How to Refinance a Multifamily Property

Owning a multifamily property comes with plenty of responsibilities. You need to find and keep quality tenants, stay on top of maintenance needs, and ensure the overall financial health of your investment.

Refinancing your mortgage to improve cash flow, reduce interest costs, or unlock built-up equity in your duplex, triplex, or quadplex doesn’t have to turn into an added burden.

However, multifamily refinances have their own requirements depending on the number of units, owner-occupancy status, and type of loan you’re applying for.

Highlights

- The process for refinancing a multifamily home is much like a single-unit residence, although you’ll likely face stricter qualification requirements.

- Investors have several conventional refinance options available, while owner-occupants may also be eligible for certain government-backed loans.

- Healthy and well-documented property finances can help improve your chances of qualifying for a multifamily refinance.

Can You Refinance a Multifamily Property?

Yes, you can refinance a multifamily property. In fact, the process is much like refinancing a standard home, although you may encounter more stringent qualification and documentation requirements.

Before we delve into the details, it’s essential to clarify that multifamily properties with two to four units are considered residential and are eligible for many of the same conventional and government-backed programs as single-family residences.

Properties with five or more units are classified as commercial and require different types of mortgages.

This article will focus on refinancing residential multifamily properties, including duplexes, triplexes, and quadplexes.

Why Refinance a Multifamily Property?

Borrowers seek to refinance multifamily properties for numerous different reasons, including to:

- Lower their monthly payments and increase cash flow

- Reduce risk by switching to a fixed-rate loan

- Tap into equity to renovate their property

- Cash out funds to finance other investments

- Obtain better terms after their property’s value has increased or rental income has stabilized

Regardless of your reasons for wanting to refinance your property, you’ll find a variety of loan options available, especially for owner-occupants who live in one of the units as their primary residence.

Note: Refinancing may result in higher finance charges over the life of the loan. Be sure to weigh both the short- and long-term costs before proceeding.

Multifamily Refinance Strategies

Property owners have several multifamily refinance strategies to choose from, each suited to meet varying needs and financial objectives.

Rate-and-Term Refinance

A rate-and-term refinance allows you to lower your interest rate and adjust the terms of your multifamily mortgage.

How we source rates and rate trends

Rates based on market averages as of Dec 02, 2025.Product Rate APR 15-year Fixed Refinance 5.37% 5.42% 30-year Fixed Refinance 6.35% 6.37%

You will probably want to opt for a rate-and-term refinance if your primary goal is to:

- Reduce your interest rate and monthly mortgage payments

- Shorten or lengthen your loan repayment period

- Eliminate private mortgage insurance requirements

- Switch between an adjustable-rate and fixed-rate loan

- Refinance out of a hard money or balloon mortgage

Rate-and-term multifamily refinances often have the most lenient eligibility requirements since you’re generally improving the terms of your loan while not taking on any additional debt.

For investment properties, you can qualify for a rate-and-term refinance with a loan-to-value (LTV) ratio up to 75%. If you occupy one of the units as your primary residence, you can refinance up to 95% of the property’s value with a conventional mortgage and 97.75% with an FHA-backed loan.

VA borrowers may even be able to refinance for the property’s full appraised value. This varies by lender.

