Is It Better to Refinance Or Pay Extra Principal?

Is it better to refinance or make extra payments to reduce your mortgage balance? That’s an excellent question when you have good cash flow and wish to save on interest and pay off your mortgage ahead of schedule.

But, as usual with such questions, the answer is, “It depends.” Read on to discover what it depends on and which choice is likely to be better for you.

The least you need to know:

- Refinancing can save more in interest—especially with a lower rate and shorter term—but closing costs and break-even timing matter.

- Making extra principal payments offers flexibility without the cost of a new loan, but requires discipline to stay on track.

- The right choice depends on your financial situation—refinancing locks in savings, while extra payments keep options open.

A Quick Refresher on Refinancing

When you refinance, you get a whole new mortgage that’s used to pay off your existing one. Your new loan may have a different interest rate from the old one and a different term. You’re typically free to swap even your loan type, perhaps from an FHA mortgage to a conventional one.

Some experts suggest that it’s normally a good idea to refinance when your new rate will be 1% (100 basis points) lower than your current one. In other words, if your current rate is, say, 7.5% and you can now refinance at 6.5%, it’s worth a serious look.

That can deliver a significantly lower monthly payment and may mean you pay less interest over the lifetime of your mortgage.

15-year Refinance vs. 30

However, those long-term savings will be influenced by the term of your new loan. Suppose you’ve had your existing 30-year fixed-rate mortgage (FRM) for 15 years and refinance to a new 30-year one.

That would mean you’re going to pay for your home over 45 years: the 15 already under your belt plus another 30 starting now. True, your monthly payments should be lower because you’re spreading those so thinly.

However, you’ll be paying your lender interest for 45 years instead of 30. And that will almost certainly raise your total cost of borrowing.

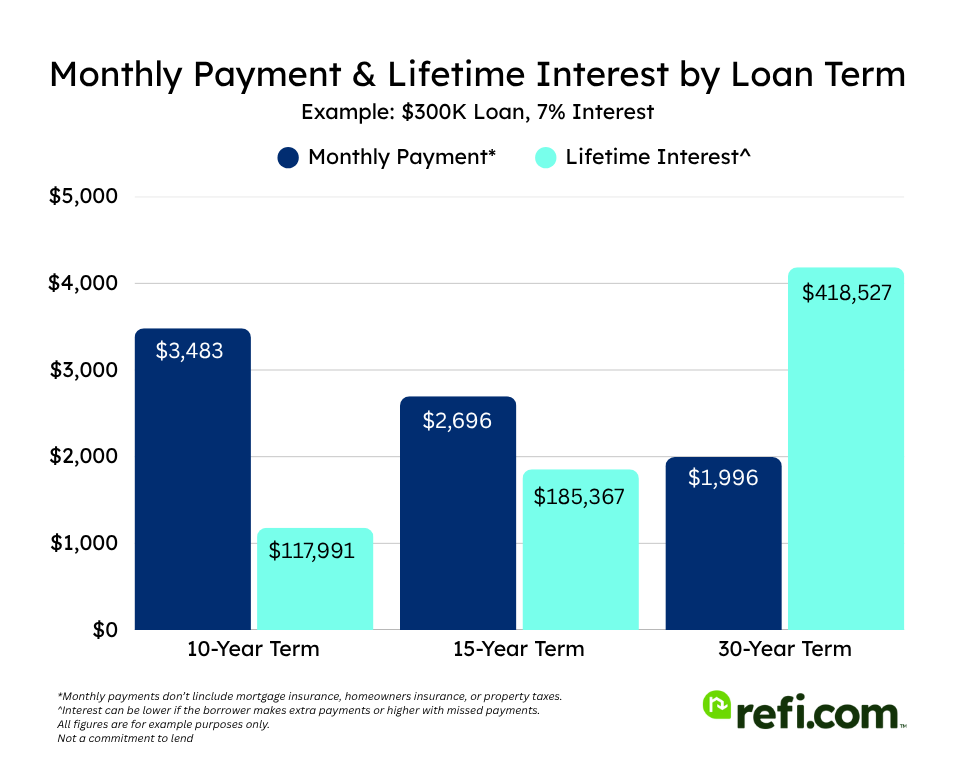

So, those who can afford to often consider a shorter term for their new loan, perhaps, 10, 15 or 20 years, depending on how much cash they’re left with at the end of each month. That may well increase their monthly payment compared with their existing mortgage. But it could save them tens or hundreds of thousands in interest over the period when they’re paying for their home.

