How to Refinance Without Resetting the 30-Year Clock

Refinancing your home loan can be a great way to reduce your monthly payments when interest rates drop.

But if you’ve already spent several years paying your mortgage, you might not want to start your new loan back at square one. Luckily, you can refinance without making it a 30-year term loan.

The least you need to know:

- Refinancing your mortgage results in a new term; but, it doesn’t always have to be a 30-year term.

- Refinance loan terms include 10, 15, 20, 25, and 30 years. Some lenders may even customize beyond that, but that’s harder to find.

- Refinancing to a shorter term is a great way to build equity and pay off your loan quicker, but may result in higher payments.

- Resetting to a new 30-year term will likely lower your monthly payments but cost you more lifetime interest in the long run.

Does Refinancing Restart Your Loan Term?

Refinancing can restart your loan term, but it doesn’t necessarily have to. In many cases, homeowners refinance to a new 30-year term. Thirty-year mortgages are the standard, and offer the lowest monthly payments of the common mortgage terms.

But, refinancing involves applying for and closing on an entirely new loan. And mortgage loans typically come in term options spaced in 5-year intervals, including:

- 10-year terms

- 15-year terms

- 20-year terms

- 25-year terms

- 30-year terms

This will vary by lender, loan program, and your own eligibility. For example, USDA loans are only available with 30-year terms.

Can You Refinance and Keep the Same Term?

Finding a lender willing to let you customize your term may be possible. Under this arrangement, your new mortgage could even match the remaining payments on your current loan.

However, not all mortgage lenders will be this flexible with their term options. If the lender you’re working with offers a great deal on your refinance but can’t match your current term exactly, consider selecting the loan most in line with your anticipated payoff.

For example: You have 26 years remaining on your mortgage, but the closest your refinance lender offers is a 25-year term. Assuming a $250,000 mortgage at a 6.75% interest rate, the monthly principal and interest (P&I) payment on a 26-year loan would be $1,702. Refinancing to a slightly shorter 25-year mortgage would only increase P&I payments by $25 monthly to $1,727.

| $250k Loan @ 6.75% Interest* | Monthly P&I Payment |

| 25-Year Term | $1,727 |

| 26-Year Term | $1,702 |

*All mentioned interest rates are for example purposes only and may not be available.

Similarly, someone with 19 years of payments left might choose a 20-year mortgage instead of a 15-year one. The latter, however, would have their loan paid off 25% faster.

Assuming a $250,000 mortgage with a 6.5% interest rate, the monthly principal and interest payment on a 19-year loan would be $1,912. Adding a year with a 20-year mortgage would reduce costs to $1,864 while moving to a 15-year term would result in P&I payments of $2,178

| $250k Loan @ 6.5% Interest | Monthly P&I Payment |

| 15-Year Term | $2,178 |

| 19-Year Term | $1,912 |

| 20-Year Term | $1,864 |

How Your Loan Term Affects Lifetime Interest Costs

A shorter loan term may increase your bills, but it will save you big in the long run. That’s because adding extra years to your repayment schedule can cost you significantly more interest over the life of your loan.