Related: Loan-to-Value (LTV) Ratio When Refinancing

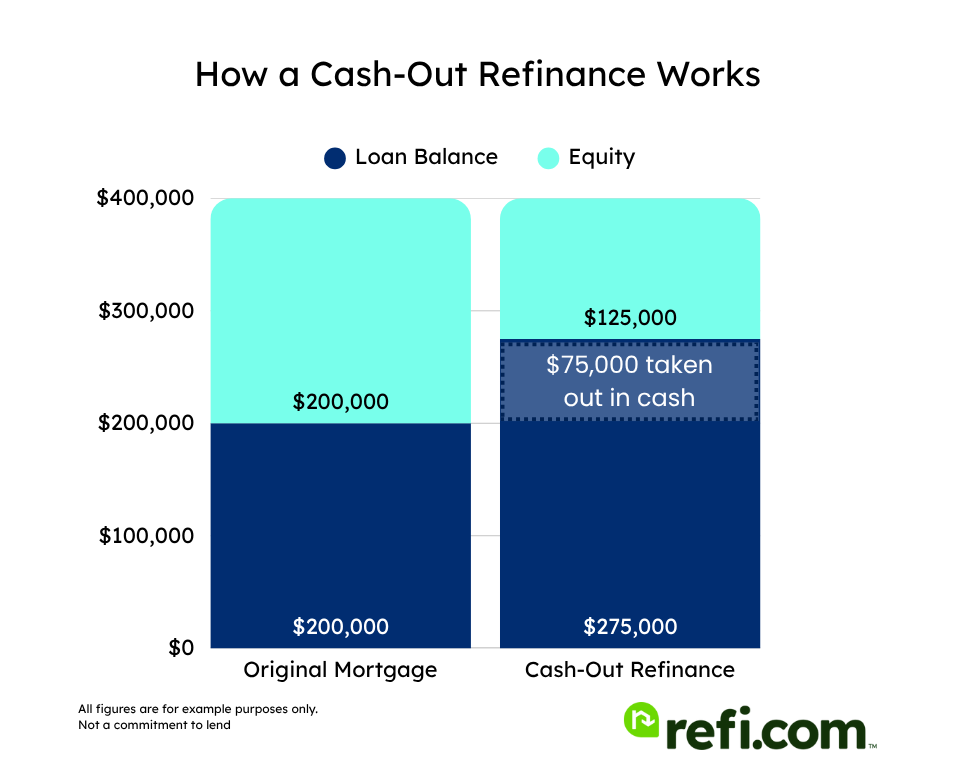

Cash-Out Refinance

With a multifamily cash-out refinance, you can tap into your property’s built-up equity and use the proceeds how you choose.

Borrowers typically opt for a cash-out refinance to:

- Renovate and modernize units to command higher rent

- Make major improvements such as replacing a roof

- Consolidate existing debts

- Purchase other properties

Since cash-out refinances involve taking on extra debt, you will likely incur more stringent qualification requirements, including:

- Higher credit score minimums

- Lower debt-to-income (DTI) allowances

- Lower maximum loan-to-value ratios

While credit score and DTI rules can vary by lender and loan program, you can expect a maximum loan-to-value of 75% for conventional cash-outs and 80% for FHA cash-outs. VA-eligible borrowers can access up to 90% of their home’s equity and potentially even 100% with some lenders.

Renovation Refinance

Renovation refinance loans are a special type of multifamily refinance strategy that can be seen as a hybrid of a rate-and-term and cash-out refinance. They’re not technically considered to be a cash-out refinance, meaning you’ll be eligible for more favorable interest rates and loan terms. Still, they do allow you to increase the size of your mortgage to fund property improvements.

The caveat here is that multifamily renovation refinance mortgages are only available for owner-occupied properties through the Fannie Mae HomeStyle Renovation, Freddie Mac CHOICERenovation, and FHA 203(k) loan programs.

Furthermore, unlike a cash-out refinance, which provides you with the funds for improvements as part of the closing process, renovation refinances come with much more lender oversight. Your mortgage company will remain actively involved in the rehabilitation process by approving work plans and distributing payments to suppliers and contractors directly.

The maximum amount for renovation refinance loans is based on your property’s after-completion value estimate and can be as high as 95% with conventional programs and 97.75% with an FHA 203(k).

Note: Refi.com does not currently offer renovation refinance loans.

Requirements for Refinancing a Multifamily Property

We briefly touched on a few of the eligibility requirements for refinancing a multifamily property based on different refinance strategies, but let’s take a more comprehensive look at the various standards you’re likely to encounter.

Note: We’ll cover the primary requirements as dictated by guidelines established by Fannie Mae, Freddie Mac, and the government agencies that insure multifamily refinance loans. Individual lenders, like Refi.com, often impose their own more restrictive requirements, referred to as overlays, which can vary depending on the mortgage company you choose to work with.

Maximum Unit Count

Four units; properties with five or more are considered commercial and do not qualify for any residential mortgages.

Investment vs Owner-Occupied

Available loan programs and eligibility requirements can differ between investment properties and those in which the owner occupies one of the units as their primary residence.

Investors will have to refinance with a conventional loan (unless they qualify for a streamline refinance, which we’ll touch on a little further down), while owner-occupants are additionally eligible for a wide range of government-backed loans.

Credit Score

Credit requirements will vary based on the loan type and program you choose. In most cases, lenders will have higher requirements for multifamily properties than for single-family residences.

Credit requirements tend to be higher for multifamily properties compared to single-unit homes, especially for investment properties or cash-out refinances. FHA borrowers may be able to qualify with a lower score, although this can vary from lender to lender.

Loan-to-Value Limits

Investors can refinance a multifamily property for up to 75% of its appraised value with a rate-and-term mortgage and up to 70% with a cash-out refinance.

Owner-occupants can refinance with a conventional rate-and-term for up to 95% and an FHA rate-and-term for up to 97.75%. For a cash-out refinance, multifamily owner-occupant LTV limits are 75% conventionally and 80% through FHA lenders.

VA borrowers may qualify for an LTV ranging from 90% to 100%, depending on the loan type and lender they choose.

Debt-to-Income Ratio

Your debt-to-income ratio is the percentage of your income that goes toward servicing your monthly debts. Acceptable DTI ratios will vary greatly by the lender and loan type you choose, although it’s a solid rule of thumb to aim for a debt-to-income level no higher than 36%.

Some lenders will allow for higher limits, particularly for rate-and-term refinances, but you’re unlikely to find multifamily refinance approval with a DTI above 50%.

Required Reserves

Reserves are funds that the multifamily property owner has available after paying for all of the closing expenses associated with their new loan. Requirements are typically quantified in terms of your monthly housing expenses, including principal and interest payments, taxes, insurance costs, and association dues.

