3 Ways to Refinance Your Mortgage With Bad Credit

- Refinancing with bad credit typically means higher interest rates and stricter requirements, potentially costing thousands more over the loan term.

- Government-backed streamline programs (FHA and VA) and using a co-signer can help you qualify for better terms even with poor credit.

- Improving your credit score before refinancing—by paying down debt, correcting errors, and maintaining on-time payments—can save you significant money and simplify the process.

Before pulling the trigger on a mortgage refinance, it’s smart to check your credit and determine whether you are considered an attractive borrowing candidate. That’s because having a poor credit score and red flags on your credit report can make refinancing more challenging and costly – even if a lender approves you.

Bad credit is generally defined as having a FICO score below 580, though some lenders may classify credit as poor if it’s under 620. Many people already know if their score is low since it’s often the result of missed payments, high debt levels, or other negative financial habits.

Fortunately, there are ways you can qualify for a refinance even if you have poor credit. But you should expect to pay more for financing and anticipate a possibly lengthier and more involved process.

Risks of a Bad Credit Refinance

Higher Interest Rates

While it’s possible to qualify for a refinance with bad credit, there are risks you should know. One of the biggest concerns is the higher interest rates that typically accompany poor credit. Those with good credit scores (670 or higher) are usually quoted lower fixed interest rates on a mortgage refinance loan than those with poor credit scores.

That can mean the difference, for example, between getting a rate below about 6.5% on a 30-year fixed-rate refi loan versus a rate well above 7%. That rate difference can equate to paying thousands extra in mortgage interest over the life of the loan.

Lenders view borrowers with low credit scores as risky, so they often charge higher rates, which may not improve your financial situation. Additionally, refinancing can come with significant upfront costs, including closing costs, appraisal costs, and other charges that can total 2% to 6% of the loan amount. These costs might outweigh any benefits if the potential savings aren’t substantial.

Increased Documentation

Dennis Shirshikov, Head of Content for Awning.com and a finance and economics professor at the City University of New York, cautions that pursuing a mortgage refinance with bad credit can be extra challenging in other ways.

“Lenders perceive you as a higher risk. You may need to provide more documentation and prove a stable income. Expect a possibly longer underwriting and closing process, too,” he adds.

Long-Term Costs

Another downside is that many people refinance to lower their monthly payments by extending the loan term. While this can provide short-term relief, it means you’ll pay more interest over the life of the loan, potentially increasing your total debt.

Thankfully, most refinance programs must offer a net positive benefit to the borrower in order to qualify. There are also plenty of online tools, like this break-even refinance calculator, to help you evaluate when it’s the right time to refinance.

Now that we’ve covered the risks, let’s get into the three best strategies for refinancing with a “bad” credit score.

3 Ways to Refinance With Bad Credit

Refinancing a mortgage with a bad credit score can be challenging but possible. Here are some strategies to help you improve your chances.

1. Check With Your Current Lender

Checking with your current lender can be helpful when trying to refinance with bad credit for several reasons. First, your lender already has a history with you, which may work in your favor if you’ve been making consistent payments. This relationship can make the lender more flexible and willing to offer refinance options despite your credit score.

Additionally, if your credit score is low due to missing mortgage payments, it likely won’t help to seek a new lender. If you’ve missed multiple mortgage payments within the past 6 to 12 months, it may be better to stick it out with consistent payments until your payment history stabilizes.

Any lender will view missed payments as a big red flag, especially if they occurred within the past 12 months. If your missed payments occurred over a year ago and you have been consistent for a considerable time, it’s probably worth checking about a refinance.

Your current lender can also likely offer refinance alternatives to lower your monthly payments, reduce your interest rate, or restructure your loan terms to make them more manageable.

2. Try a Government-Backed Program

Streamline refinancing is a simplified loan process offered by government-backed programs like FHA and VA loans. It is designed to help homeowners refinance their existing mortgages with less paperwork, no appraisal, and often no credit check, as long as they have a history of timely payments.

Streamline refinancing’s main goal is to reduce interest rates or switch from an adjustable to a fixed-rate mortgage, making it easier and faster for borrowers to improve their loan terms.

FHA Streamline Refinancing Requirements

- You must already have an FHA loan product.

- At least 210 days must have passed since your first mortgage payment due date.

- At least six mortgage payments must have been made.

- The refinance must have a net tangible benefit to the borrower, meaning it should benefit you in the long run.

- You must have enough cash to close.

- You must pay an upfront mortgage insurance premium (MIP) of 1.75%.

Read more about the FHA Streamline refinance here.

VA Streamline Refinance (IRRRL) Requirements

- You must already have a VA loan product.

- At least 210 days must have passed since your first mortgage payment due date.

- You must have made six consecutive mortgage payments.

- You must have two years of employment history.

- You must have enough cash to close.

- The refinance has to have a net tangible benefit for the borrower.

Read more about the VA Streamline Refinance (IRRRL) here.

Unlike the FHA and VA loan programs, Freddie Mac and Fannie Mae are government-sponsored enterprises (GSEs) offering homeowners streamlined refinance options.

3. Use a Co-Signer

Having a co-signer with good credit can increase your chances of securing a refinance with better terms. The co-signer becomes responsible for the loan if you default, so you should very carefully consider this option.

Make sure to check your particular mortgage program’s requirements around co-signers because they vary. For example, if you have a VA loan, your co-signer needs to be a qualified military member or spouse.