Closing Costs

You’re getting a whole new mortgage when you refinance. So, the process can be as time-consuming and costly as when you applied for your existing mortgage.

True, less costly and burdensome streamline refinances are available on government-backed loans (FHA, VA and USDA loans) with no cash out. But, if you have a conventional loan, you should expect to pay normal closing costs.

And those typically run at between 2% and 6% of the sum you’re borrowing. Your lender may allow you to roll those costs up within your new loan or might offer to trade you zero closing costs for a slightly higher mortgage rate. Either way, you’ll pay them in the end — and then some.

Suppose your new mortgage has an opening balance of $300,000 and your lender wants 4% closing costs. That’s $12,000, a sum most of us will take seriously.

This sometimes has implications for the viability of refinances. Suppose you’re going to save $200 a month on your payments through a lower interest rate. It would take you 60 months (five years) for those savings to pay for the closing costs. ($12,000 costs ÷ $200 monthly saving = 60 months to break even.)

And, if you think there’s a strong possibility of your selling up and moving on in less than five years, you’d be better off not refinancing.

This refi payback period is called the “break-even point.” And you can use a break-even calculator to work out yours.

The Impact of Paying Extra Principal

The goal of refinancing to a shorter — 10-, 15- or 20-year — term is to pay off your mortgage earlier. But you can achieve that goal without a refinance by simply making extra payments.

Typically, you’ll be more successful paying off the loan faster by refinancing to a shorter term. This is mainly due to the extra payments being required. It’s easy to skip a voluntary extra payment here and there when noone is holding you to it.

But there can be valid reasons for choosing to make extra payments. And there’s a great deal of flexibility over how you do so. Here are some common methods:

- If you’re paid every four weeks, you’ll get 13 paychecks annually. Make 13 monthly mortgage payments each year instead of 12.

- Suppose you’re paid every two weeks, which is 26 times a year. Make 26 half payments annually.

- Use any bonuses you get to reduce your mortgage.

- If you receive any windfall cash — an inheritance, perhaps, or a lottery win — send it on to your mortgage lender. Few would blame you if you deducted a little first for a treat.

- Simply make each payment bigger than the minimum.

