Refinancing a Manufactured Home

Fact-checked by Tim Lucas.

Refinancing a manufactured home is possible for most owners.

However, the rules for refinancing a manufactured home are different from those for other types of real estate. The first hurdle to clear is whether your home counts as a manufactured home or a mobile home.

Highlights

- Most manufactured homes qualify for refinancing, but mobile homes do not.

- Manufactured homes must meet HUD standards and be classified as real property to qualify.

- The home must be on a permanent foundation, taxed as real property, and meet size requirements.

- Borrowers must meet specific credit, debt-to-income, and equity thresholds, which vary by loan type and lender.

- Refinance options include conventional, FHA, VA, and USDA loans, each with tailored terms for manufactured homes.

Manufactured Homes vs. Mobile Homes

Manufactured homes can qualify for traditional refinancing, while mobile homes cannot. The main difference between them is the date they were built.

If your home was constructed before June 15, 1976, it is considered a “mobile home,” once referred to as a trailer. According to the industry definition, it’s technically not a manufactured home, so you can’t get a traditional refinance.

If it was built on or after June 16th, 1976, it is considered a manufactured home and can be refinanced with a traditional refinance for most owners. To qualify, manufactured homes will need to have HUD identifying labels.

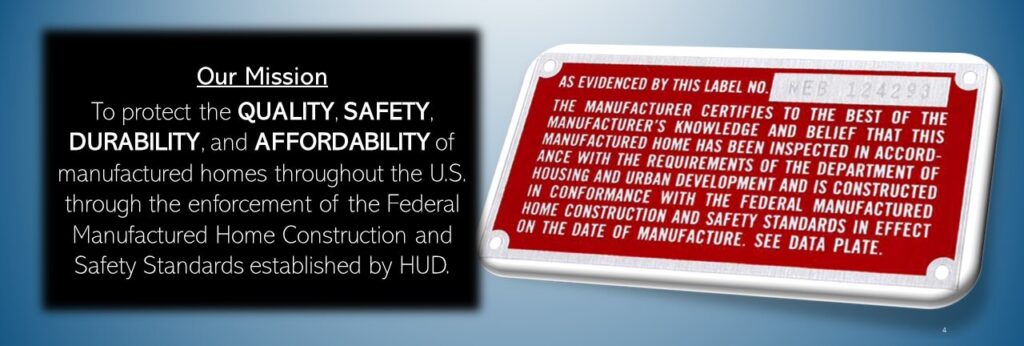

HUD Identifying Labels

That 1976 date was when the U.S. Department of Housing and Urban Development (HUD) first set standards for manufactured homes, making them more secure, durable, and safe. A manufactured home will have two identifying markers if it complies to standards.

- Data Plate: It’s not a plate but a paper certificate showing a map of the U.S. found inside the home, typically by the electrical panel, kitchen cabinet, or bedroom closet.

- Certification Label: A 2-inch by 4-inch metal plate attached to the outside of the home.

Photo credit: HUD

If you can’t find the certification label, HUD may be able to issue a “Letter of Label Verification for units for which it can locate the necessary historical information.”

Manufactured Home Requirements for Financing

Having your HUD labels or letter of label verification is a great first step. But there are more hurdles:

- You must own the land on which the home is located. A rented plot means your home can’t be mortgaged or refinanced

- The home must be permanently affixed to foundations that meet HUD standards

- It must be taxed as real property, not as a vehicle or a personal property

- The home can’t have wheels, axles, or a towing hitch

- It must have a floor area of at least 400 square feet (more for some loans and lenders) and be at least 12 feet wide

If your home is currently classed as a vehicle or chattel (personal property), you may be able to apply to your state to have it reclassified as real estate. Of course, the home would have to conform to local standards for your application to be approved.

Other rules may apply, and these vary from state to state. Fannie Mae has a free, downloadable guide that details each state’s requirements.

Manufactured vs. Modular Home

Like a manufactured home, a modular home is built in a factory and transported to the site. However, its many component parts are then put together and constructed on the site. It must comply with local building codes, not the federal code. When finished, modular homes are often indistinguishable from their traditionally built counterparts.

Most lenders offer regular mortgage financing for modular homes, giving you more options. Modular homes are eligible for traditional refinancing.

Requirements for the Borrower

As with all mortgages and refinances, your lender will verify

- Your income (latest pay stubs, W2s, and potentially tax returns)

- A credit score of at least 620 for a conventional refinance. FHA, VA, and USDA streamline refinances may have no credit score minimum

- A debt-to-income (DTI) ratio under 45%. Streamline options may not have a DTI maximum

- Have enough “equity”: the amount by which your home’s value exceeds your mortgage balance. Again, streamline refinances may waive this requirement

Different types of mortgages and different lenders have different thresholds for many of these rules.

For example, a VA Streamline may require no equity (you owe as much or more than the property is worth). A conventional mortgage approved with Fannie Mae or Freddie Mac standards most likely needs 5% equity left after the refinance. However, an FHA loan may require just 2.25% equity and a 580 score.

Because there are so many guidelines and refinance options, your best plan is to contact a lender for a personalized review of your situation.

You can model your options ahead of time using our refinancing calculator.

Types Of Manufactured Home Refinances Available

Many refinance options could be available to you.

Conventional Loans

Conventional loans are approved by standards set by Fannie Mae and Freddie Mac. Most lenders in the U.S. can approve loans by these guidelines.

- Loan-to-value (LTV): 95% in most cases. Max is 97% for refinances on MH Advantage and CHOICEHome properties, which meet a set of higher standards by Fannie and Freddie. Max 65% for cash-out refinances

- Credit score: 620

- DTI: 43%

- Other requirements: Typically best for those with higher credit.

FHA

FHA offers three types of manufactured home refinances: standard, streamline, and Title 1.

Standard

- Loan-to-value (LTV): 97.75% (80% for cash-out)

- Credit score: 580

- DTI: 50%

- Other requirements: Can refinance out of another loan type with this option

Streamline

- Loan-to-value (LTV): No limit (no appraisal or value estimate required)

- Credit score: No minimum, although some lenders may require a minimum score

- DTI: N/A. No income verification required

- Other requirements: Must have an FHA loan currently

Title 1 (For manufactured homes not on owned land)

- Loan-to-value (LTV): N/A – no appraisal required

- Credit score: No minimum

- DTI: 45%

- Other requirements: Loan limit of $105,532 for single-wide and $193,719 for multi-wide

VA

Standard

- Loan-to-value (LTV): Up to 100%, even for cash-out loans

- Credit score: No minimum, although some lenders may require a minimum score

- DTI: 41% or higher in some cases

- Other requirements: Maximum loan term of 25 years

Streamline

- Loan-to-value (LTV): N/A – no appraisal required

- Credit score: No minimum, although some lenders may require a minimum score

- DTI: N/A – no income verification

- Other requirements: Must have a VA loan currently

USDA

USDA offers a streamline refinance for those with an existing USDA loan on the manufactured home.

- Loan-to-value (LTV): N/A – no appraisal required

- Credit score: No minimum

- DTI: No income verification

- Other requirements: Must have a USDA loan currently

Start your Manufactured Home Refinance

When rates drop unexpectedly, as they often do, you should be ready to refinance. That includes talking to a lender and making sure you can qualify for your best program. Get started here.