year term and have been quoted roughly the same interest rate, you can expect a sizable drop in your monthly payment.

For example, a $300,000 15-year mortgage at 6.5% would have principal and interest (P&I) payments of $2,613. Refinancing to a 30-year mortgage at the same 6.5% interest rate would result in payments of $1,896 – a savings of $717 per month.

You’re Refinancing to a Lower Interest Rate

Refinancing to a lower interest rate and extending your term simultaneously can save you even more on your monthly mortgage payment.

For example, if your $300,000 15-year loan had an interest rate of 7.5%, your monthly P&I payments would be $2,781. Reducing your rate to 6.5% while switching to a 30-year mortgage with payments of $1,896 would boost your monthly savings to $885.

You’re Refinancing to a Higher Interest Rate

Depending on how much higher the new rate is, refinancing your 15-year mortgage to a 30-year term can still provide a reduction to your monthly payments.

For example, say your $300,000 15-year loan has an interest rate of 5.0% with a monthly P&I payment of $2,372. Refinancing to a 30-year loan at a rate of 7% would result in payments of $1,996 – which is still a savings of $376 per month.

Keep in mind that all interest rates mentioned are for example purposes only and may not be available.

How we source rates and rate trends

Rates based on market averages as of Dec 02, 2025.Product Rate APR 15-year Fixed Refinance 5.37% 5.42% 30-year Fixed Refinance 6.35% 6.37%

2. Easier to Qualify for a 30-Year Refinance

It can be easier to qualify for a 30-year refinance because the lower monthly payment will have less impact on your debt-to-income ratio.

Lenders have a maximum limit for how much of your income can be allocated toward housing expenses and other installment debts. If a more expensive 15-year mortgage puts you above this limit, you won’t be approved.

For some homeowners, even those who currently have a 15-year loan, recently added debt or a reduction in income could prevent them from qualifying for a shorter term. In this case, you may need to opt for a 30-year mortgage to proceed with the refinance.

3. Put More Into Savings and Investments

If your investments generate a higher rate of return than the interest costs on your mortgage, it may seem financially advantageous to lengthen your loan and use your capital elsewhere. However, investment returns are not guaranteed, and this strategy may not be appropriate for all borrowers.

It is important to consult a licensed financial advisor to explore the best options for your situation.

4. Greater Flexibility if Your Income Is Reduced

Even if you’re comfortably making your payments now, switching from a 15-year to a 30-year loan provides greater flexibility in the event your income ever gets reduced.

This could be something unexpected, such as being laid off or developing a long-term illness, or it could be for planned life events, like expanding your family or transitioning into self-employment.

5. Interest Payments May Be Tax Deductible

A longer loan term means paying more interest, both as a portion of your monthly payment and over the life of the loan. While that is a downside of a 30-year mortgage, the upside is that your interest payments may be tax deductible if you itemize deductions on your federal tax return.

The current US tax code allows homeowners to deduct interest paid on the initial $750,000 of mortgage debt on their primary residence or second home. However, everyone’s tax situation is different, and if you’re unsure whether you can save with a mortgage interest deduction, consult your tax preparer or financial advisor.

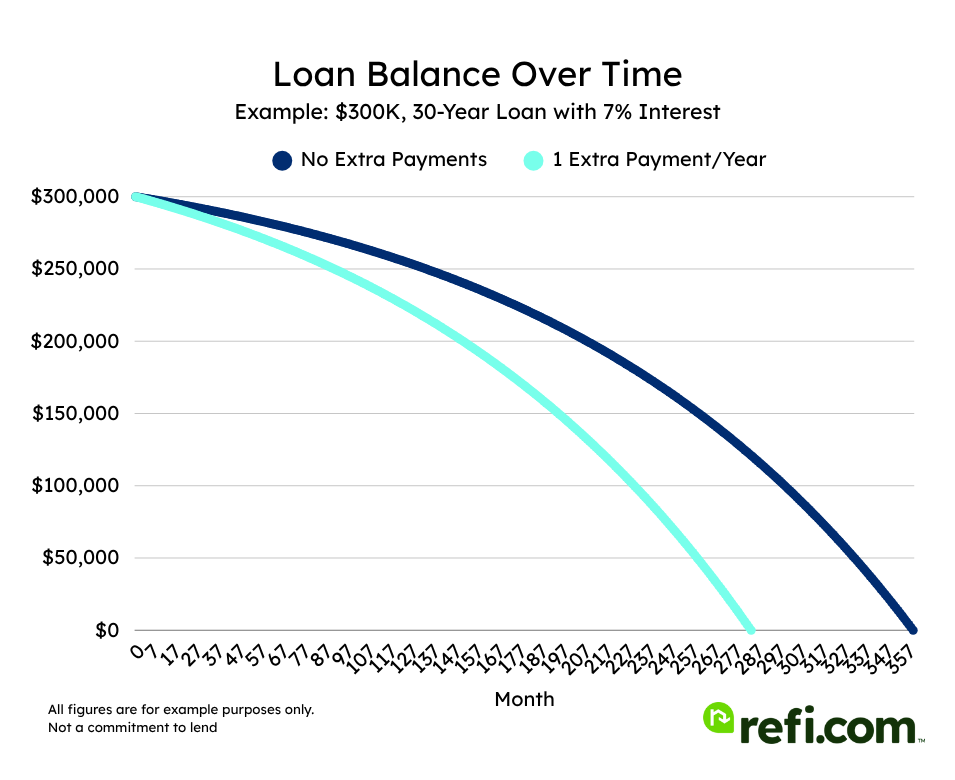

6. Make Extra Payments When Convenient

With a 15-year mortgage, you’re locked into a larger monthly payment for the entirety of the loan. By refinancing to a longer term, you get the benefits of smaller payments but the option to make an extra, larger payment whenever it’s convenient.