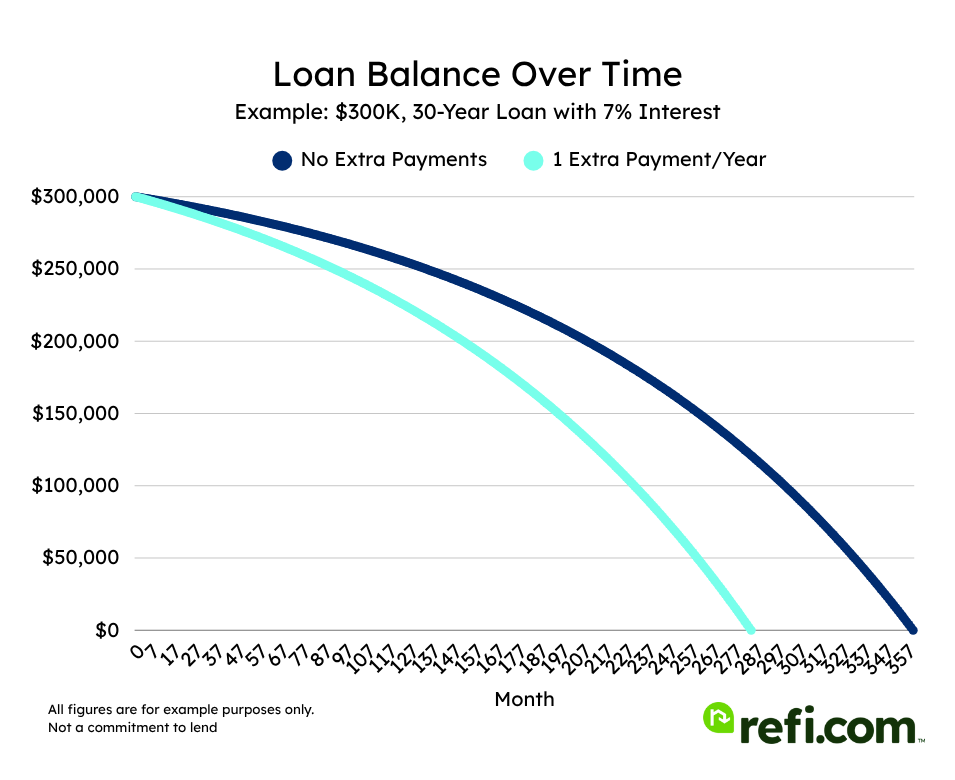

Does it really make that much difference if you make just one extra payment a year? Well, yes.

Using an amortization calculator, you can see that making an extra payment each year on a 30-year, fixed-rate mortgage of $300,000 at 7% could cut six years and five months off your mortgage repayment and save over $106,000 in lifetime interest.

You must let your lender know what you’ll be doing before you start making extra payments. In particular, it needs to know to apply all the extra money you send to your principal balance.

4 Times It Could Be Better to Refinance

Refinancing to a shorter term has one huge advantage we haven’t yet mentioned. You tend to get a lower mortgage rate than you would with a 30-year term.

Those rates move around all the time, so we can’t give you a definitive figure. The most recent Freddie Mac survey of nationwide rates shows that the average 15-year mortgage rate was 0.82% lower than the 30-year rate. That rate difference alone would save you about $2,500 per year in interest on a $300,000 loan.

How we source rates and rate trends

Rates based on market averages as of Dec 02, 2025.Product Rate APR 10-year Fixed Refinance 5.21% 5.26% 15-year Fixed Refinance 5.37% 5.42% 20-year Fixed Refinance 6.05% 6.08% 30-year Fixed Refinance 6.35% 6.37%

1. When You Can Refinance to a Lower Rate

The best time to refinance is when mortgage rates have fallen since you took out your existing loan.

That’s been a tough ask since mid-2021 when those rates were at their lowest (2.77% 30-year; 2.10% 15 year), according to Freddie Mac. Yet, rates are lower than their peak in October 2023. While there’s a chance rates could drop further, experts suspect rates will remain well above early 2020s levels for some time.

2. When Your Borrower Profile Improves

Your personal mortgage borrower profile can help you get a better rate if it’s improved. Suppose you got your current mortgage when your credit score was low or you were encumbered with a lot of other debt. You almost certainly fetched a higher mortgage rate than if you had the perfect borrower profile.

If your credit score has since soared and you’ve paid off debt, you may now qualify for a significantly lower mortgage rate than you’re paying, despite what’s happened to market rates.

Related: Credit score needed to refinance your home

3. When You Can Recoup Closing Costs

Closing costs make refinancing too often uneconomic. Remember, they’re often 2% to 5% of the amount you’re borrowing, which frequently means a five-figure sum.

Some mortgage experts recommend refinancing only when you can shave 1% (100 basis points) off your current mortgage rate. That can often deliver a reasonable breakeven point. And the lower rates that typically come with 15-year and other shorter terms can make a big difference.

Try our Refinance Breakeven Calculator

4. When You Can Afford a Larger Payment

Usually, refinancing to a shorter term increases your monthly payments, even if you get a lower mortgage rate. You’re repaying the same loan within a shorter period so each payment is likely to be higher.

Can you comfortably afford those higher payments? And will you still do so in five or 10 years’ time? You don’t want to commit to larger payments if there’s much chance of losing an income source in the future. It’s easier to stop making voluntary payments than get out of a high 15-year mortgage payment in an emergency.

When It’s Better to Pay Extra Principal

Some borrowers choose to pay extra principal each year because they’re unsure about their financial future. Maybe they feel insecure in their job, or they fear a recession, or they worry that a medical condition could flare up and undermine their earning capacity.

Those are sensible considerations for those who face such risks. Most 15-year refinancings involve making a higher monthly payment than the one on the existing 30-year loan.

And, once you’ve opted for a 15-year term, you can’t just ask your lender to make your loan into a 30-year one again. Yes, the lender will usually respond to actual financial distress with some form of mortgage modification.