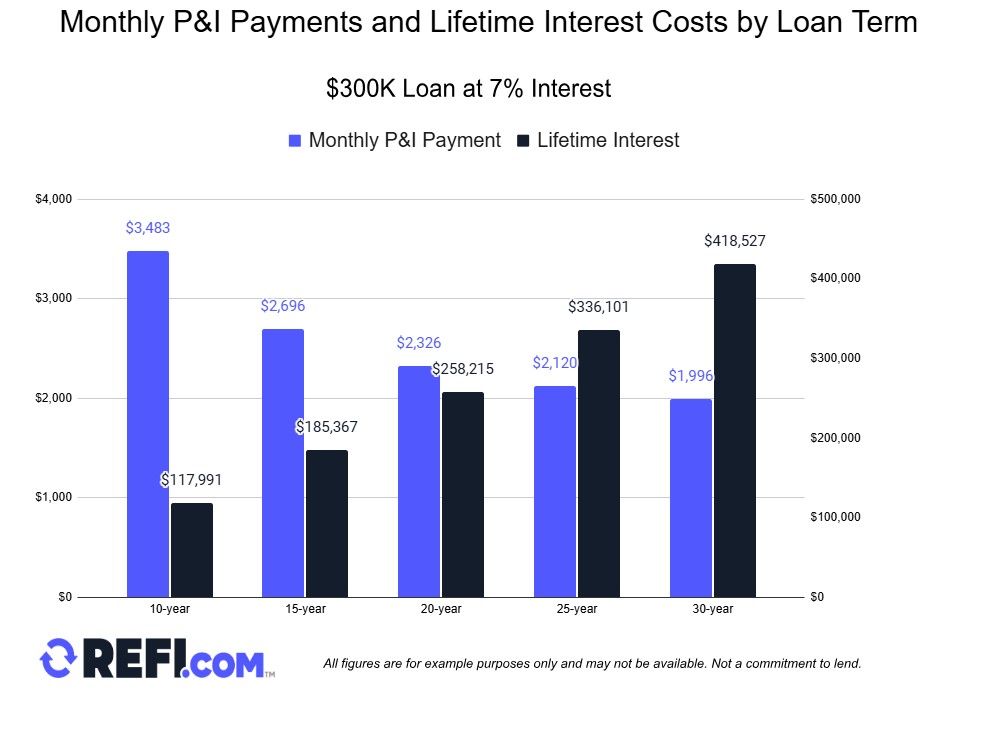

Here’s a quick look at the principal and interest payments on a $300k fixed-rate mortgage financed at 7% for various loan lengths, along with the total lifetime interest you would pay with each term.

Keep in mind that shorter loans generally have lower interest rates. While we’ve used a constant figure to avoid confusion, the savings of a shorter mortgage are likely to be even greater.

| Term | Monthly P&I Payment | Total Lifetime Interest |

| 10-Year | $3,483 | $117,991 |

| 15-Year | $2,696 | $185,367 |

| 20-Year | $2,326 | $258,215 |

| 25-Year | $2,120 | $336,101 |

| 30-Year | $1,996 | $418,527 |

| 35-Year* | $1,916 | $504,959 |

| 40-Year* | $1,864 | $594,861 |

*Conventional guidelines limit mortgages to 30 years. However, some non-QM lenders may offer loans with up to 40-year terms.

Advantages of Choosing a Shorter Mortgage Term

If you can comfortably afford a shorter-term mortgage, it’s usually a good decision. Some of the advantages to keeping your current repayment schedule, or switching to a shorter one, include:

Paying Off Your Loan Sooner

The most obvious advantage of having a shorter mortgage term is that you’ll pay off your loan sooner. Whether you’re early in your career or planning for the switch to a fixed retirement income, being mortgage-free can cushion your budget and relieve you from the costliest monthly expense that most Americans face.

Interest Rates Are Usually Lower

Shorter loan terms are less risky for lenders. As a result, a borrower will typically qualify for lower interest rates on loans with faster repayment. In some cases, this difference may be minimal. Other times, you could see anywhere from 0.5% to 1.0% or even greater savings by opting for a term shorter than 30 years.

How we source rates and rate trends

Rates based on market averages as of Dec 02, 2025.Product Rate APR 10-year Fixed Refinance 5.21% 5.26% 15-year Fixed Refinance 5.37% 5.42% 20-year Fixed Refinance 6.05% 6.08% 30-year Fixed Refinance 6.35% 6.37%

More of Your Payment Is Going to the Principal

With a shorter term, you have a higher monthly payment, meaning more money is going towards the principal (reducing your mortgage balance) rather than towards interest each month. This builds equity, pays off your loan, and reduces interest costs quicker. As we demonstrated above, your mortgage term can significantly impact your total interest payment.

Let’s take a look at the principal and interest portions of the first payment on a $300K loan at 7% by term length:

| First Monthly P&I Payment on a $300K Loan at 7% Interest | ||

| Term | Interest | Principal |

| 10-year | $1,750 | $1,733 |

| 15-year | $1,750 | $946 |

| 20-year | $1,750 | $576 |

| 25-year | $1,750 | $370 |

| 30-year | $1,750 | $246 |

*Payments are rounded to the nearest dollar. All figures are for example purposes and may not be available.