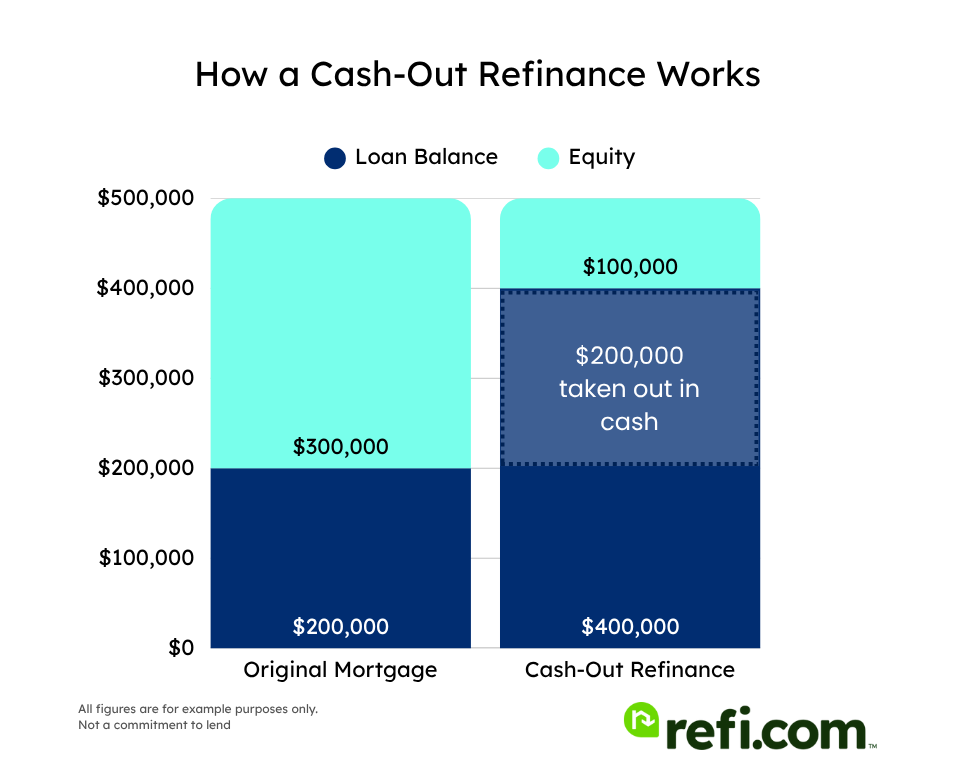

Tips for a Cash-Out Refinance with Bad Credit

Unlike some of the more streamlined refinance options, cash-out refinancing requires a credit check. Lenders typically require a minimum credit score of 620, though it differs depending on the lender.

Keep in mind that these are minimums required by federal programs. Private lenders often overlay stricter requirements. Refi.com requires a 660 credit score for a conventional cash-out refinance and a 620 for an FHA cash-out refinance.

Not only do you need a decent credit score to qualify for a cash-out refinance, but you also need sufficient equity in your home.

A borrower can determine if they have enough equity for a cash-out refinance by calculating their loan-to-value (LTV) ratio. Lenders typically require that you retain at least 20% equity in your home after the refinance. You can easily calculate your LTV with these steps:

Estimate Your Home’s Current Value

You can use online tools or get a professional appraisal to estimate your home’s market value.Check Your Current Mortgage Balance

Look at your latest mortgage statement to see how much you still owe on your loan.Calculate Your LTV Ratio

Divide your current mortgage balance by your home’s estimated value, then multiply by 100 to get a percentage. For example, if your home is worth $300,000 and you owe $200,000, your LTV ratio is about 67%.

For a cash-out refinance, most lenders require your LTV to be no higher than 80%, meaning you need at least 20% equity remaining in the home. If your LTV is below 80%, you likely have enough equity to qualify for a cash-out refinance.

Even if you have sufficient equity in your home, a lender will want to assess your overall creditworthiness to ensure that you can handle the new loan and any cash you receive.

Tips to Improve Your Credit for a Potential Refinance

Ideally, it’s best to work hard at upping your credit score and improving your credit rating many weeks before applying for a mortgage refinance loan, which can result in a smoother process and lower total costs. Try these strategies:

- Review your three free credit reports. Check for errors or inaccuracies you see on your reports, and dispute any errors with Experian, TransUnion, and Equifax.

- Pay your bills punctually. Establish a solid track record of paying your debts on time, every time.

- Try to repay your debts in full, or at least pay more than just the minimum amount due every month. Paying down debt can have an immediate positive impact on credit utilization, which is the second most significant factor in determining your credit score.

- Avoid applying for any new credit before applying for your mortgage refi.

- Request a higher credit limit from your credit card company or another creditor.

- Don’t overspend or max out on your credit limit. Keeping your balance below 50% of your credit limit – ideally 33% – is extremely important. If you exceed 50% of the limit on your credit card, for example, it will hurt your credit score – even if you pay your bill on time.

FICO now says, “Generally, keeping it [your card balance as a percentage of your credit limit] below 10% (and consistently paying bills on time) can help you build and maintain a good FICO® Score. That’s tough but it’s a good goal.

Ready to Refinance? Start Your Application with Refi.com

When it’s time to explore your refinance options, evaluate several factors before committing to a loan. Carefully consider the total loan costs, the impact on your long-term financial goals, and the potential for future rate increases if you opt for an adjustable-rate mortgage, as well as the possibility of rates lowering soon if you prefer a fixed-rate mortgage.

Even if your credit isn’t perfect, refinancing could still save you money or help you access your home’s equity. Whether you’re looking to lower your rate, reduce your monthly payment, or consolidate debt, Refi.com specializes in refinance solutions tailored to your situation.

Start your refinance application with Refi.com today and see what rates you qualify for – the process takes just minutes, and there’s no obligation to proceed.