This lets you pay down your principal faster, on your own terms, with the ability to make your regular minimum payment on months when you need to use the money elsewhere.

7. Soften the Impact of a Cash-Out Refinance

If you plan to do a cash-out refinance and withdraw some of your home’s equity, refinancing to a 30-year term could help soften the impact of increasing your loan balance.

For example, say your current monthly principal and interest payments are $1,325, and your remaining loan balance is $150,000. You plan to withdraw $100,000 as part of your cash-out refinance for an ending balance of $250,000.

With a 15-year mortgage at 6.5%, your payment would shoot up to $2,178. With a 30-year mortgage at a slightly higher 7%, your monthly costs would only be $1,663.

Drawbacks of Refinancing From a 15-Year to a 30-Year Mortgage

Although it can make sense for some homeowners to make the switch from a 15-year to a 30-year mortgage, it isn’t always the best decision. Sure, your payments could be lower, but if you’re comfortably within your budget, you’ll likely save money in the long-term by sticking with a shorter term.

Slower to Build Equity

Your payments are lower with a 30-year mortgage because you’re paying down a smaller portion of your principal balance. This means that you’ll be building equity in your home slower.

For example, if you have a $300,000 30-year mortgage at a rate of 7%, you’ll have a balance of around $282,500 after five years of payments. Not including any appreciation to your home’s value, this represents $17,500 in equity.

However, after five years of payments on a $300,000 15-year mortgage at the same 7% rate, your remaining loan balance would be approximately $232,000 with $68,000 in equity.

Interest Rates Are Higher

While it’s simpler to compare loan terms with a consistent interest rate, lenders generally offer better rates for shorter-term mortgages.

Sometimes, you might pay a small premium to refinance from a 15-year to a 30-year loan, something modest like 0.25%. Other times, extending your loan term to 30 years could result in an interest rate that’s 1% or higher than 15-year options.

Pay More Long-Term Interest

A major downside of paying a higher interest rate for an extended period is that you end up spending more on long-term interest. When comparing 15-year and 30-year loans, this difference in lifetime interest can be staggering.

Here’s a quick chart showing how much the payments and lifetime interest would be on a $400,000 mortgage at 6.5% interest over varying repayment lengths.

| $400K Mortgage @ 6.5% | Monthly Payment | Total Lifetime Interest |

| 10-Year | $4,542 | $145,030 |

| 15-Year | $3,484 | $227,197 |

| 20-Year | $2,982 | $315,750 |

| 25-Year | $2,701 | $410,249 |

| 30-Year | $2,528 | $510,178 |

Refinance Closing Costs

Refinancing isn’t free. You can expect to pay for closing costs just like when you initially took out your mortgage. For the most part, these closing expenses will be similar, including things like a lender origination fee, title insurance, and document filing. Conventional refinance closing costs typically run 2% to 4% of the total loan.

Alternatives to Refinancing to a 30-Year Mortgage

Depending on why you want or need to refinance, you may have other options besides simply switching from a 15-year to a 30-year loan. Before going through with your refinance, here are a few alternatives worth considering.

Customize Your Mortgage Term

15-year and 30-year mortgages aren’t your only two options. Conventional lenders offer a variety of terms ranging from ten to 30 years. Some companies will even let you customize your loan length to match your financial planning goals.

How we source rates and rate trends

Rates based on market averages as of Dec 02, 2025.Product Rate APR 10-year Fixed Refinance 5.21% 5.26% 20-year Fixed Refinance 6.05% 6.08%

Consolidate Other Debts

If you’re dealing with other high-interest debts on top of your mortgage, it may make sense to consolidate them with a cash-out refinance. For example, if you have $20,000 of ongoing credit card debt at 25%, you’re spending $5,000 annually on interest. Wrapping that debt into your 7% mortgage would reduce the interest cost to $1,400.

Forbearance and Loan Modification

Has your mortgage become too much of a burden on your budget? If your financial situation has changed and you’re having trouble making your monthly payments, you should talk with your lender about forbearance and loan modification.

Forbearance allows you to work out a plan with your lender to skip (or make reduced) payments until you can get your finances back on track. If your issues are likely to be permanent, loan modification lets you alter the details of your loan – including the term – without refinancing.

Be aware, however, that these options are often tied to financial hardship and may not be available unless you’re already experiencing difficulty making your payments. In some cases, accessing them may impact your credit.

Should You Do a 15-Year to 30-Year Refinance?

If you’re making the payments on your current loan with no problem and don’t necessarily need to free up any money in your budget, you may want to stick with your 15-year mortgage. Not only will you own your home sooner, but you will also pay less interest to your lender in the meantime.

But going through with a 15-year to 30-year refinance can drastically reduce your monthly payments in many cases. For borrowers considering a cash-out refinance, extending the term can make their new payments far more manageable.

Ultimately, the decision will hinge on your personal finances and individual mortgage needs.

Ready to get started on a refinance? Start your application with Refi.com here.