As you can see, the interest portion is the same across the board for the first payment. But, the principal portion gets considerably larger the shorter the term length. That’s how you build equity and pay off your loan sooner. Let’s take a look at that same comparison but with payment #72 (the last payment of your sixth year):

| 72nd Monthly P&I Payment on a $300K Loan at 7% Interest | ||

| Term | Interest | Principal |

| 10-year | $864 | $2,619 |

| 15-year | $1,266 | $1,430 |

| 20-year | $1,456 | $870 |

| 25-year | $1,561 | $560 |

| 30-year | $1,624 | $372 |

As you can see here, by year 6 of your loan, the interest and principal portions are vastly different. The higher principal payments on shorter-term loans decrease the loan balance and, thus, the interest portion of your payments much quicker.

Private Mortgage Insurance Can Be Cheaper

When you do a conventional refinance with less than 20% equity, you are required to pay for private mortgage insurance (PMI). Costs vary by several factors, but rates can be cheaper with shorter-term loans. Typically, mortgage insurance companies offer lower costs for loans of 20 years or fewer.

You’ll Eliminate PMI Faster

If you are still paying for private mortgage insurance, having a shorter mortgage will help you reach 20% equity faster. Depending on your premium, this could alleviate a considerable portion of the financial burden added by selecting a more compact term.

Disadvantages of Choosing a Shorter Mortgage Term

Are you confident you want to refinance your loan to the same length or shorter term? There are still disadvantages that you should consider. These limitations won’t affect everyone, but it’s important to be aware of the drawbacks before you secure your refinance loan.

Monthly Mortgage Payments Will Be Higher

Yes, you may save on interest, but repaying your principal sooner will almost always require larger monthly mortgage payments. Depending on the loan lengths you’re looking at and their associated interest rates, there could be a considerable difference in monthly costs.

Less Flexibility If You Hit a Financial Snag

Because payments are higher, you have less flexibility in your budget if you hit a financial snag. Few people plan to run into budget troubles, and having a longer term with lower payments can offer leeway if problems do arise.

Harder to Qualify

Since shorter-term loans have higher monthly costs, it may be more difficult for some borrowers to qualify for them. You would need a higher income level or fewer other debts to be eligible for a 15-year loan compared to a 30-year one.

Reasons to Refinance Back Into a 30-Year Loan

There’s no denying the benefits of refinancing to a shorter loan term. However, as with most personal finance topics, no single decision is right for everyone. Some homeowners may find it more sensible to use their refinance to reset the 30-year clock.

Here’s why:

More Affordable Payments

Your payments will be lower since you’re amortizing your debt over a longer period. This can be beneficial if unexpected emergencies arise or if you anticipate a major life event, such as growing your family or transitioning into self-employment.

Easier to Qualify

If your finances have worsened since you took out your current mortgage, it may be more difficult for you to qualify for a shorter loan term – even one that matches your current repayment schedule.

A 15-year mortgage with higher payments will have a greater impact on your debt-to-income (DTI) ratio than a more affordable 30-year loan. Higher DTIs equate to higher interest rates, and lenders won’t be willing to approve borrowers with ratios above a certain threshold.

You Can Pay Down Your Principal With a Lower Minimum Payment to Fall Back On

Most lenders will allow you to make extra payments to reduce your principal balance sooner. You can even match what your payments would be on a shorter loan term. This way, however, you aren’t locked into higher payments if you need to use the funds for other purposes. This is sometimes referred to as “refinance-to-prepay”.

For example, if you’re refinancing a $400,000 loan with 22 years left, maintaining that term at an interest rate of 6.5% would result in monthly P&I payments of around $2,850. Refinancing to a term of 30 years would have a slightly higher rate, 7% in this sample scenario, but would result in monthly payments of $2,660.

This is nearly $200 less per month than with a 22-year term. In this situation, you could lock yourself into the lower payments but still have the option to pay the larger monthly amount to help reduce your principal sooner. Then, if you need to make lower payments for an emergency, you can fall back on the lower required payment and hold off on paying the principal. Essentially, this route gives you more options at the cost of a slightly higher interest rate.

Refinance Without Resetting the Clock – But Should You?

While most borrowers end up with another 30-year loan, it’s possible to refinance without resetting the clock.

There’s no single answer to determine if extending your loan term is the right financial decision for you. To get a more personalized look at your refinance options, including how different loan lengths could impact your housing costs and payoff date, contact us to get started.