But, if you want to go back to a 30-year term, you’ll have to refinance. That means more closing costs. Worse, if you’re already off sick or are unemployed or working short hours when you apply, you might struggle to qualify for the refi.

And there are other times when sticking with your existing loan and making extra payments makes sense. When:

- The refinance rate will be higher than your existing one. Why pay more?

- You’re planning to move soon. If you sell before reaching your refi’s breakeven point, you’re losing money on the transaction.

- Your current mortgage has only a few years left to run. You’re already on the final, downhill stretch in your race to be mortgage-free. Messing with your loan now could do more harm than good.

Is It Worth Paying Extra Now If You Plan to Refinance Later?

Yes. When you do come to refinance, your principal balance will be lower. Not only will you be borrowing less, which may qualify you for a lower refi rate, but you’ll also pay lower closing costs.

It’s seldom a bad idea to pay down any debt. Even Fidelity, which you may think wants your investments, recommends, “If the interest rate on your debt is 6% or greater, you should generally pay down debt before investing additional dollars toward retirement.”

Of course, the smart move is to pay down higher-interest debt first, such as credit card balances. But, once you’ve reined those in, switching to prepaying your mortgage’s principal makes good sense, certainly if your mortgage rate is 6% or higher.

Paying Extra and Then Recasting Your Mortgage: An Alternative to Refinancing

Mortgage recasting is different from refinancing. With a recasting, you keep the same mortgage at the same rate.

But you pay a lump sum to reduce the principal and then ask your lender to recast your monthly payments to reflect your lower mortgage balance. So, you pay less each month.

This is different from making extra principal payments. When you do that, your goal is to pay down your mortgage earlier than scheduled. With recasting, your mortgage term doesn’t change.

So, recasting is good if you have a lump sum and your monthly payments are uncomfortably high. But it doesn’t bring the long-term benefits of principal prepayments — unless, that is, you make those prepayments later.

Be aware that your lender is free to refuse recasting requests and some do. Also, you can’t recast a government-backed mortgage, meaning an FHA, VA or USDA loan.

Refinancing vs. Paying Extra: Scenarios

Let’s imagine a scenario where refinancing to a shorter term is better than principal prepayments and another when the opposite is the case.

When to Refinance to a Shorter Term

- You can get a rate that’s 1% or more lower than your current one

- If you’ve already refinanced, you’re past its breakeven point

- This refinance delivers a sensible breakeven point

- You expect to stay in your home for many years

- You feel financially secure and are comfortable about the future

- The higher monthly payment is easily affordable

- Your current mortgage has longer to run than the new loan’s term

When to Make Extra Principal Payments

- Your current rate is lower than your new one will be — or close to it

- Closing costs make a refinance not pay for itself and then some

- You’ll likely move before your refinance reaches its breakeven point

- You’re worried about your financial future

Bottom Line: It Depends On Your Goals, Current Mortgage, and Finances

In March 2025, in an e-newsletter for The Economist magazine, Josh Roberts wrote, “For decades, mortgage-holders who invested any spare cash rather than paying off debt might in fact have been husbanding their resources rather well. Interest rates stayed low for years, and certainly much lower than the returns available on shares, whose prices soared. Now, though … the arithmetic has flipped.”

Roberts’ February 2025 article had the headline, “Why you should repay your mortgage early.” He called the era of low interest rates a “holiday from reality,” using holiday in its British sense of a vacation. And his point was that today’s higher rates make the math very different.

If your financial goal is to maximize your net worth, paying down your mortgage early is frequently a smart move. Once you’re mortgage-free, you’ll have loads of free income to optimize your other investments.

Yes, we all want to make the most of our money. But our priorities shift over time as our circumstances change. And the many readers who can barely make their scheduled payments, let alone extra or higher ones, shouldn’t feel bad. With luck, their time will come.

Those who do have plenty of spare cash each month should know that refinancing to a shorter term and making extra principal payments will both result in an earlier repayment of their mortgage — and a lower interest bill.

In the right circumstances, a refinance will typically get rid of your mortgage earlier and save you more. But, as we’ve made clear, that option doesn’t suit everyone. So, make your choice with care.