Reserve requirements can vary depending on your loan program, loan type, credit score, and debt-to-income ratio.

Conventional lenders generally require six months of funds in reserve; however, borrowers with lower credit scores, higher debt levels, or multiple financed properties might need much more. FHA-backed refinances can require one month of reserve funds for duplexes and three months of funds for triplexes and quadplexes.

Rental Income

You can refinance a multifamily property using its rental income to help you qualify for the loan, but the rents must be sustainable and well-documented. This generally includes providing one year of filed Schedule E tax forms.

Appraisal Requirements

Multifamily refinance loans will require a current professional appraisal, except for FHA and VA streamline refinances. Because multifamily appraisals require more work and research (such as a rental income analysis), you can expect a higher cost than you’d incur with a traditional 1-unit appraisal.

Loan Options for Multifamily Refinances

Now, let’s break down the various multifamily refinance options available through the different conventional and government-backed lending programs.

Conventional (Fannie Mae/Freddie Mac)

Conventional loans are available for both investors and owner-occupants with multifamily properties containing two to four units. While requirements can be stricter, multifamily residences qualify for most of the same loans as single-unit homes, including the HomeStyle Renovation and CHOICERenovation programs.

FHA Refinance

Owners who occupy one of the property’s units as their primary residence can qualify for the full range of FHA refinance programs, including the standard rate-and-term refinance, cash-out refinance, and 203(k) renovation refinance.

Borrowers with duplexes, triplexes, and quadplexes who currently have an FHA-backed mortgage can also apply for the agency’s streamline refinance program. The FHA streamline refinance is a low-doc rate-and-term loan that typically does not require an appraisal, income verification, or in-depth credit check.

One major point worth noting is that investors who originally obtained an FHA loan and occupied their multifamily property for a minimum of 12 months before converting it into a full investment are also eligible for the FHA streamline refinance, the only FHA-backed refi option open to non-occupant owners.

VA IRRRL or Cash-Out

VA refinance loans are available to multifamily owner-occupants who qualify for a Certificate of Eligibility (COE) from the US Department of Veterans Affairs. This is typically limited to veterans and active-duty servicemembers but may apply to surviving spouses in certain situations.

Current VA loan holders can apply for the VA interest rate reduction refinance loan (IRRRL), a low-doc rate-and-term mortgage option. Similar to the FHA streamline program, it may be possible for investors to qualify for an IRRRL on a property they previously met the occupancy requirements for.

The VA cash-out refinance option allows eligible multifamily borrowers to tap into their property’s equity for up to 100% of its appraised value, although most VA lenders cap cash-out refis at 90% LTV.

Qualifying homeowners who currently have another type of mortgage can use the cash-out option to pay off their current loan and refinance into the VA loan program.

DSCR Loans

Debt service coverage ratio (DSCR) refinance loans are a unique type of conventional mortgage available to multifamily investors. Although offered by conventional lenders, these loans do not follow Fannie Mae and Freddie Mac guidelines.

DSCR mortgages use the income generated by the subject property for qualification rather than the applicant’s debts and income. This makes them an ideal refinance option for property owners with strong rental income but a high personal DTI ratio that may disqualify them from conventional options.

To get approved for a DSCR refinance loan, your property will need a net operating income (NOI) that can fully support its mortgage payments. In many cases, lenders will look for a DSCR ratio of 1.25, meaning that your multifamily property must generate income (after operating expenses) of at least 1.25 times the total payment.

Documentation Needed to Refinance a Multifamily Property

Applying to refinance a multifamily property is a lot like applying for a standard mortgage. As such, you’ll generally need to supply:

- Proof of employment/income

- Two years of filed tax returns

- Bank and investment account statements

- Valid ID

Applicants using rental income to qualify will need:

- Two years’ tax returns

- Appraisal for 1025 (Small Residential Income Property Appraisal Report) completed by the appraiser

- Potentially, your property’s rent roll, leases, and a profit and loss statement

Tips to Improve Refinance Approval Odds

Qualified borrowers with a stable income and rental receipts are usually able to be approved for a multifamily refinance with ease. Even still, there are some best practices for improving your refinance approval odds that you should keep in mind, especially if your credit score or debt level isn’t quite as strong as lenders may prefer.

- Check your credit report for errors prior to applying.

- Reduce vacancies and maintain lease agreements for all units.

- Properly document operating expenses and rental income receipts.

- Make improvements and enhance the property’s curb appeal to help ensure a successful appraisal.

- Choose a proven mortgage company that is experienced in issuing loans on multifamily properties.

Final Thoughts

Refinancing a multifamily property can be an effective way to reduce your costs, improve your returns, and grow your investment portfolio. However, regardless of your reasons for refinancing, selecting the correct type of loan is crucial to achieving ongoing financial success.

Ready to take the next step? Apply online with Refi.com and explore your options.